Supporting Resources

This page provides supporting material for entries in the Squeezing Putin list, such as charts and more detailed dicsussion of actions of particular companies

Table of Contents

AUMA Exports to Russia · March 5, 2023Otis Exports into Russia · March 5, 2023

Baker Hughes Exports into Russia · March 6, 2023

Yokohama Exports into Russia · March 7, 2023

Procter & Gamble Exports into Russia · March 10, 2023

Reckitt Benckiser Exports into Russia · March 12, 2023

Guess Exports into Russia · March 27, 2023

Oil Additives Exports into Russia · March 27, 2023

Airbus Russian Direct Imports and Exports · April 10, 2023

Pernod Ricard Exports into Russia · April 18, 2023

Energizer and Duracell Exports into Russia · April 22, 2023

Bayer Seeds Exports into Russia · April 22, 2023

Hugo Boss Exports into Russia · May 3, 2023, updated September 20, 2023

Mondelēz Exports into Russia · May 4, 2023

Metamorphosis of Wildberries · May 13, 2023

Chocolate Exports into Russia · May 18, '23, updated Nov 12, '23

Lacoste Exports into Russia · May 22, 2023

GSK (GlaxoSmithKline) Exports into Russia · May 24, 2023

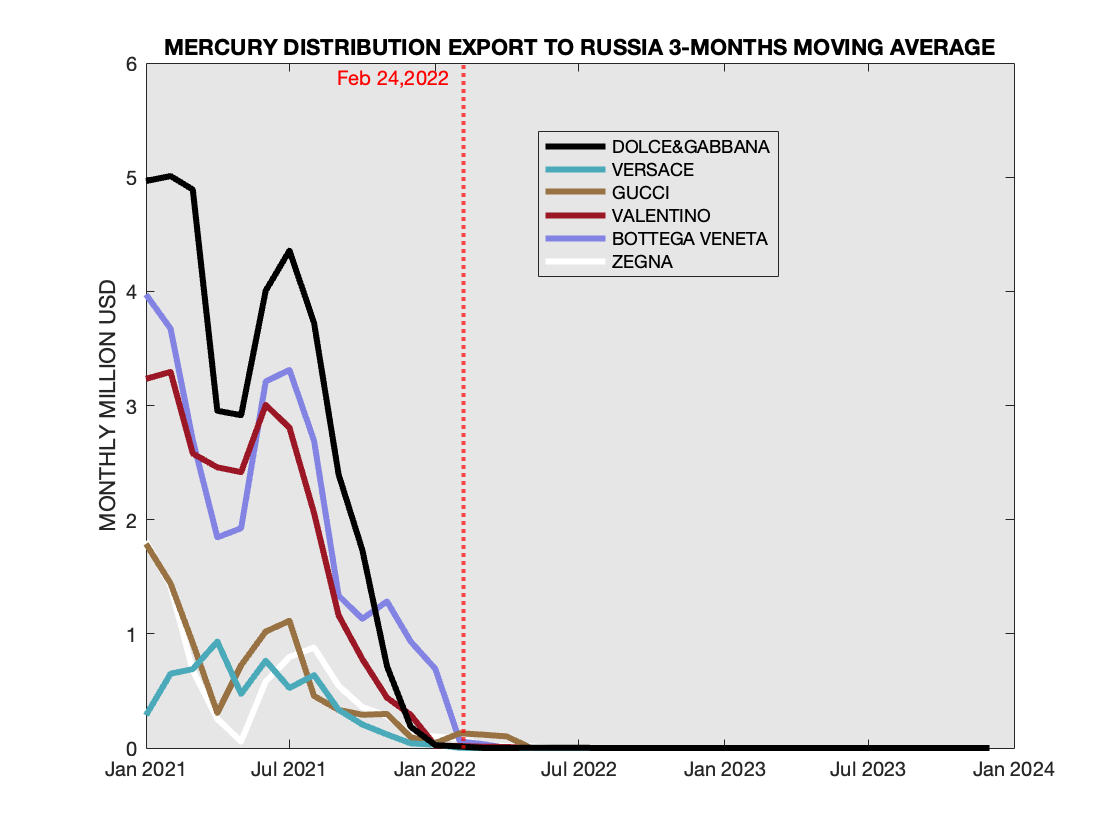

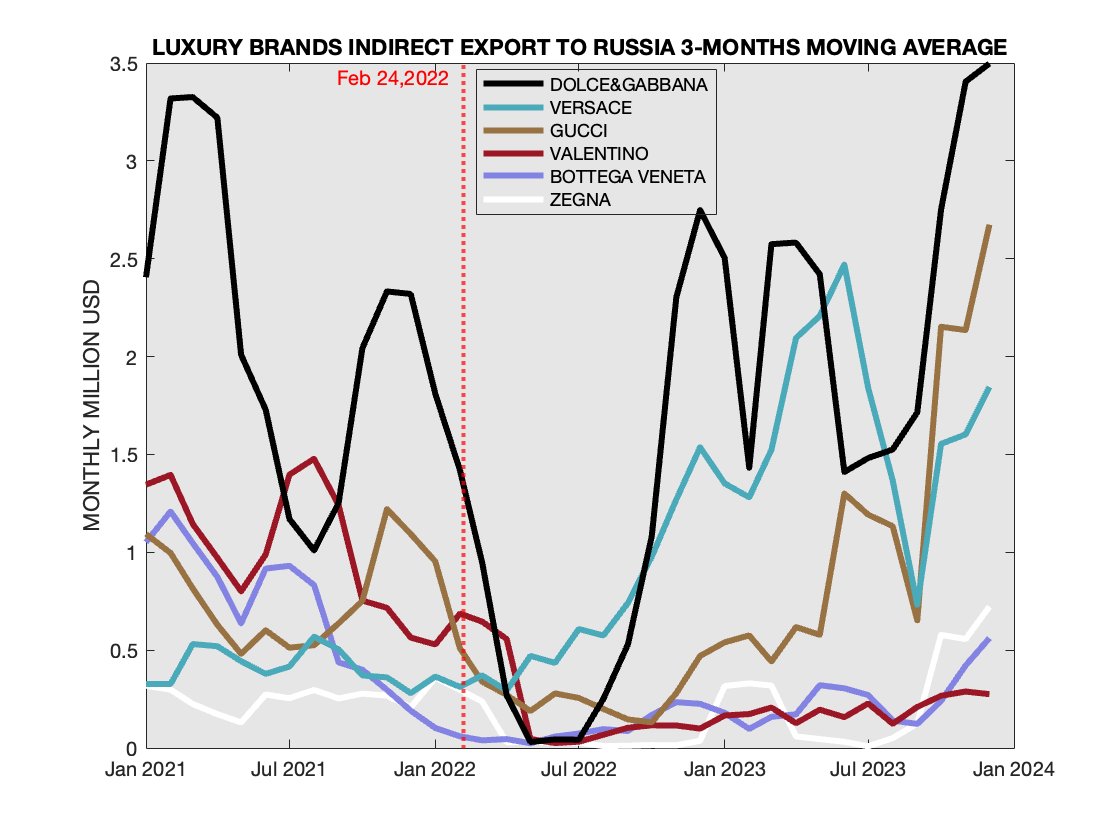

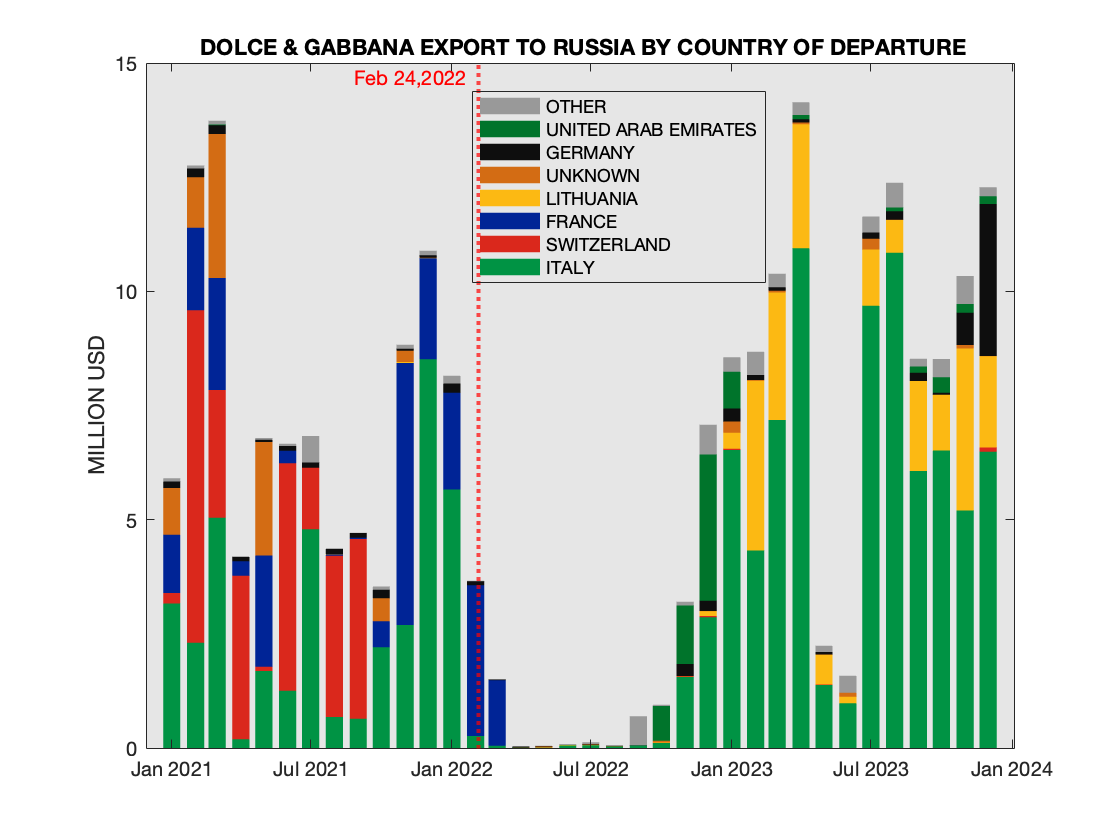

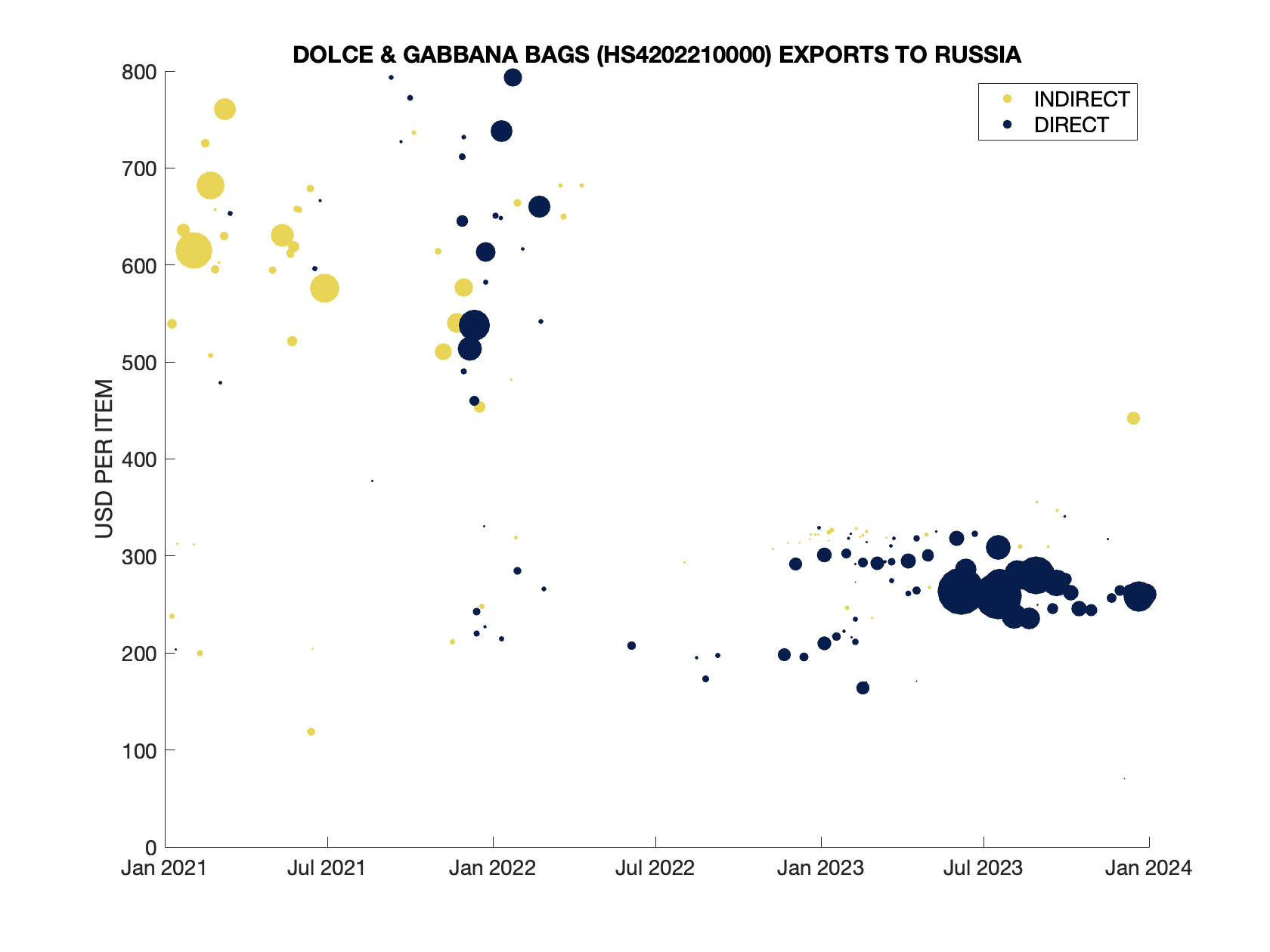

Fashion Exports into Russia · June 5, '23, updated Sep 22, '24

Selected Steel Exports into Russia · June 8, 2023

Paints&Varnishes Russian Exports · June 13, 2023

Adidas and Puma Exports into Russia · June 21, 2023, updated August 27, 2023

Cocoa Exports into Russia · June 23, 2023, updated February 12, 2024

Russian Exports of Crude Oil Into India · June 25, 2023

Imports of Iphones into Russia and Kazakhstan · July 4, 2023

Man Suits Exports into Russia · July 16, 2023

ExxonMobil Exports into Russia · July 24, 2023

CNC Exports into Russia · Aug 21, 2023

Estonia Exports into Russia · September 5, 2023

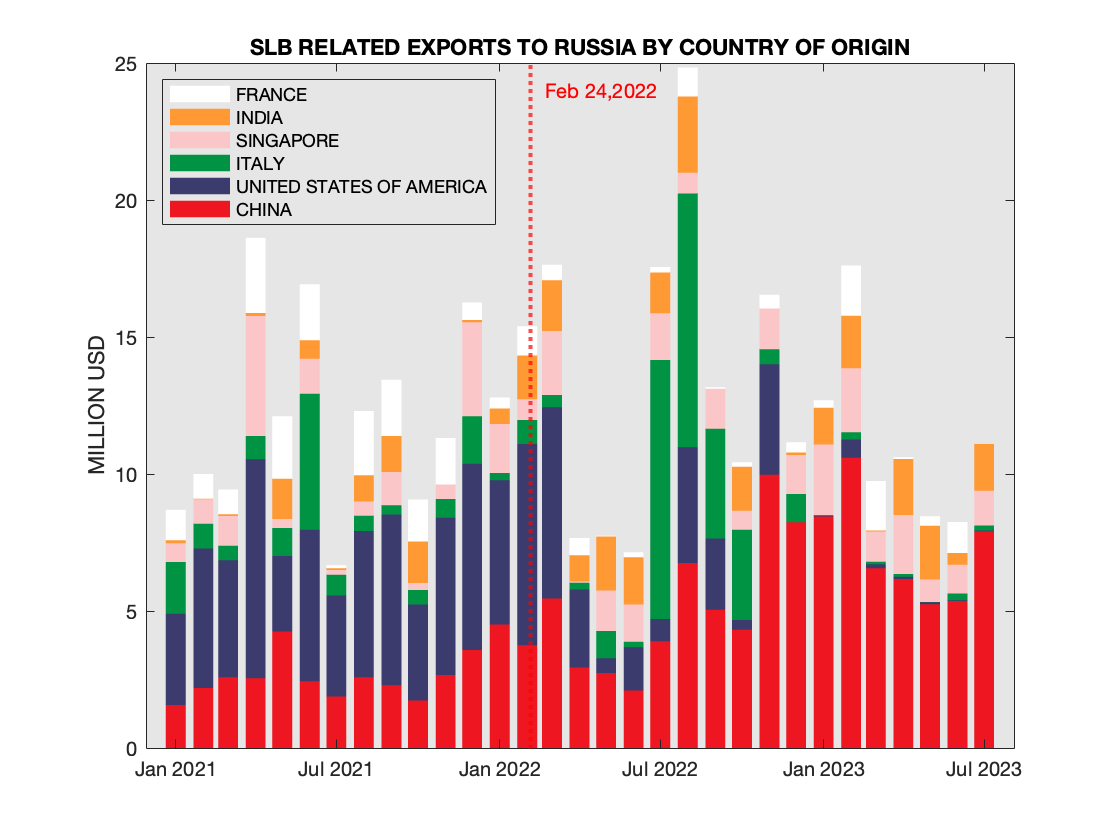

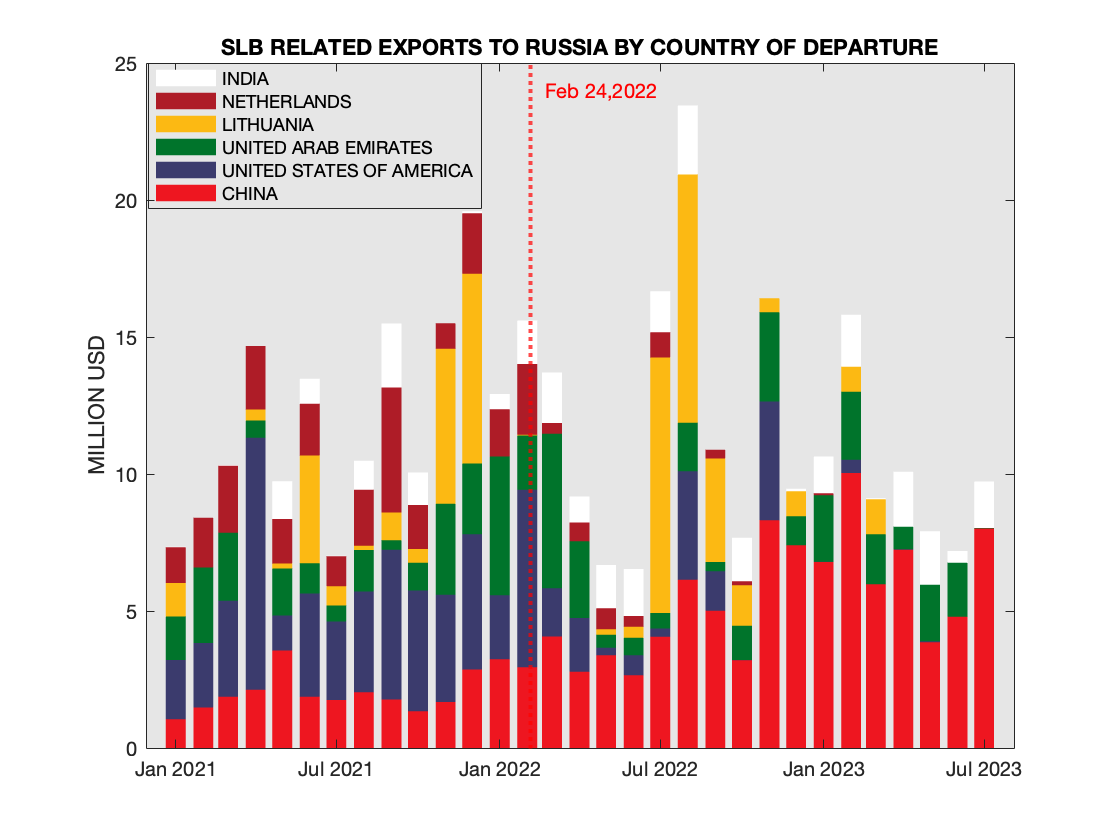

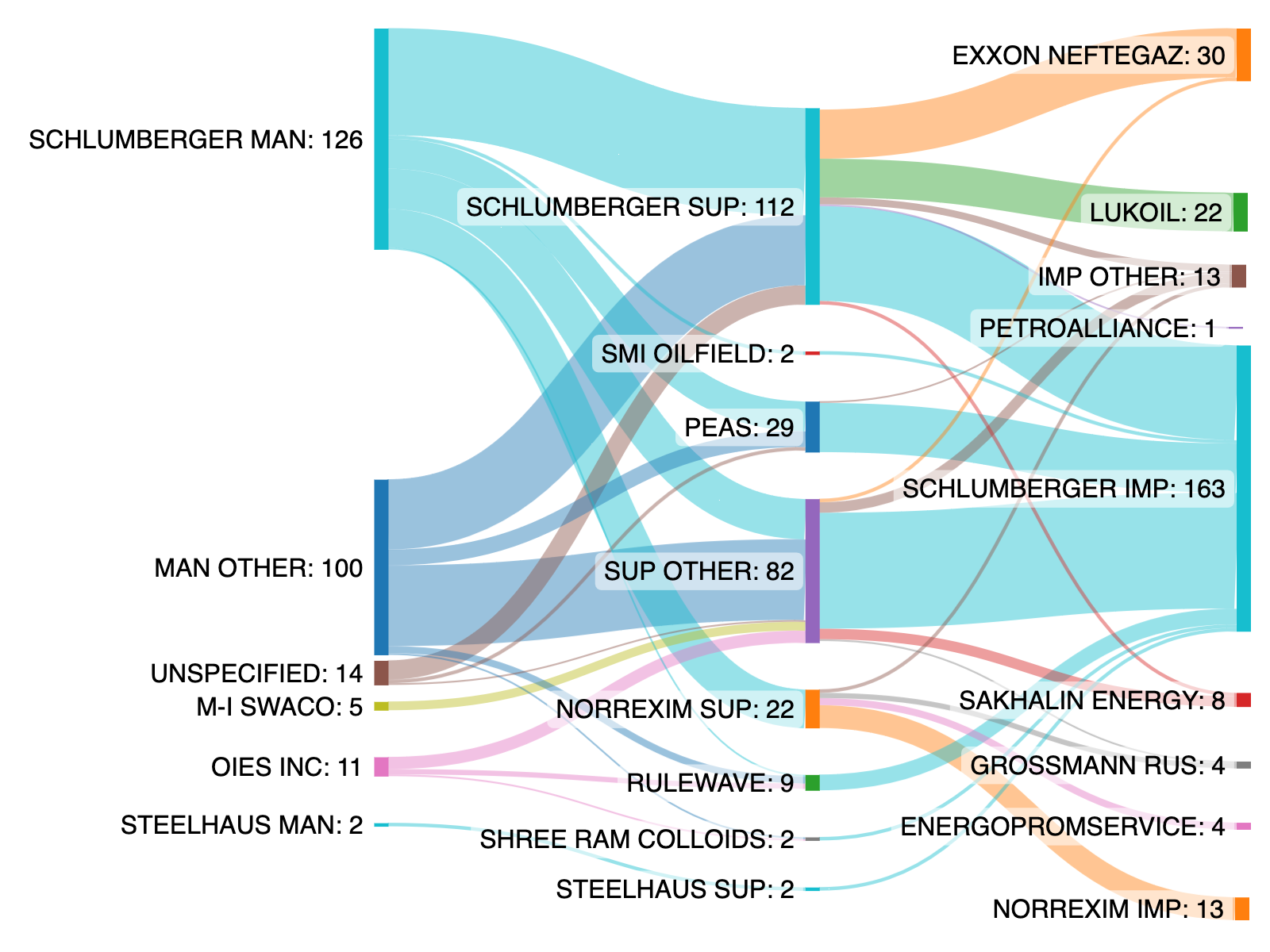

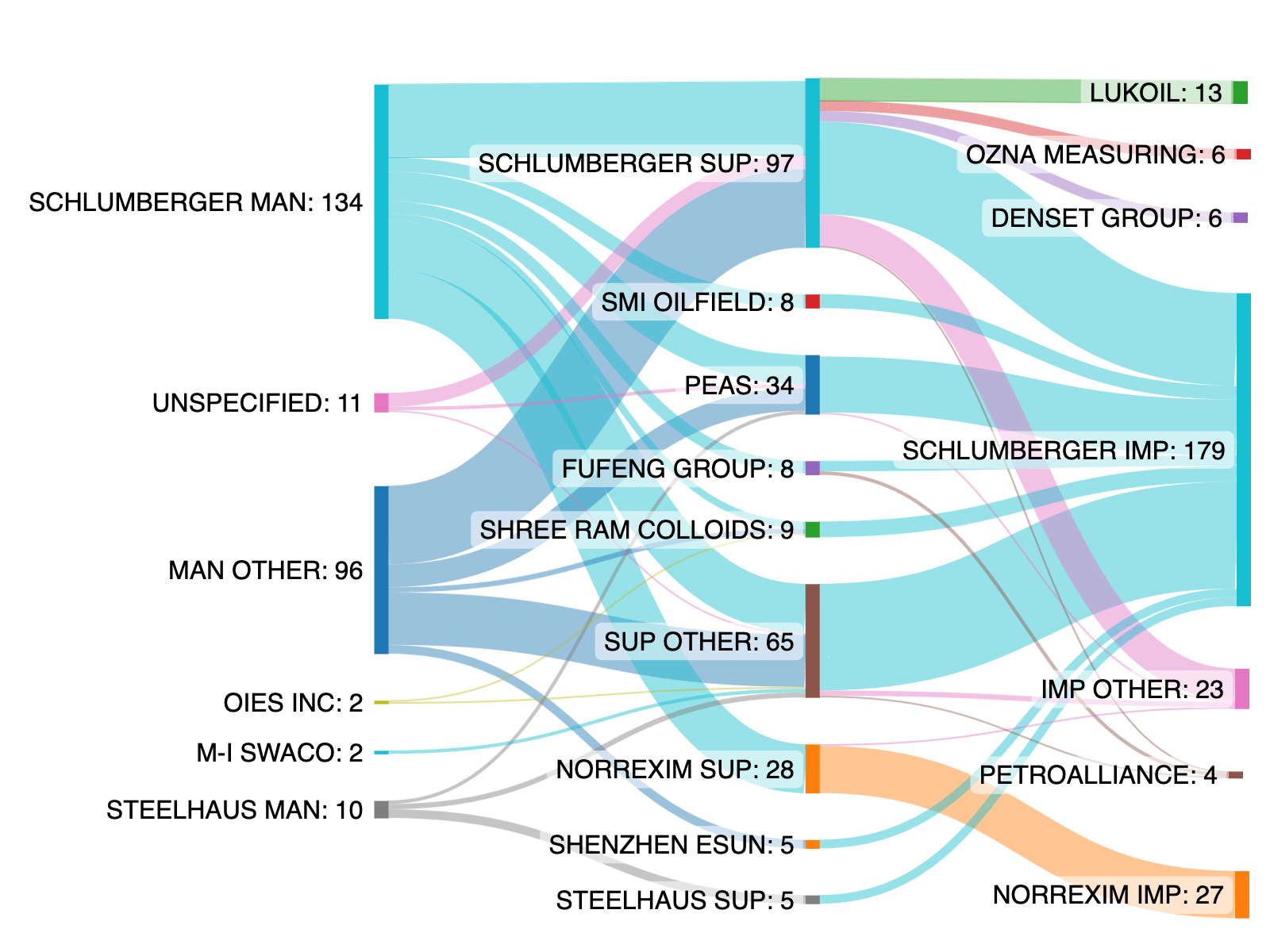

Schlumberger Exports into Russia · September 5, 2023

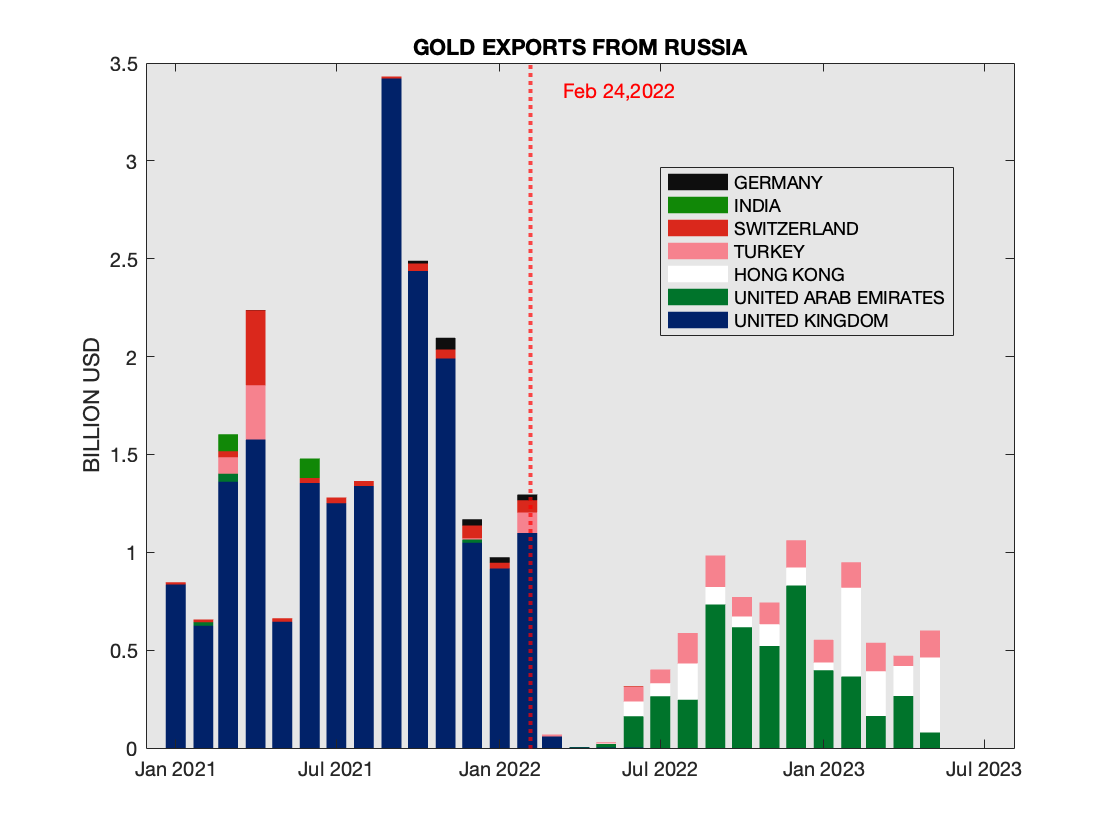

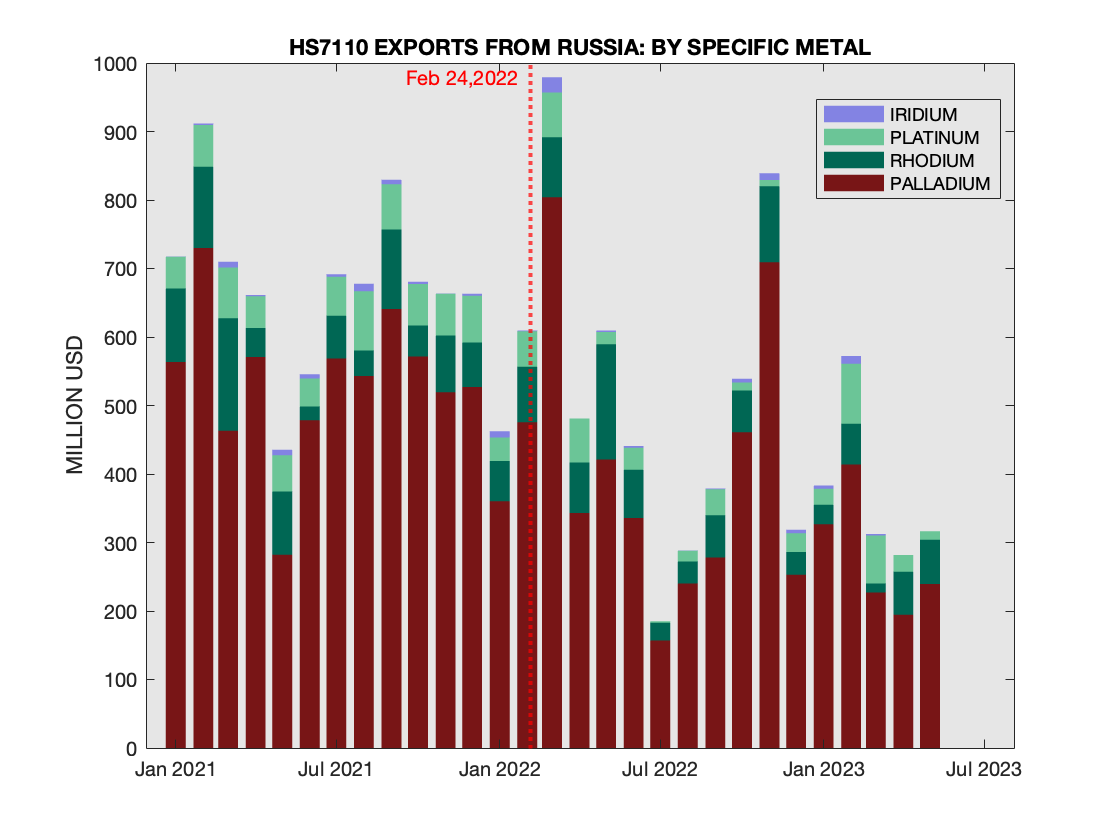

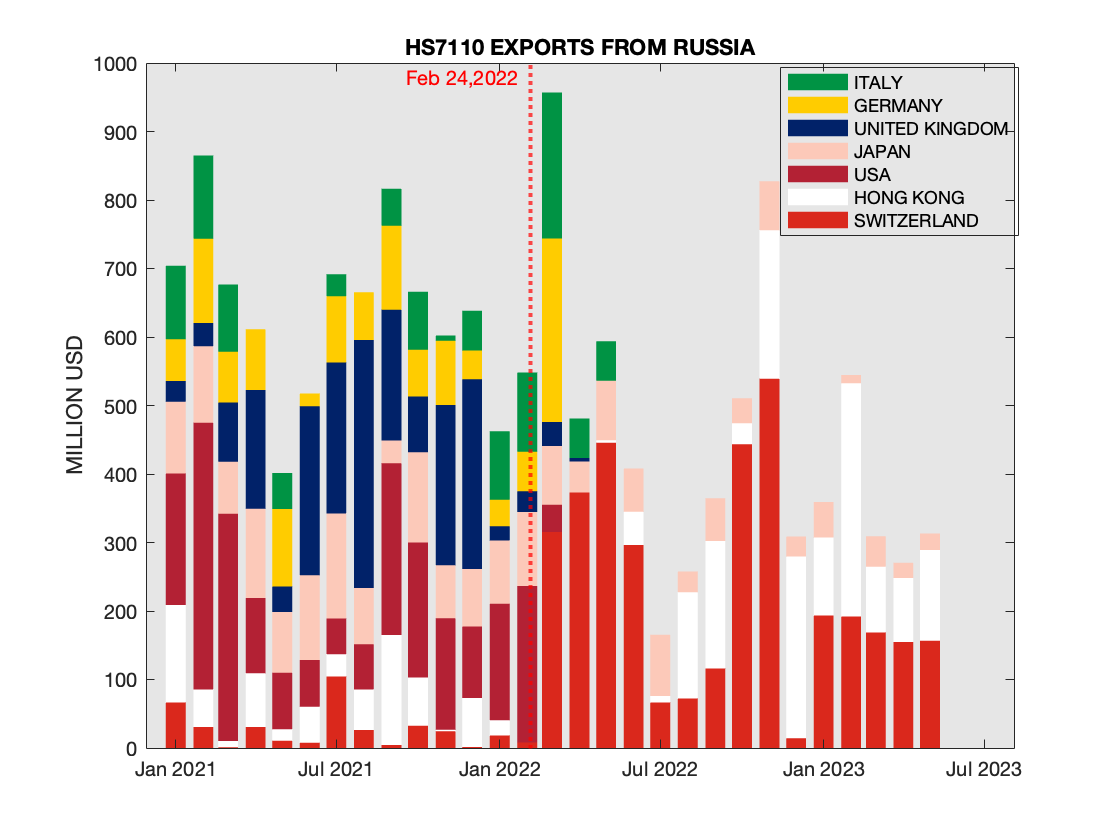

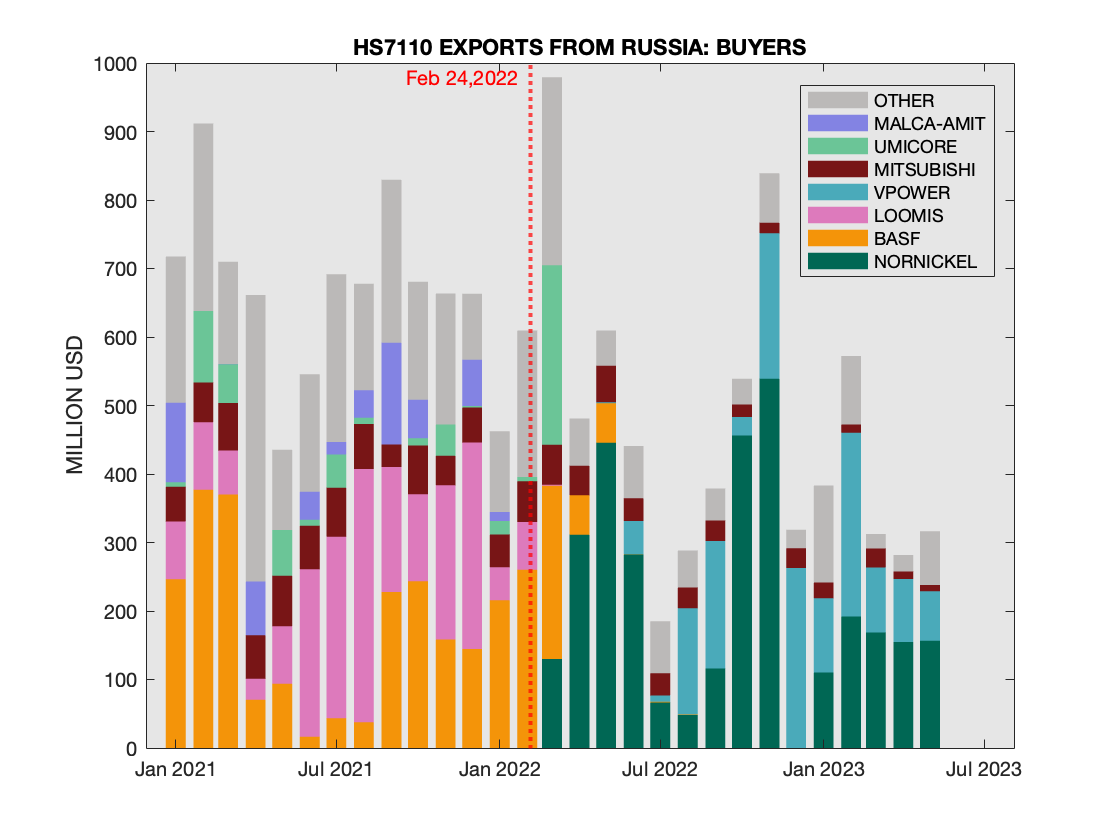

Metal Exports from Russia · October 5, 2023

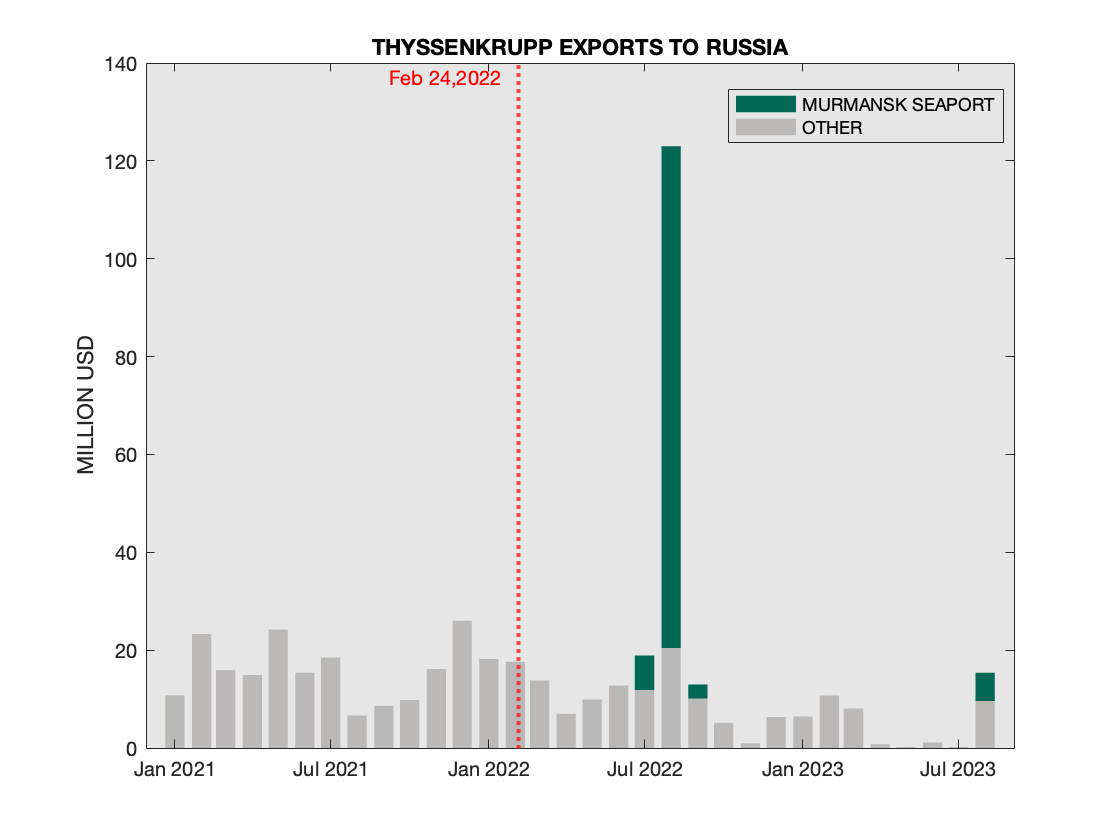

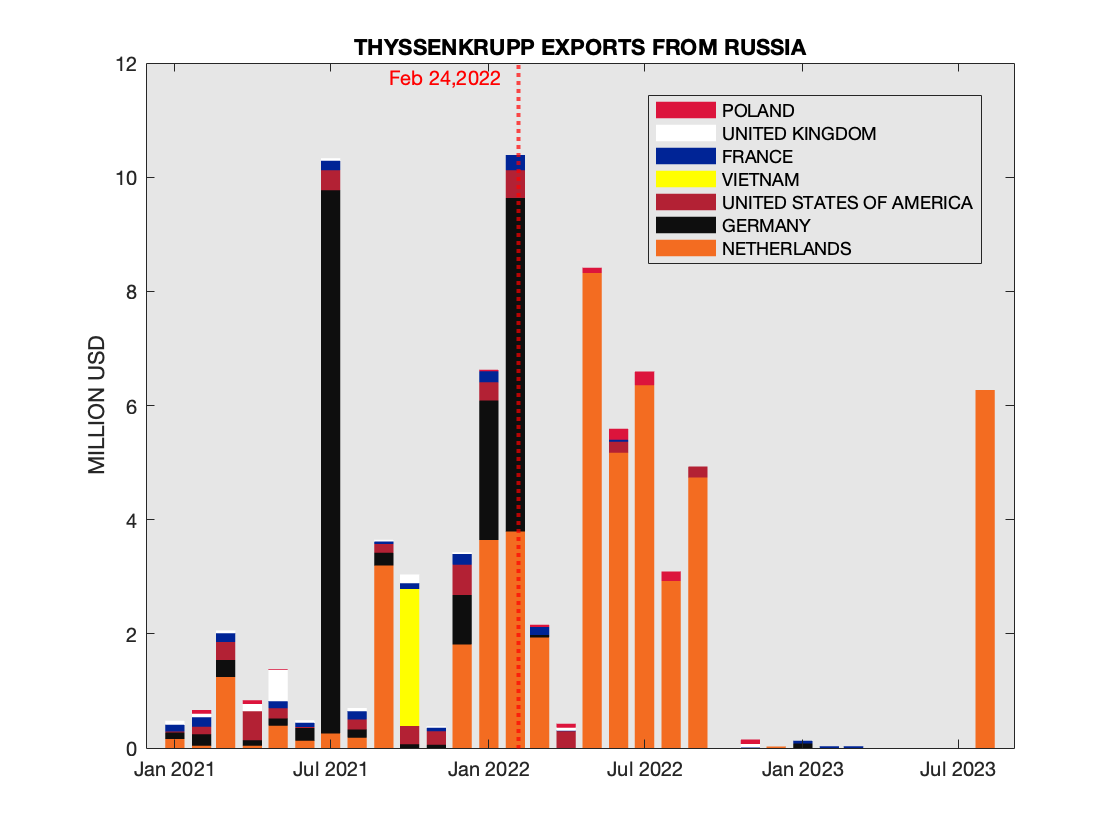

ThyssenKrupp Business with Russia · October 25, 2023

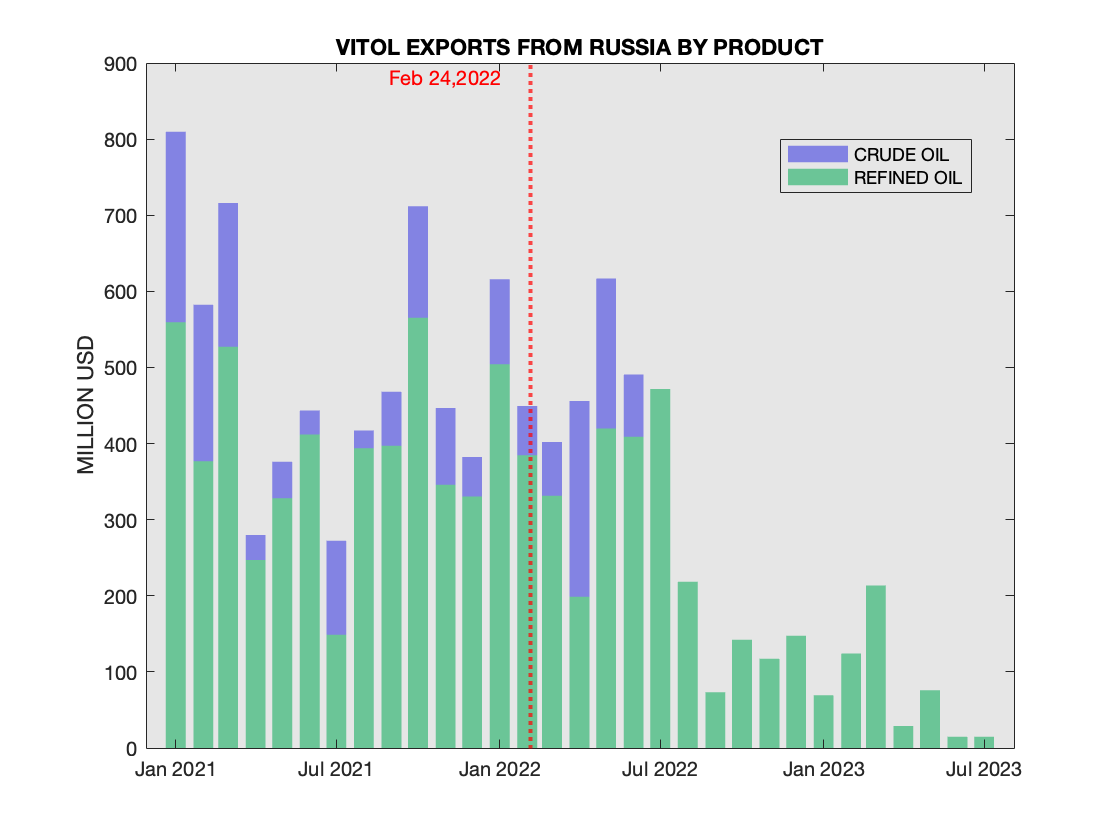

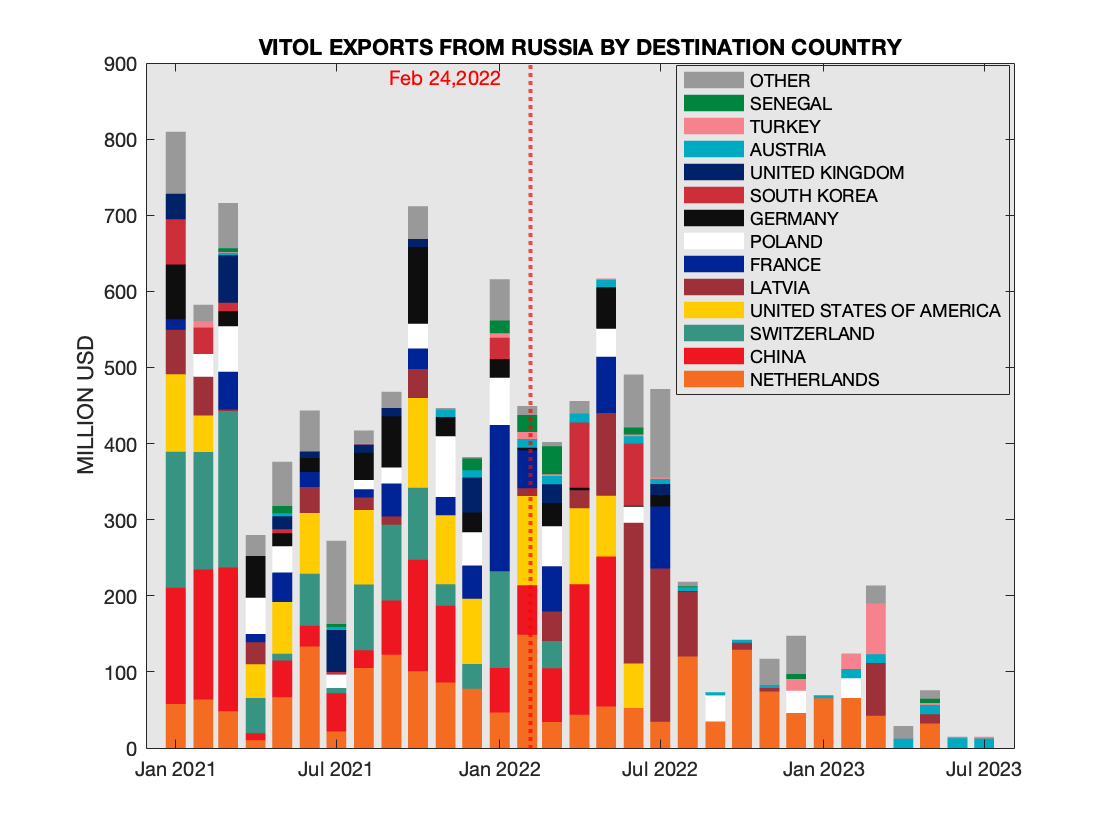

Vitol exports from Russia · Nov 12, 2023

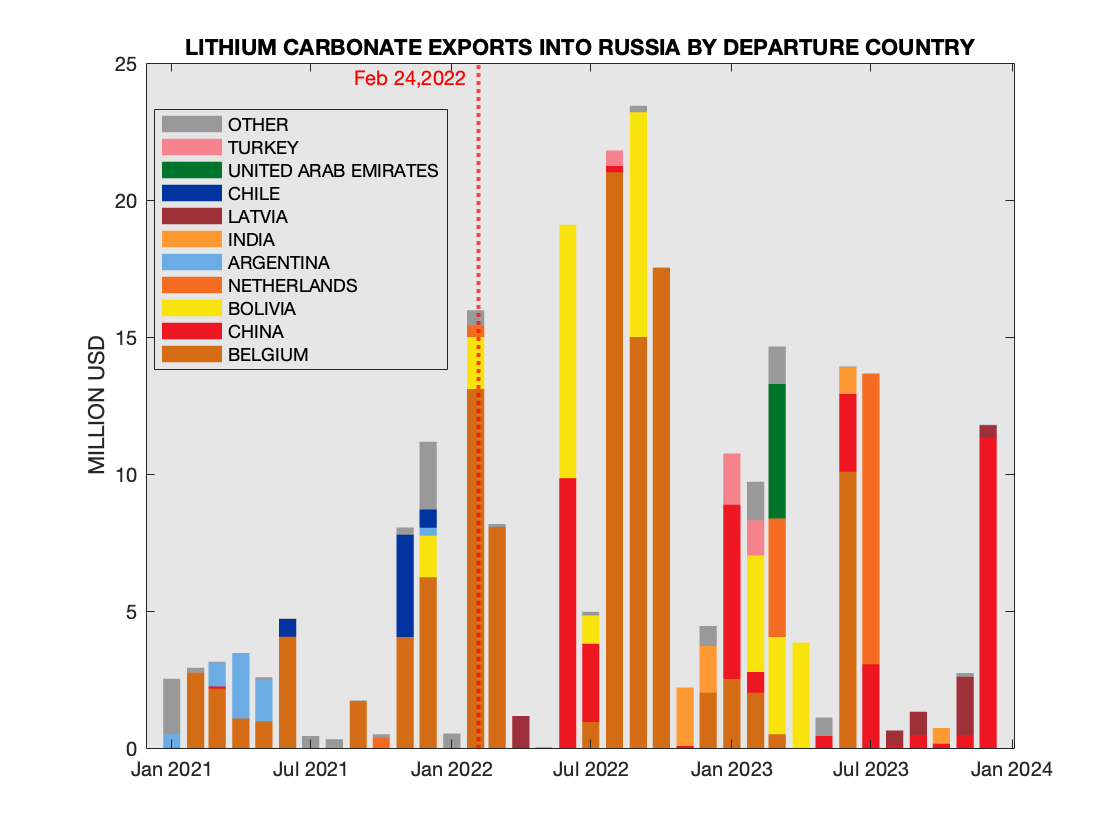

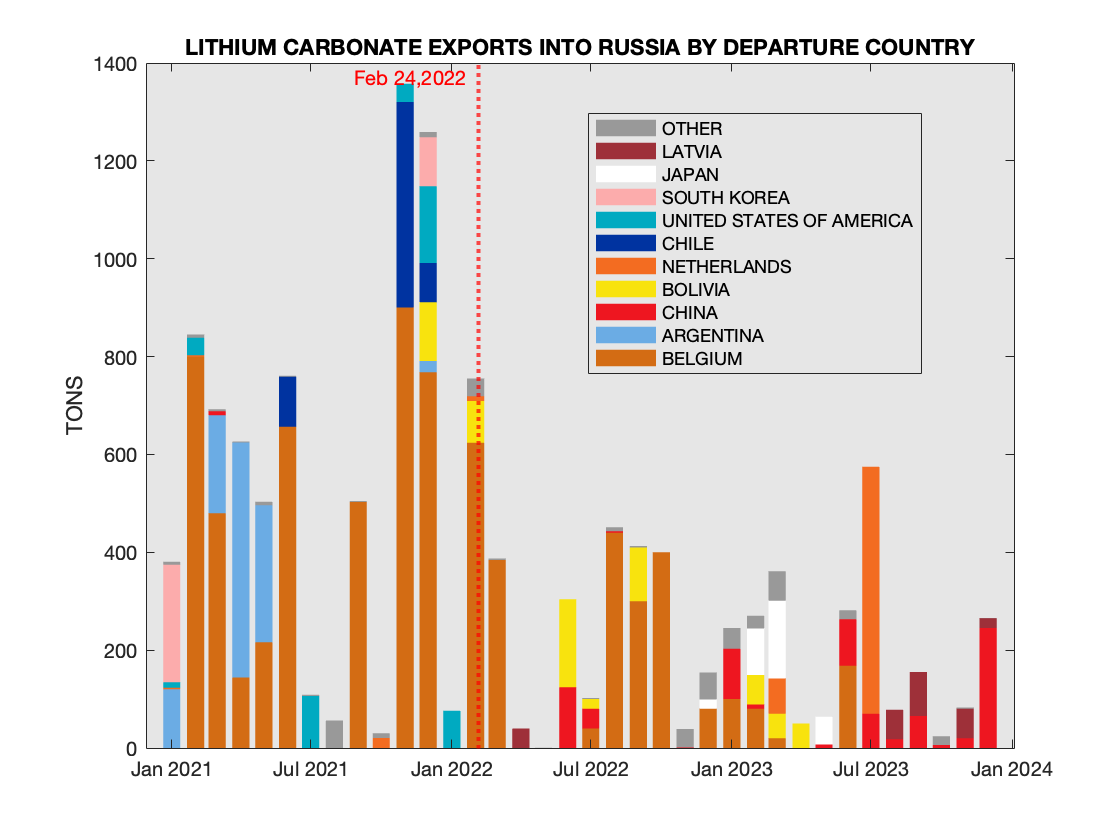

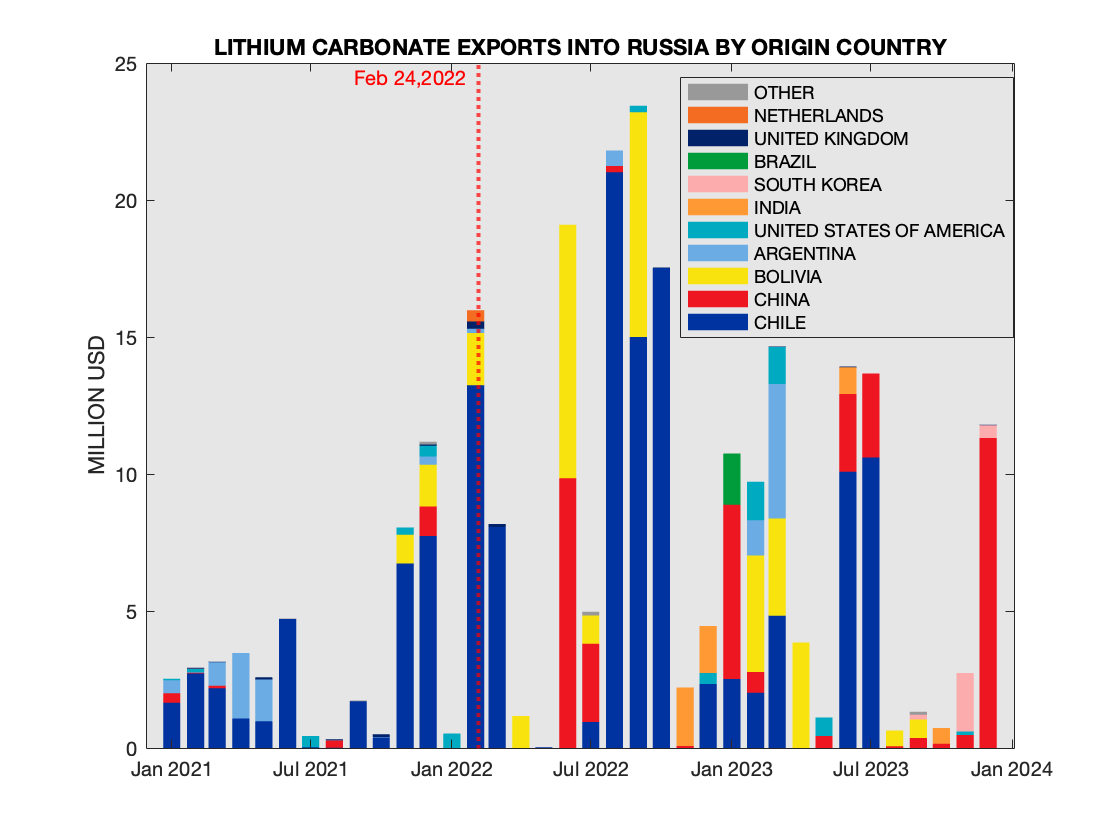

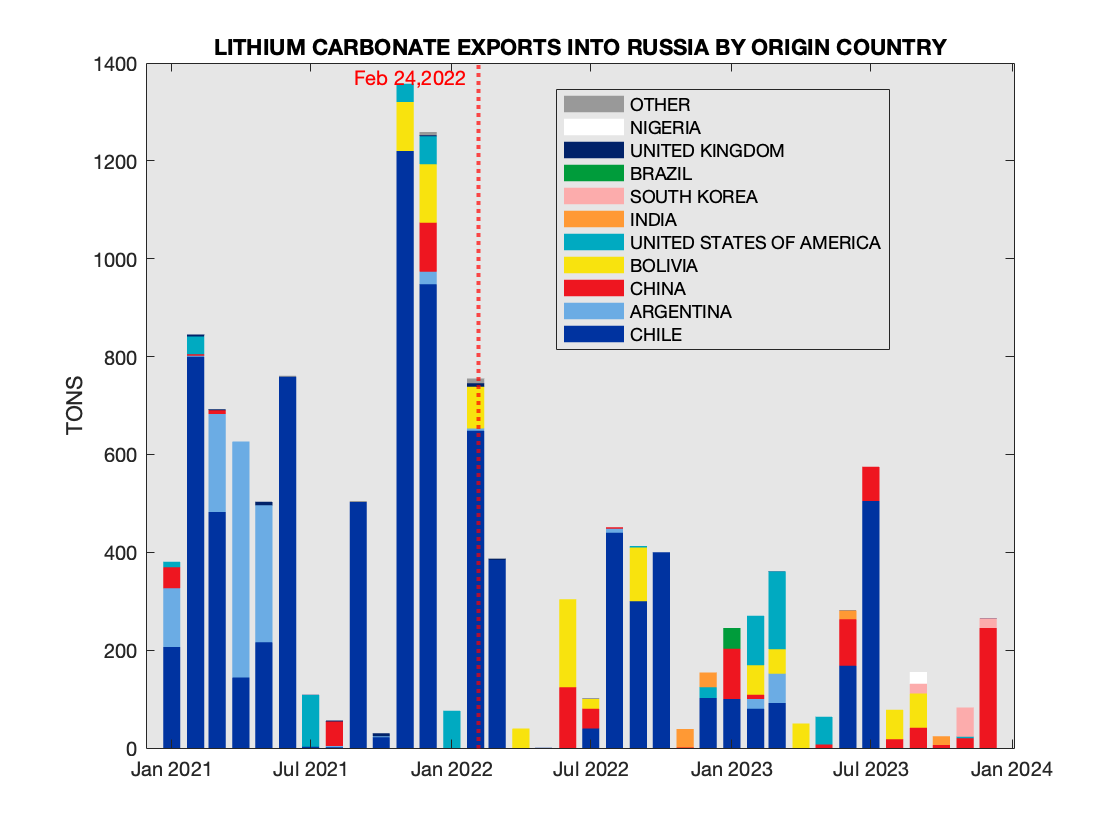

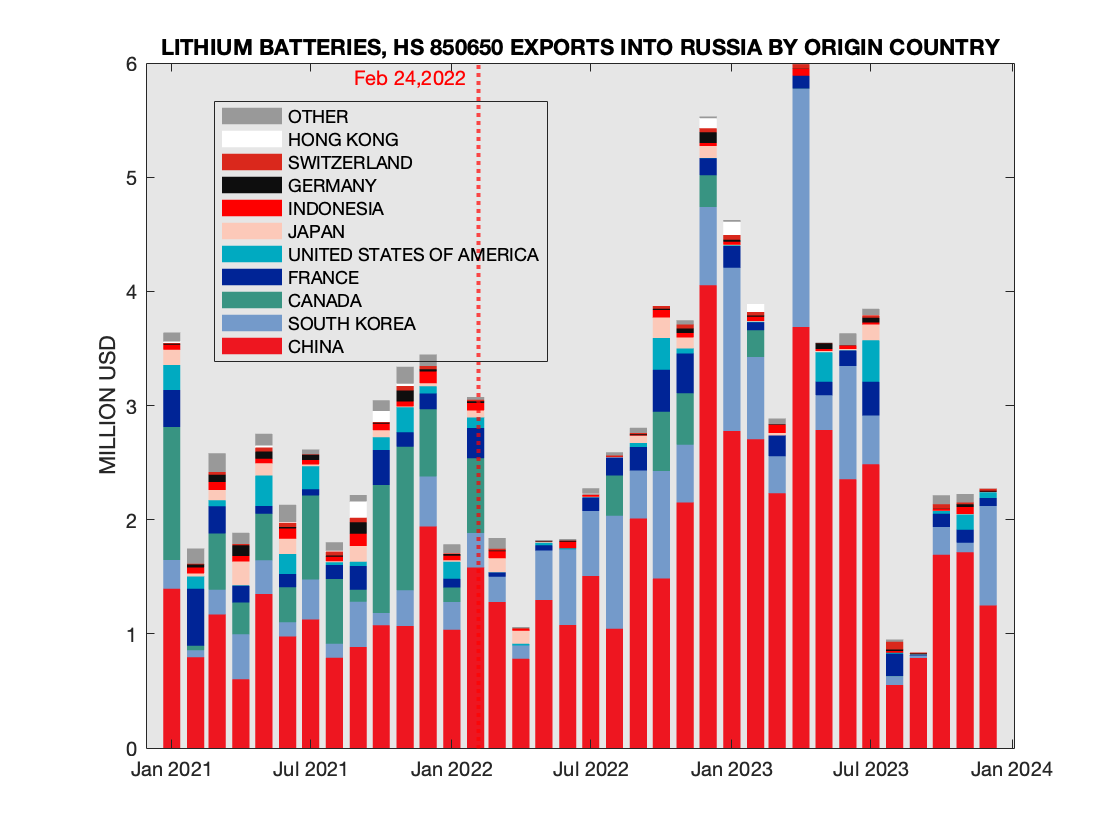

Lithium Exports into Russia · February 28, 2024

Revisiting Mondelēz Exports into Russia · Feb 20, 2024

Revisiting Adidas Exports into Russia · Feb 25, 2024

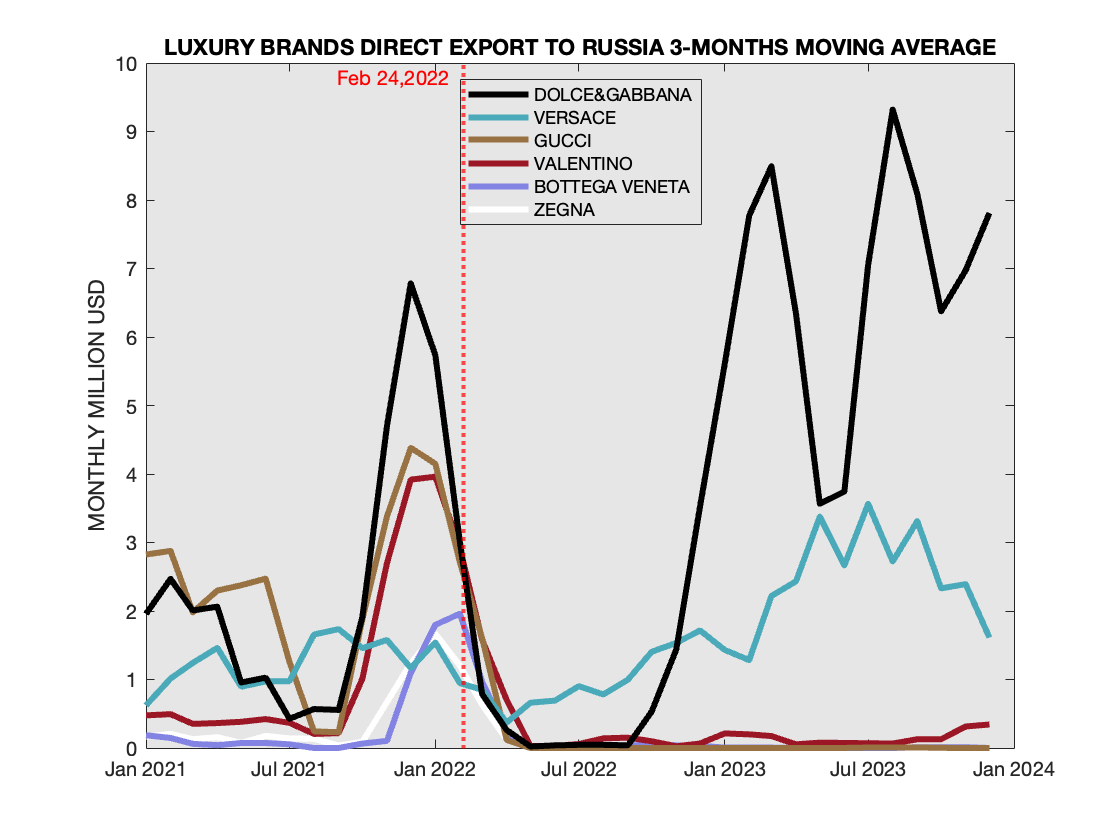

Italian Fashion Exports into Russia · May 25, 2024

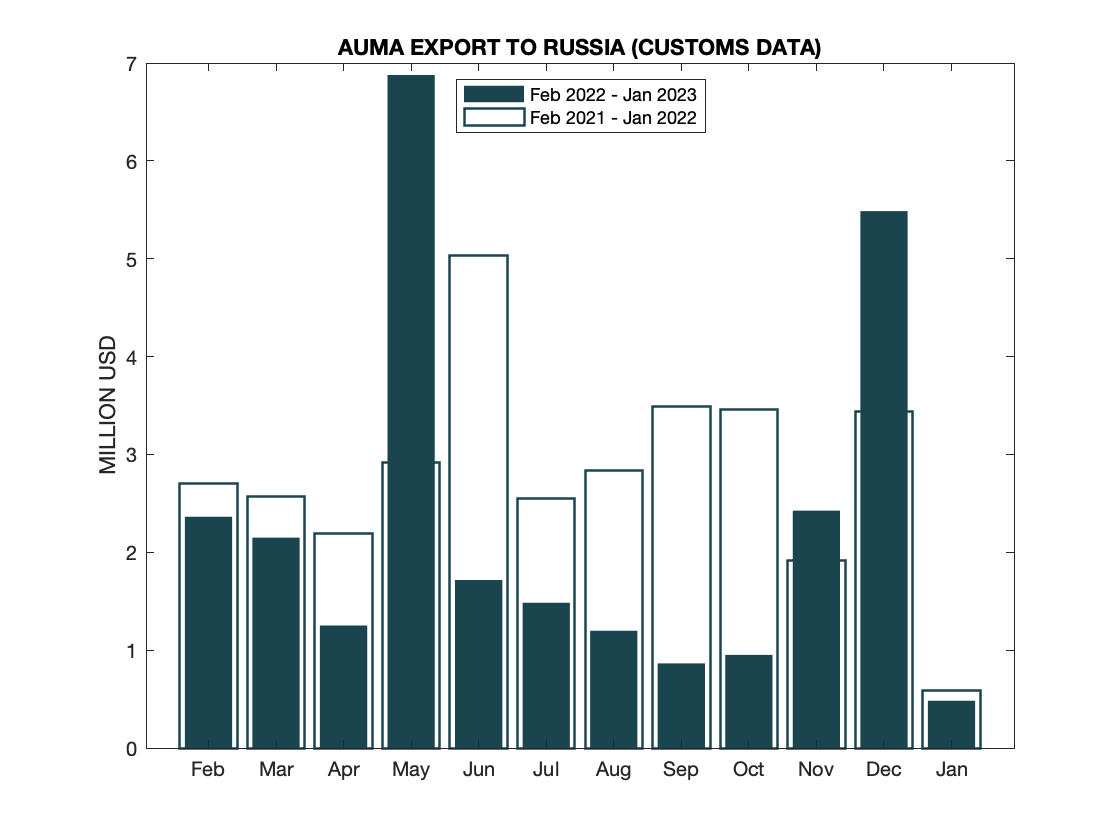

AUMA Exports into Russia

March 5, 2023

AUMA shipments into Russia based on Russian customs February 2021 - January 2023. Comparing period February 2022 - January 2023 to the corresponding months a year ealier.  AUMA Monthly Totals Comparison

AUMA Monthly Totals Comparison

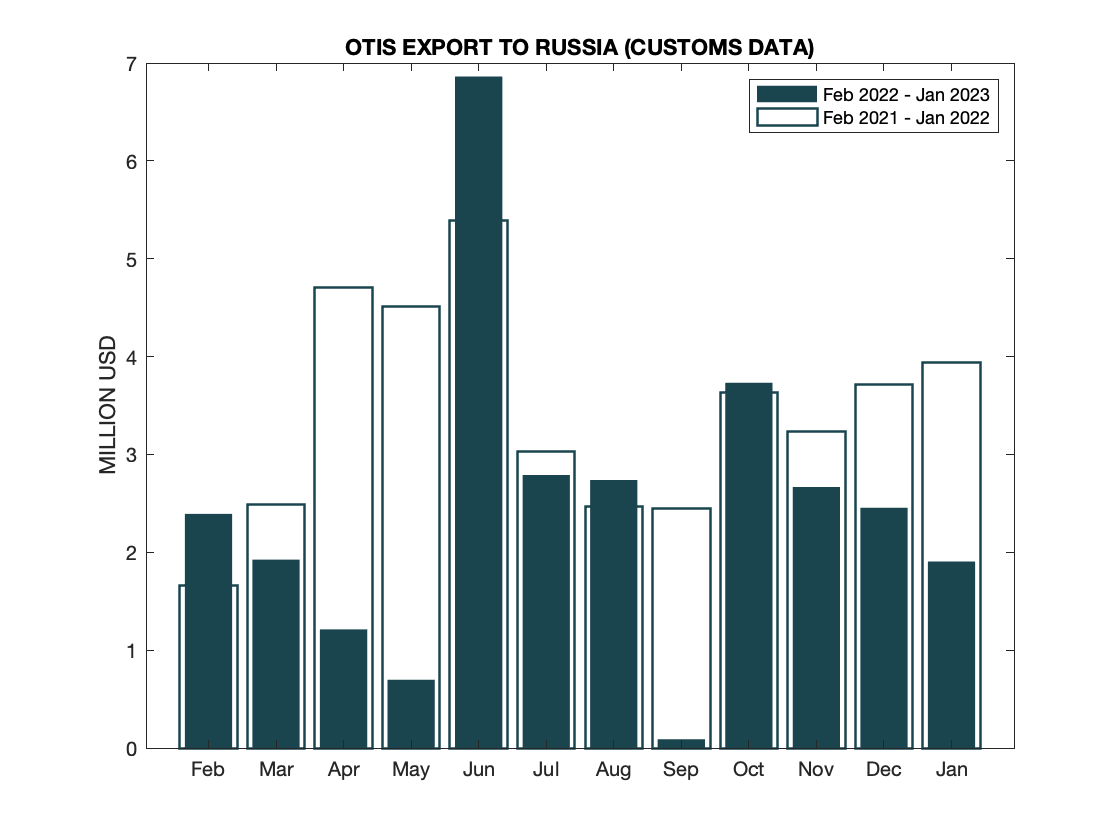

Otis Exports into Russia

March 5, 2023

Otis shipments into Russia based on Russian customs February 2021 - January 2023. Comparing period February 2022 - January 2023 to the corresponding months a year ealier.  Otis Monthly Totals Comparison

Otis Monthly Totals Comparison

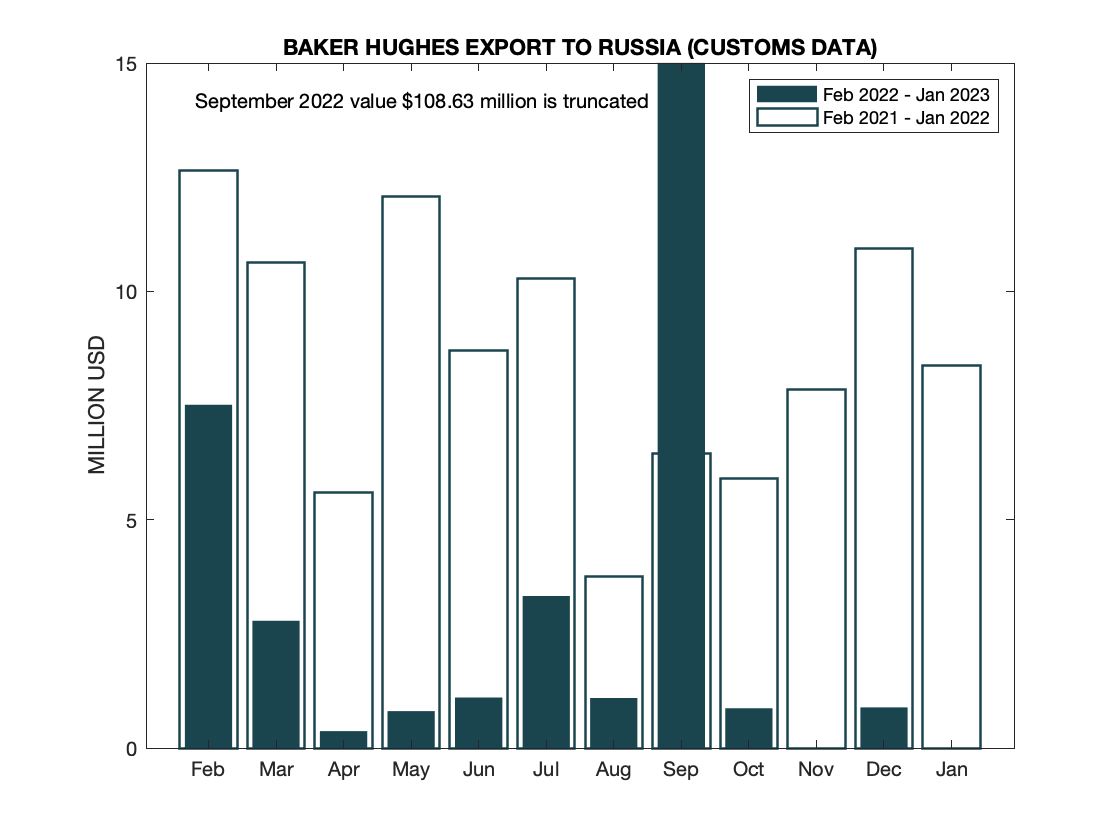

Baker Hughes Exports into Russia

March 6, 2023

Baker Hughes shipments into Russia based on Russian customs February 2021 - January 2023. Comparing period February 2022 - January 2023 to the corresponding months a year ealier.  Baker Hughes Monthly Totals Comparison

Baker Hughes Monthly Totals Comparison

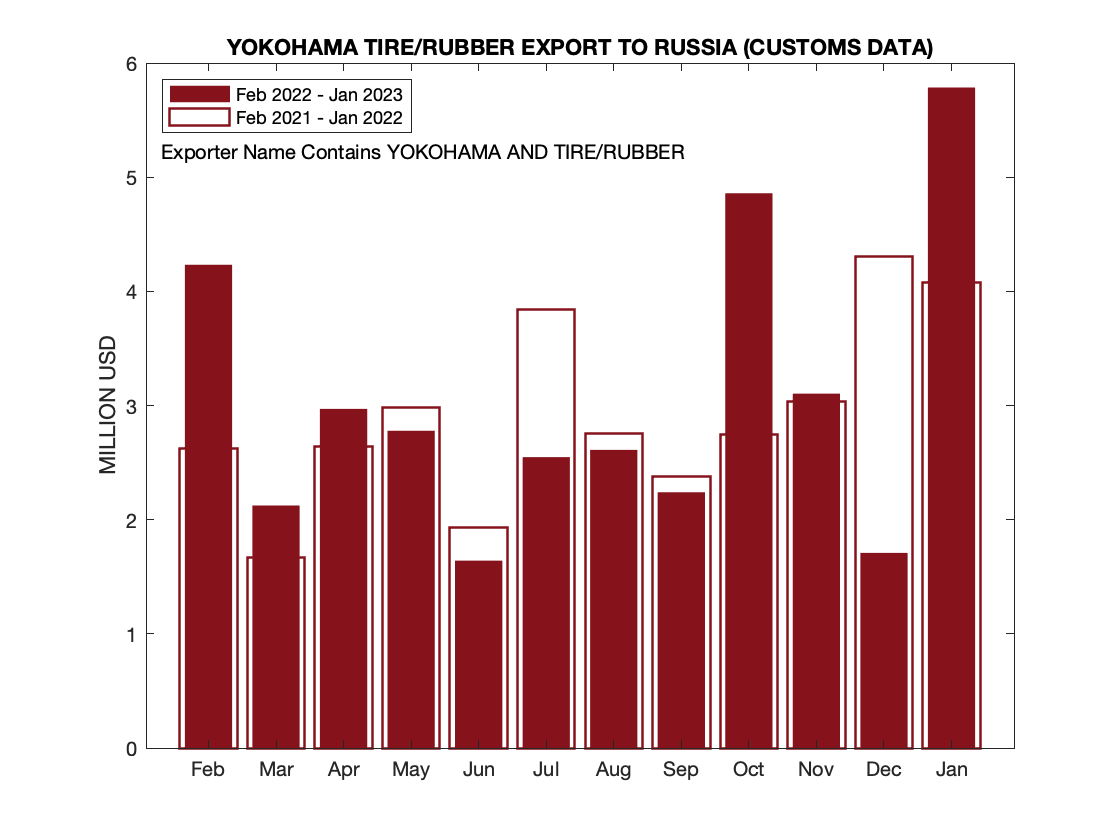

Yokohama Rubber Exports into Russia

March 7, 2023

The Yokohama Rubber Company, Limited is one of the largest tire manufucturers in the World. In Russia, it has a plant in Lipetsk where it stopped production in the Spring of 2022 due to logistics challenges. In the summer however, those difficulties have been resolved and production resumed. In addition, the shipments of tires continued apace. First chart shows total exports into Russia for exporter that contain name "Yokohama" and either "Rubber" or "Tire" (different divisions of the company have this variations in the name). It compares February 2022-January 2023 with the corresponding months one year prior.  Yokohama Rubber Monthly Totals Comparison

Yokohama Rubber Monthly Totals Comparison

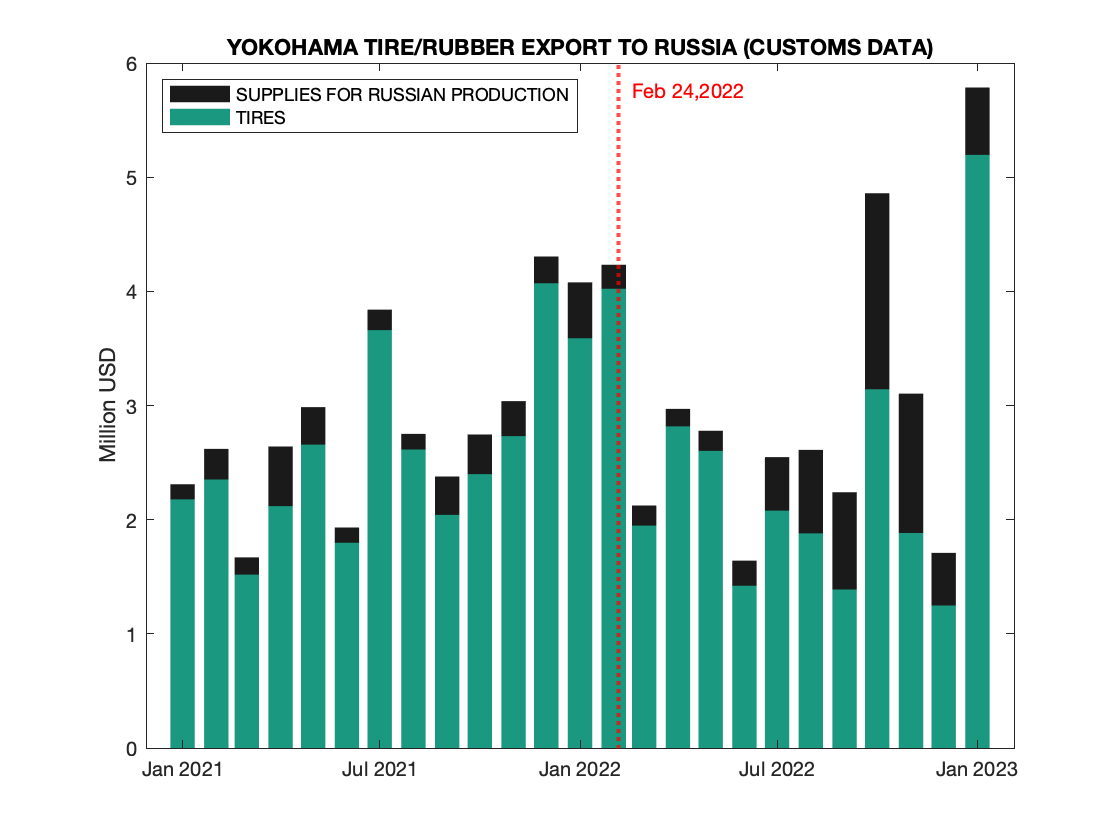

The second chart breaks down the monthly exports from Yokohama into two categories - tires (based on the Russian word used to describe tires "шины" in the description) and everything else - with the second category covering supplies for the plant in Lipetsk (such as volcanizing agents). One can observe that, while tire exports continue apace, the supplies indeed slowed down in the Spring, but this decline was amply compensated in the Fall of 2022.  Yokohama Rubber Monthly Totals Jan 21-Jan 23 for Tires and Supplies

Yokohama Rubber Monthly Totals Jan 21-Jan 23 for Tires and Supplies

Procter & Gamble Exports into Russia

March 10, 2023

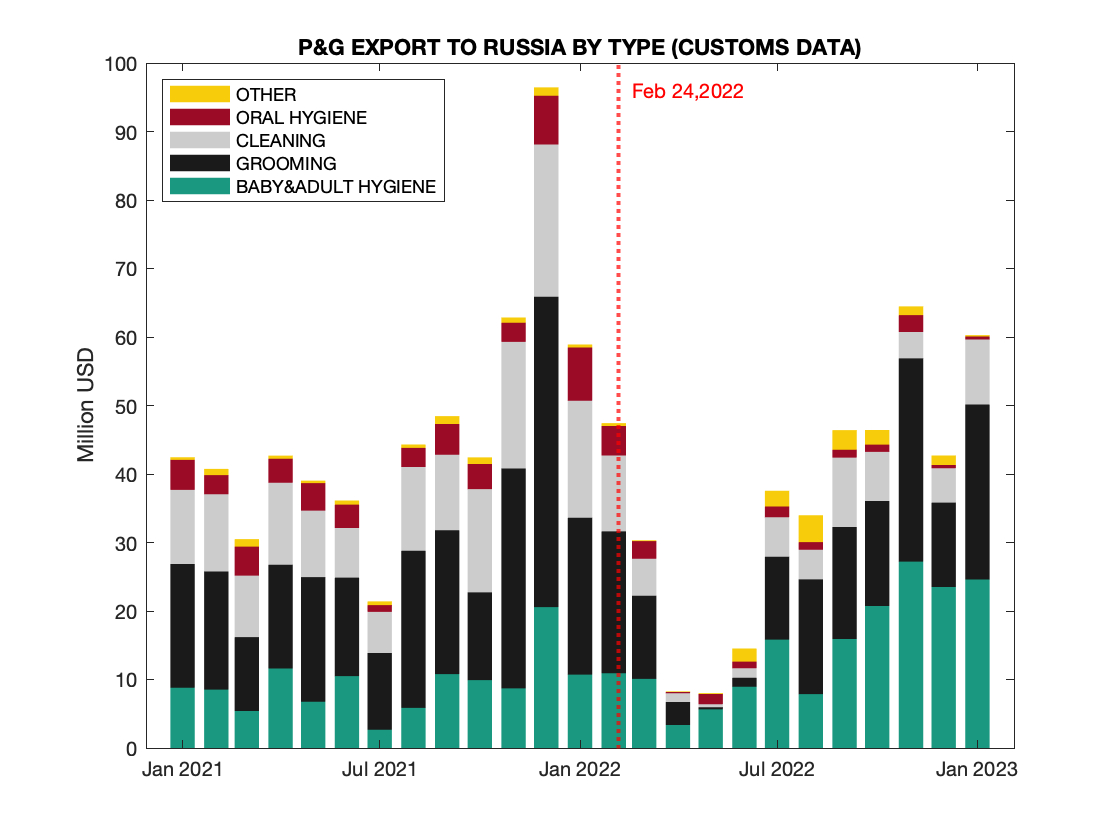

In the Spring of 2022 P&G issued the following statement about its operations in Russia: "We are significantly reducing our product portfolio to focus on basic health, hygiene and personal care items needed by the many Russian families who depend on them in their daily lives. As we proceed with the reduced scale of our Russian operations, we will continue to adjust as necessary." The first chart shows exports by P&G as a Supplier Jan 21-Jan 23 grouped into five categories:

- Baby & Adult Hygiene

- Feminine care, diapers and adult incontinence products and supporting material, including for supporting local production, HS four-digit codes 3404,3906,3919,3920,3926,5603,8516,9619

- Grooming

- Shaving, hair, deodorants and supporting material, including for supporting local production, HS four-digit codes 3305,3307,3924,4703 6804,8212,8510

- Cleaning

- Detergents, soaps and supporting material, including for supporting local production, HS four-digit codes 3302,3401,3402,3823

- Oral Hygiene

- Tooth paste and brushes,floss, etc., HS four-digit codes 3306,8509,9603

- Other

- Everything else, mostly spare parts for local production (such as ball bearings) - not clear for which of the above categories

P&G Monthly Totals by Type

P&G Monthly Totals by TypeOne can observe that after initial reduction in the Spring of 2022 was quickly followed by the resumption of the volume in the Summer and the Fall, across all categories, with the possibly exception of Oral Hygiene. The relative increase of the "OTHER" category can be attributed to stocking up on the spare parts and supporting equipment to maintain production.

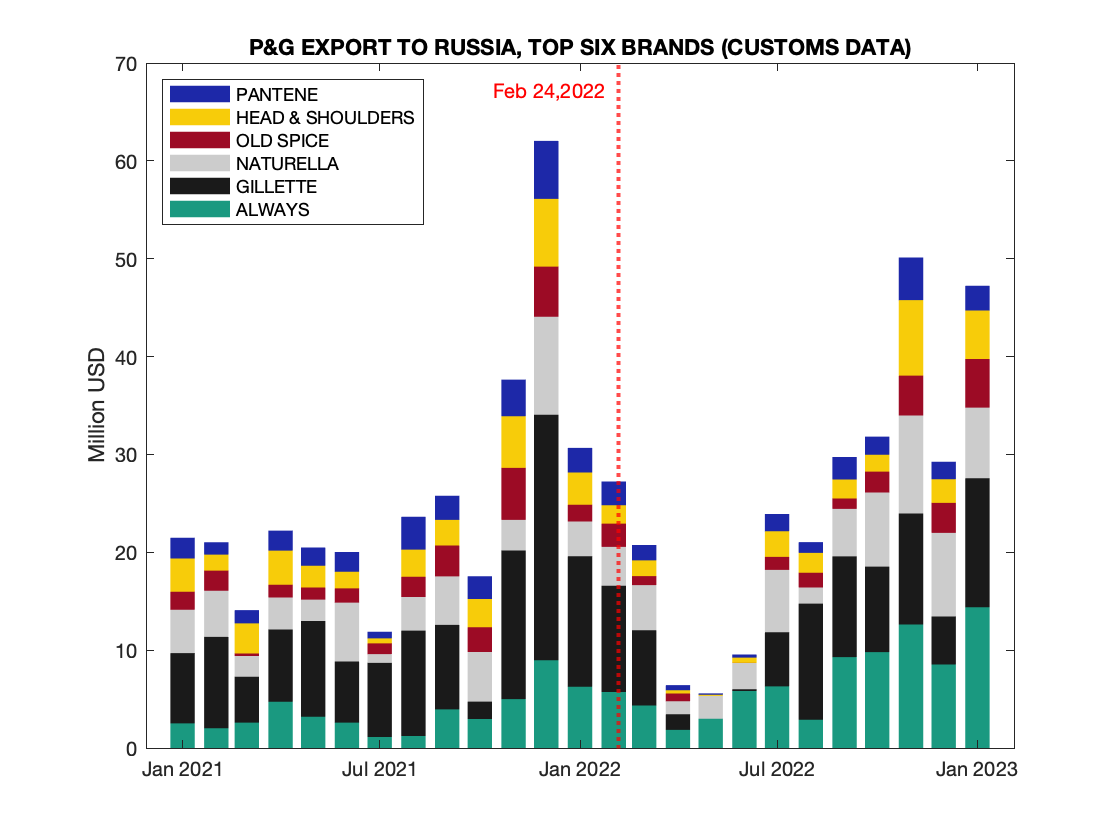

The second chart shows the monthly totals for the six top brands  PG Monthly Totals Jan 21-Jan 23 for six top brands

PG Monthly Totals Jan 21-Jan 23 for six top brands

Similar to the first chart, there is no reduction of the volume that can be observed for the top six brands

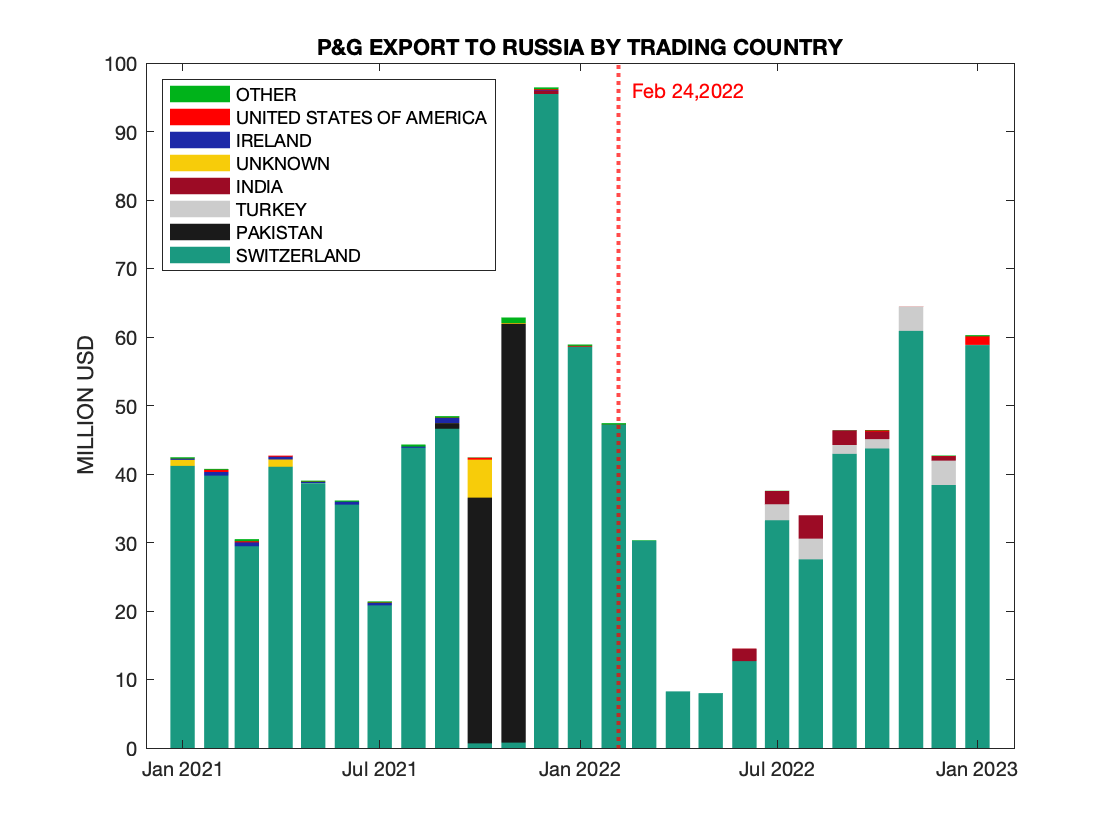

Finally, the third chart shows the monthly totals for by the trading countries  PG Monthly Totals Jan 21-Jan 23 by Trading Country

PG Monthly Totals Jan 21-Jan 23 by Trading Country

While the main trading country remain Switzerland, there are two observations: first, in the fall of 2021 trading mostly switched to Pakistan, and second, Turkey and India increased their contribution after the invasion.

Reckitt Benckiser Exports into Russia

March 12, 2023

In the Spring of 2022 Reckitt Benckiser issued a series of statements about its operations in Russia: The state that they are "meeting the needs of ordinary Russians who rely on our basic hygiene and health products for their everyday needs". They "have stopped all advertising, promotion and sponsorships in Russia. Last week, we also froze any capital investments in the country". On April 13, 2022 they announced that "Reckitt has begun a process aimed at transferring ownership of its Russian business, which may include a transfer to a third party or to our local employees." However, ten months later Bloomberg reported that trasfer failed to materialize at the time of reporting.

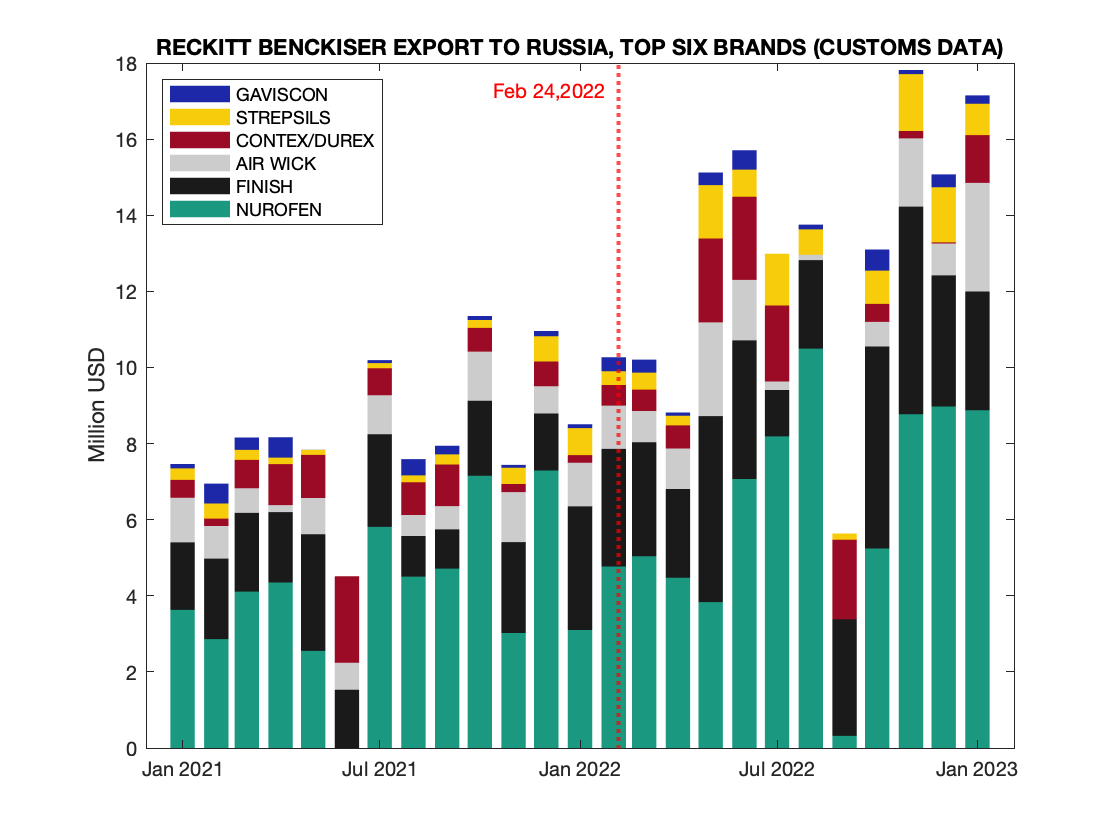

In the meantime, the exports continue a pace. The first chart shows the total of the top brands  Reckitt Benckiser Monthly Totals Top Brands

Reckitt Benckiser Monthly Totals Top Brands

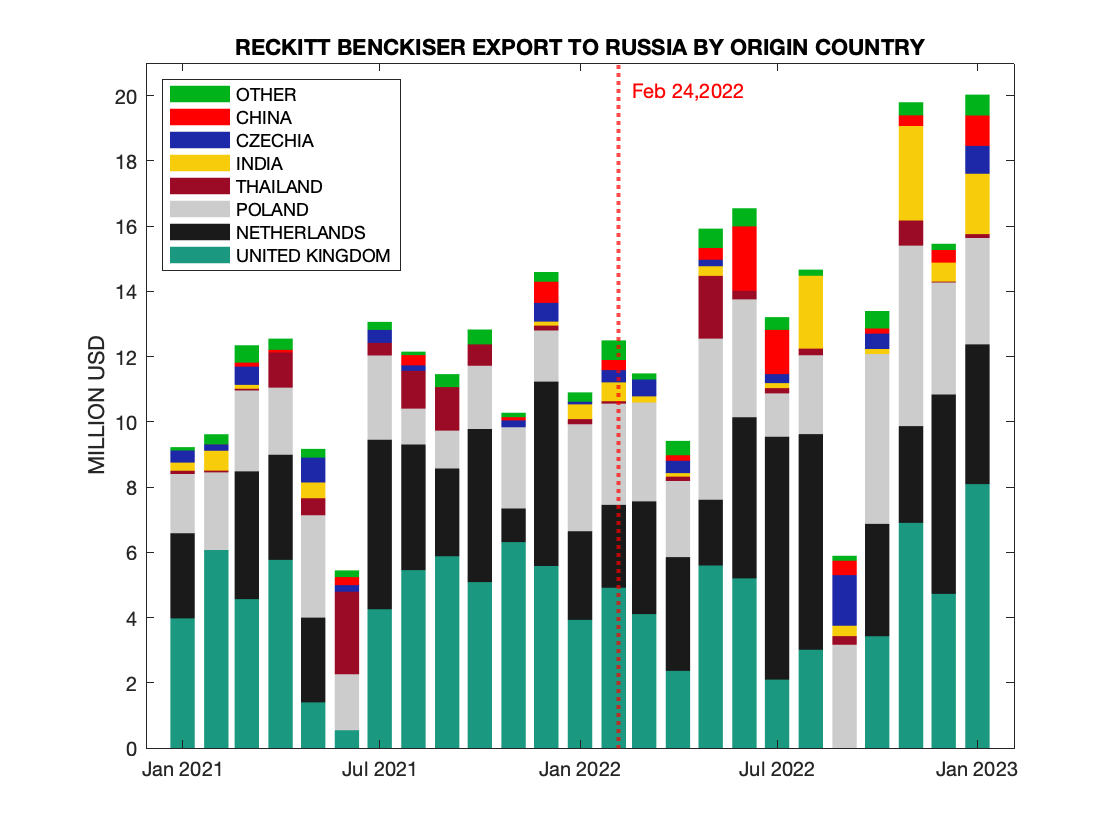

The second chart shows exports by country of origin. While the dominant countries (UK, Netherlands and Poland) remain the same, one can notice a small, but sizeable growth of India  Reckitt Benckiser Monthly Totals by Country of Origin

Reckitt Benckiser Monthly Totals by Country of Origin

Guess Exports into Russia

March 27, 2023

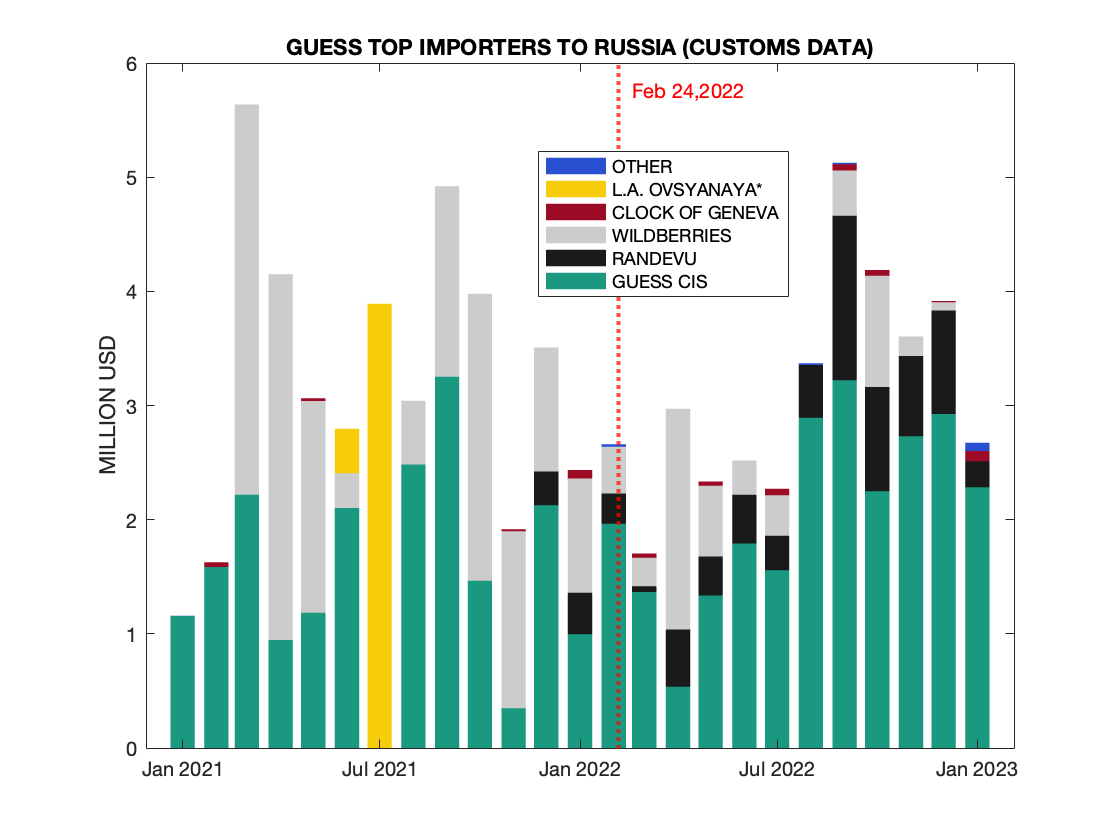

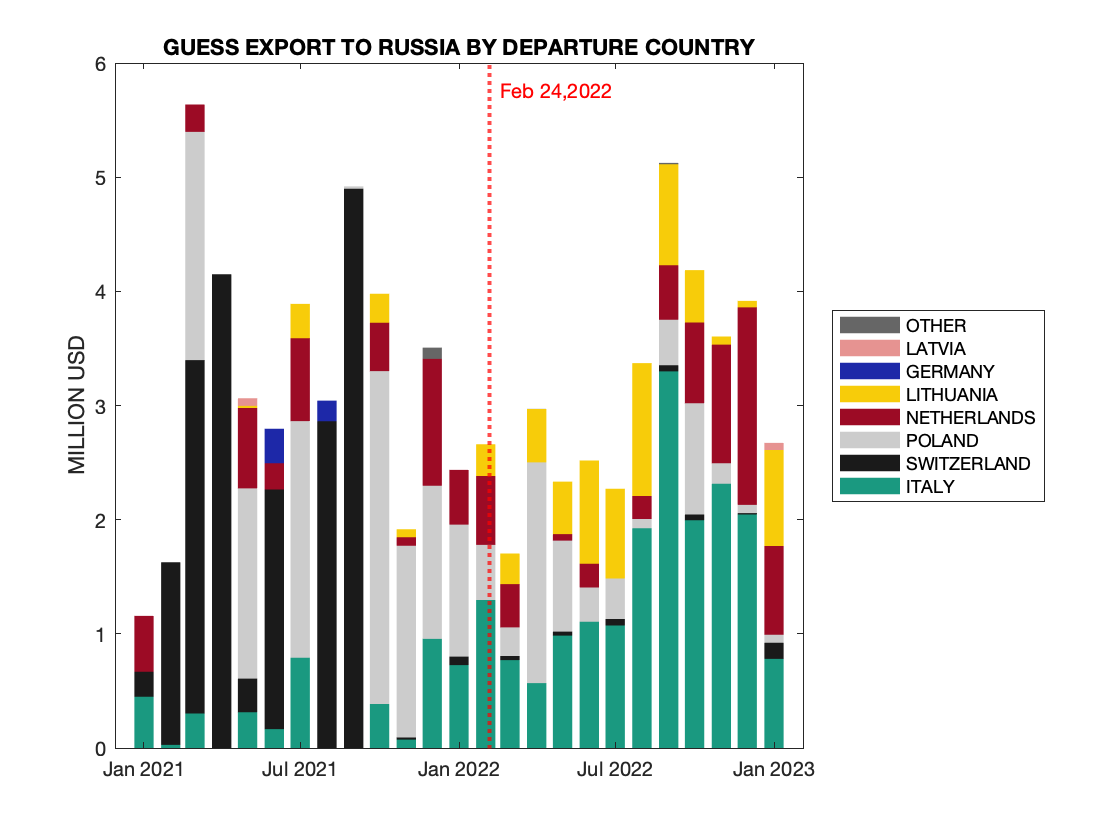

In March of 2022 publically traded American company Guess faced criticism from Ukrainians on its Facebook site for continuing operations in Russia, while Russians bombed Ukrainian cities. Guess's response is worth quoting: "Regarding our business in Russia, we have a joint venture structure there. So we are not a 100% direct operation. We're actively discussing and negotiating actions with our Russian partner. For the time being, we are suspending deliveries and investments into Russia and closing our direct e-commerce business. We will continue to monitor the situation with our partner as we move forward."

The Joint Venture referred in that response is apparently Guess CIS. In accordance with the latest financial report 10-K 2022, it is majority owned (70%) by Gap. Strictly speaking, 70% is indeed less than 100%, but does it make any difference for operational decisions of the joint venture? In accordance to the same report, slightly less than 3% of total revenues in 2022 were generated in Russia. The financial report discusses the Russian invasion into Ukraine solely in the context of operational risk and does not mention any voluntary measures for curtailing operations.

The direct e-commerce business that was supposed to be "closing" is very much operational a year later boasting new arrivals. Finally, let us take a look at the "suspended" deliveries. First chart shows the monthly breakdown by the Importer, including the abovementioned joint venture, and the Wildberries (recenly in the news for the strikes). One can observe that neither for the joint venture, nor the total shipments have descreased or suspended by any measure. The entry shown in yellow (L.A. Ovsyanaya) is the apparent artifact of the customs records, where in July 2021 about third of all imports were assigned to this otherwise unknown person. It is not clear whether that was a deliberate or accidental overwrite of the "Importer" field.  Guess Exports, Monthly Totals by Importer

Guess Exports, Monthly Totals by Importer

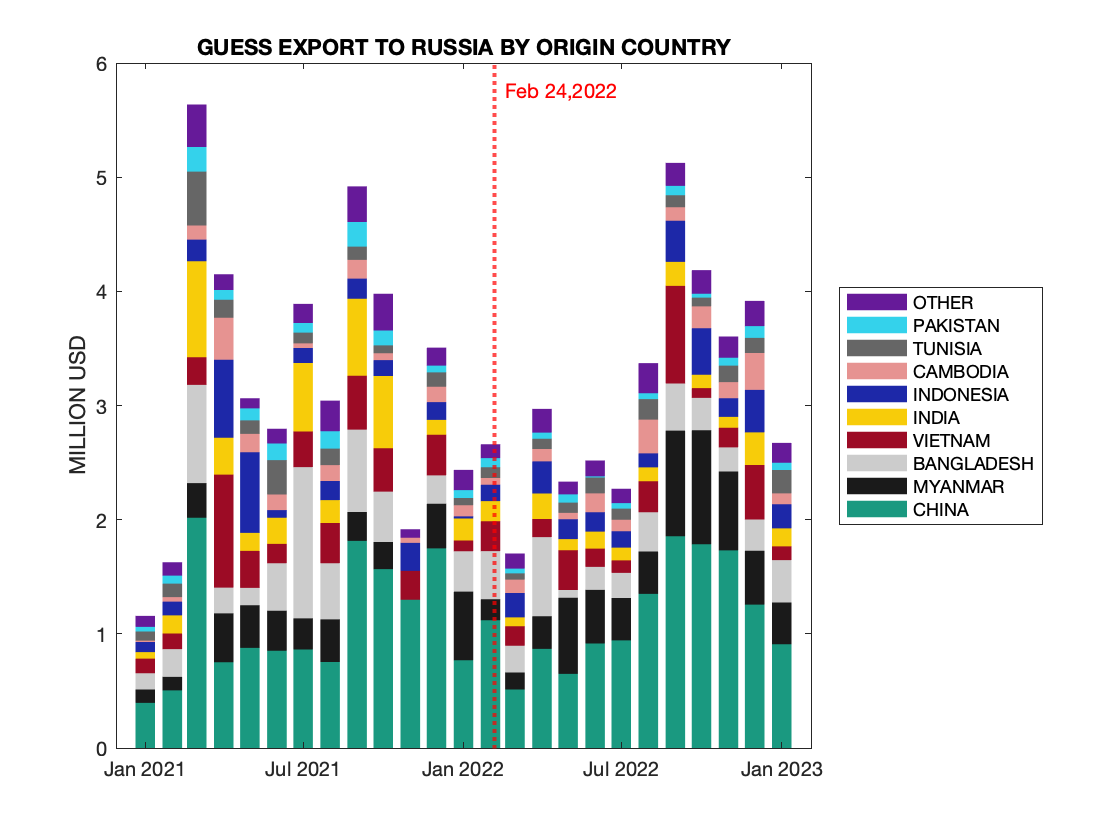

The next chart shows the breakdown of the shipments by the country of origin: no clear pattern can be observed with China and Myanmar maintaining dominating positions.  Guess Exports, Monthly Totals by Country of Origin

Guess Exports, Monthly Totals by Country of Origin

Guess Exports, Monthly Totals by Country of Origin

Guess Exports, Monthly Totals by Country of OriginOil Additives Exports into Russia

March 27, 2023

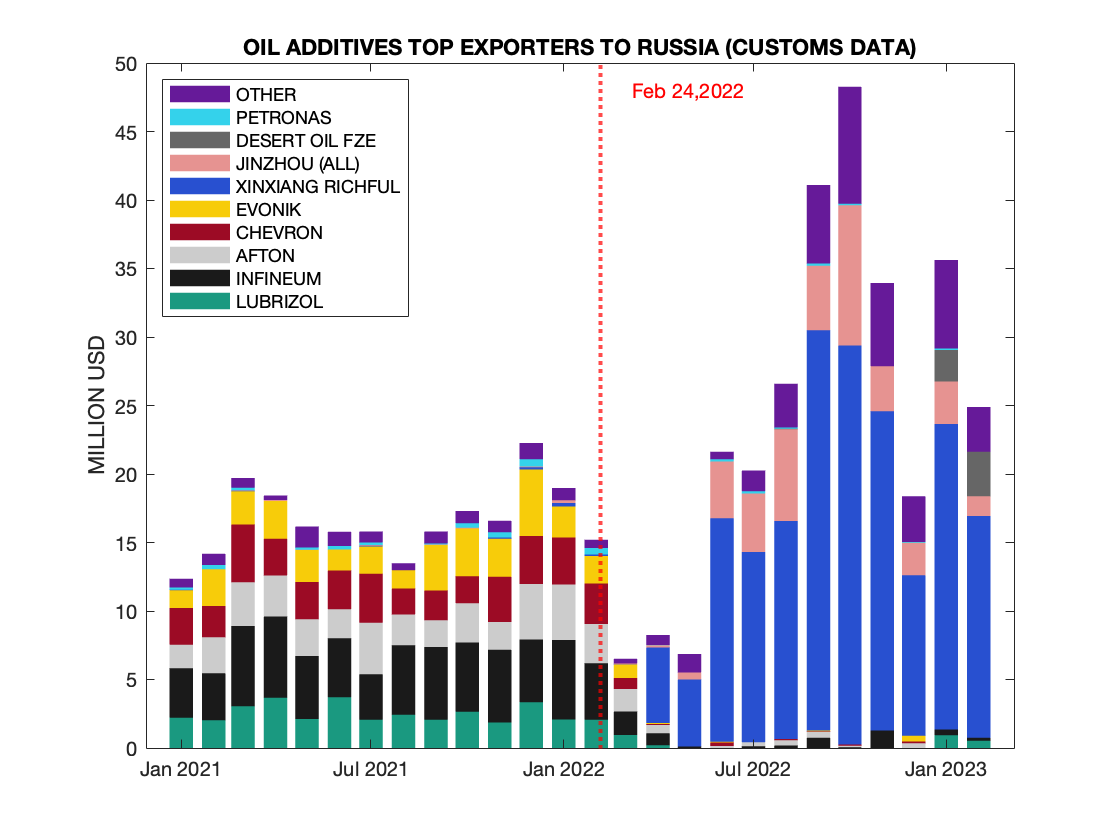

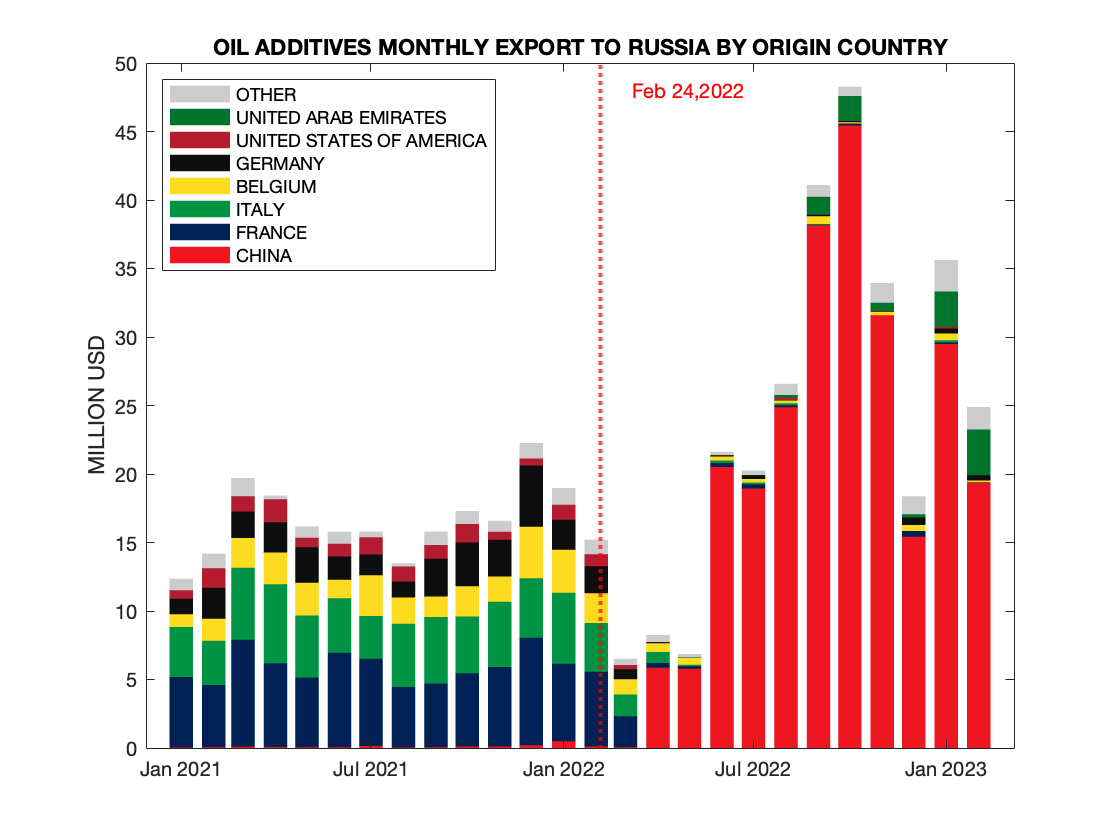

There is the World's "Big Four" of major oil additive producers: Lubrizol Corp. (owned by Berkshire Hathaway), Chevron Oronite, and Afton Chemical (publically-traded New Market Corporation), all three US-based and UK-based Infineum (joint venture between ExxonMobil and Shell). Other major players on the market are also Western (such as German Evonik). The oil additives are critical to manufacturing machine oil used in about any engine (including all non-EV cars). The certification and know-how creates a high barrier for entering the manufacturing of these additives for Russian and even for Chinese companies. The sanctions imposed by the West in the Spring of 2022 precluded Western companies from dealing with the Russian state entities. Majority of the Russian machine oil was produced by the Russian state entites, and giving the opacity of the Russian intermediaries, selling to Russia creates large risks for the western companies to run afoul of the sanctions. As a result, while only Chevron Oronite confirmed withdrawal from the Russian market, the rest of the big four curtailed operations as well, while staying silent about it. The remaining export appears to be largely "parallel".

The first chart shows how the make-up of the exporters dramatically changed after the Russian invasion for the HS code 381121  Oil Additives Top Brands

Oil Additives Top Brands

Xinxiang Richful Lube Additive Co. has become the dominant player after the invasion. Its additives meet American Petrolium Association (API) specs, one of the two major standards, but not the other standard, ACEA (Association des Constructeurs Européens d'Automobiles) specs. As a result, its additives are not recommended to be used with European cars, including US, Japanese, and Korean brands produced in Europe. The specs of other oil producers (such as multiple companies from Jinzhou) are unclear, and for some companies, such as Desert Oil FZE from UAE there is practically no public informational trace.

The second chart shows exports by country of origin. One can see even more clear how Chinese companies replaced the Western ones. Overall, the most surpizing aspect is not that there was a switch from Western to Chinese oil additives, but that the overall increase in volume of exports.  Oil Additives Monthly Totals by Country of Origin

Oil Additives Monthly Totals by Country of Origin

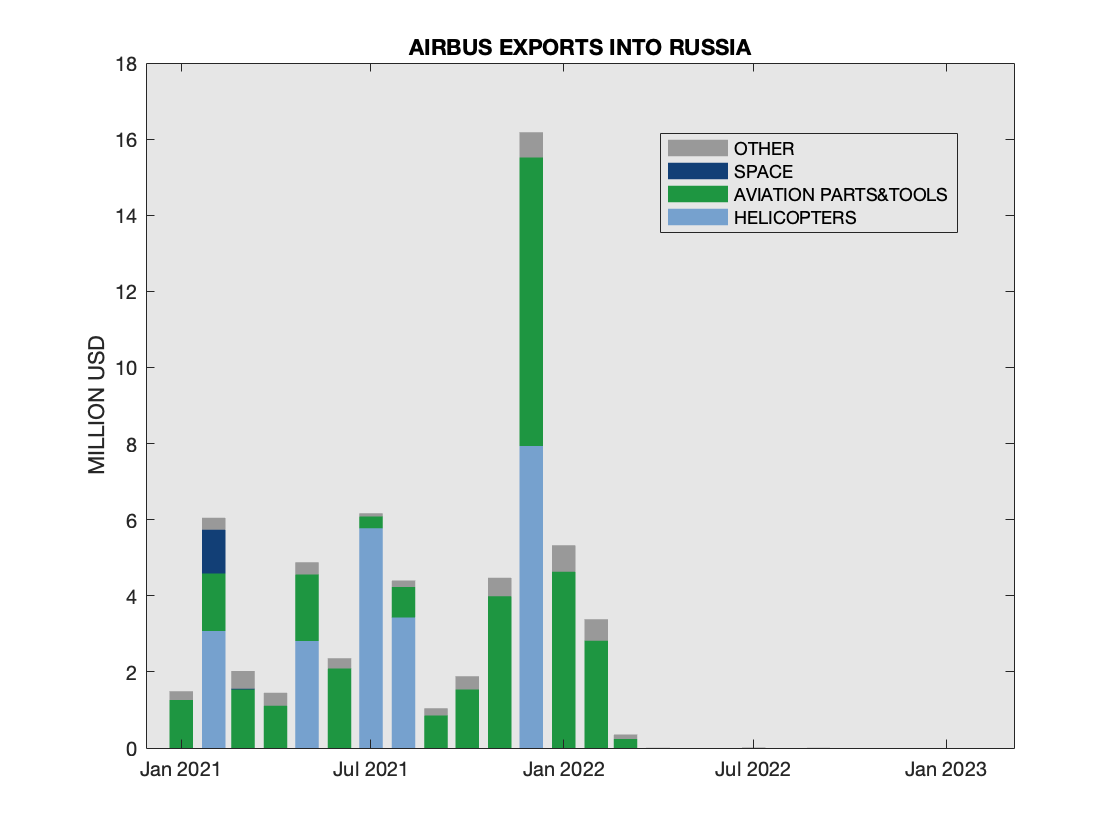

Airbus Russian Direct Imports and Exports

April 10, 2023 revised April 16, 2023

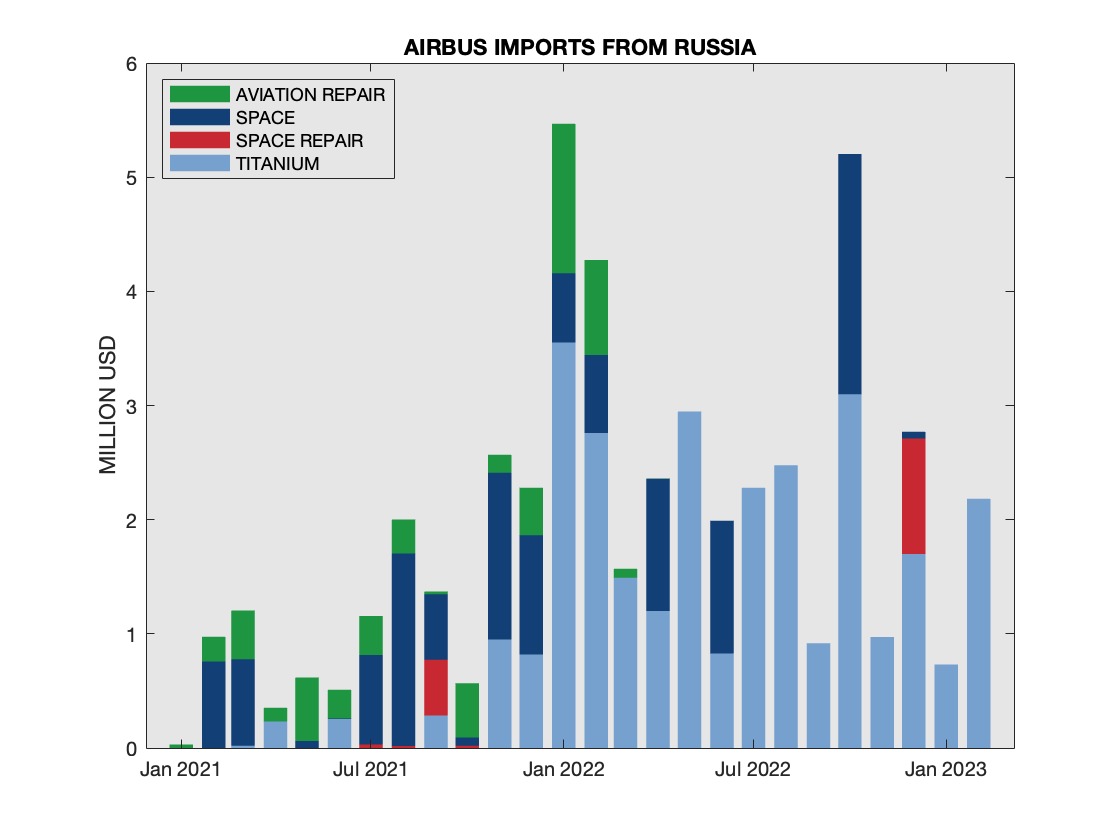

After February 24, 2022 sanctions imposed on aviaion industry in Russia precluded direct export of Western aircraft-related items into Russia  Russian Imports from Airbus, Monthly Totals by Type

Russian Imports from Airbus, Monthly Totals by Type

- Helicopters

- HS four-digit codes 8802

- Aviation Parts & Tools

- The following HS four-digit codes are included: 8529,3926,7326,7616,8517,8412,8807,7318,4016,9026, 8302,8547,8537,8536,8481,6307,7604,8471,8523,8108,9031,8544,8473,8421,9405,8425, 7304,9015,7607

- Space

- Space collaboration identified by the Importer "FEDERAL STATE BUDGETARY INSTITUTION OF SCIENCE"

- Other

- This category also contains aviation parts and tools for supporting fixed and rotary wing aircraft with HS not explicitely categorized (HS codes other than those listed above)

One can observe that the direct imports effectively stopped.

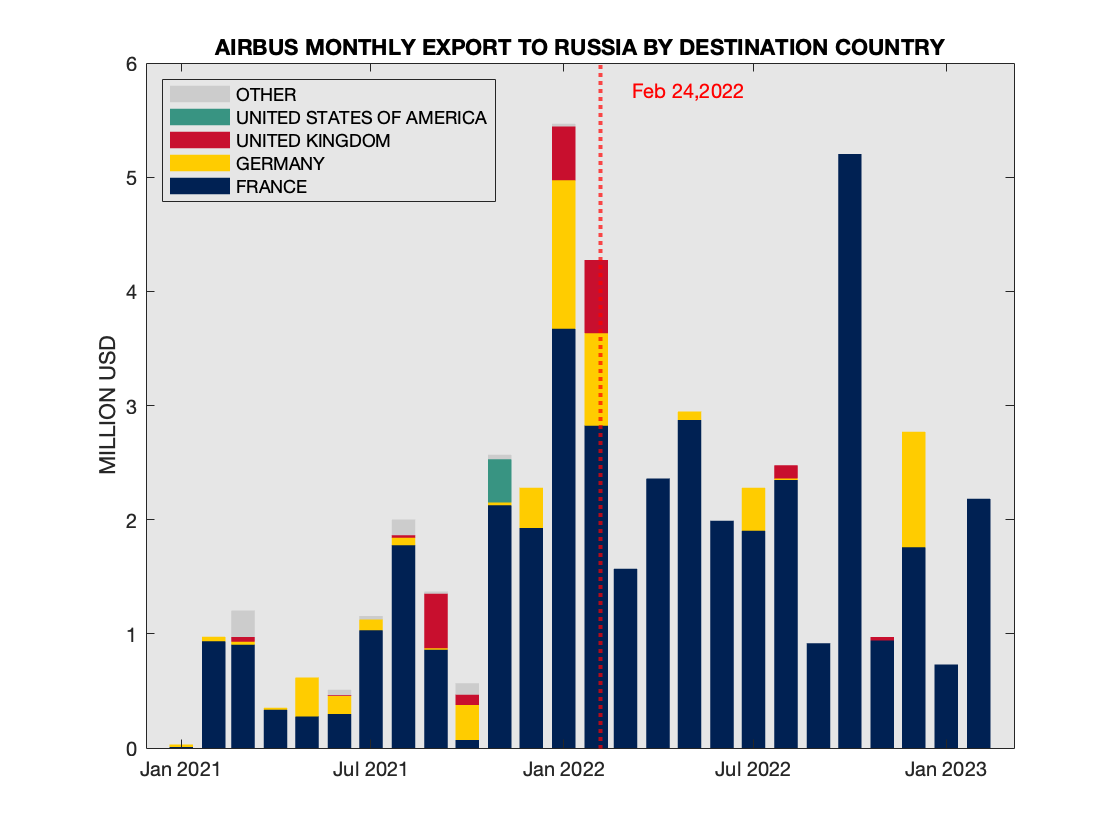

While Boeing made an early announcement about halting purchases of titanium from Russia Airbus continued titanium purchases. In December 1 of 2022, Airbus made announcement about its intention to decouple its supply chain from Russian Titanium in a "matter of months". It is not clear how many months Airbus has in mind, but as of the end of February (the last available data points), exports continued as can be seen from the next chart.  Airbus Exports from Russia, Monthly Totals by Type

Airbus Exports from Russia, Monthly Totals by Type

Here the Type is broken in the following way

- Titanium

- Identified by the VSMPO as the exporter

- Space

- Space and Satellite components identified by description and HS codes with Russia being the country of Origin

- Space Repair

- Space and Satellite components identified by description and HS codes with Russia NOT being the country of Origin

- Aircraft Repair

- This category also contains aviation parts and tools that were not Russian origin, so those parts appear to return to the Airbus for repair. In general, this is a common practice in aviation for repairable parts (so-called rotables). The original version of this post assigned some shipments in December of 2022 to this category. However, upon closer examination those shipments appear to be part of the Space program, so the appropriate correction to the charts is made

The last chart shows the breakdown of the exports from Russia by the destination country, where France continue to be the main recepient.  Airbus Exports from Russia, Monthly Totals by Country of Destination

Airbus Exports from Russia, Monthly Totals by Country of Destination

Pernod Ricard Exports into Russia

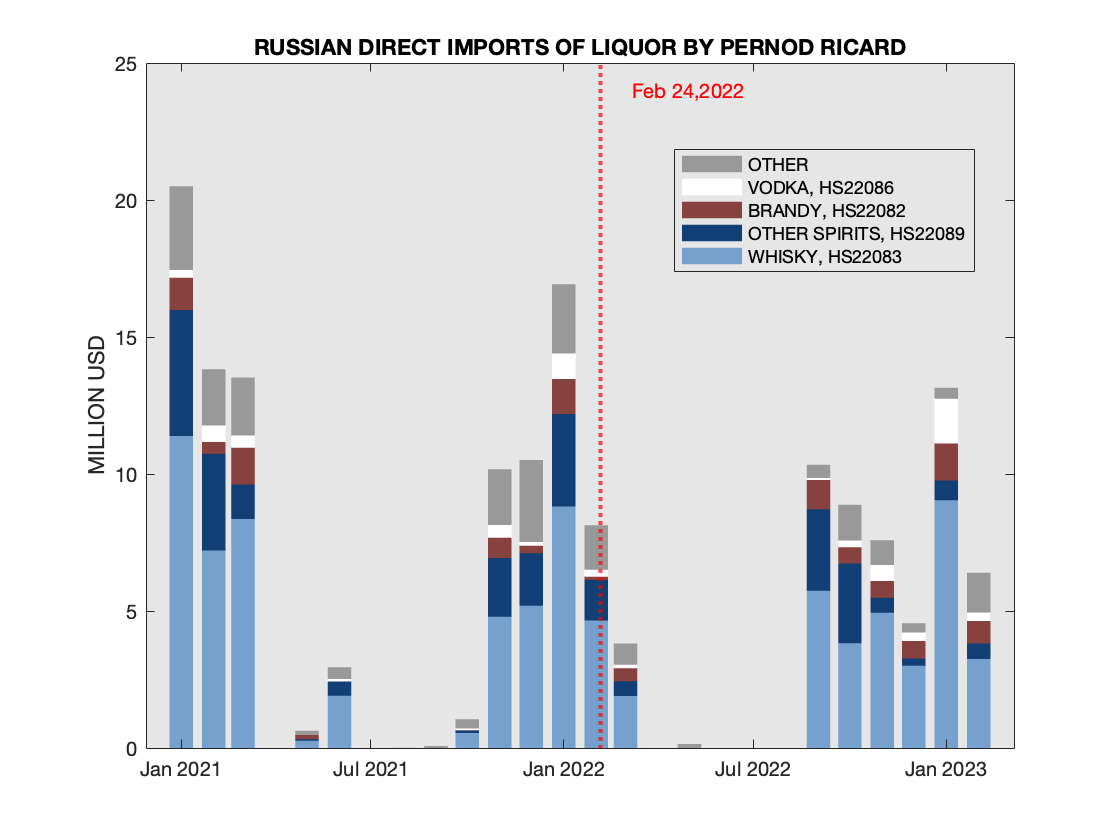

April 18, 2023 updated May 12

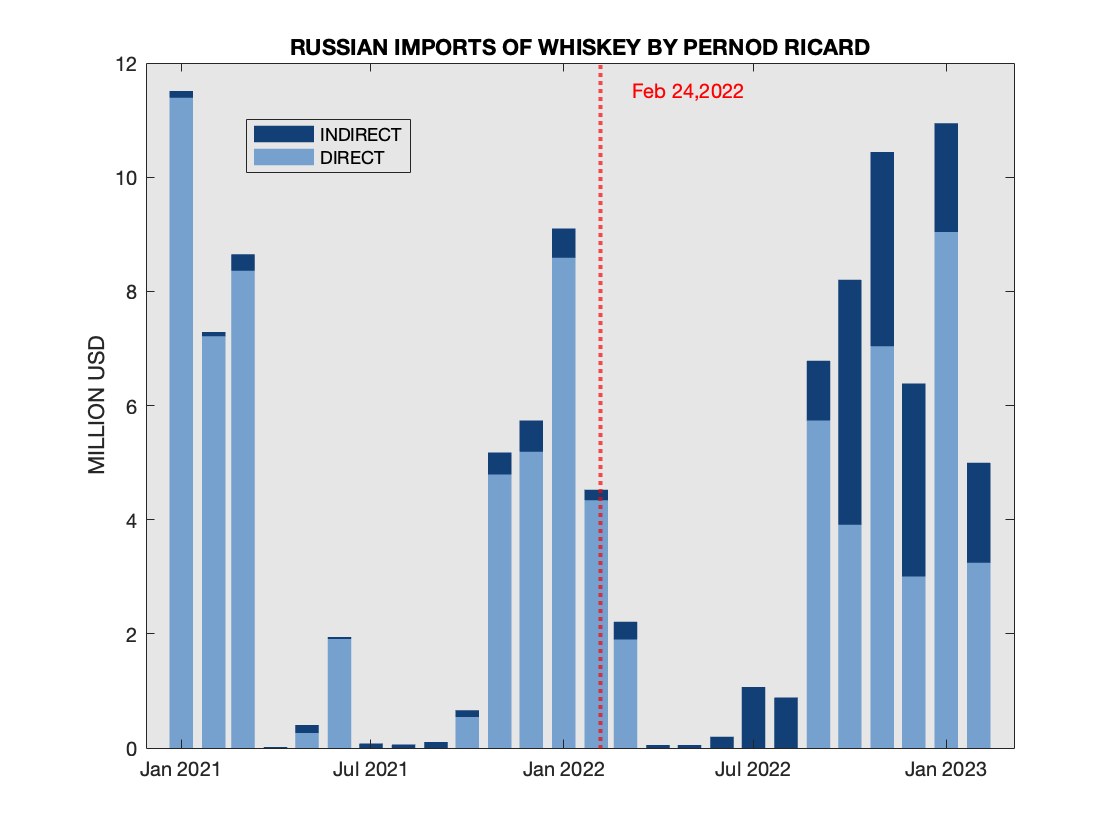

In March of 2022 Pernod Ricard issued a statement on Ukraine. The last sentence of the statement was "Pernod Ricard has suspended its exports to Russia", in the Fall (September 9) the statement has been revised, where this last sentence has been removed. Earlier this month (April 2023), local press of the countries where Pernod Ricard owns famous brands drew public attention to the resumption of exports. In Ireland, it was about Jameson Whiskey. In Sweden, about Absolut Vodka. So, when did Pernot Ricard resume the shipments?  Direct Pernod Ricard Exports to Russia 2021- February 23

Direct Pernod Ricard Exports to Russia 2021- February 23

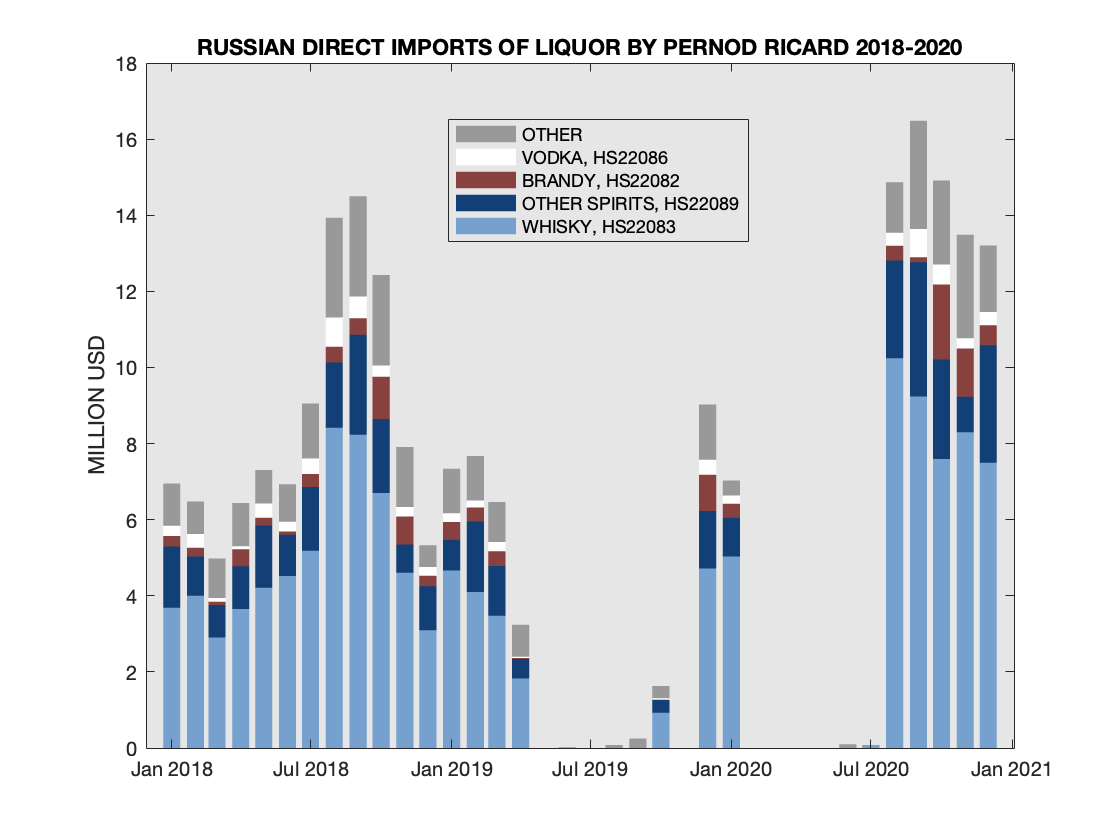

Furthermore, the previous year data shows strong seasonal variability of shipments with few or none shipments in the late Spring - early Fall. It is unclear whether this variability is real or an artifact of Russian customs data-keeping.

A look at the previous three years shows a mixed picture with respect to variability: strong variability in 2020 (Covid year) and 2019, but a smoother pattern in 2018.  Direct Pernod Ricard Exports to Russia 2018- 2020

Direct Pernod Ricard Exports to Russia 2018- 2020

Next, a more detailed look at Whiskey (which appears to be the most popular export by the company into Russia). Here in addition to direct shipments (based on the supplier name), indirect shipments are added (with either Trademark or Raw Manufacturer field indicating one of the brand of the company).  Pernod Ricard Whiskey Exports to Russia 2018- 2020

Pernod Ricard Whiskey Exports to Russia 2018- 2020

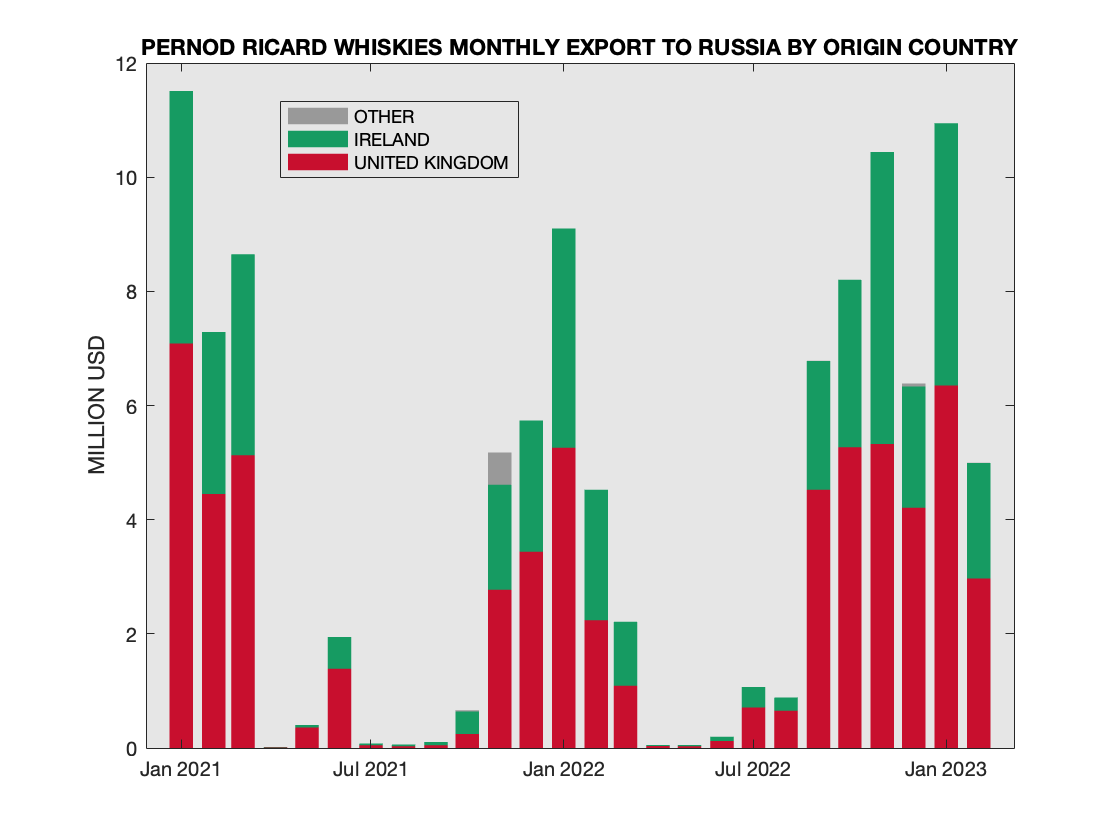

Separating by the origin country reveals a pretty even split between UK (with Scotch brands such as Chivas Regal and Ballantine) and Ireland (Jameson).  Pernod Ricard Whiskey Exports to Russia by Country of Origin

Pernod Ricard Whiskey Exports to Russia by Country of Origin

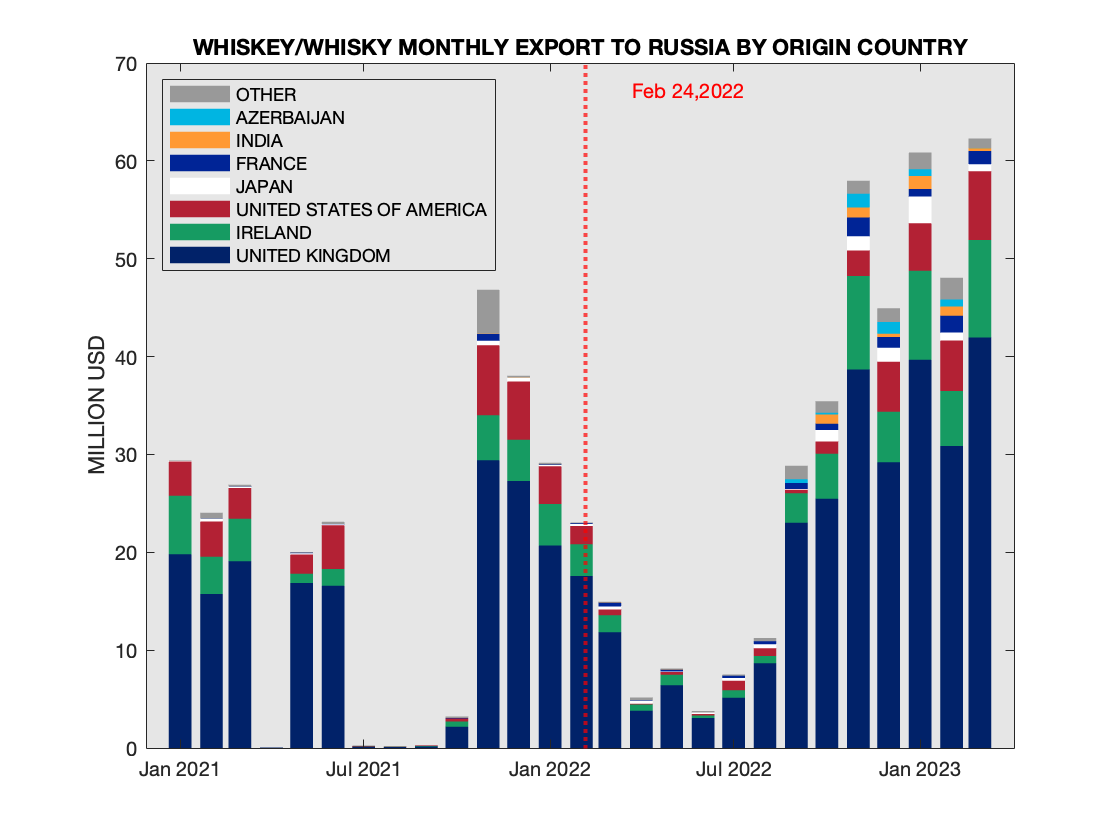

All Whiskey/Whisky Exports to Russia by Country of Origin

All Whiskey/Whisky Exports to Russia by Country of OriginAn update from May 12, 2023: public pressure appeared to have worked, and Pernod Ricard announced that they have stopped all international shipments as of the end of April and plan to "cease the distribution of our portfolio in Russia, a process that we anticipate will take some months to complete". A welcome development, but continued monitoring is in order.

Bayer Seeds Exports into Russia

April 22, 2023

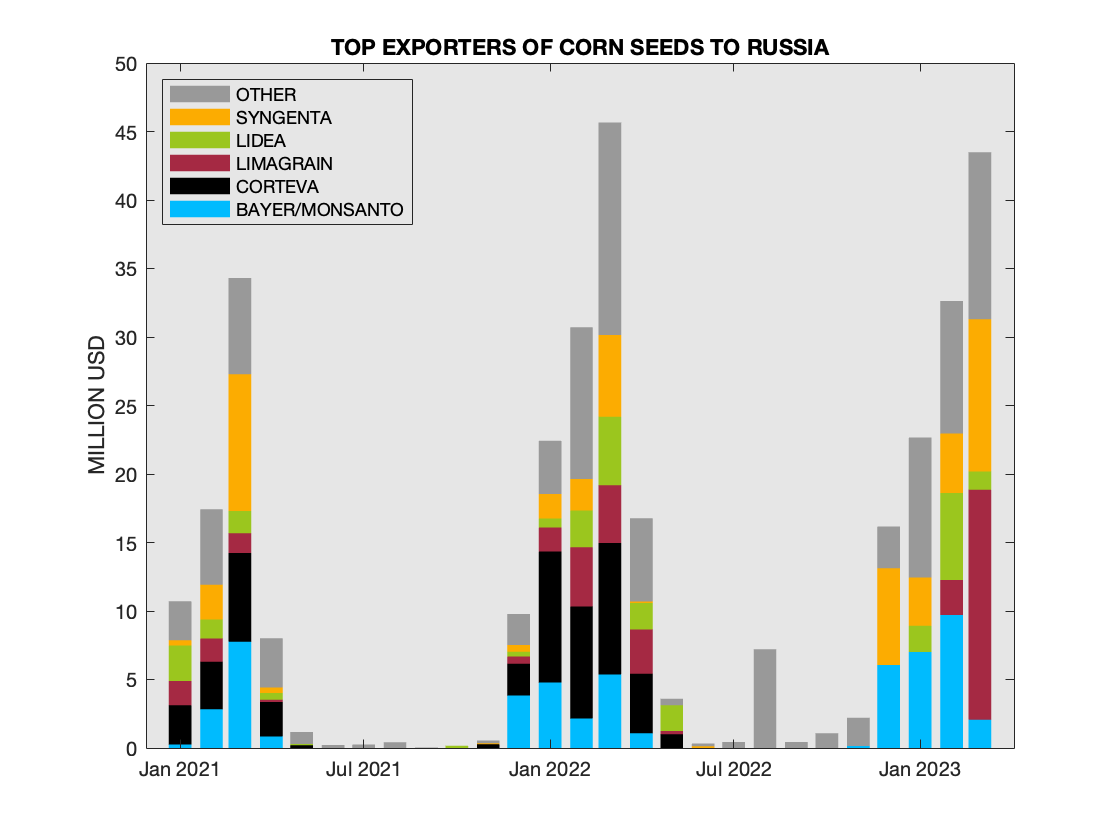

After sending seeds in the Spring of 2022, Bayer (who acquired Monsanto in 2018) issued a statement In part, it read "we will closely monitor the political situation and decide about supplies for 2023 and beyond at a later stage, depending on Russia stopping its unprovoked attacks on Ukraine and returning to a path of international diplomacy and peace." Judging by the continued shipments, from Bayer's perspective, this condition of "Russia stopping its unprovoked attacks on Ukraine and returning to a path of international diplomacy and peace." has been met.

See chart of corn seeds to Russia  Top Corn Seed Exporters to Russia Out of major exporters of corn seeds to Russia only Contreva stopped shipments.

Top Corn Seed Exporters to Russia Out of major exporters of corn seeds to Russia only Contreva stopped shipments.

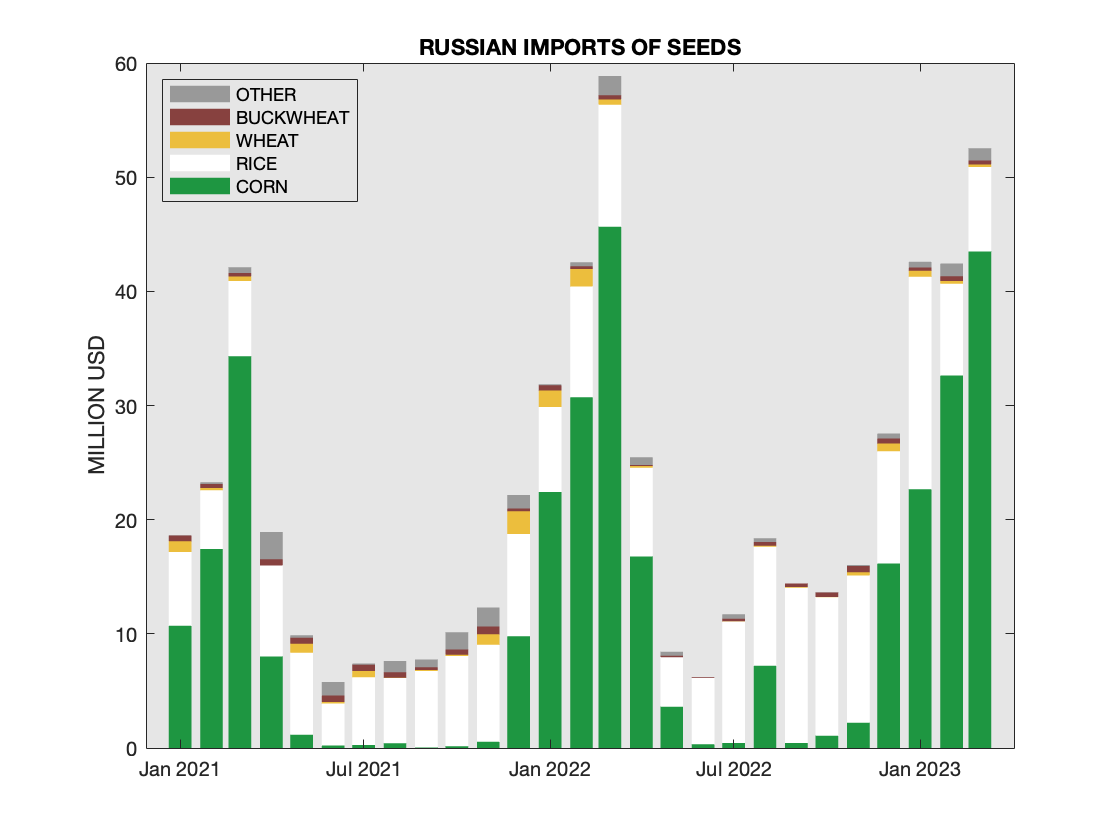

As can be seen from the next chart, corn is the main type of seeds imported by Russia (followed by rice that mostly comes from Asia). Corn in Russia is used almost exclusively for domestic consumption, so the connection to the world food supplies is not as direct as often portrayed by the companies that continue supplying seeds to Russia.  Russian Imports of Seeds by Type

Russian Imports of Seeds by Type

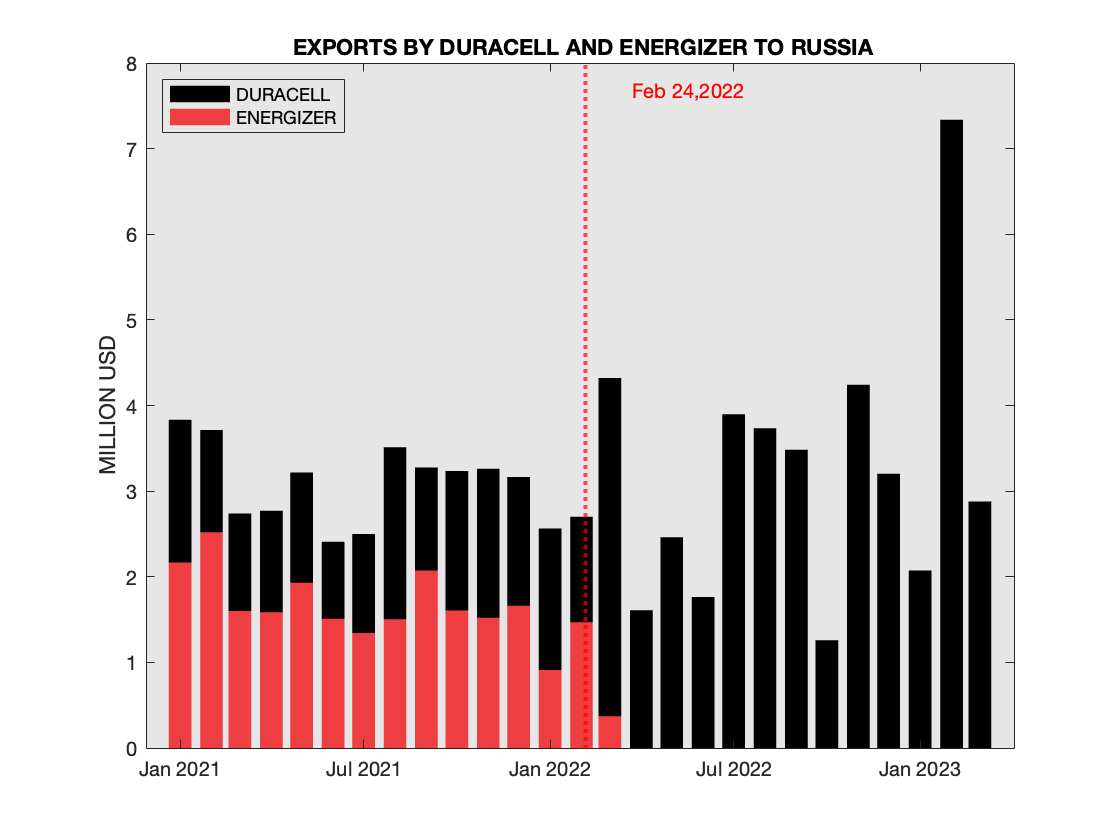

Energizer and Duracell Exports into Russia

April 22, 2023, updated April 23, 2023

In the last couple of days there is a series of conflicting statements about Duracell leaving Russia: First, Telegram Channel Mash published a copy of a letter from CEO of Duracell in Russia, Yuri Korotaev to its business partners, indicating that shareholders of the company made the decision to pull out of Russia and wanted to finalize mutual settlements.

Then TASS agency published what seems like a rebuttal where two dealers of Duracell, OOO Colors Group and Master indicated that they have not received the letter and shipments continue.

Finally Oreanda News cited comment of Yuri Korotaev to the Telegram channel Rise where he confirmed the authenticity of the letter. At the moment (April 22, 2023) there are no statements in English speaking press, so it might makes sense to wait and see for a more official confirmation

In the meantime, it is worthwhile to compare Direct shipments of Duracell and and Energizer (its direct competitor)  Energizer and Duracell Direct Exports into Russia Here direct shipments are considered (based on the Supplier name). The contrast between the two companies cannot be more stark, and the last shipment from Duracell was on March 31, 2023, the last day of available Russian customs data.

Energizer and Duracell Direct Exports into Russia Here direct shipments are considered (based on the Supplier name). The contrast between the two companies cannot be more stark, and the last shipment from Duracell was on March 31, 2023, the last day of available Russian customs data.

For the period of analyzed data (Jan 2021 - March 2023) 88.7% of all shipments of both companies by value corresponded to HS code 850610 (manganese dioxide often referred to as alkaline, batteries), and 7.3% are lithium batteries (HS code 850650). Combined, these two categories account for over 96%, so the next couple of charts show the shares of Energizer and Duracell in these two categories.

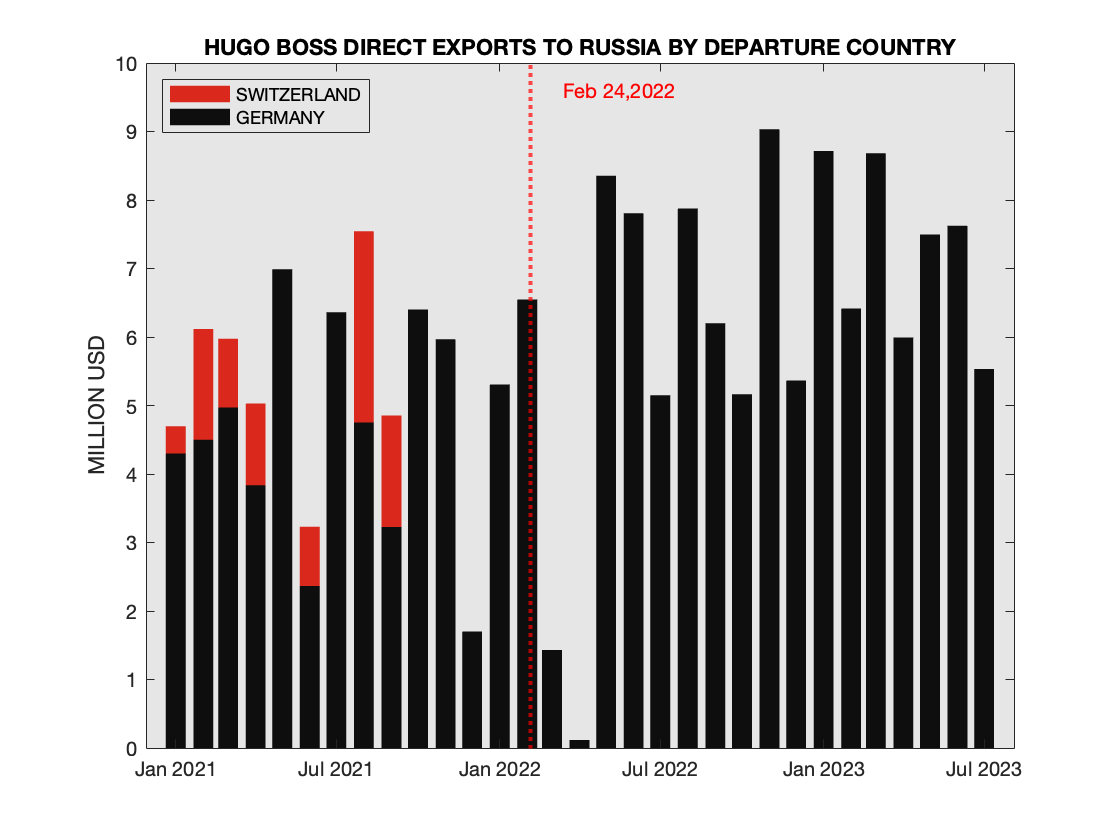

Hugo Boss Exports into Russia

May 3, 2023, updated September 20, 2023

After closing stores temporarily in Spring of 2022, a year later Hugo Boss has a live website that, apparently, is focused on careers in Russia. The view on Kremlin on May 3, 2023 might elicit not quite the same emotions that the Hugo Boss web designers had in mind.

Here is the chart of export to Russia by Departure Country (dominated by Germany)  Hugo Boss Exports to Russia by Departure Country

Hugo Boss Exports to Russia by Departure Country

One can see that there was a very brief interruption in the Spring of 2022, and after that the exports resumed at the full volume.

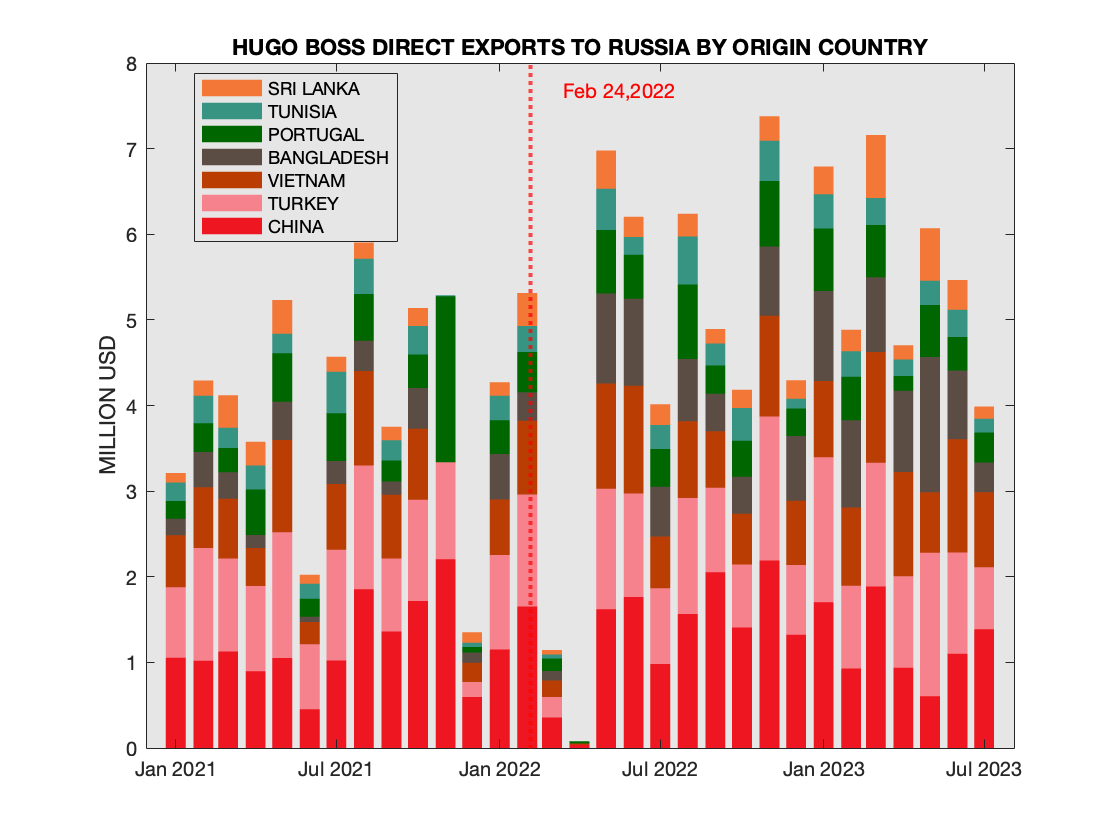

The next chart shows the countries of origin.  Hugo Boss Exports to Russia by Country of Origin

Hugo Boss Exports to Russia by Country of Origin

Mondelēz Exports into Russia

May 4, 2023 updated May 7, 2023

In Spring of 2022, Mondelēz issued a statement on Ukraine, outlining its policies in Russia, reading in part: "we are scaling back all non-essential activities in Russia while helping maintain continuity of the food supply during the challenging times ahead. We will also continue to support our colleagues in the market who are facing great uncertainty. We will focus our operation on basic offerings, discontinue all new capital investments and suspend our advertising media spending."

In October of 2022 CEO of Mondelēz International Dirk Van de Put defended the decision to stay in Russia: "We sell chocolate and biscuits. In some countries, the biscuits are considered as part of a normal diet,[In] many countries, biscuits are a breakfast item. And so, we do feel that we supply products to the normal consumer in Russia." There was also the following statement "We're making the country completely standalone from a supply chain standpoint."

Early this year, in the financial report for 2022, (10-K form) stated: "We might also face questions or negative scrutiny from stakeholders about our operations in Russia despite our role as a food company and our public statements about Ukraine and Russia"

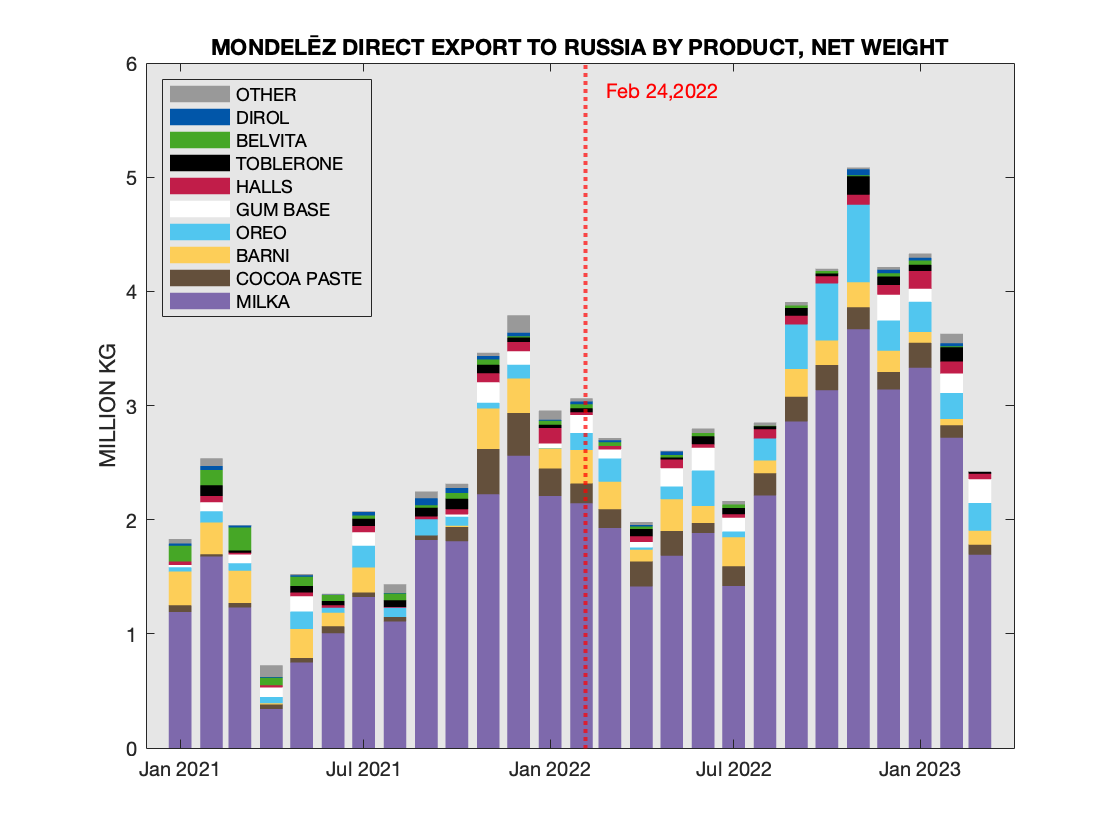

Given these statements from the company, let us have a detailed look at the shipments into Russia from January 2021 until 31 of March of 2023. The records have been selected based on the Supplier field containing the word "Mondelez" and checked to ensure that no spurious entries are included. It is possible that this search missed some records as some of other brands from the company are shipped differently. In the process we deliberately excluded indirect shipments at this phase, while understanding the importance of such shipments as well. For example, an iconic Swedish chocolate "Marabou" was traded by the Finnish company Atma Trade Oy, and multiple other entities have been shipping Oreos. Still overall scale of these indirect shipments is quite small compare to direct shipments (see Chocolate Exports into Russia · May 18, 2023 where both direct and indirect shipements for prepared chocolate for the company are shown).

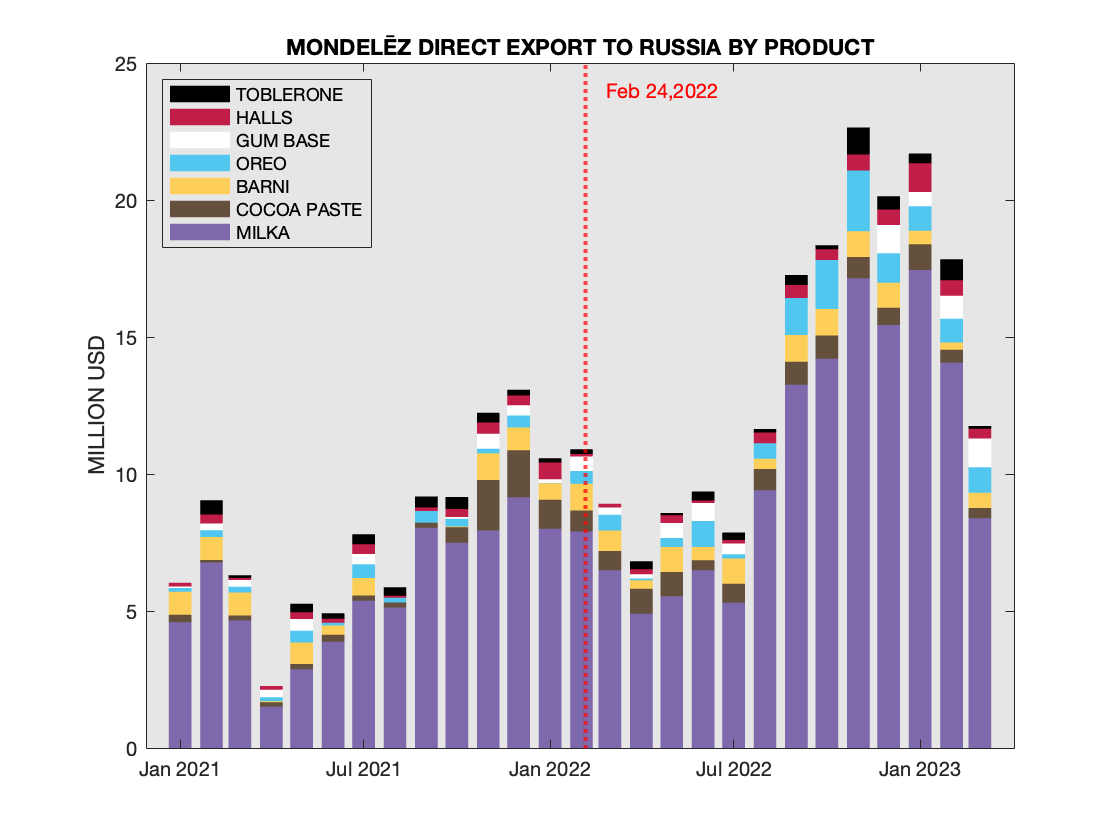

The first chart groups shipments based on declared in Customs trademark. The records with the empty trademark field were further investigated, and it turns out that overwhelming majority of those fall into two categories: Cocoa Paste and Gum Base (to manufacture gum). So these two categories have been added. When trademark included both Milka and Oreo, only one category was assigned (Milka).  Mondelēz International Exports to Russia by Product Type One can observe the dominance of Milka, which Mr. Dirk Van de Put apparently categorizes as essential and basic. All top brands are going strong, which begs a question: what is considered to be non-essential out of Mondelēz International portfolio of products?

Mondelēz International Exports to Russia by Product Type One can observe the dominance of Milka, which Mr. Dirk Van de Put apparently categorizes as essential and basic. All top brands are going strong, which begs a question: what is considered to be non-essential out of Mondelēz International portfolio of products?

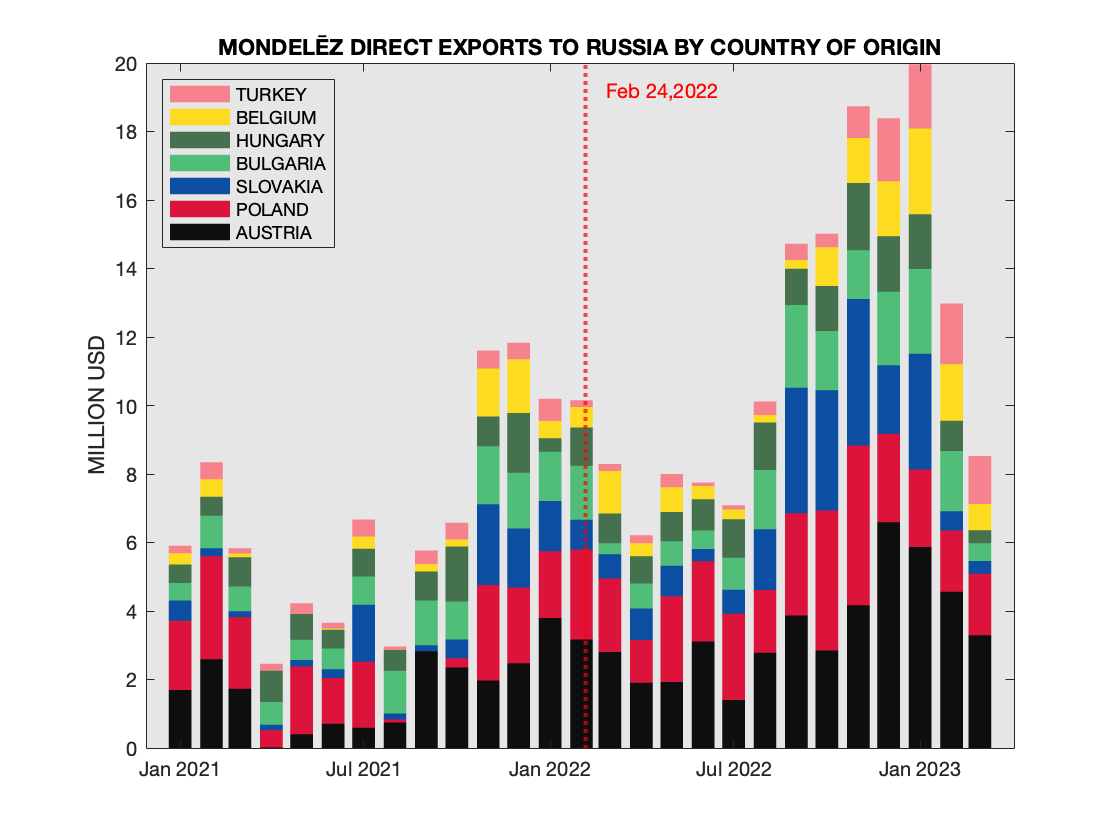

The next chart shows the countries of origin: just like with the individual brands, no major pattern changes are observed after February 24, 2022.  Mondelēz International Exports to Russia by Country of Origin

Mondelēz International Exports to Russia by Country of Origin

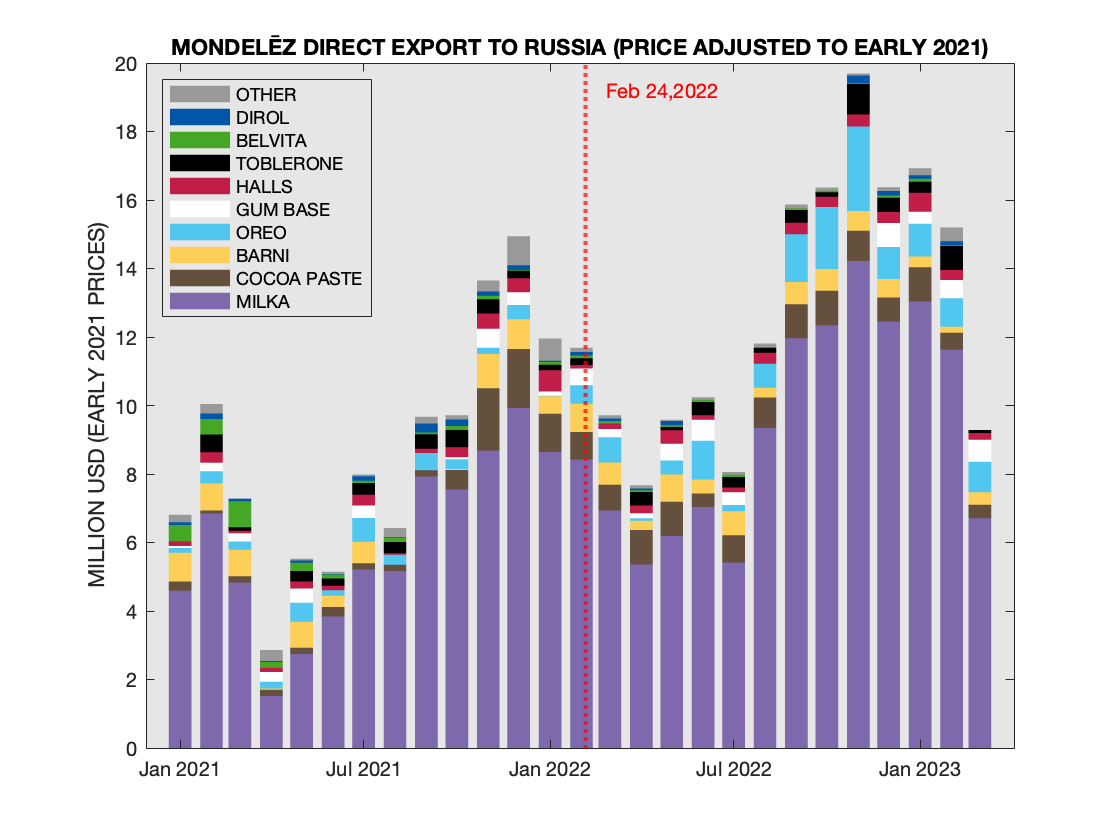

Overall in USD values there was 59% increase in 2022 compared to 2021. Naturally, a question arises: is the increase can be attributed to the inflation or to the volume increase? To address this question, we use the following techique:

- Subdivide transactions by type and HS code

- For each type of product we separate the data by specific HS Code in order to obtain a relatively uniform "tranche" of data.

- Evaluate reference value per unit of net weight

- Find the first month when transactions of this type exist. Find the value per unit of net weight and use this value as a reference

- Find adjusted value

- For the consequent months for this "tranche" of transactions evaluate the total net weight and multiple by the reference value found at the previous step

- Aggregate

- Aggregate values across all HS code for a given type

The end result of this procedure is depicted in this chart. Taking into account for adjusted prices, the 2022 increase by 49% compared to 2021.  Mondelēz International Exports Adjusted to Early 2021 prices

Mondelēz International Exports Adjusted to Early 2021 prices

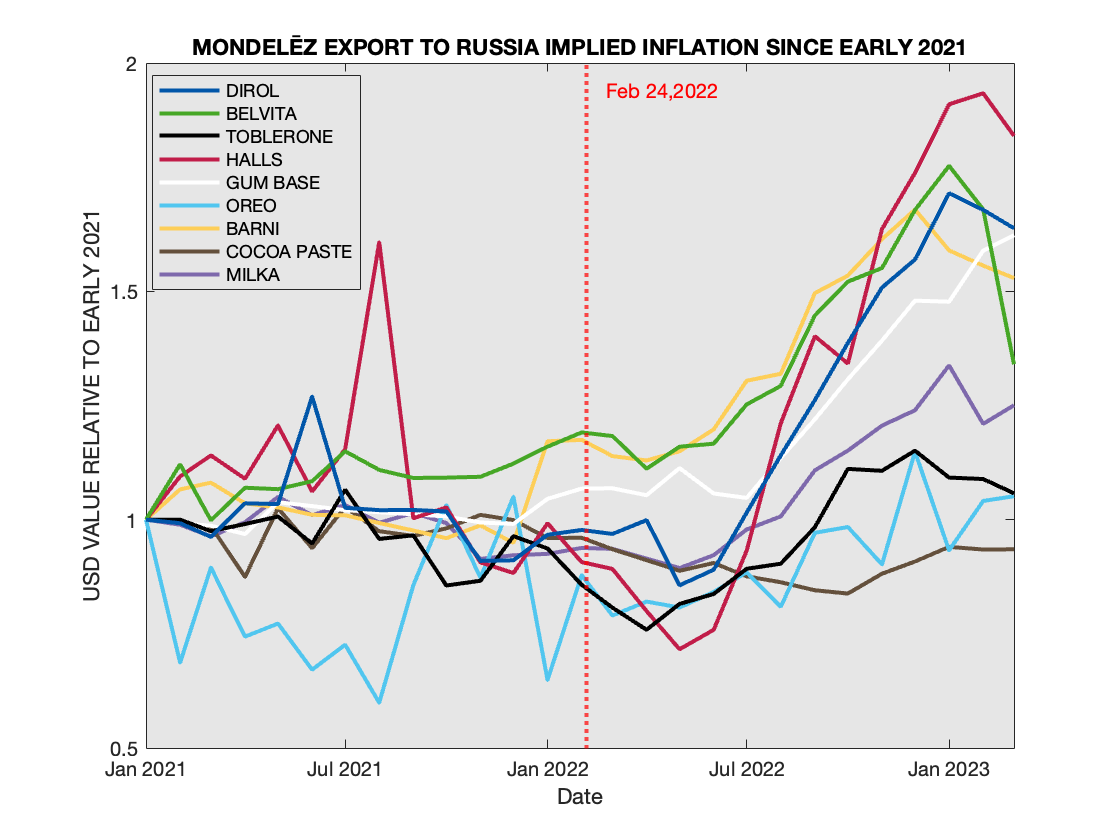

A more detailed look "under the hood" reveals that prices did not grow at all in 2021 and somewhat increased in the second part of 2022, albeit very non-uniformly. The overall trend it practically identical to the one of Milka product (no shown on the chart).  Mondelēz International Exports Adjusted to Early 2021 prices

Mondelēz International Exports Adjusted to Early 2021 prices

As a simple check of this procedure, we can look directly at the total net weight, as shown in the next chart  Mondelēz International Exports Monthly Net Weight This simple check does not account for the possible shifts in the type of products shipped to Russia. The resulting increase in sheer volume of shipments for 2022 as compared to 2021 is 52.6%, confirming the hypothesis the main source of incresed value of shipments in Russia is the increased volume and not the higher prices.

Mondelēz International Exports Monthly Net Weight This simple check does not account for the possible shifts in the type of products shipped to Russia. The resulting increase in sheer volume of shipments for 2022 as compared to 2021 is 52.6%, confirming the hypothesis the main source of incresed value of shipments in Russia is the increased volume and not the higher prices.

Metamorphosis of Wildberries

May 13, 2023

The title does not refer to a new auteur film that combines ideas of Kafka and Bergman. Instead it is a look at the largest Russian internet store for clothing and shoes that has been expending abroad in recent years including US and UK.

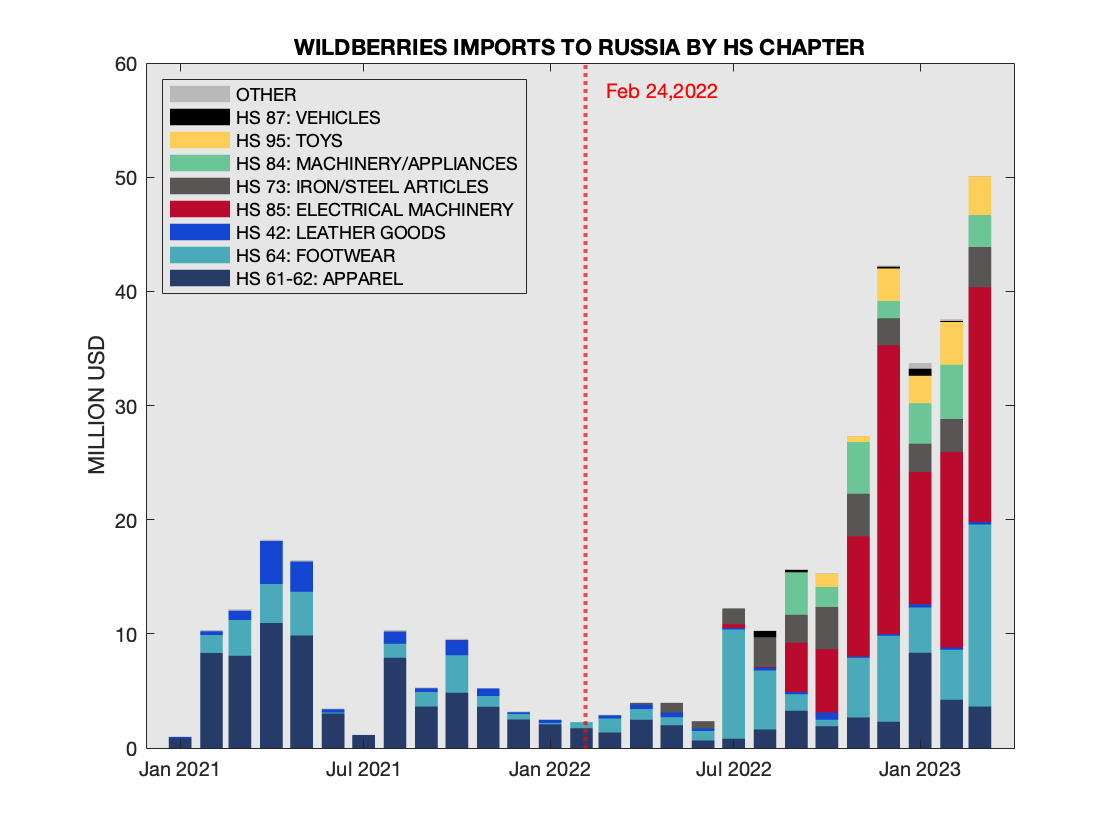

Here is the chart of imports by HS Chapter (the first two digits of HS code):  Wildberries Imports to Russia by HS Chapter

Wildberries Imports to Russia by HS Chapter

One can observe that after the invasion, expected for the company HS Chapters corresponding to clothing and leather goods are supplemented with a broad range of other HS chapters, including for electronics and steel articles. In fact the latter categories become dominant by dollar value. To exlore this metamorhosis further, we separate HS codes into two categories: the clothing, footware, etc. goes into the first category that one would expect to be in the wheelhouse of Wildberries. The second category corresponds to the "extracurricular" activities of the company. We look at both categories next

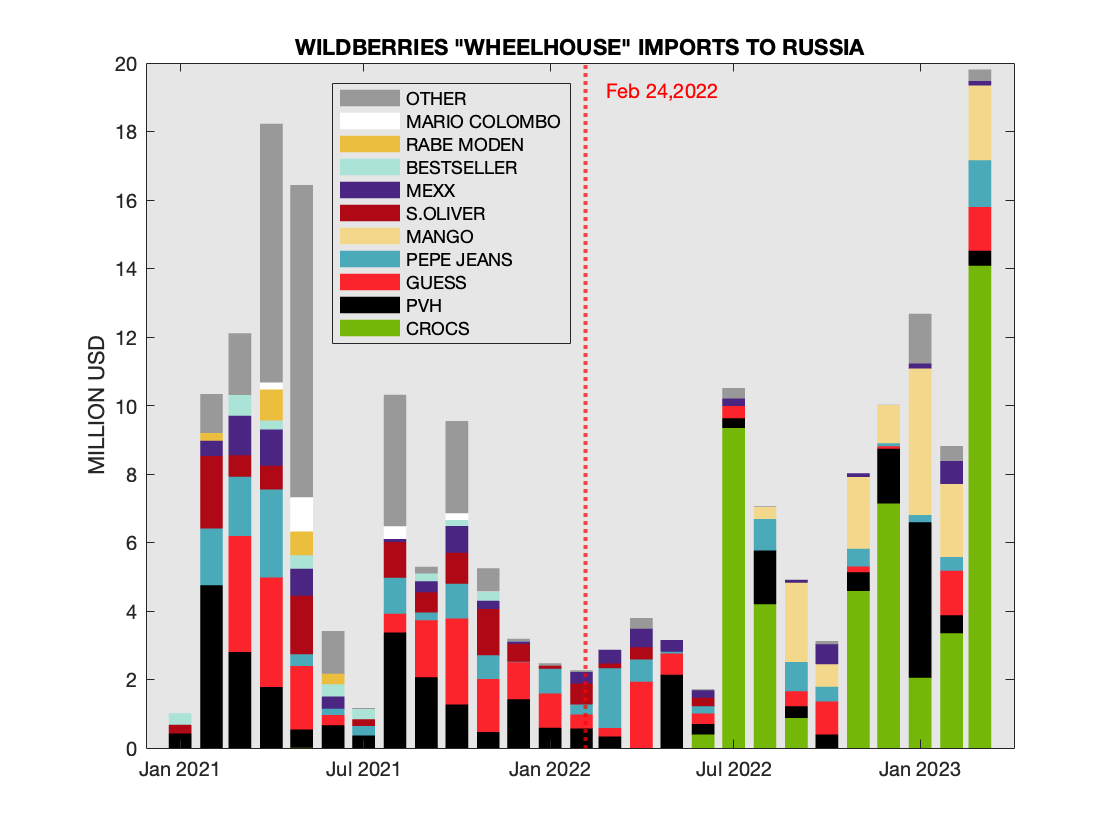

First, we look at the "Wheelhouse" category. The emergency of Crocs as the dominant category is probably the most noteworthy here. The continued presence of Guess is not entirely surprising, as we covered this company back in March. A bit more surprising is the presence of PVH (brands include Calvin Klein and Tommy Hilfiger) that are apparently actively protecting their brands from parallel import. It would be interesting to see if these legal actions by PVH have involved Wildberries, given that the latter did not hide its willingness to participate in the parallel import as far back as May of 2022.  Wildberries Imports to Russia that are in the "wheelhouse" of the company

Wildberries Imports to Russia that are in the "wheelhouse" of the company

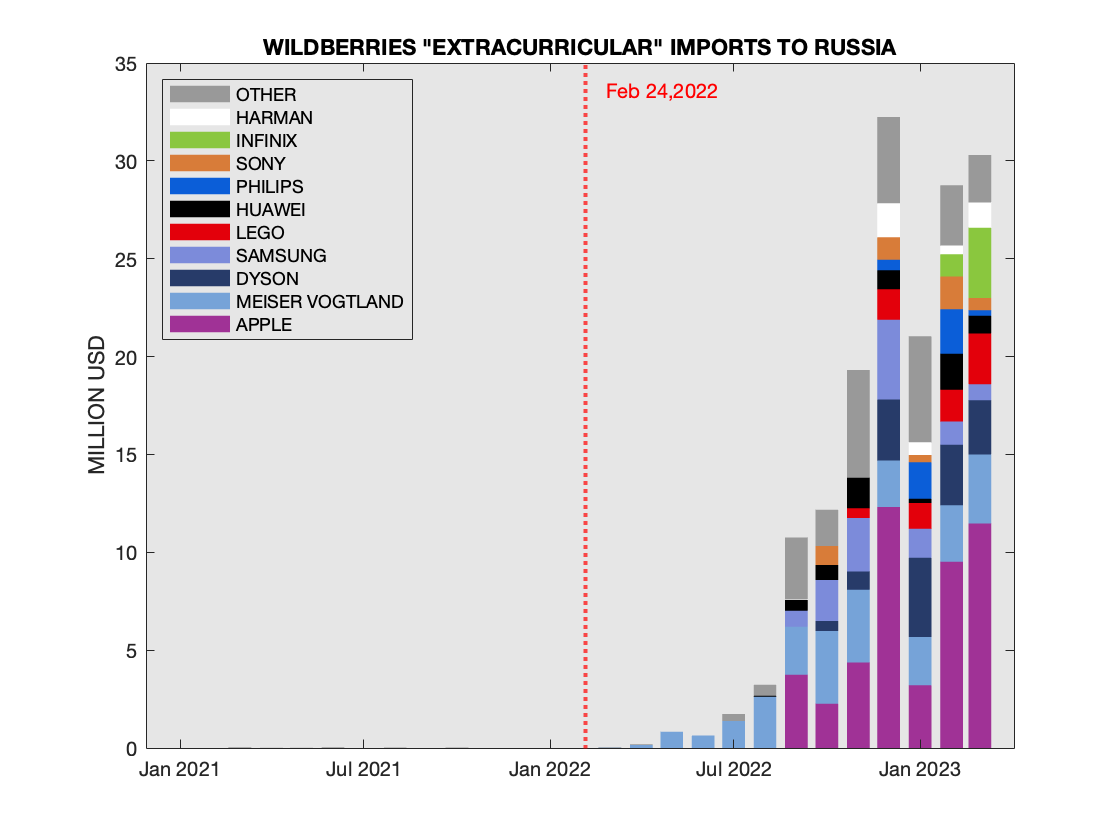

Next, we look at the "Extracurricular" category. This category was absent before the invasion, but iPhones and video consoles are very much part of the extension strategy. Let us note that this chart does not include export through Kazakhstan . Indeed, we are looking at customs data of imports into Russia, which exclude shipments from Kazakhstan (due to the custom union that both countries belong to).  Wildberries "Extracurricular" Imports to Russia

Wildberries "Extracurricular" Imports to Russia

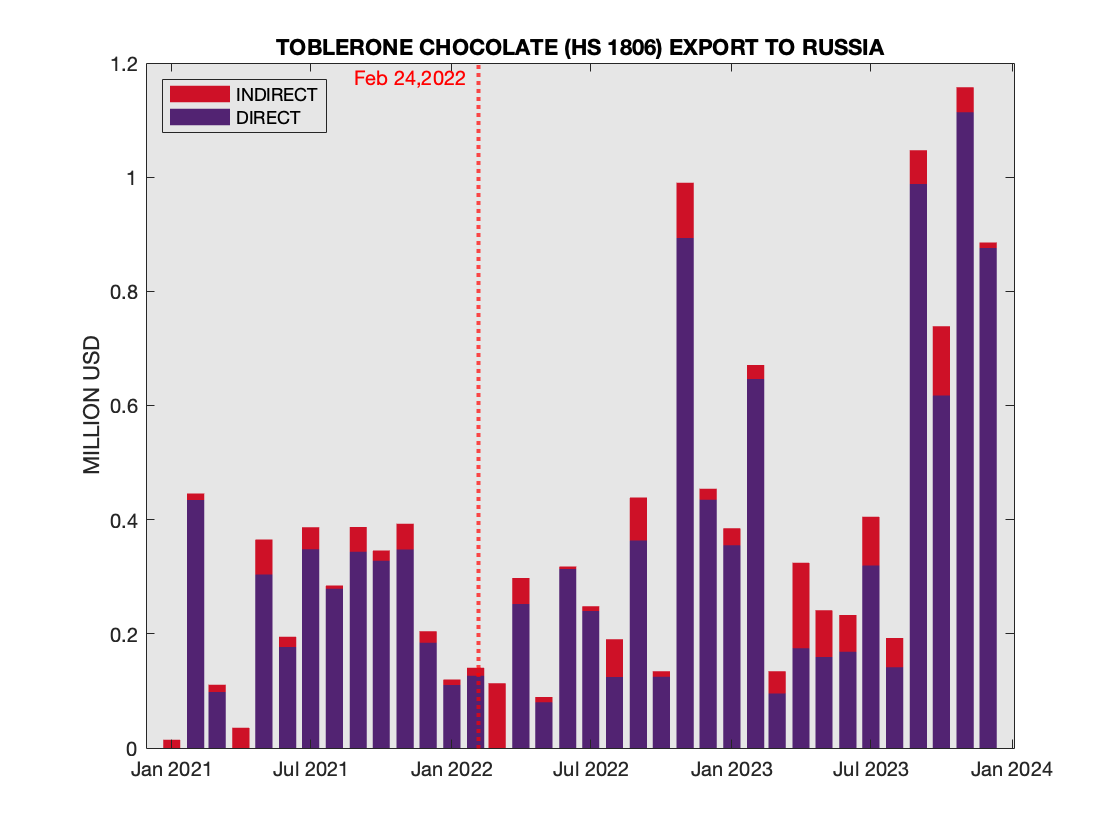

Chocolate Exports into Russia

May 18, 2023 partially updated Feb 12, 2024

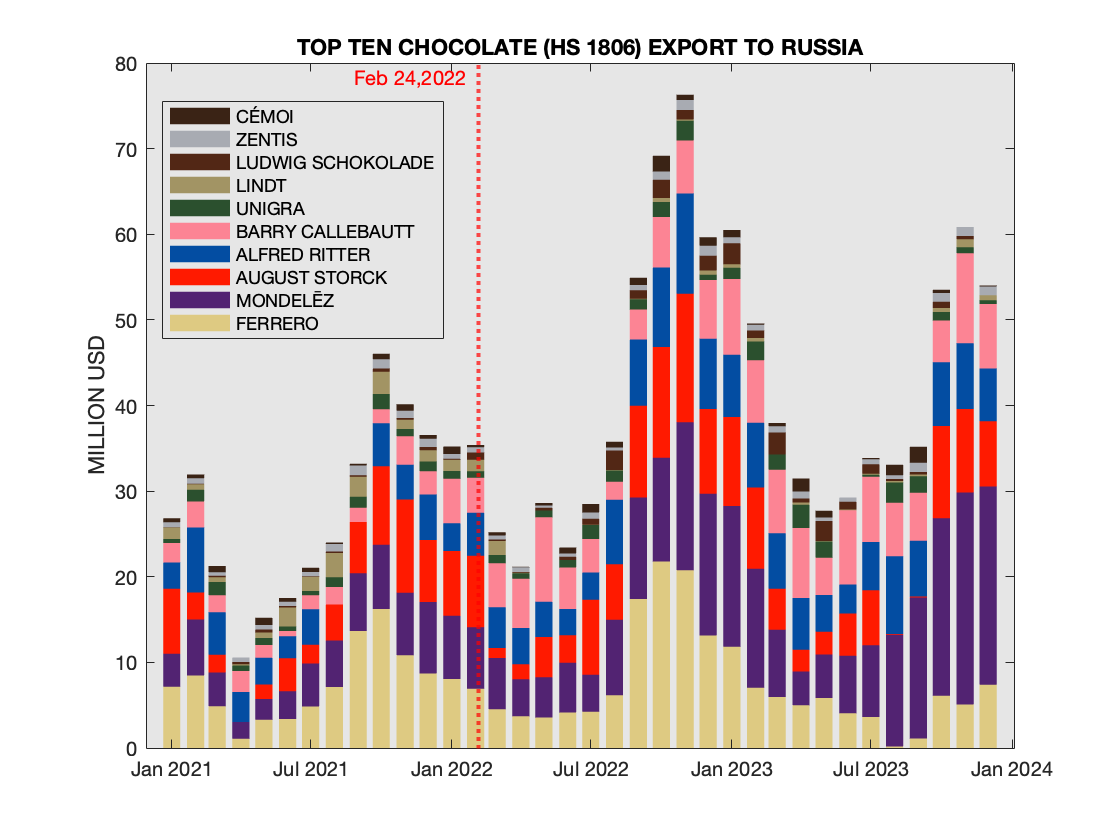

A systematic look at the chocolate export in Russia reveals patterns that are illustrative of changes in logistics chains that occurred in Russia after February 24, 2023 with a lot of industries. We focus on HS Code 18.06 ("Chocolate and other food preparations containing cocoa"). First we look at top ten exporters, and then look at individual companies from the top ten as well as some other notable cases. Some of the chocolate producers produce chocolate inside Russia (e.g., Mars and Nestle) and that production would not be reflected in this category, since we are looking at the customs records. Nevethereless, some of the companies, such as Mondelēz International, see the entry from May 4, 2023, and Ferrero) manage to do both: have factories in Russia and export ready-to-eat chocolate products.

First a look at ten top chocolate exporters in Russia (based on total value of exports to Russia, the original ranking was made using January 2021 - March 2023 time range, but the top ten chart below has been updated to include all 2023). Here is the chart of top ten exporters to Russia. The companies are listed in order of the total value (bottom to top)  Top 10 Chocolate exporters, updated to include all 2023

Top 10 Chocolate exporters, updated to include all 2023

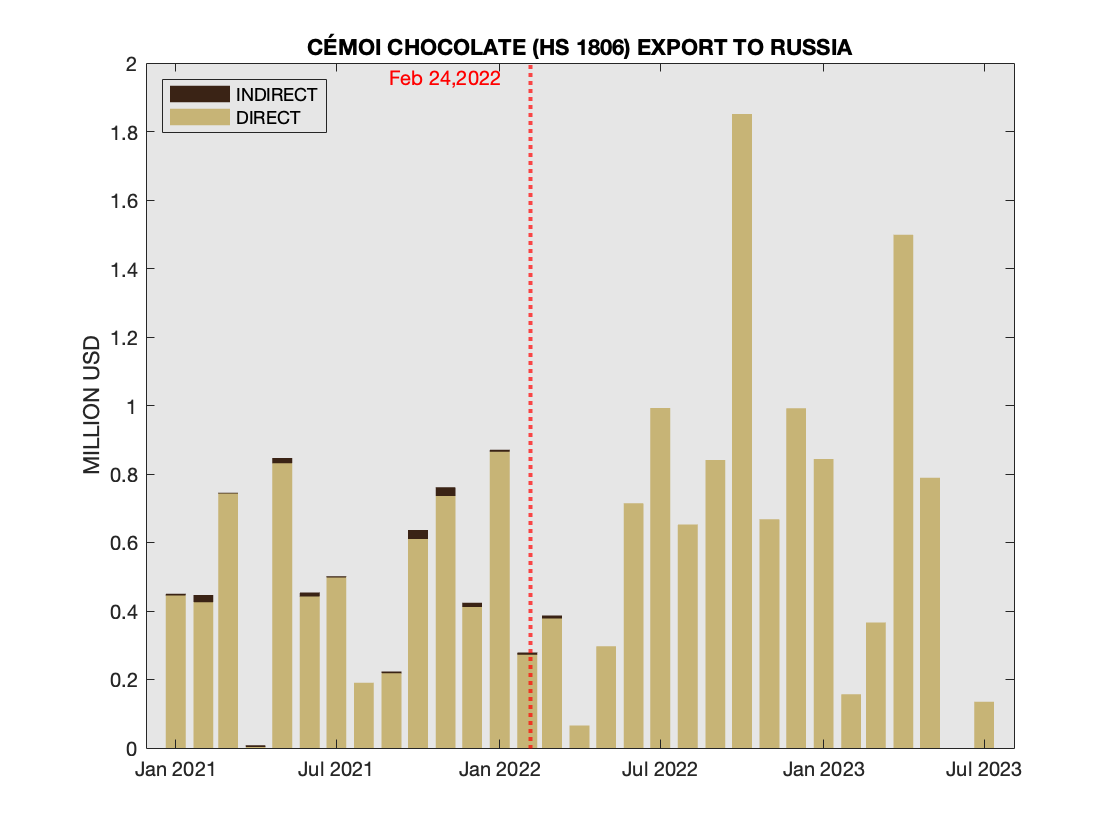

Next we look at individual companies one by one separating direct exports (where the supplier shipping the product is directly affiliated with the company) and indirect shipments (when shipments occur through an intermediary) Number 10 on the list is Cémoi. Before invasion 13, after #8. The volume of shipments only increased after the invasion, and the shipments are direct.  Cémoi Exports to Russia

Cémoi Exports to Russia

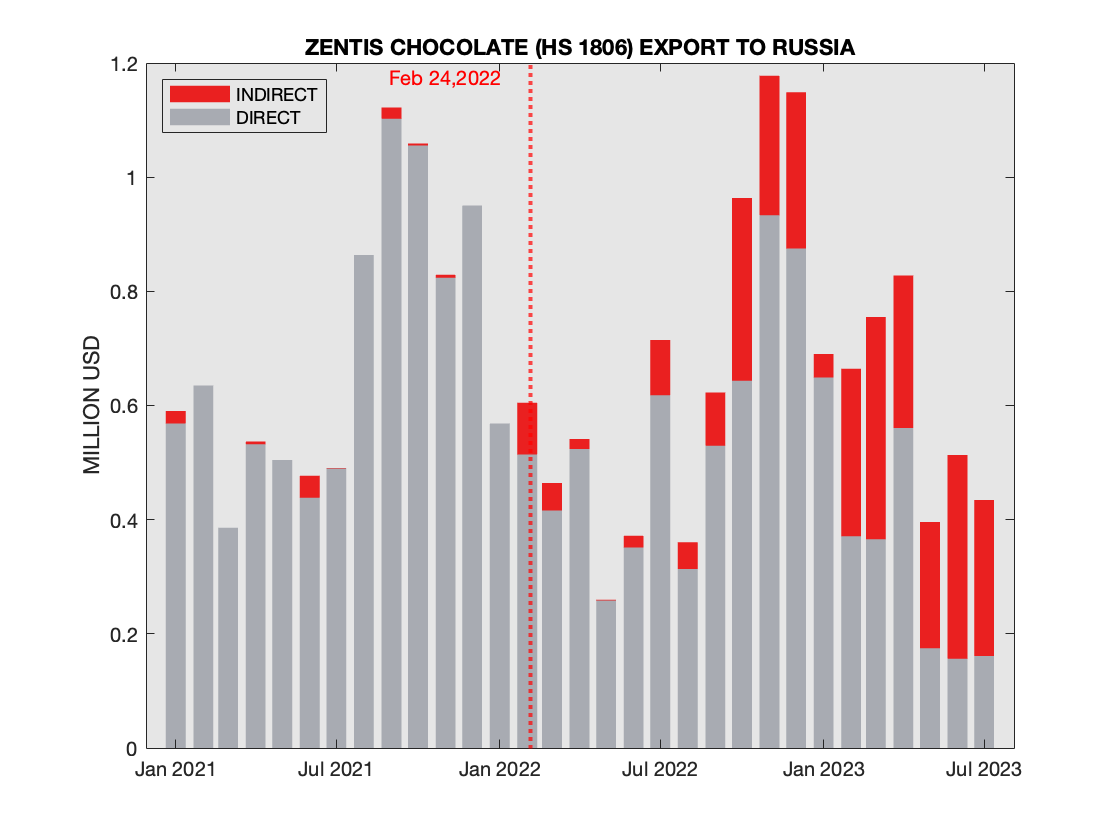

Number 9 on the list is Zentis. The volume of shipments stayed about the same, and most of the shipments are direct, although we can observe some indirect shipments post-invasion  Zentis Exports to Russia

Zentis Exports to Russia

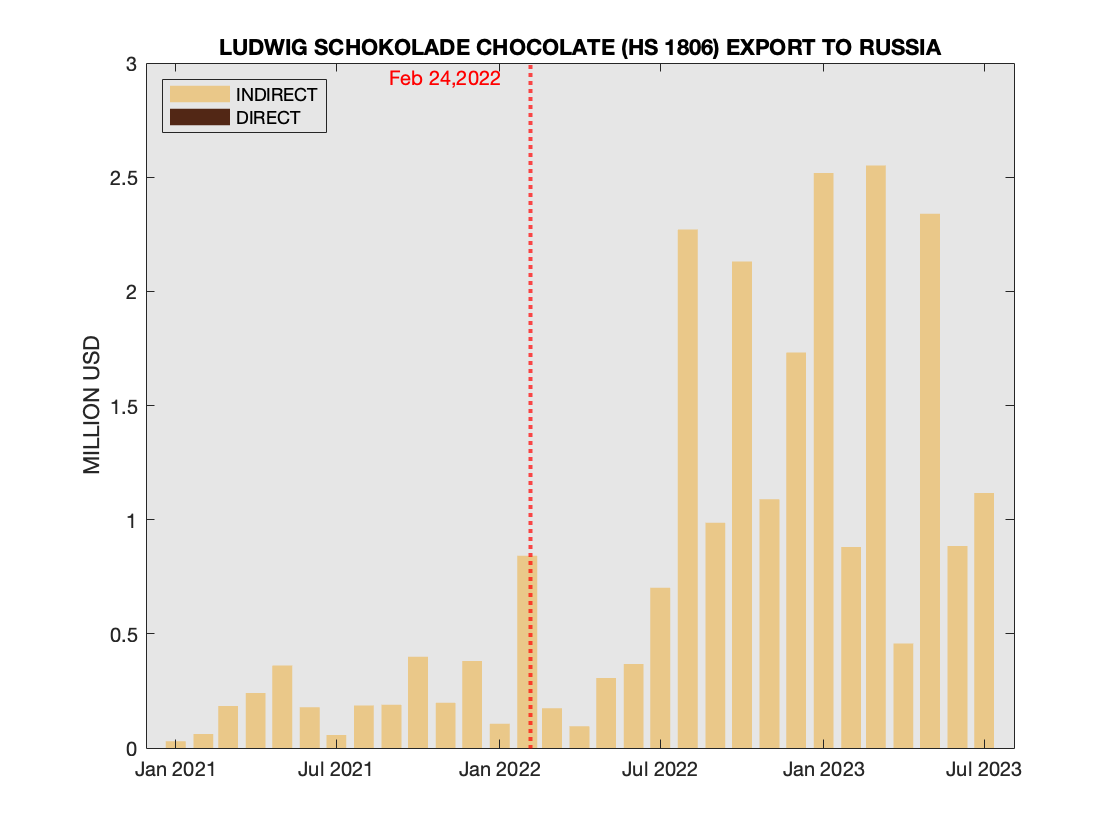

Number 8 on the list is Ludwig Schokolade, which is a part of KRÜGER group. In contrast to the previous two companies, all shipments are indirect, and the volume has significantly increased after the invasion (In Mar '21-Feb '22 the rank is 15). Moving up to 7th spot after invasion (value increase 136%). What is remarkable, is that the Russian location has been removed from the its websiteof locations, yet the locations is still showing on the pretty map there. This archived version of the Website lists Krüger GRAND in Moscow Region, complete with the link to the Russian website, which is very much operational.  Ludwig Schokolade Exports to Russia

Ludwig Schokolade Exports to Russia

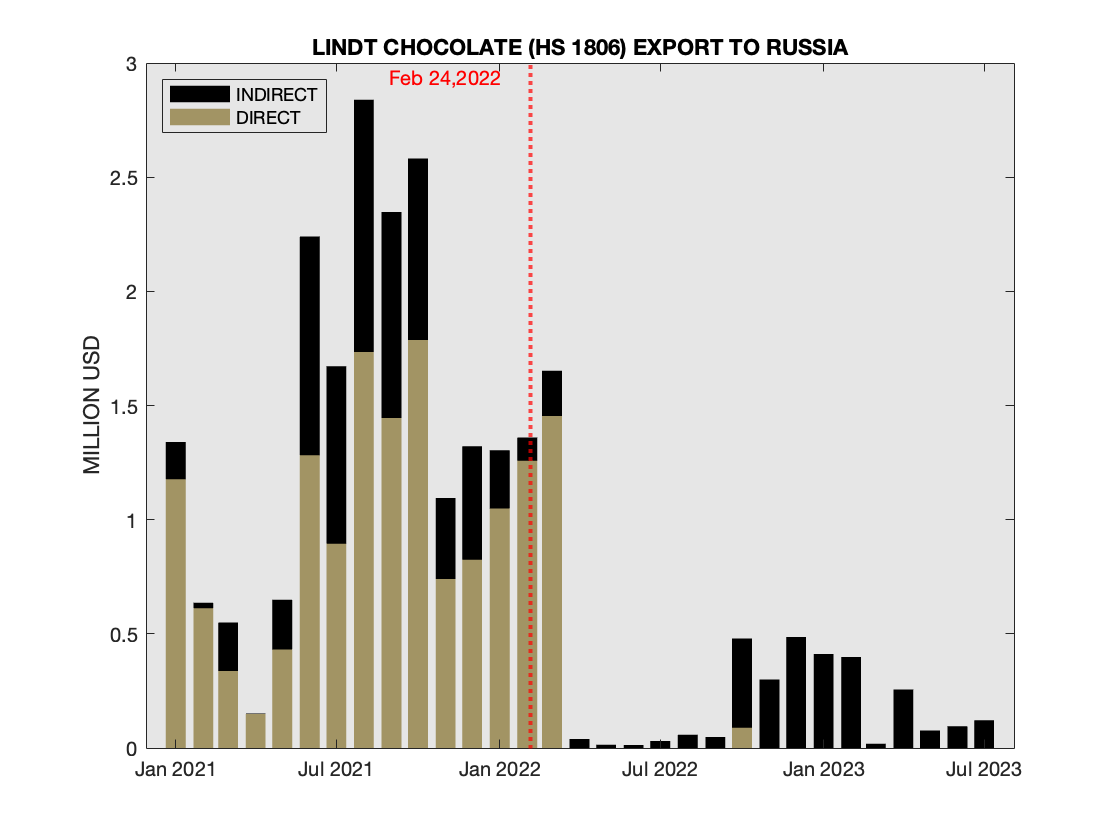

Number 7 on the list is Lindt, which in August of last year announced exit from Russia. One can observe positive (from our perspective) move in value ranking from #6 before the invasion to #13, with most of direct shipments ending in March of 2022. There is an interesting exception that can be seen on the chart in October of 2022, which corresponds to the shipment of Caffarel chocolates by Lindt by order of Clardges Trading LTD.  Lindt Exports to Russia

Lindt Exports to Russia

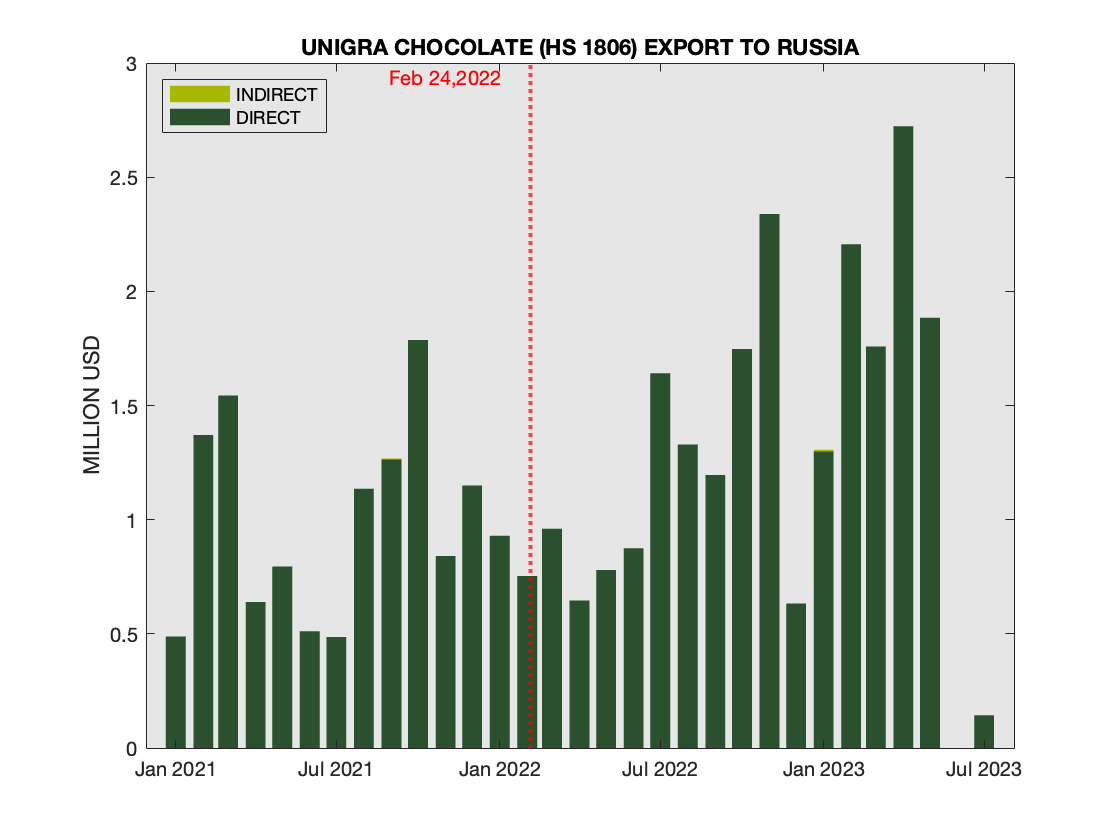

#6 On the list is Unigra from Italy, before invasion #7, after #6. All shipments are direct  Lindt Exports to Russia

Lindt Exports to Russia

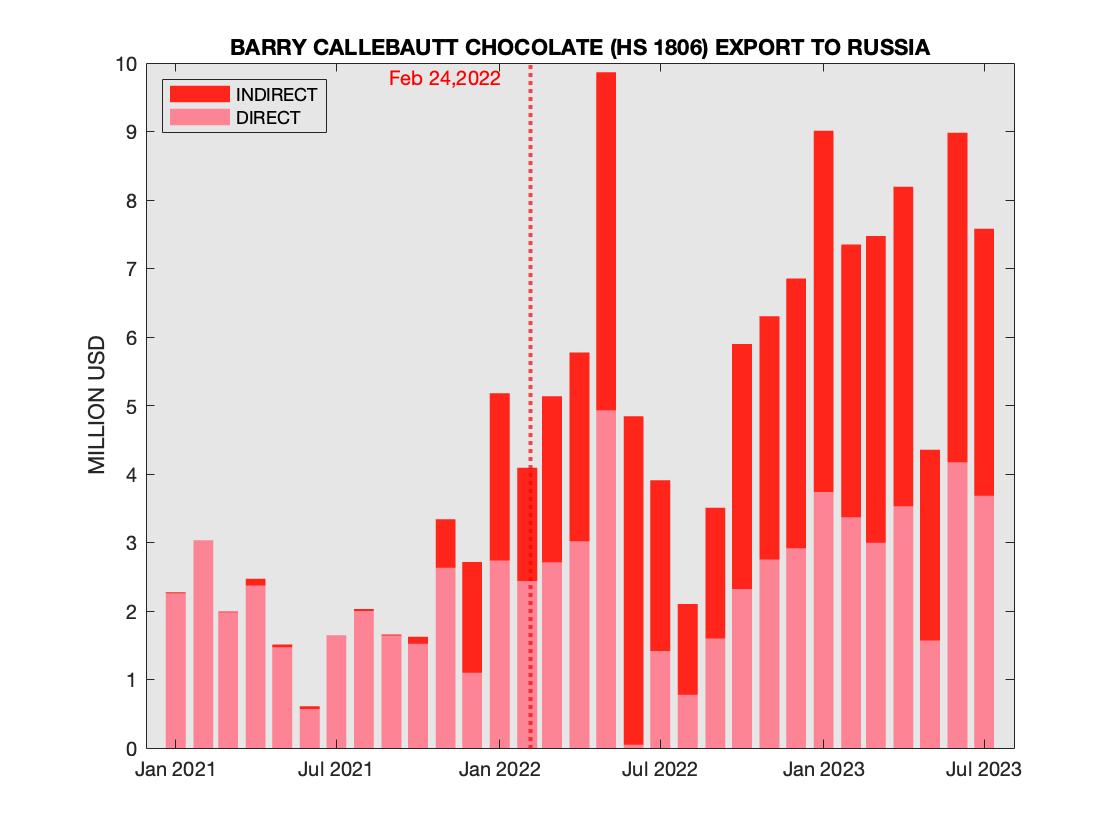

Holding steady at Number 5 is Barry Callebaut that also has three factories in Russia. The company has claimed that they provide essential goods "chocolate is part of the daily diet of many." This has a certain ring of "Qu'ils mangent de la brioche" to it (even if the expression predates Marie Antoinette). Comparing total export for a year starting on March 1, 2022 vs. a year before the value more than doubled (70.9 million USD vs. 29 million USD), more precisely it grew 145%.  Barry Callebaut Exports to Russia

Barry Callebaut Exports to Russia

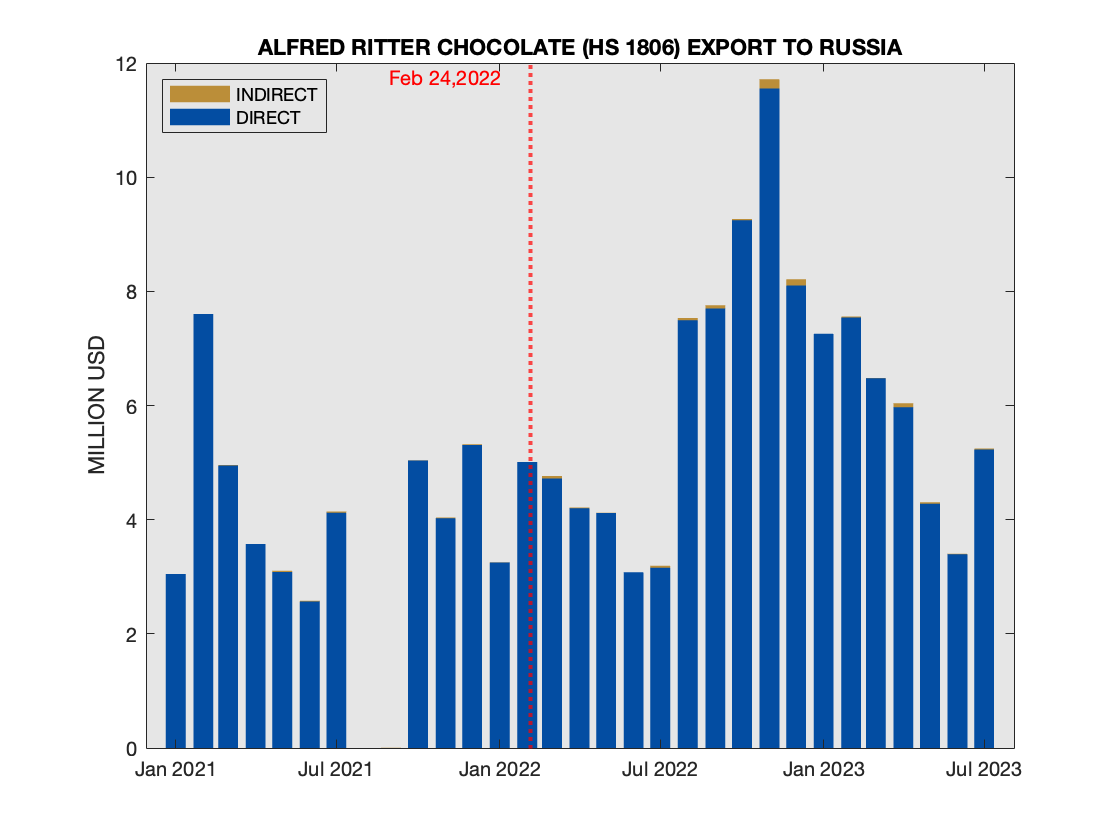

At number 4 (both before and after the invasion) is Alfred Ritter (Ritter Sports). The medium size German company put out a statement on Twitter over a year ago, explaining that Russia is the second largest market for the company after Germany, and committing all profits to humanitarian aid organizations: "to secure jobs and the livelihoods of many cocoa farming families we continue to supply chocolate to the Russian population". Caring for the cocoa farmers is commendable. Does it justify 91% increase year-to-year after the invasion? A year starting March 1, 2022 saw an increase to 79 million USD from 41.4 million USD the previous year. The latter number provides a good sanity check of the data: indeed, as reported in The Times, Ritter generates €500 million in turnover per year, and Nexta reported tbat Russia accounts for 7% of the global revenues. Using the average exchange rate we can evaluate the Russian revenues: 500*1.183*0.07 = 41.4, given the uncertainties in the timing of reporting, rounding errors etc. the exact match is likely to be a mere coincidence, but it is nevertheless a good confirmation that the overall numbers checked out.

We also note that 7% is an unusually high fraction of sales coming from Russia for a western companies. We note that even higher percentage, namely 10% has been also reported. While our calculations show that later in 2022 the fraction might be even higher, at the time of the reporting (March 2022) is questionable due to the clear problem with the second reported figure in that article. Namely, the article states that Ritter has 7% of the market share in Russia. This seems highly unlikely: based on our calculations for a year March 1, 2021 - February 28, 2022 Ritter's share of the exported chocolate was 8.4% out of total 493 million USD. However, the exported chocolate is clearly dwarfed by the domestic production in Russia, with Mars alone penciling in 2.6 billion USD of revenue - see the discussion below, and the presence of the likes of Nestlé, Ferrero, and Mondelēz International. In addition, there are multiple local brands as well. So, while Ritter might have 100% in square chocolates (see The Times article above), its market share in all chocolates in Russia is signifiantly smaller than 7%.

Returning to the chart, it is important to note that practically all shipments are direct  Ritter Sports Exports to Russia

Ritter Sports Exports to Russia

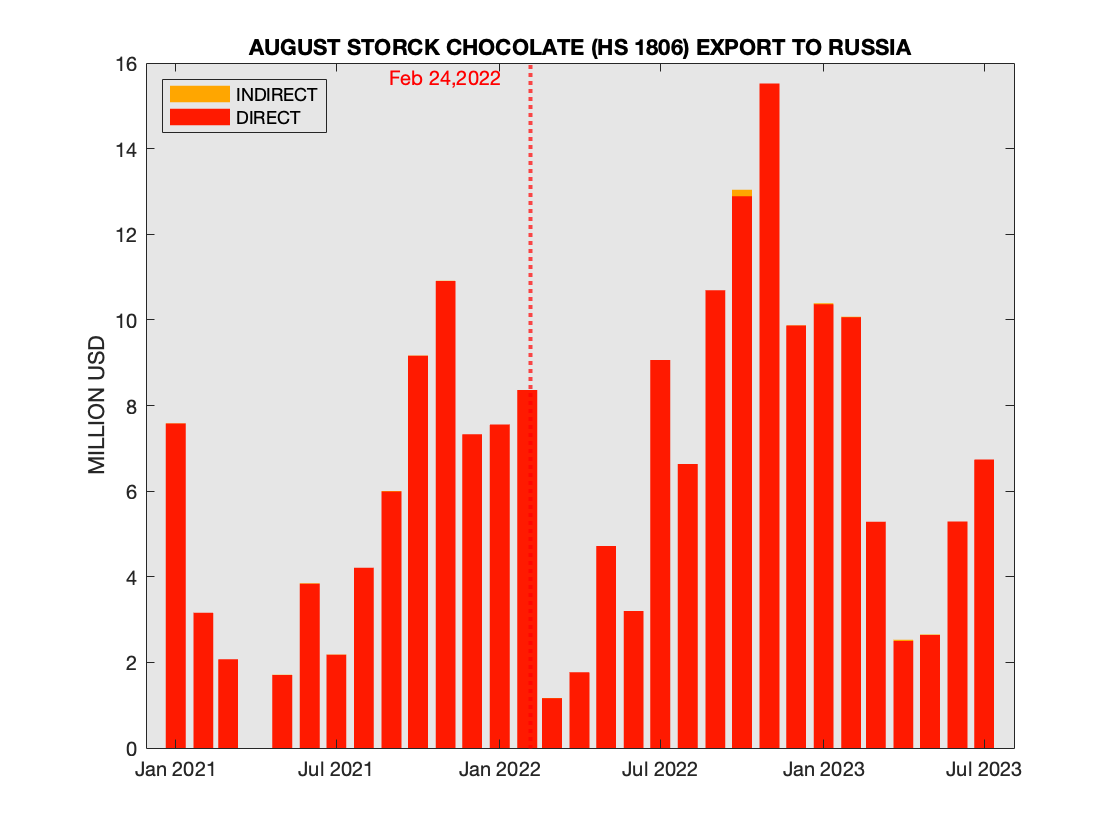

Holding steady at #3 is August Storck No statement seems to be available, and the Russian Website boasts "Storck products are convincing consumer across Russia from Kaliningrad to Vladivostok!" Comparing total export for a year starting on March 1, 2022 vs. a year before by value, the increase is "only" 51% (96 million USD vs. 64 million USD). Slightly increasing the market share of exported chocolate from 12.9% to 13.7%. Company's global revenue in 2021 was, in accordance with a href=https://www.bloomberg.com/billionaires/profiles/axel-oberwelland/>Bloomberg was 3.5 billion USD, implying that exports to Russia constitued less than 2% of global revenues.  August Storck Exports to Russia

August Storck Exports to Russia

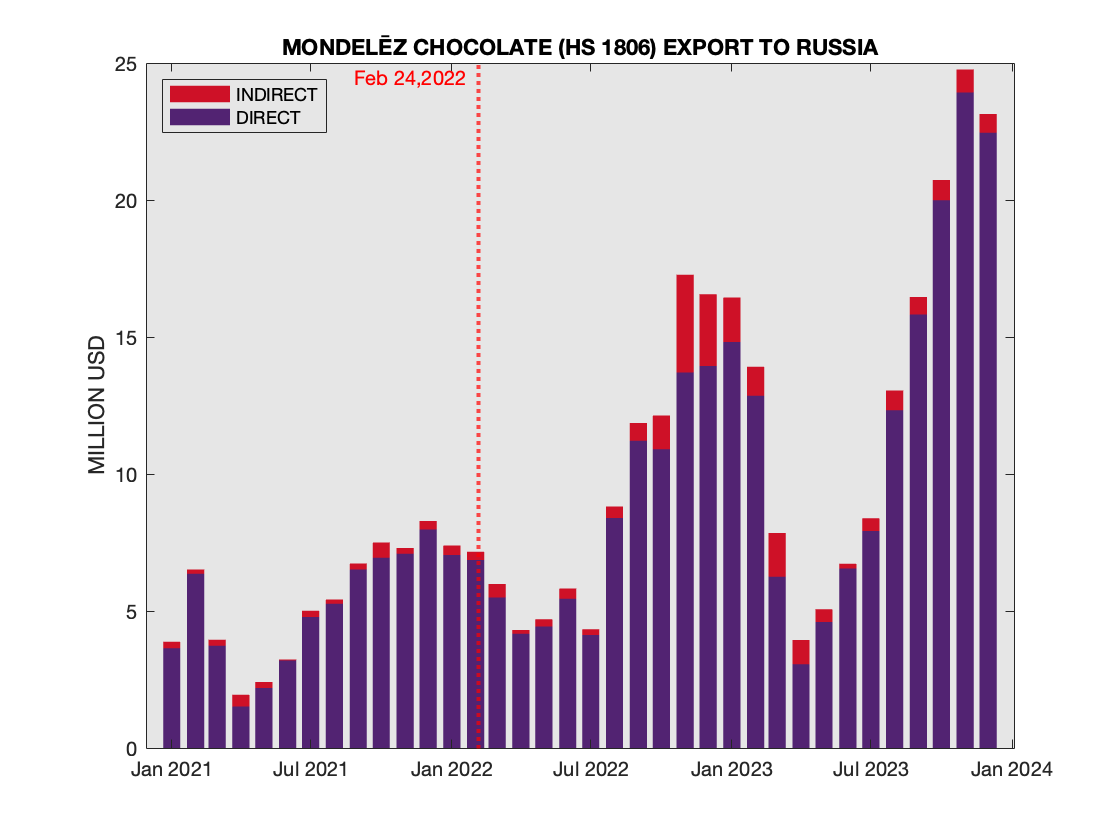

Mondelēz International is #2 based on the entire period (January 2021-March 2023), but it is #1 in the year following the invasion March 2022 - February 2023. We have already covered in detail its direct exports. Majority of the exports are direct, but there are some indirect ones, as shown in the next chart (note that here we are only looking at chocolates) Comparing total export for a year starting on March 1, 2022 vs. a year before by value, the increase is 85% (123 million USD vs. 67 million USD). Increasing the market share of exported chocolate from 13.5% to 17.5%.  Mondelēz International Exports to Russia updated to include all 2023

Mondelēz International Exports to Russia updated to include all 2023

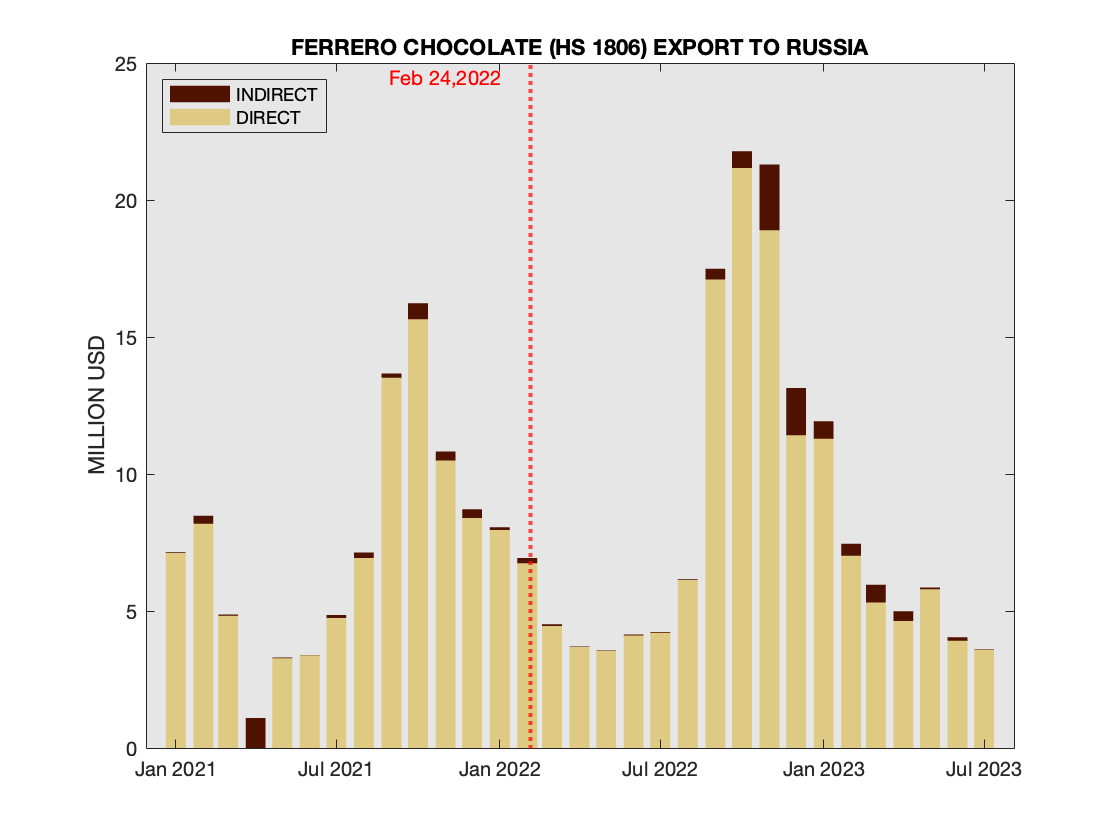

Ferrero is #1 based on the entire period (January 2021-March 2023), while sliding to #2 in a year following the invasion March 2022 - February 2023. The original statement of the company on Ukraine contained the following sentence "we have decided to temporarily pause all non-essential activities and development plans in Russia, in line with most other food companies" later this portion of the statement has been revised to "All non-essential activities and development plans in Russia remain paused", avoiding comparison with "other food companies". Vast majority of the exports are direct, as shown in the next chart. Comparing total export for a year starting on March 1, 2022 vs. a year before by value, the increase is 33% (120 million USD vs. 90 million USD). 33% increase by value was not enough to maintain its market share of exported chocolate: it slid from 18.2% to 16.9%.  Ferrero Exports to Russia

Ferrero Exports to Russia

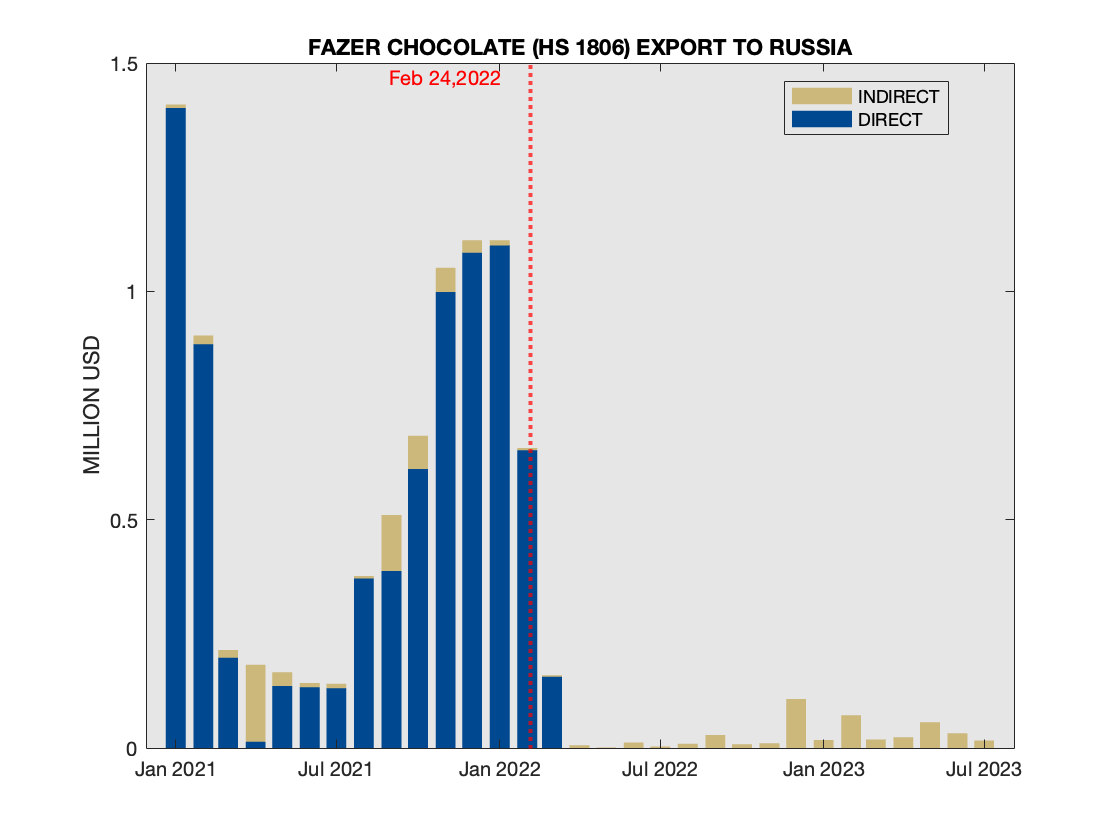

In addition to the top ten, it is useful to see actions of other players. In particular we have other companies that significantly curtailed their export, and the remaining one is mostly indirect (similar to Lindt). In this category we can identify Fazer from Finland  Fazer Exports to Russia

Fazer Exports to Russia

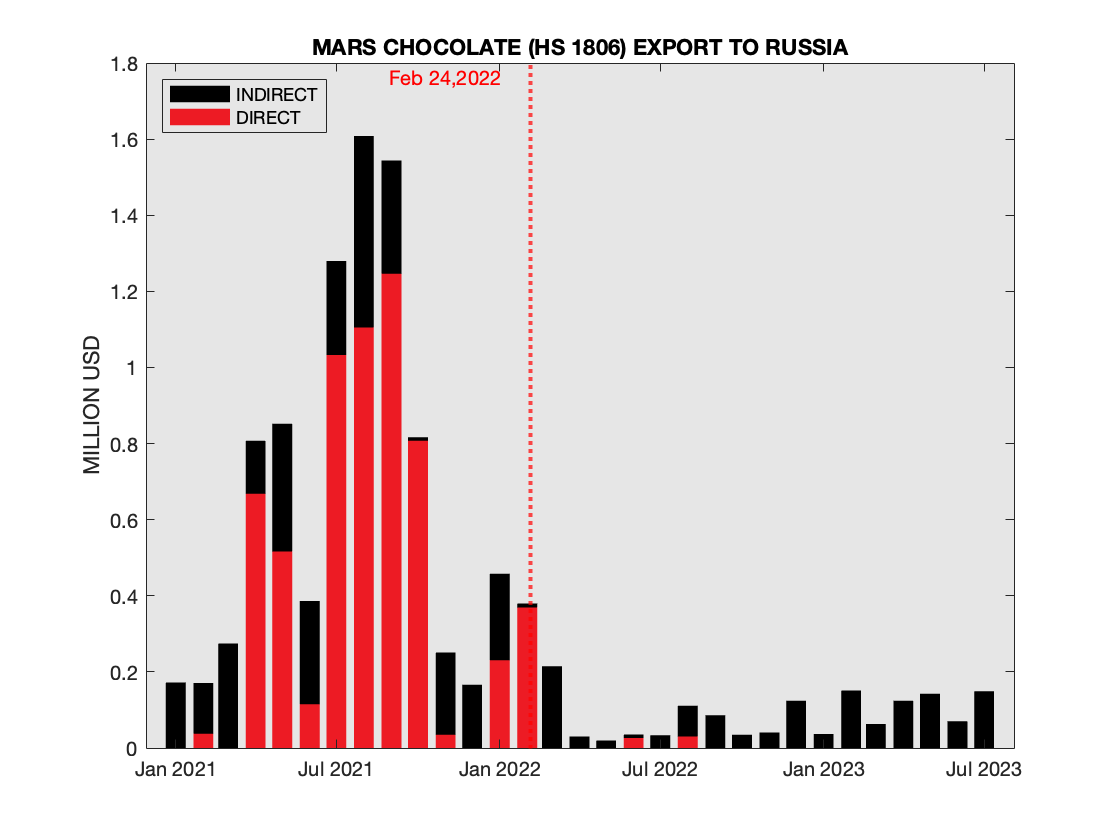

For Mars the pattern looks similar to Fazer's and generally matches the company's pledge to stop exports to and imports from Russia. Caveat: the year before the invasion (Mar '21-Feb '22') the value of export was around 9 million USD. In accordance with the calculations of the Kiev School of Economics (KSE), the total revenue in Russia for the company in 2022 was a whopping 2.6 billion USD. In other words, export value was less than 0.5%  Mars Exports to Russia

Mars Exports to Russia

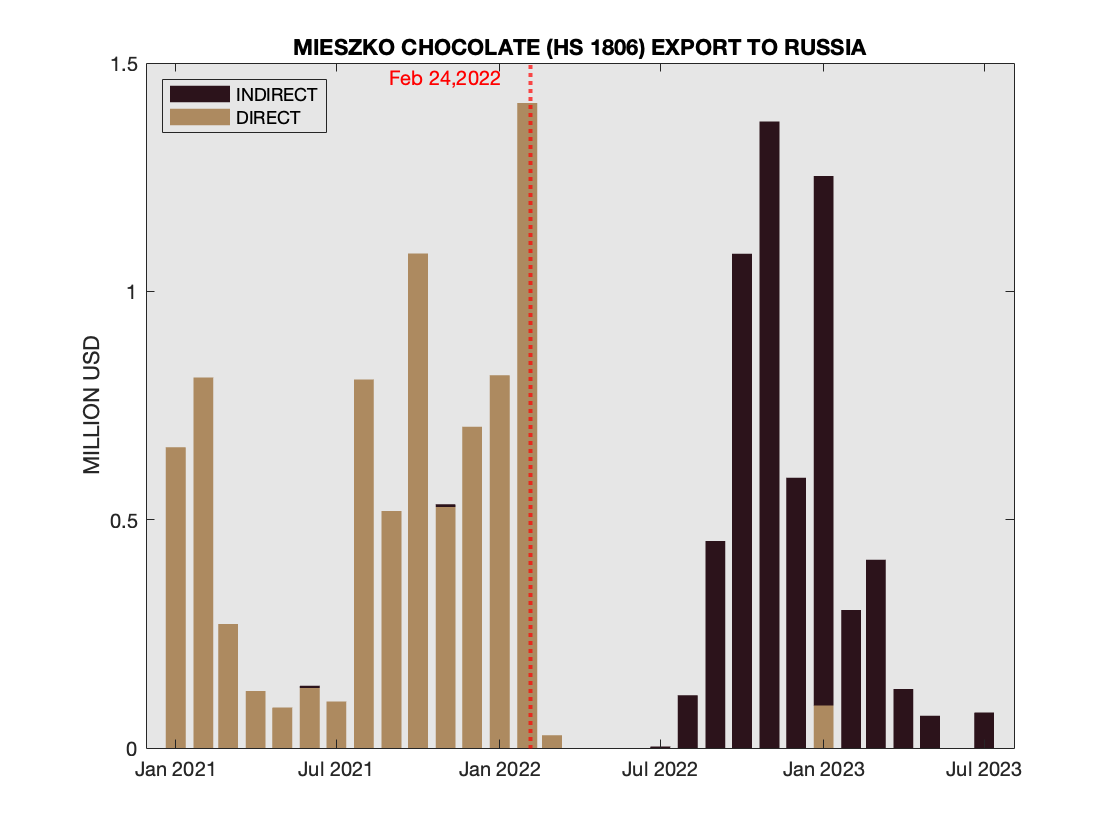

A different pattern is observed with Polish Mieszko, where indirect shipments appear to approach pre-invasion volumes.  Mieszko Exports to Russia

Mieszko Exports to Russia

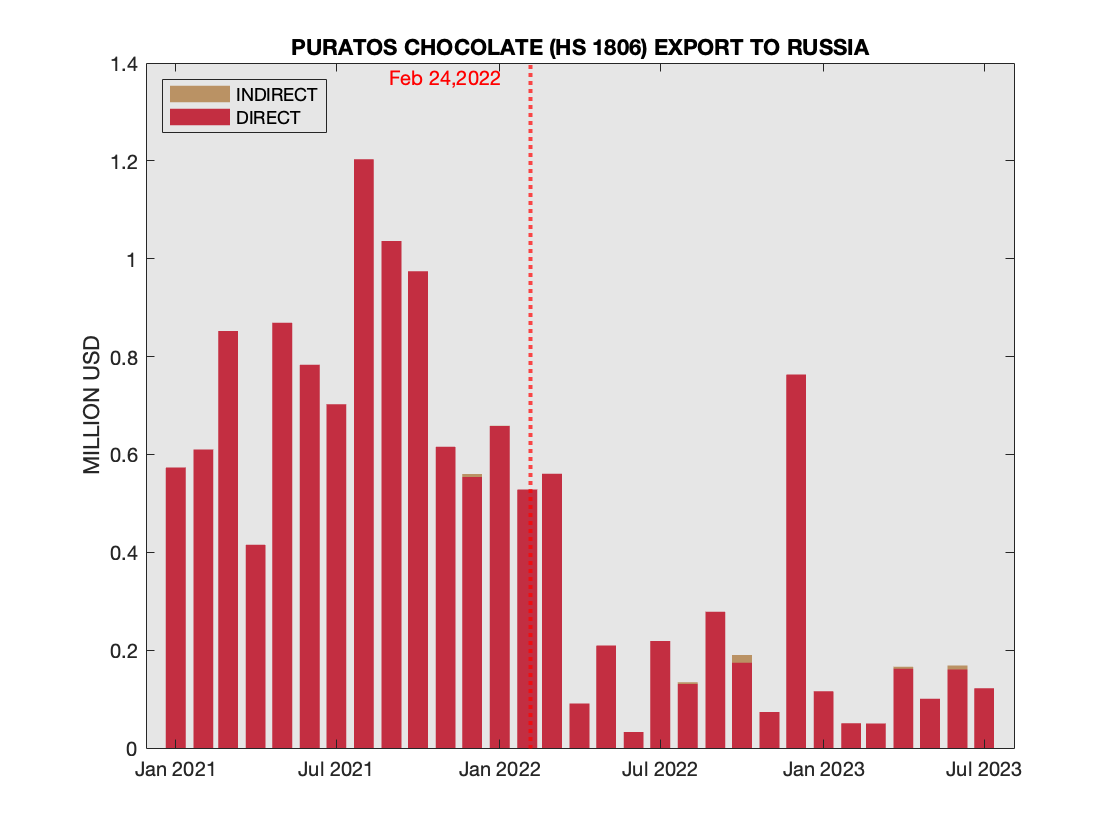

Finally, there is an interesting case of Belgian company Puratos, where direct shipments continue but at a significantly lower volume (basicallyб one-third of pre-invasion volume). The company has not issued any statement regarding the invasion  Puratos Exports to Russia

Puratos Exports to Russia

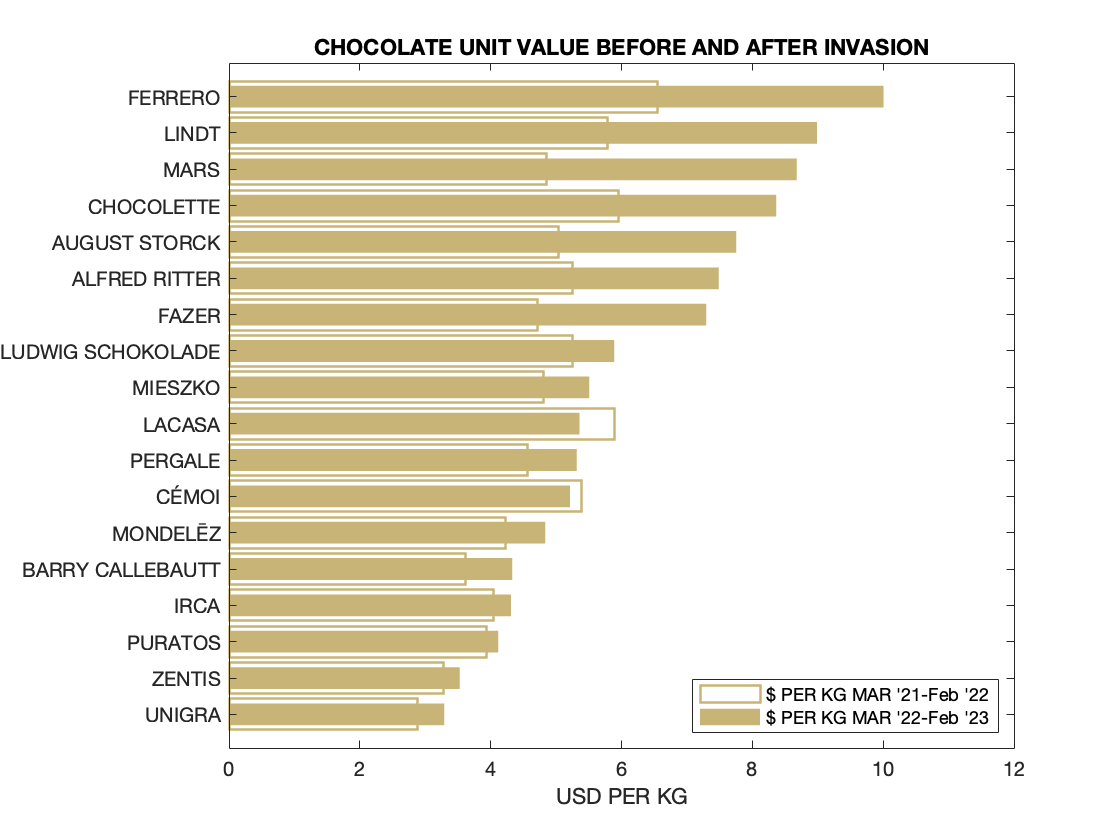

We see an overall increase of exports by value, so the natural question is whether this increase can be attributed to the increase of volume, or the inflation. The answer to that is "it depends". The chart shows the unit value, i.e., declared value in USD per KG of net weight. This helps to infer effective inflation (assuming that the portfolio of products exported by a given company does not change much).  Chocolate Unit Value USD per KG (Mar '21-Feb '22) vs. (Mar '22-Feb '23)

Chocolate Unit Value USD per KG (Mar '21-Feb '22) vs. (Mar '22-Feb '23)

When there is a clear switch to indirect shipments (Mars, Lindt, Fazer) one would expect value increase, and this has indeed happened (implied inflation was 79%, 55%, and 55%, respectively). Somebody really wanted those Mars bars! However, the trend did not hold for Mieszko (the implied inflation was only 14%). At the same time for Ferrero and August Storck the implied inflation was 53% and 54%, respectively - fully explaining the increase in the value. For Ritter the implied inflation was 43%, which contributed to roughly two-thirds of the value increase of 91% (the weight increase was 34%). On the other end of the spectrum, for Spanish Lacasa the implied inflation was -9%, so 59% increase by value occurred despite a lower unit value.

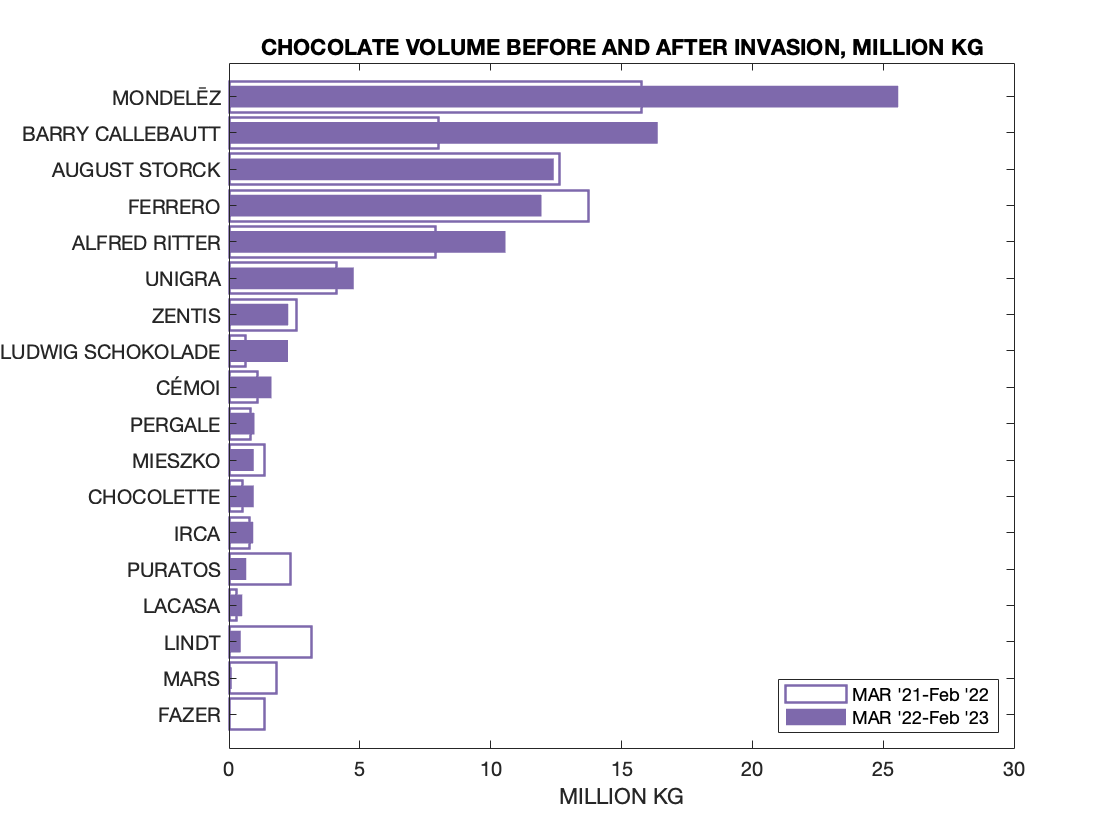

An update on November 23, we look at the overall volume changes year to year, first we compare the last full year before the invasion (Mar '21-Feb '22) to the following year (Mar '22-Feb '23) for the total volume (in million kg of the neight weight)  Chocolate volumes million KG (Mar '21-Feb '22) vs. (Mar '22-Feb '23)

Chocolate volumes million KG (Mar '21-Feb '22) vs. (Mar '22-Feb '23)

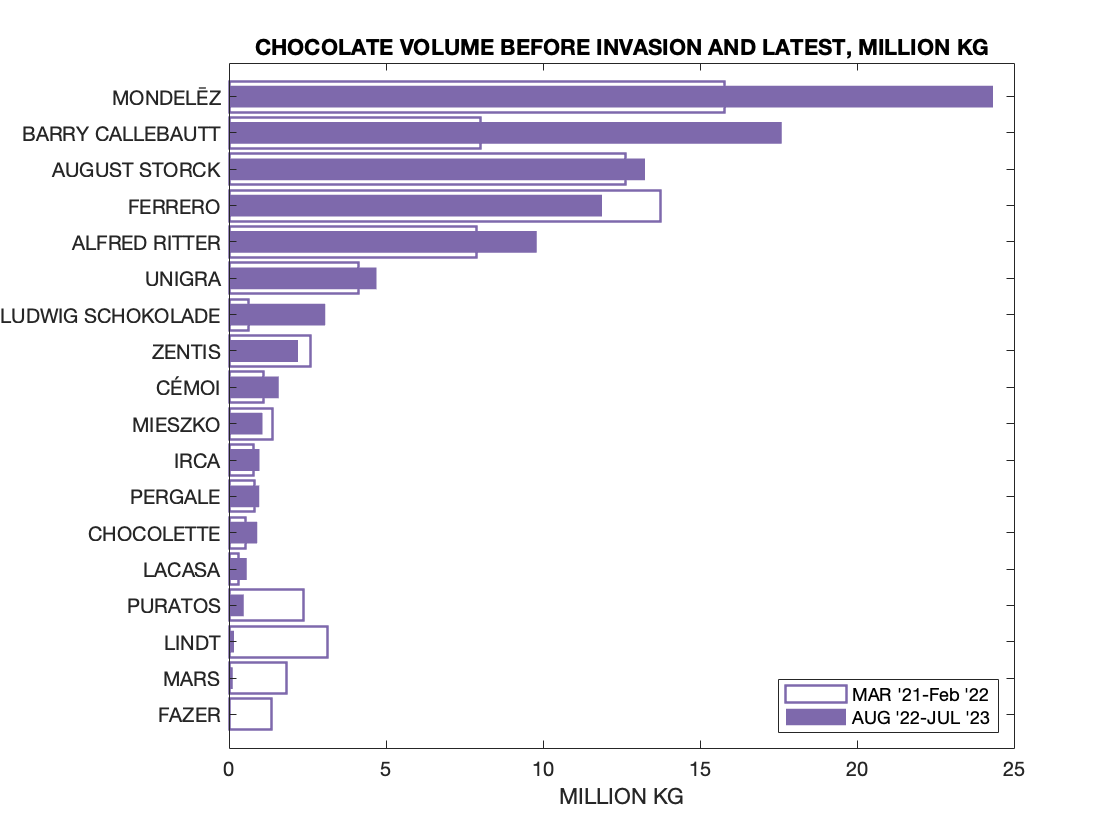

Next we compare that the last full year before the invasion (Mar '21-Feb '22) to the latest available full year (Aug '22-Jul '23) for the total volume (in million kg of the neight weight)  Chocolate volumes million KG (Mar '21-Feb '22) vs. (Aug '22-Jul '23)

Chocolate volumes million KG (Mar '21-Feb '22) vs. (Aug '22-Jul '23)

Lacoste Exports into Russia

May 22, 2023 updated July 28 and September 5, 2023

Note: The entry has been updated on July 28 to include April-June shipments data. The bottom line has not changed - shipments continue, the last shipment was on June 30. Further update on September 5, 2023 included July shipments. They actually grew substantially in July. We will continue monitoring

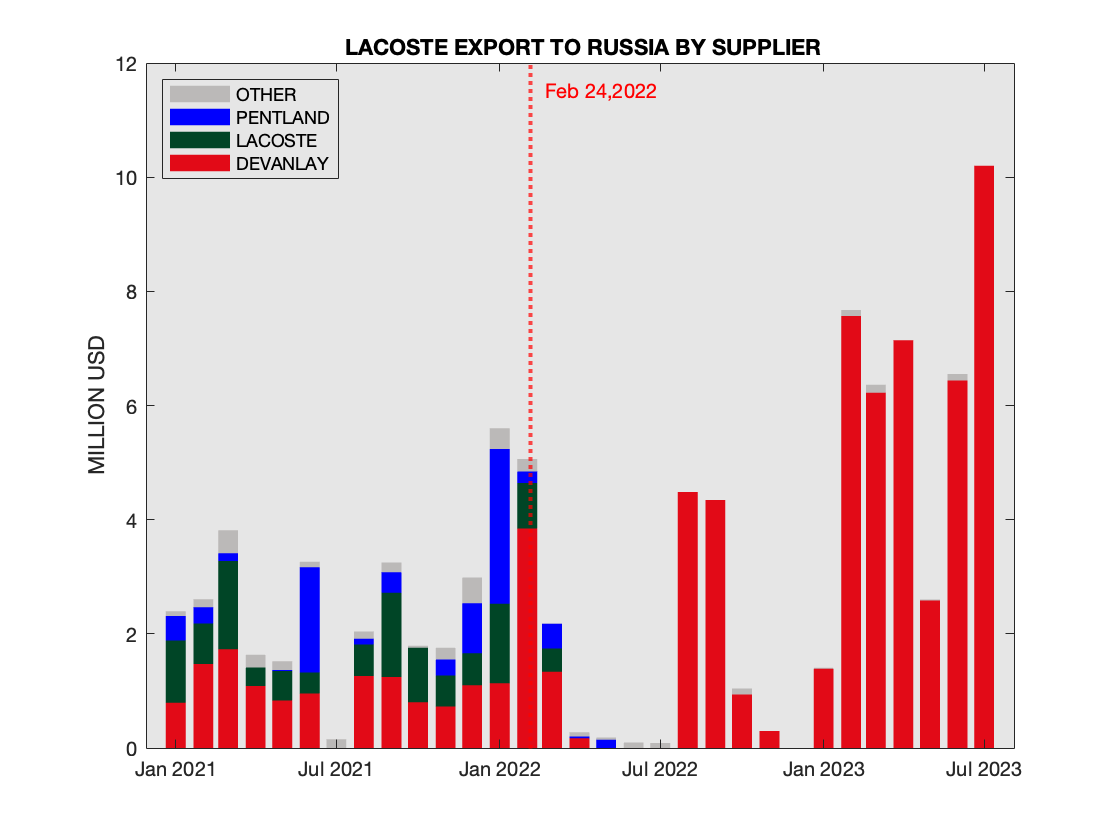

Today is the opening of Roland-Garos (French Open), let us look at the Premier Partner of that event, Lacoste. The official distributor of Lacoste in Russia is Lode LLC. We will look at what this company has imported.

It turns out that there are three main suppliers for this company, all shipments bearing the Lacoste trademark: LACOSTE OPERATIONS SA, PENTLAND CHAUSSURES LIMITED, and DEVANLAY-EREN TEKSTIL SANAYI A.S.. Pentland is the official distributor of Lacoste Chaussures, while DEVANLAY-EREN (the entity that owns Lode LLC), is both manufacturer and distributor of Lacoste products in. The website is available in three languages: Russian, Turkish, and English. The English version of the website modestly states: "Some part of Lacoste products is being produced by Devanlay-Eren Tekstil Sanayi ve Ticaret A.Ş. established by partnership of French Textile Company Devanlay SA and Eren Group." The Russian version duplicates the English one. The Turkish version, however is more specific, stating "the production rights of the famous French brand Lacoste, which is sold in 114 countries all over the world, have been held by its licensed manufacturer, Devanlay-Eren for 18 countries in total, including Russia, Ukraine, Poland, Czechia, Slovakia, Hungary, Baltic and CIS countries since 2005"

The chart shows how Suppliers changed over time after the invasion, with Lacoste Operations and Pentland stopping shipments, but Devanlay-Eren continuing.  Lacoste Exports to Russia by Supplier

Lacoste Exports to Russia by Supplier

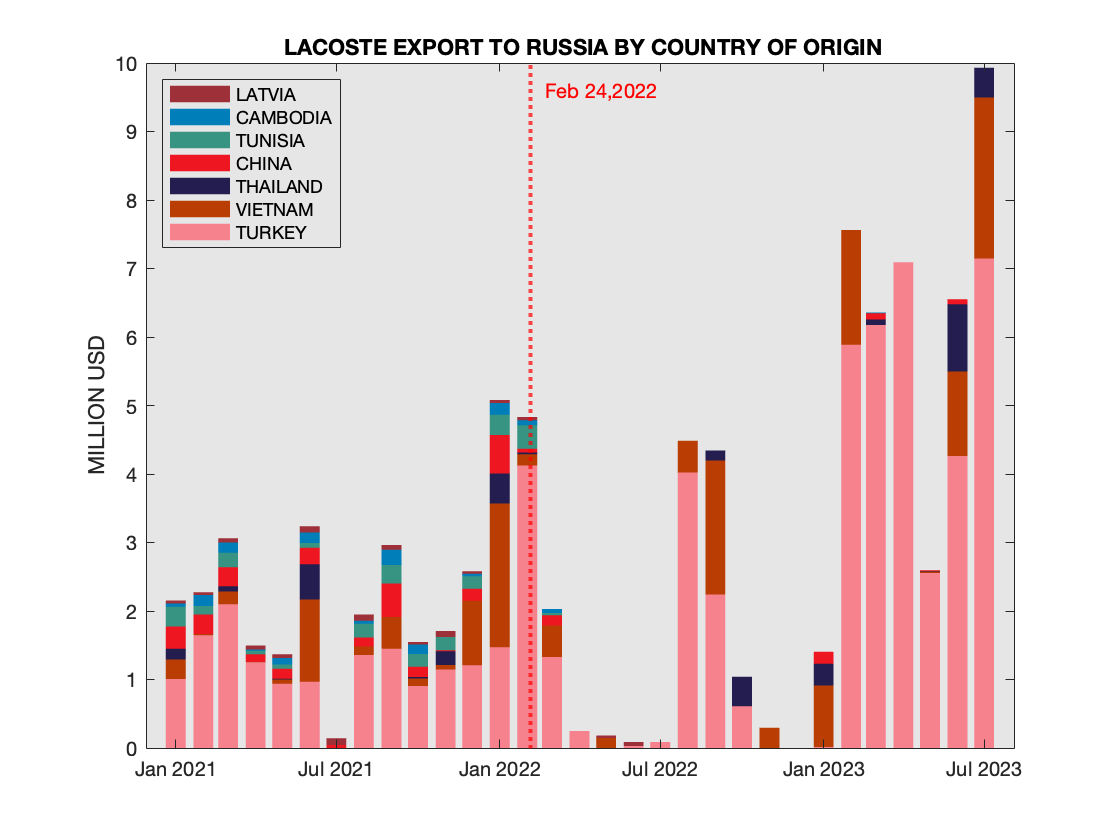

The next chart shows the countries of origin.  Lacoste Exports to Russia by Country of Origin

Lacoste Exports to Russia by Country of Origin

GSK (GlaxoSmithKline) Exports into Russia

May 24, 2023

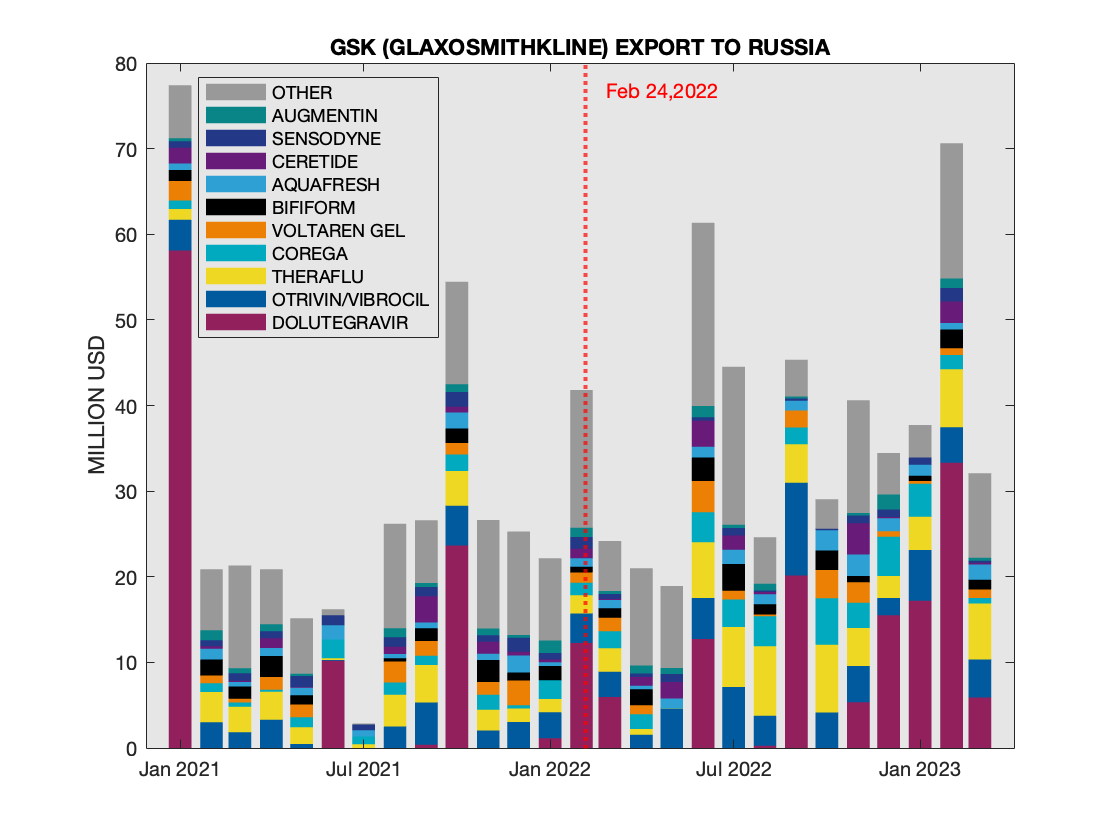

GSK announced in the Spring of 2022 that they will continue to provide essential medicine to Russia. There are no manufacturing capabilities inside Russia, so everything is shipped from outside of Russia. The chart shows the products shipped to Russia based on the search conducted using a combination of Importer field (GLAXOSMITHKLINE) and Manufacturer Field (GLK). The latter search required removal of spurious companies that also have GLK in their name. he classification is based on the Trademark field. The result shows the top 10 products over the period Jan '21-Mar '23. The top spot is HIV treatment Dolutiegravir (Tivicay and Dovato). It is followed by Nasal Sprays (Otrivin and Vibrocil), Theraflu (cold medicine), Corega (denture adhesives), Voltaren Gel (pain relief for arthritis), Bifiform (probiotic), Aquafresh (oral hygiene), Ceredite (Asthma treatment), Sensodyne (oral hygiene), Augmentin (antibiotic).

In its response to the "situation in Ukraine", the company states: "We continue to supply medicines and vaccines to Russia. Where we experience challenges delivering them, we will prioritise supply of products that are essential for people’s health (always in compliance with sanctions). This prioritisation will take into account medical criticality, patient need and availability of alternatives." There seem to be a big difference between HIV treatment and tooth paste, so clear guidelines for defining what constitutes essential would be helpful.  GSK Exports to Russia by Product (top 10)

GSK Exports to Russia by Product (top 10)

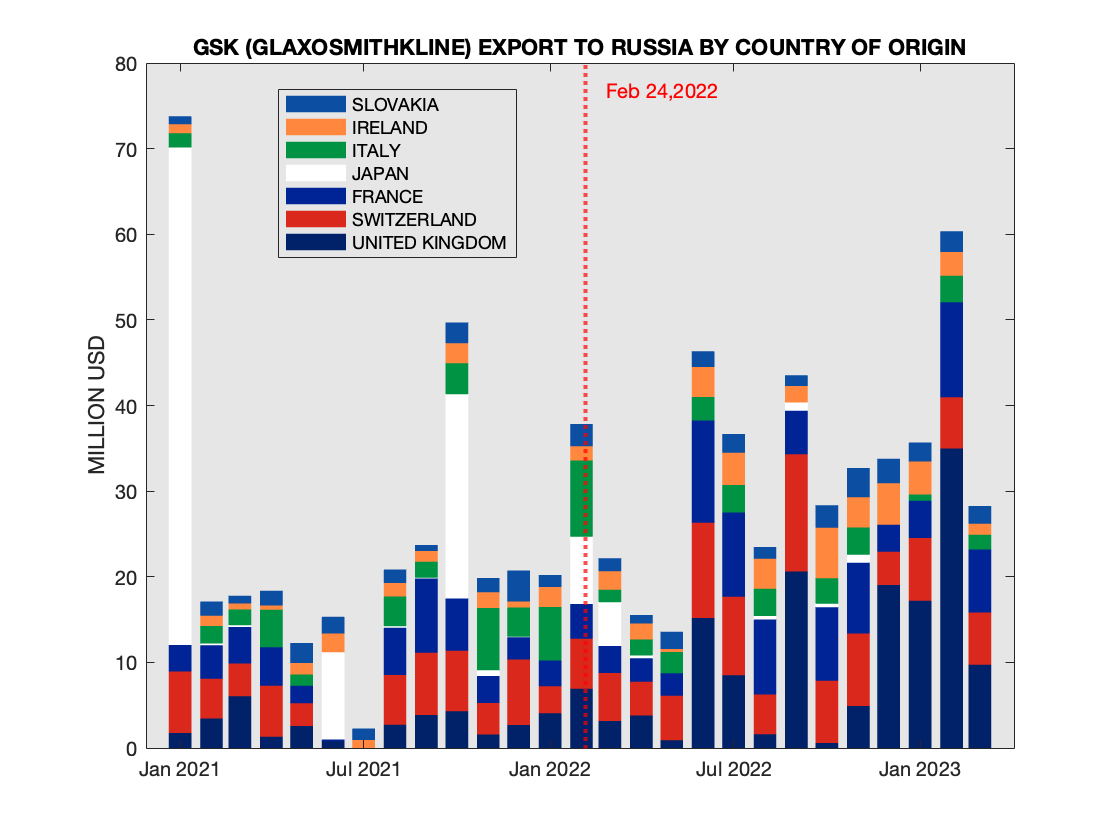

The next chart shows the countries of origin. The only trend of notice is a relatively light representation of Japan recently.  GSK Exports to Russia by Country of Origin

GSK Exports to Russia by Country of Origin

Fashion Exports into Russia

June 5, 2023, updated for Christian Dior on September 22, 2024

We previously covered Hugo Boss and Lacoste, and today we will take a look at other fashion brands. Here and below we use queries for Russian customs data, based on Name of Manufacturer field containing the company name, ajusted as needed. Such queries have some inherent limitations. Some of these limitations can be mitigated: for example, the manufacturer name can differ from the company name (see entry for Lacoste) - so a preliminary search is conducted, custom records contain duplicates, which have been removed.

At the same time, there are limitations that cannot be easily mitigated, so they must be recognized. Those include the errors of omission (all databases are imperfect), not all goods flow into Russia through customs, due to the presence of Eurasian Customs Union that includes Russia, Kazakhstan, Kyrgyzstan, Armenia and Belarus. As a result, goods can go to another member of the union (for example, Kazakhstan). In addition, declared values can differ from the actual sale prices charged by the companies. Reported sales/revenues generally lag customs data (since there is a delay between the time goods cross customs and are being sold).

Soon after the invasion, headlines appeared indicating wholesale exit of upscale fashion brands from Russia, resulting in empty shelves of luxury stores. On March 15th EU sanctioned luxury exports to Russia for items over €300.

Combined effect of sanctions and relative vulnerability of fashion industry to pressure on moral issues signifiantly constrained its ability to continue Russian operations. However, these constraints and the resulting actions of the companies varied greatly, creating multiple shades of grey. One obvious (but not the only) factor the fraction of a company's product line directly impacted by the the €300 ceiling.

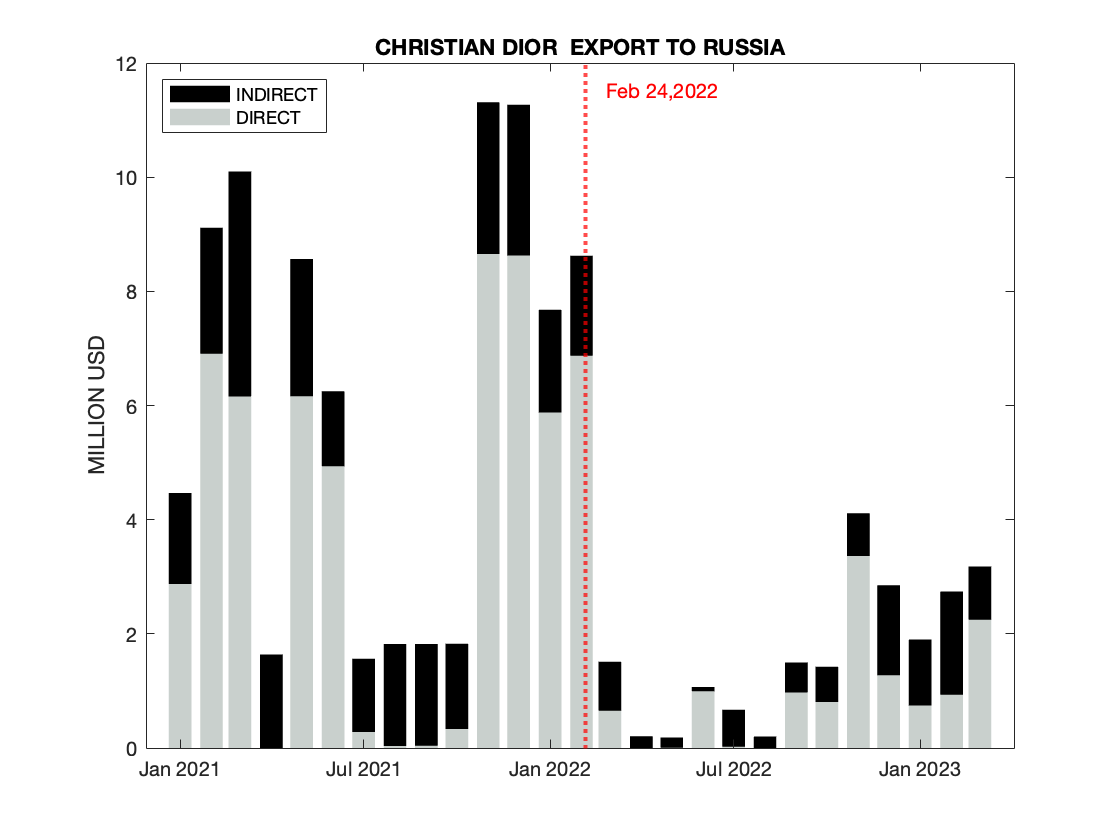

Speaking of shades of gray, we start with the company that is known for owning one: Trianon Gray of Christian Dior. The company is majority (59%) owned by LVMH.

The first chart distinguishes direct shipments (when supplier name contains the company name) from indirect shipments (where supplier is a third-party entity). One can observe that after a steep drop right after the invasion, shipments never really stopped, and recovered the volume somewhat by the Fall of 2022, albeit not at the pre-invasion level. Moreover, a significant portion of the shipments is direct.  Christian Dior Exports to Russia

Christian Dior Exports to Russia

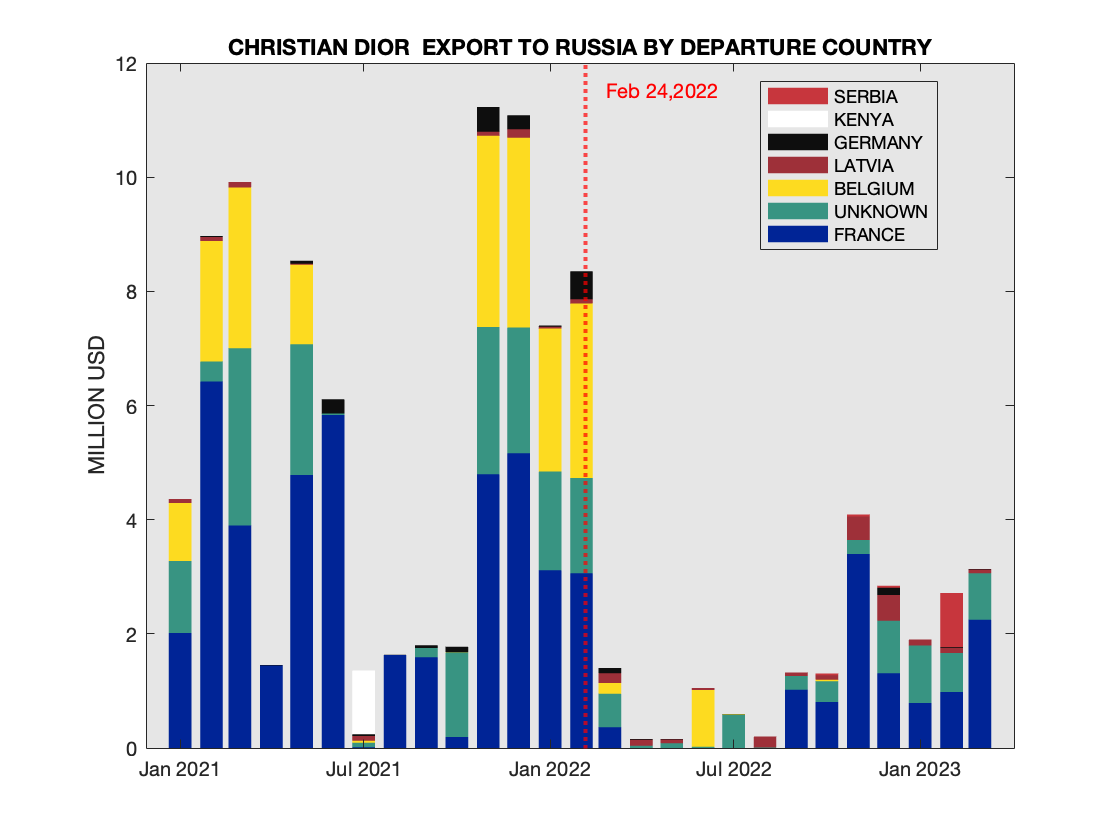

The next chart shows the breakdown of shipments for Christian Dior by the departure country. While majority of shipments are sent from from France, increasing importance of Latvia and Serbia must be noted (Update: Poland appears at the later stage as well)  Christian Dior Exports to Russia by Departure Country

Christian Dior Exports to Russia by Departure Country

Update in 2024 From April 1, 2024 until May 24, 2024 (the latest data available), there was over 24 million USD direct shipments all effectively with the supplier being Perfums Christian Dior and importer is Seldico LLC (spelled in customs records as Seldiko LLC).

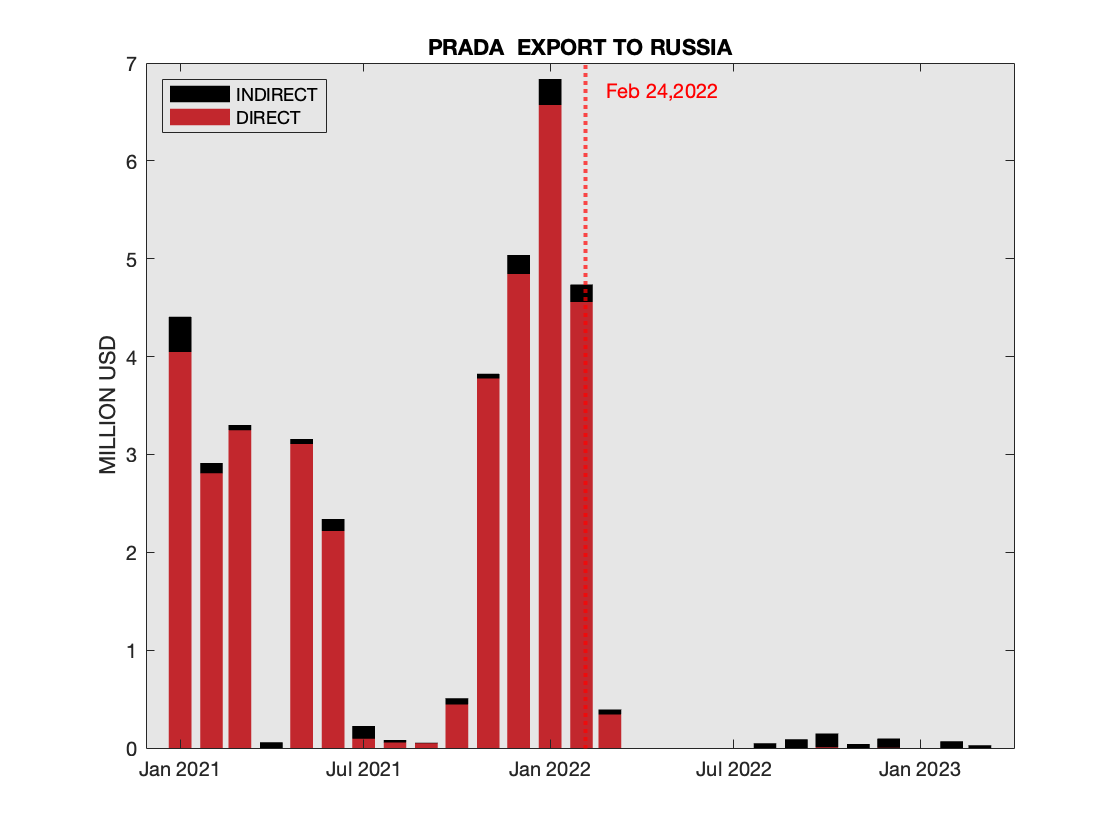

Let us compare and contrast the pattern of Christian Dior with Prada. Here the shipments dropped sharply after the invasion, and very few remaining shipments are all indirect.  Prada Exports to Russia

Prada Exports to Russia

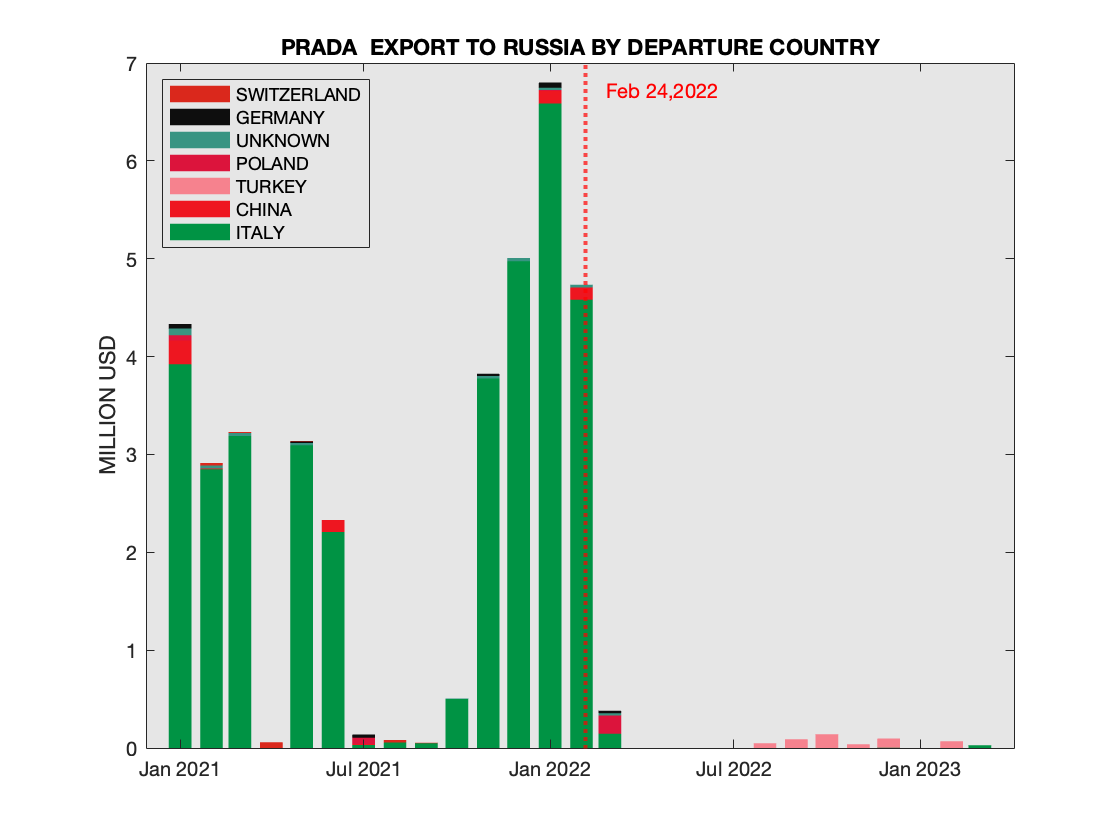

The next chart shows the breakdown of shipments for Prada by the departure country. The bulk of indirect shipments after invasion are sent from from Turkey.  Prada Exports to Russia by Departure Country

Prada Exports to Russia by Departure Country

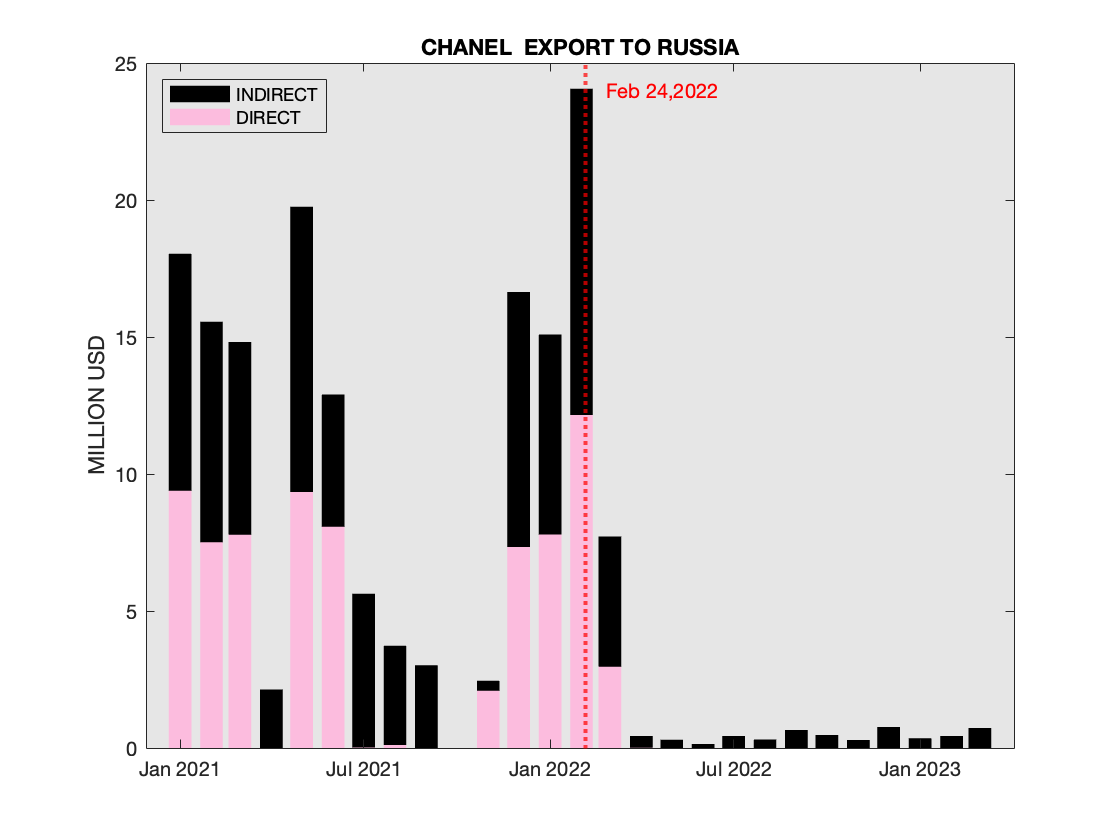

Chanel shipments are similar to that of Prada (and can be contrasted to Christian Dior). Here the shipments dropped sharply after the invasion, and very few remaining shipments are all indirect.  Chanel Exports to Russia

Chanel Exports to Russia

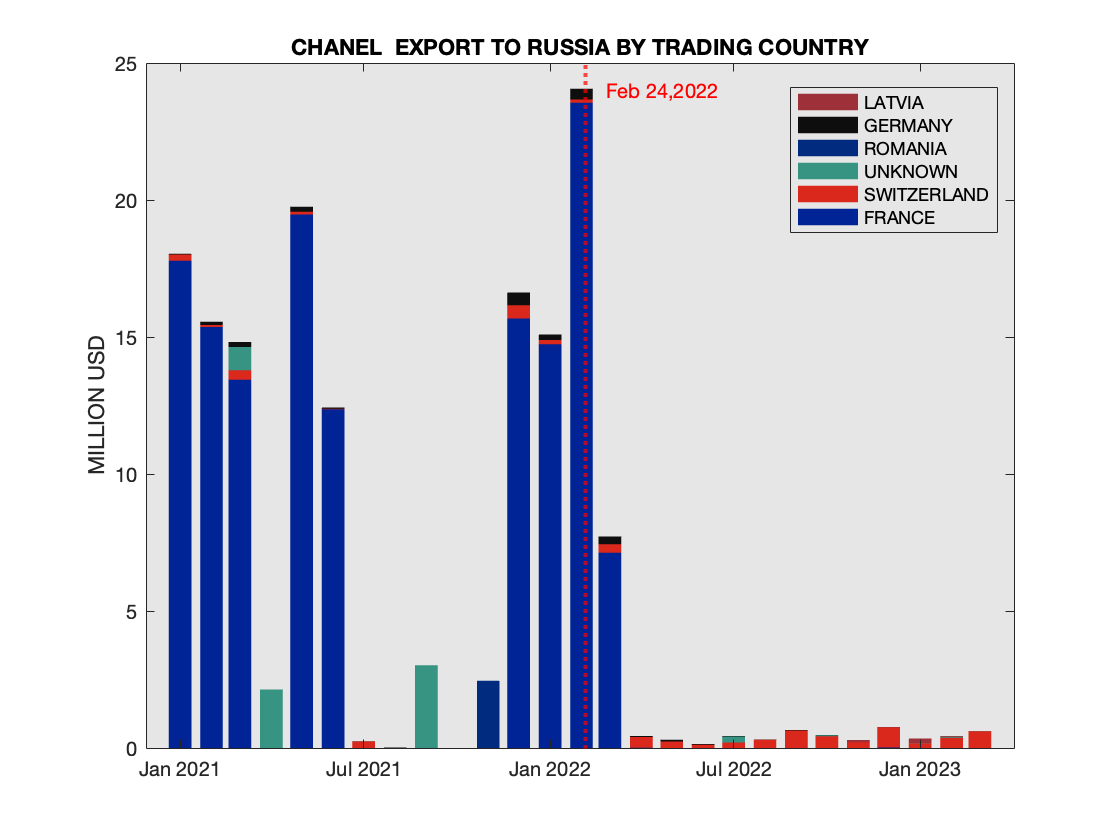

Chanel Exports to Russia by Trading Country

Chanel Exports to Russia by Trading CountrySelected Steel Exports into Russia

June 8, 2023

Steel exports is one of the categories of goods that don't attract as much media attention as well-known consumer brands or electronics. Here we look at four companies in this area.

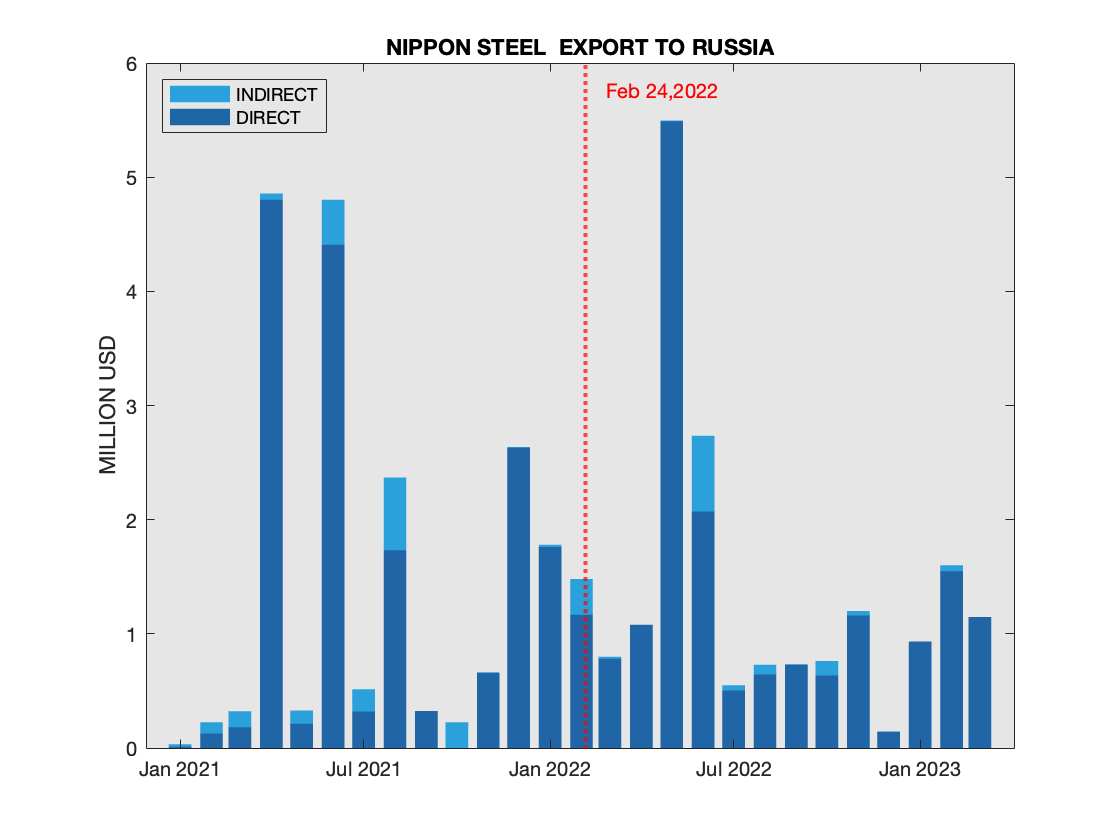

First, let us look at Nippon Steel (and its subsidiary Sumitomo Metal Industries, not to be confused with Sumitomo Metal Mining), a Japanese company. Exports continue, with a significant portion being direct  Nippon Steel Exports to Russia

Nippon Steel Exports to Russia

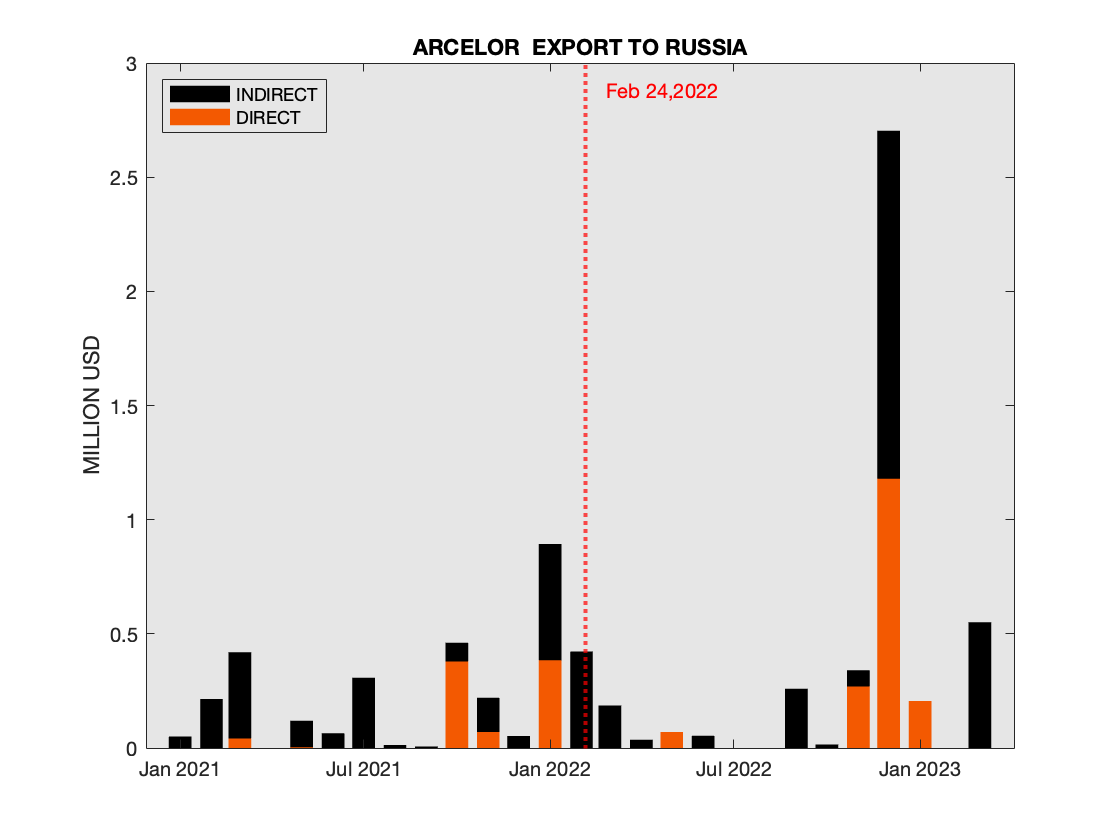

Next, look at another large company, ArcelorMittal. Both direct and indirect shipments continue, with a remarkable peak in December of 2022  Arcelor Exports to Russia

Arcelor Exports to Russia

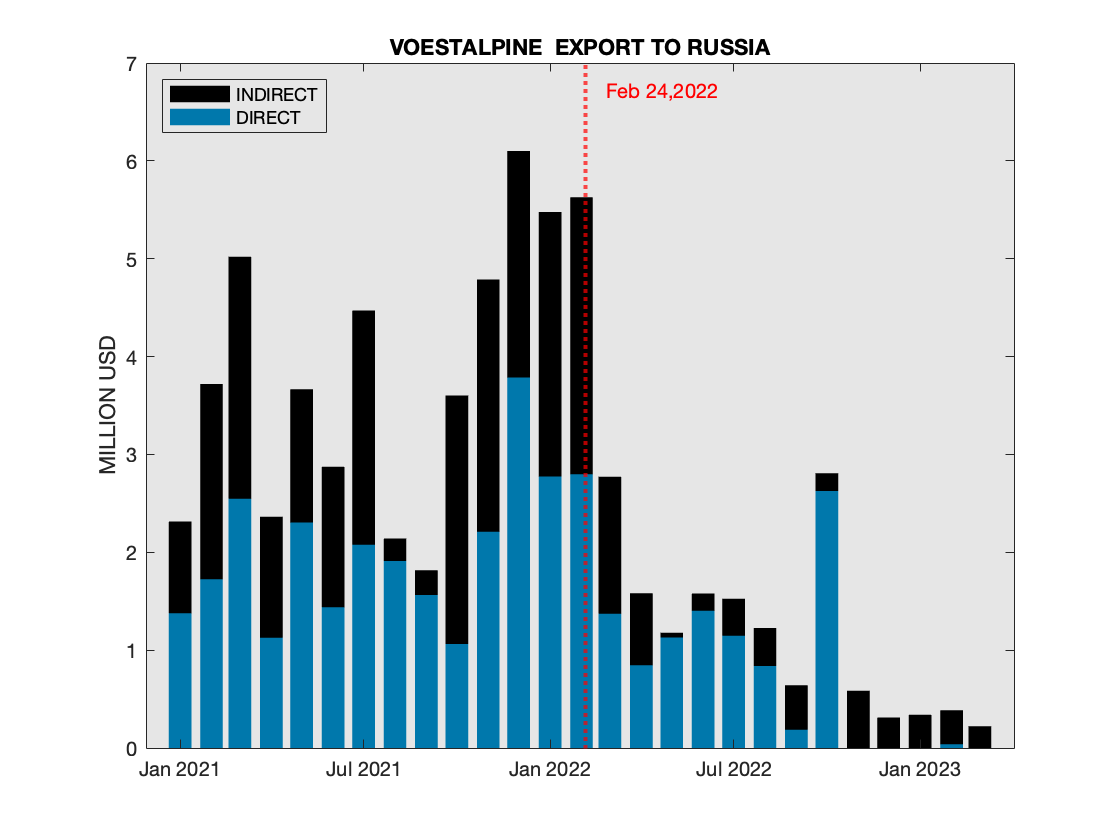

Turning to less known companies, first is Austrian Voestalpine - some reduction of volumes, but exports continue, including direct ones.  Voestalpine Exports to Russia

Voestalpine Exports to Russia

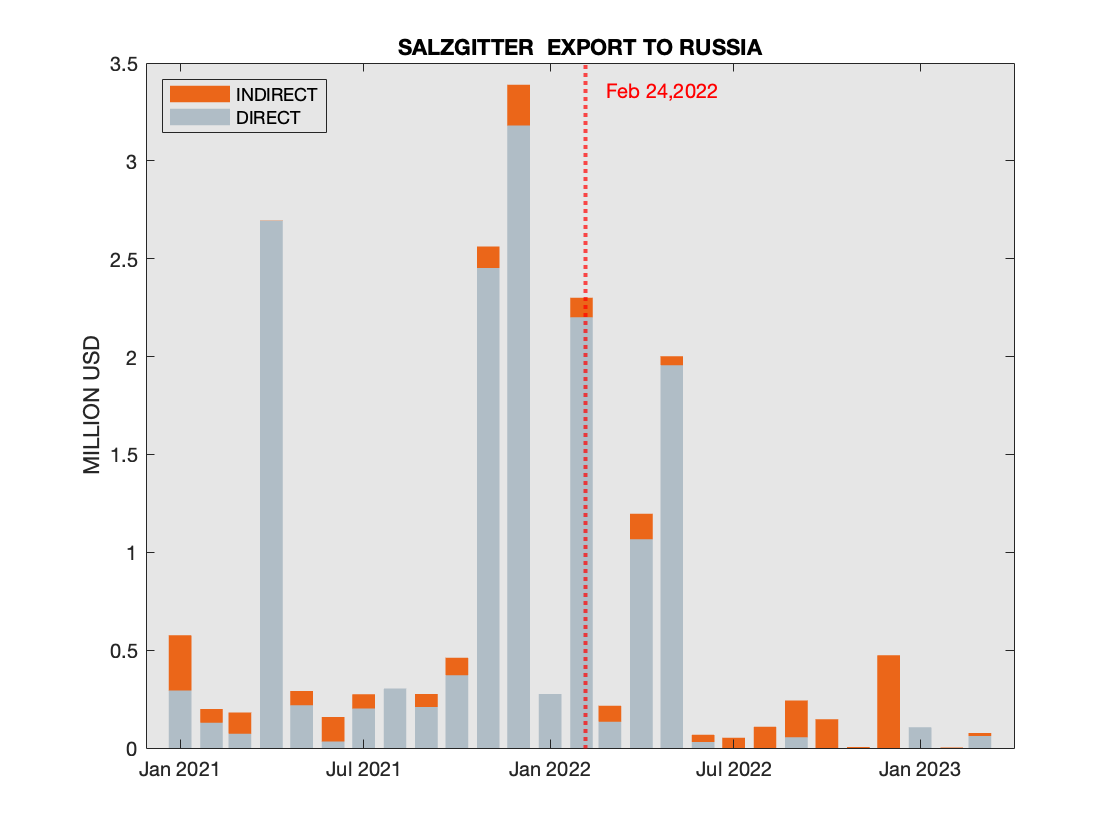

Finally, a German Salzgitter - a more positive (from our perspective) pattern: reduction of exports and most of the remaining exports are indirect.  Salzgitter Exports to Russia

Salzgitter Exports to Russia

Paints and Varnishes Exports into Russia

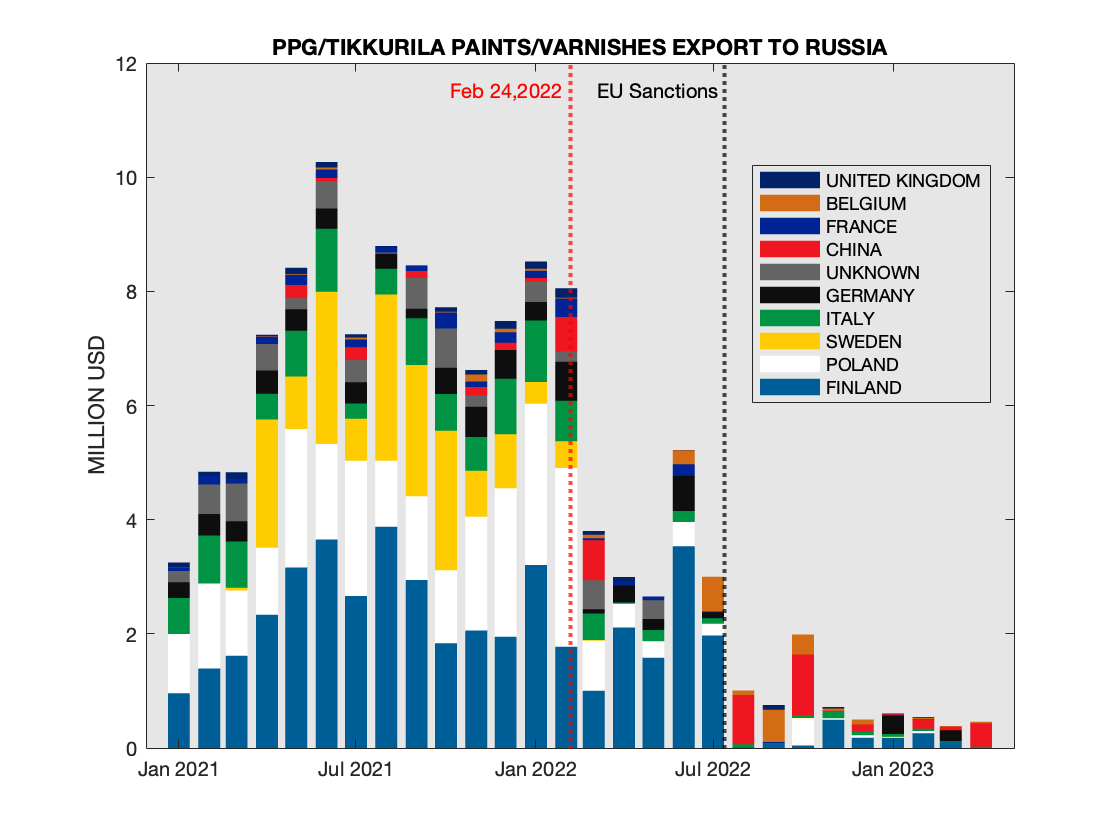

June 13, 2023 updated June 16,2023

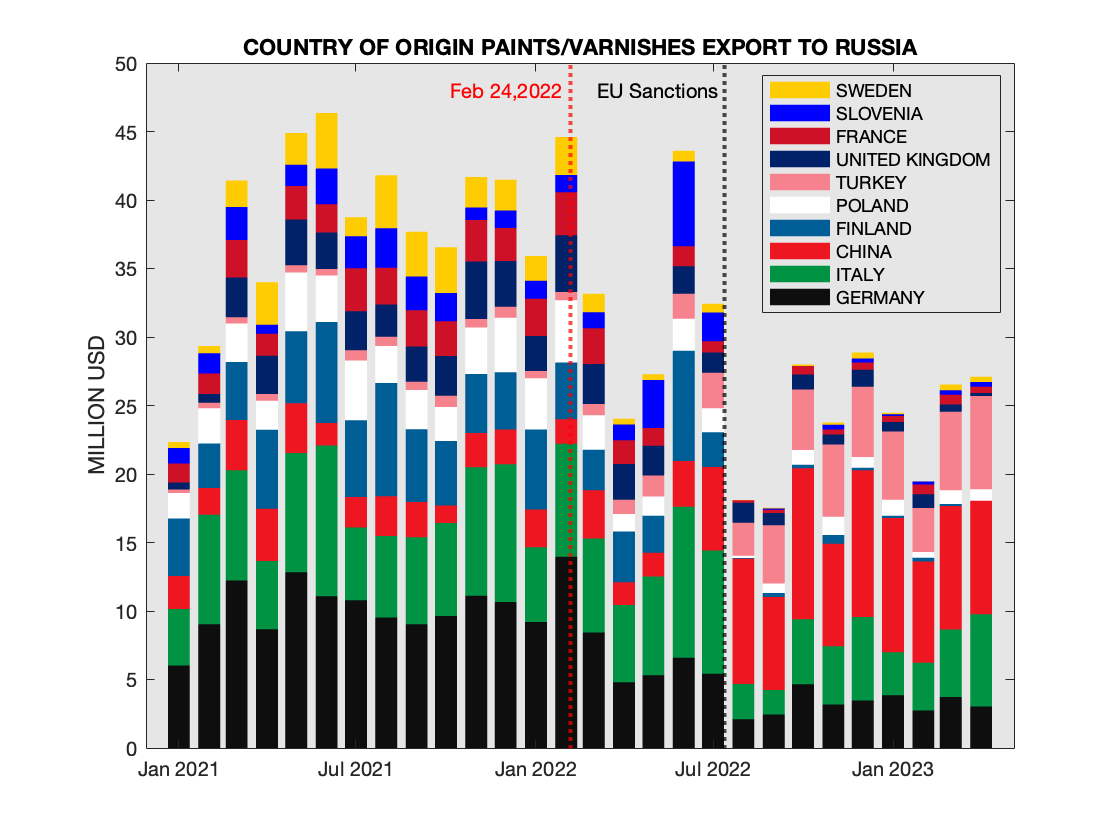

The export of Paints and Varnishes provides an interesting subject of study due to the fact that multiple categories have been sanctioned by EU in the end of July of 2022. Specifically, we will look at the HS codes that correspond to the sanctioned goods: HS 3208 10, 3208 20,3208 90, 3209 10, 3209 90, 3210 00. Russian Customs data reveals that these categories were dominated by EU producers.

First, the big picture - looking at all categories of sanctioned paints and varnishes by country of origin. The chart has two vertical lines, indicating the full-fledged Russian invasion to Ukraine and the EU introduction of sanctions. One can see that while the share of China and Turkey increased, goods originated from Italy and Germany remained very significant, so the sanctions appear to be only partially successful.  Sanctioned Paints and Varnishes Exports to Russia by Country of Origin

Sanctioned Paints and Varnishes Exports to Russia by Country of Origin

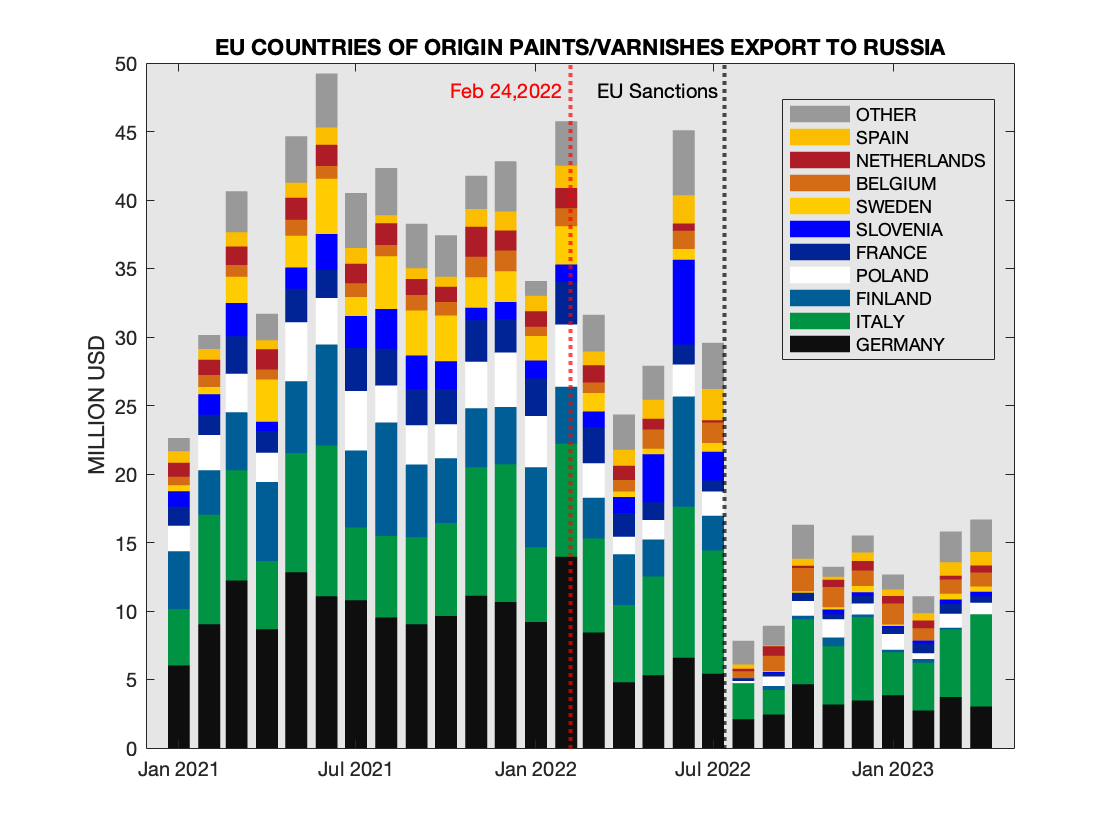

Next, we will focus on the goods of EU origin (subject to sanctions after the end of July of 2022). The value of total exports of EU origin between Aug 1, 2022 (after the sanctions have been imposed) until the end of April of 2023 was over 118 million USD (or roughly 13 million USD per month). Before the sanctions the average monthly volume was around 37 million USD per month.  Sanctioned Paints and Varnishes Exports to Russia for EU Countries of Origin

Sanctioned Paints and Varnishes Exports to Russia for EU Countries of Origin

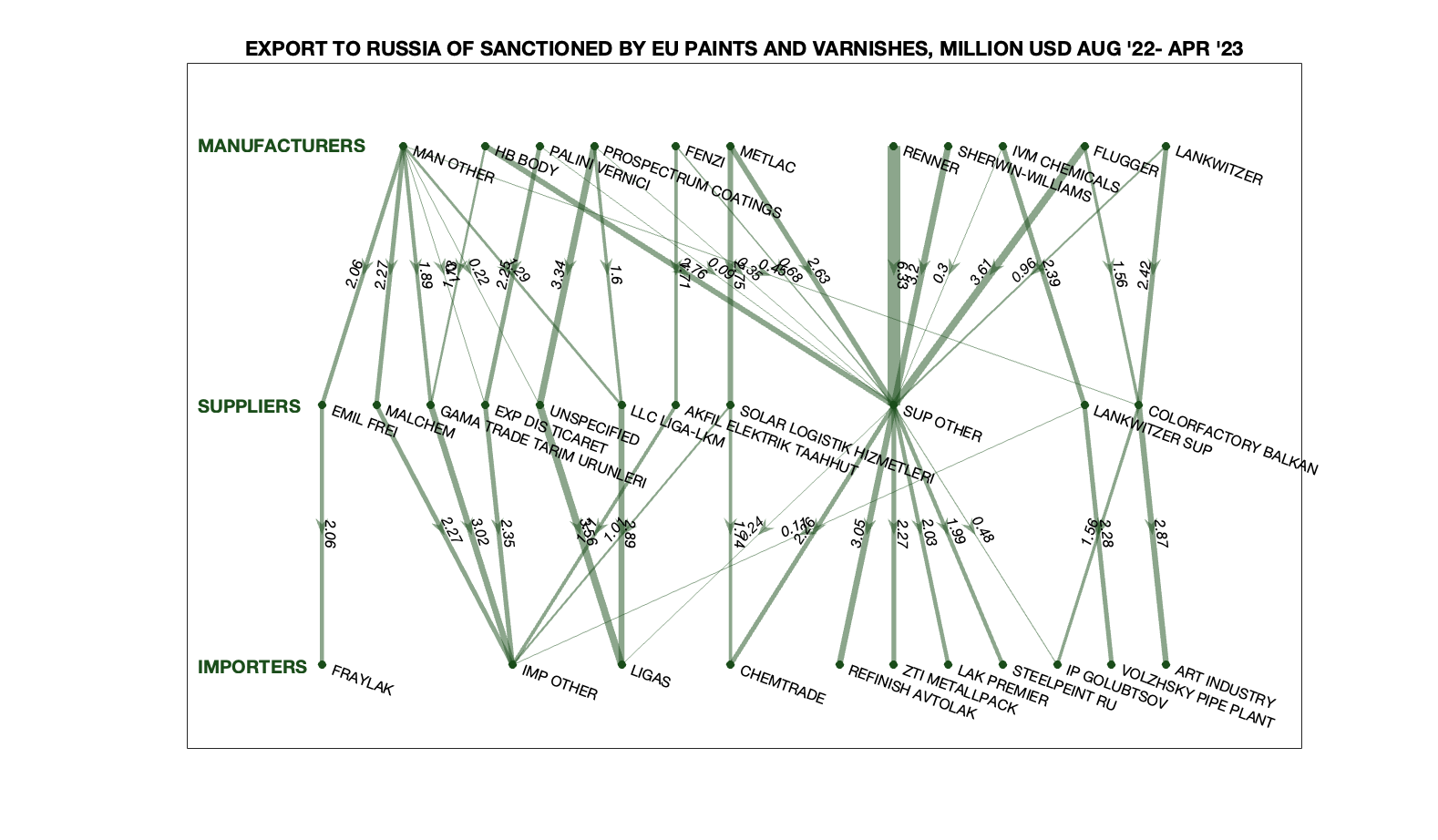

The following chart shows some details of these transactions: the top ten Manufacturers, Suppliers and Importers. In each category there are much more than 10 entities, and they are all combined into the "OTHER" bin. The chart omits the flow from "Man Other" to "Sup Other" and from "Sup Other" to "Imp Other" for clarity (the inclusion of these two flows would dwarf all others, precluding the visual connection of thickness of edges to the volume of trading). To make all nodes of the chart distinct, the identical names are appended with "Man" (for manufacturing) or "Sup" (for supplier).  Network of Manufacturers, Suppliers and Importers from EU to Russia

Network of Manufacturers, Suppliers and Importers from EU to Russia

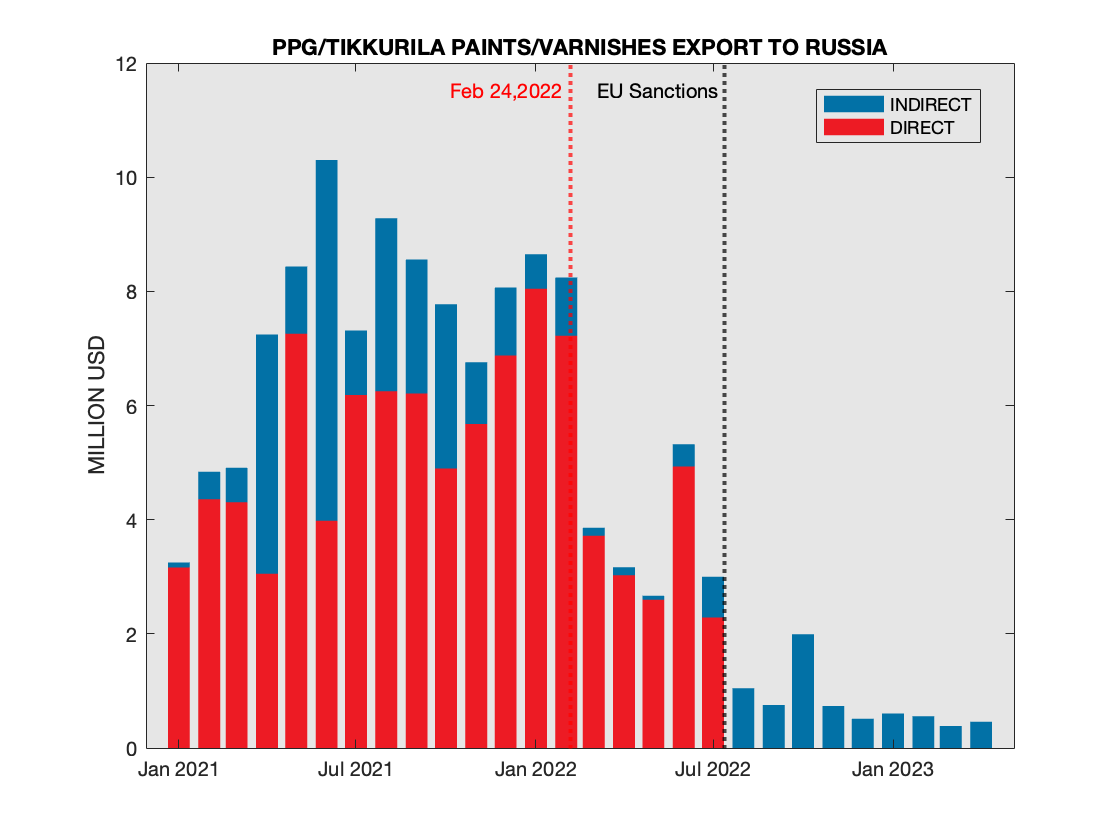

We plan to look into specific companies, and we start with PPG, an American Company with a Finnish Subsidiary, Tikkurila, that was a market leader on Russian market before the full-fledged invasion in February of 2022. One can observe that the volume has decreased after EU sanctions have been imposed, will all shipments being indirect. We will look at those shipments next.  Paints and Varnishes Exports to Russia for PPG/Tikkurila

Paints and Varnishes Exports to Russia for PPG/Tikkurila

First, let us look at the breakdown of the shipments by the country of Origin. The largest supplier after the sanctions were imposed is FIRM HENAN KADE ALUMINUM KENS CO., LIMITED (China) that imported goods produced by PPG COATING, CHINA. Formally, since those goods are produced in China, they don't fall under the sanctions. However, there are other suppliers, such as Turkish UNITRADE AMBALAJ PAZARLAMA SANAYI VE TICARET AS that exported earlier this year over half-a-million USD value for goods produced by PPG INDUSTRIES LACKFABRIK GMBH in Germany.  Paints and Varnishes Exports to Russia for PPG/Tikkurila by Country of Origin

Paints and Varnishes Exports to Russia for PPG/Tikkurila by Country of Origin

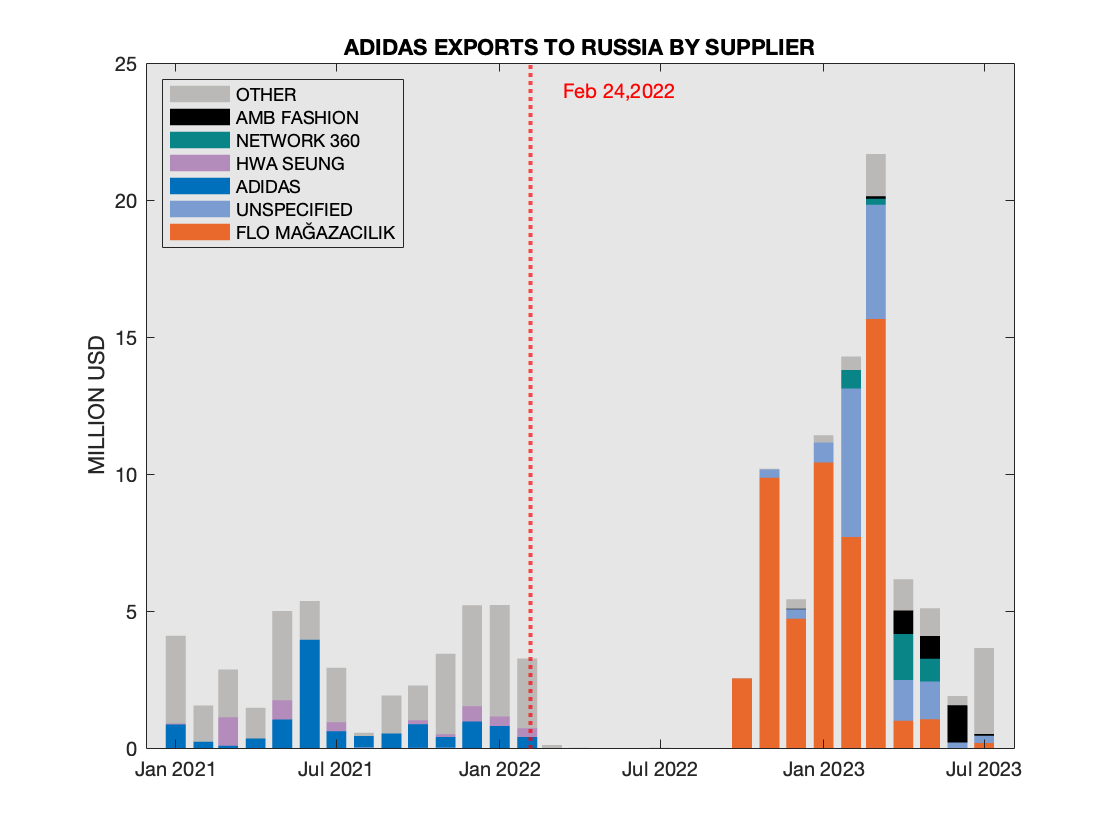

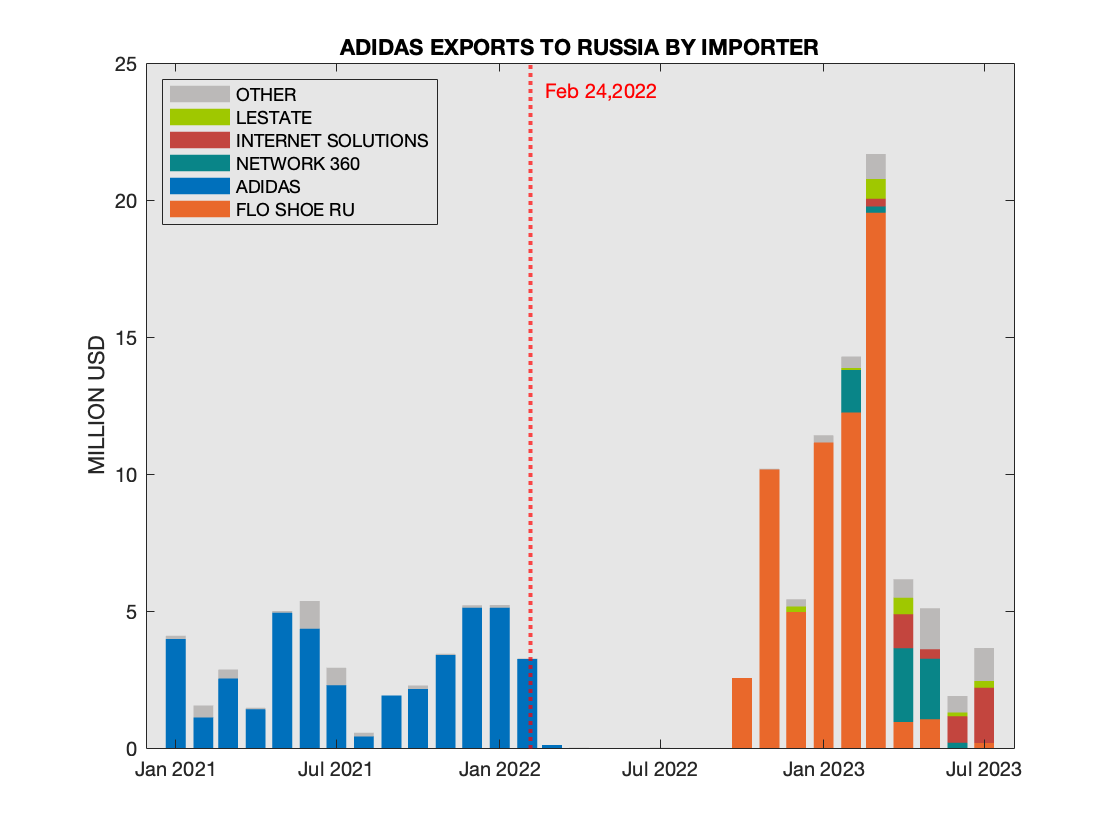

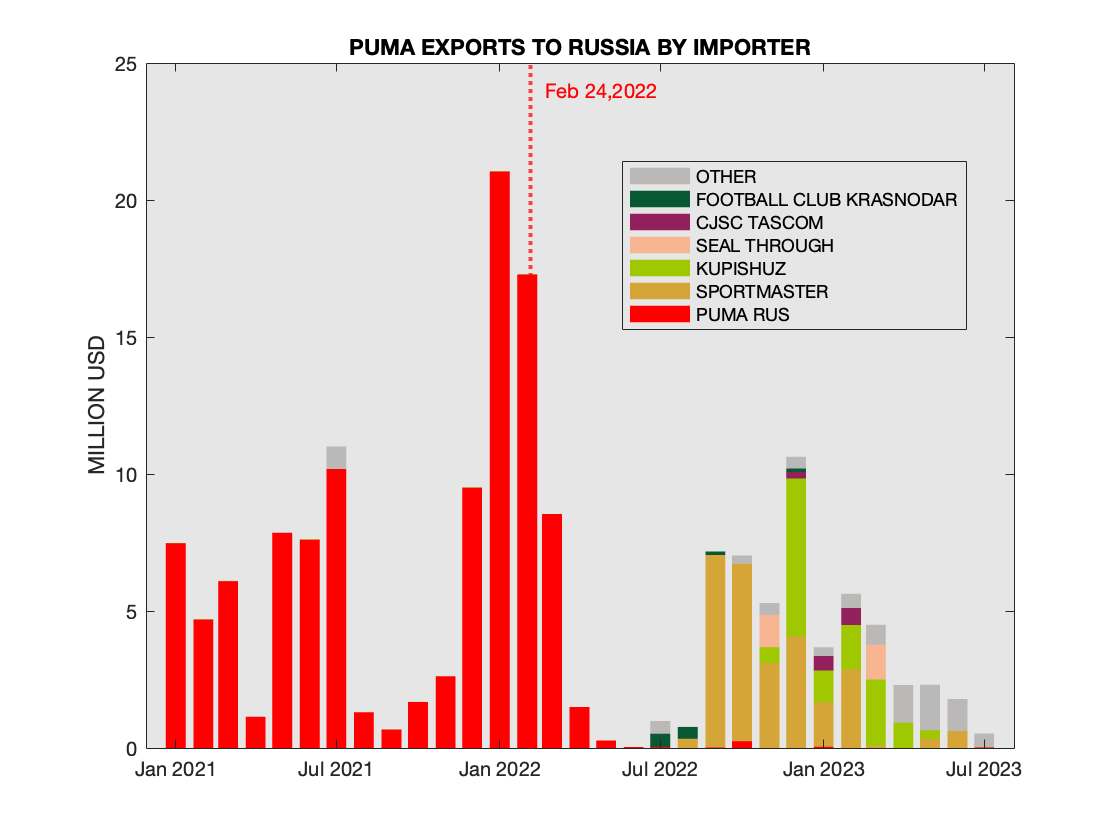

Adidas and Puma Exports into Russia

June 21, 2023 updated August 27, 2023

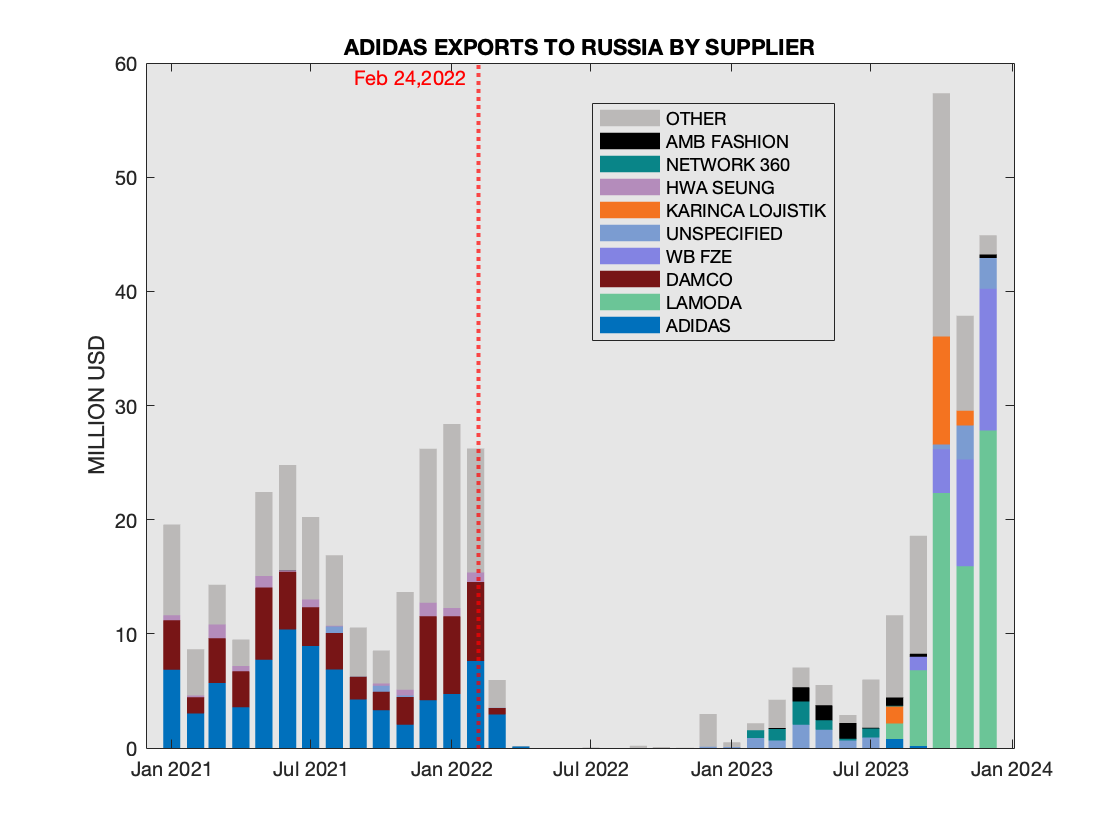

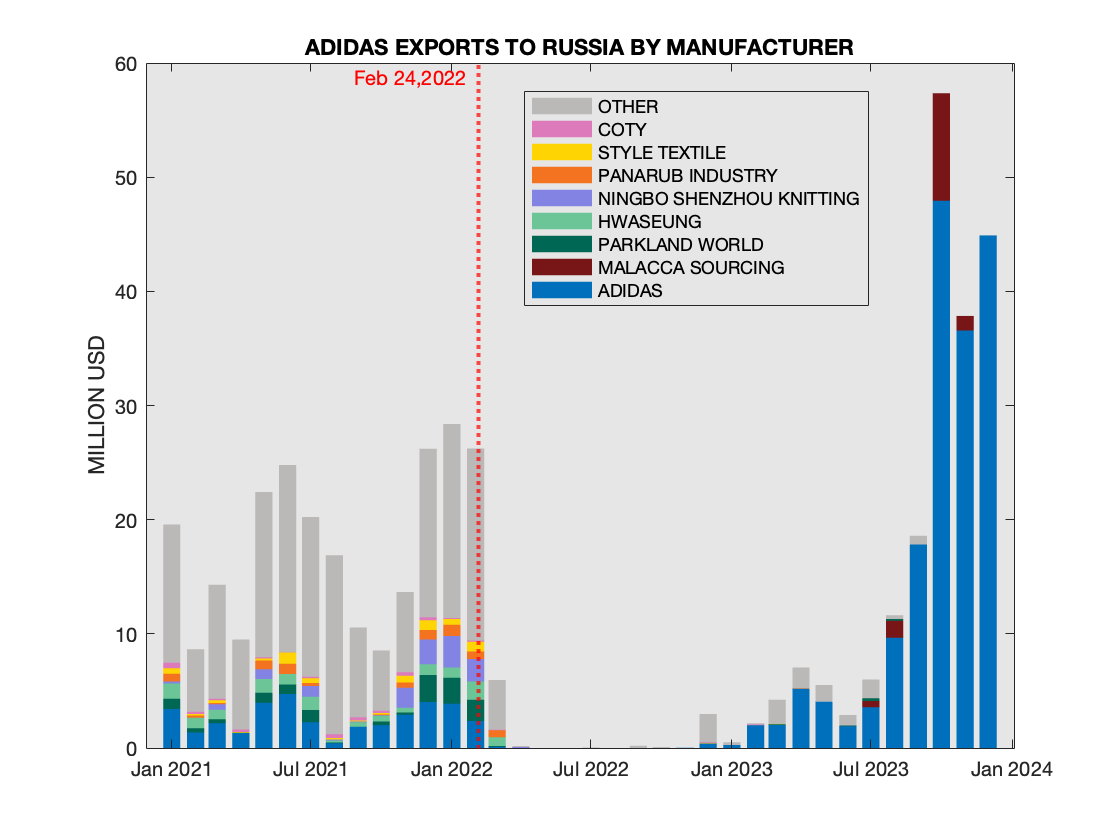

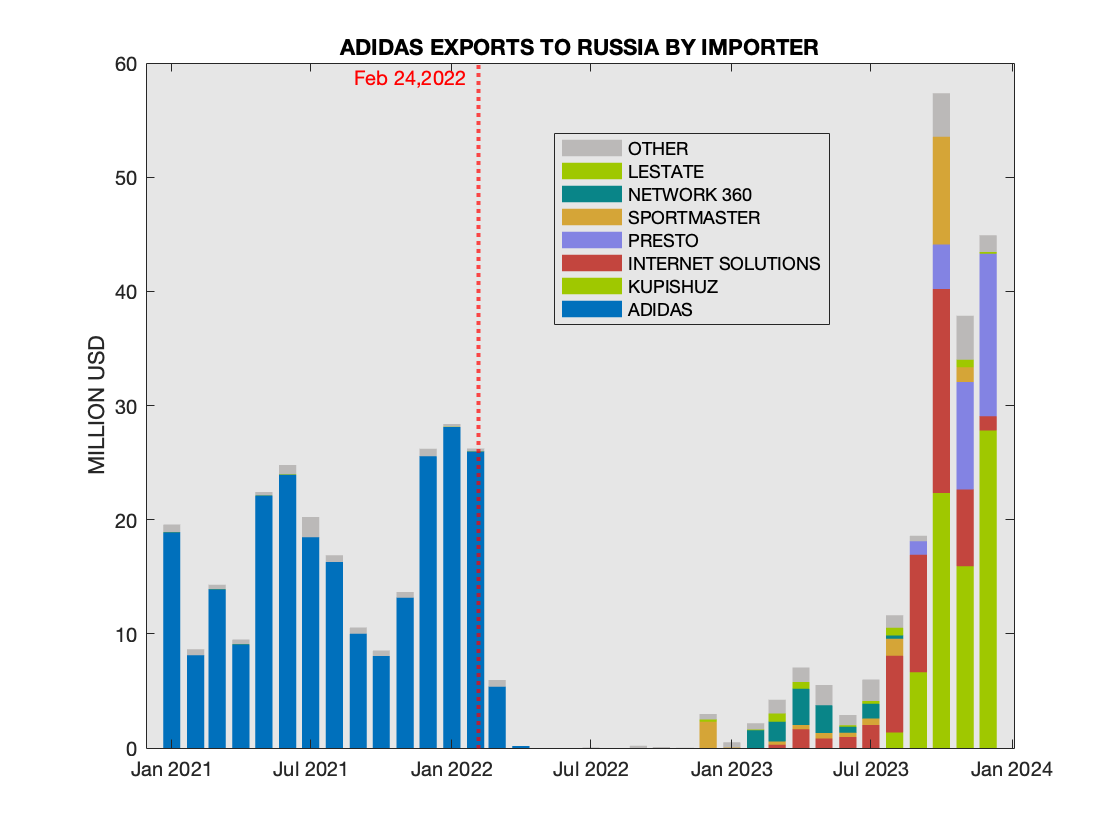

Adidas announced closing its stores in Russia shortly after the invasion in 2022. The customs records indeed show that shipments of Adidas products stopped as well. However, the shipments have resumed in October of 2022 and by value have easily exceeded pre-invasion levels. The chart shows suppliers, and one can see that the leading supplier is the Turkish company Flo Magazacilik Ve Pazarlama A.S. The company been linked with the purchase of Reebok's stores in Russia back in May of 2022 (Reebok was only recently sold by Adidas to Authentic Brands Group, and at the time Reebok in Russia was still controlled by the Adidas OOO). This chart in updated to include May-July data.  Adidas Exports to Russia by Supplier

Adidas Exports to Russia by Supplier

Adidas Exports to Russia by Importer

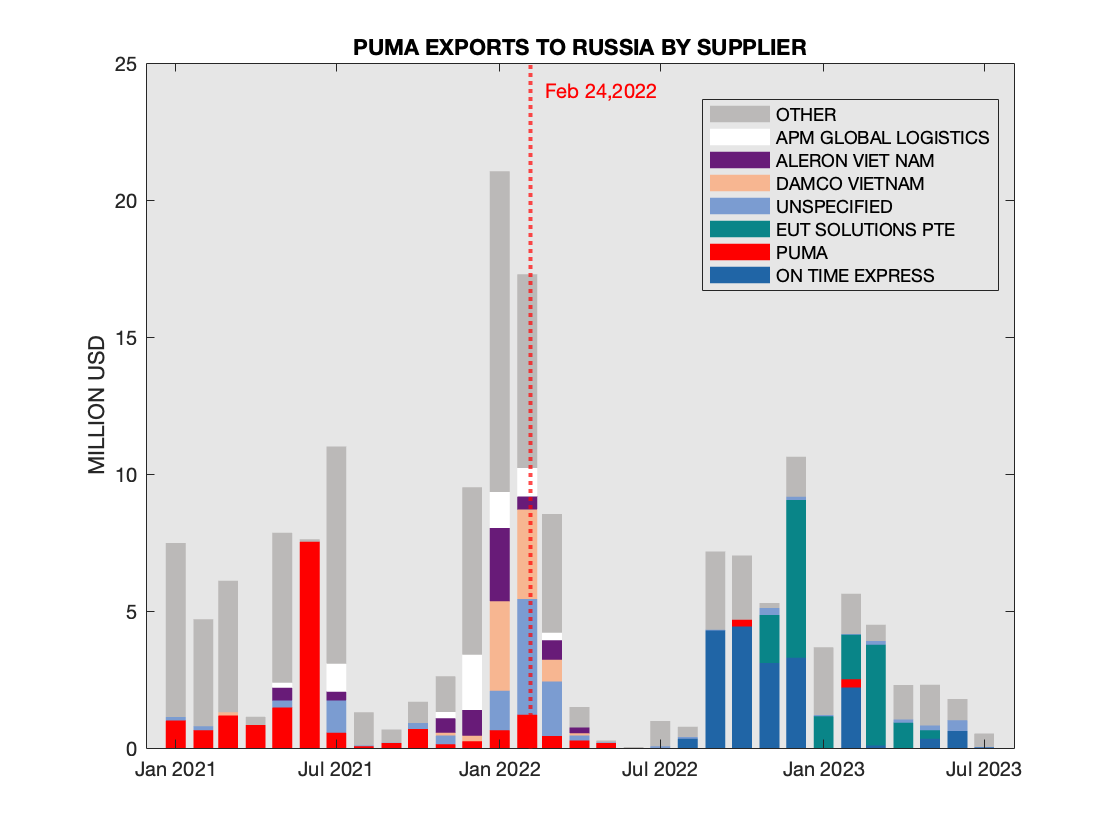

Adidas Exports to Russia by ImporterNaturally, conversation about Adidas will not be complete without a look at Puma, which announced closing of its stores in Russia simultaneously with Adidas. At the time, Puma's statement on twitter included the announcement of suspending the contact with the Russian Basketball Association. Puma had also sponsored three football teams in Russia, but the suspension with the Russian Football Association has been conspicuously absent, and Wikipedia still lists three Russian clubs, including Krasnodar, which apparently imported some 1.17 million USD of Puma products after March 5, 2022. The chart shows top importers of Puma products in Russia since 2021. This chart in updated to include May-July data.  Puma Exports to Russia by Importer

Puma Exports to Russia by Importer

Questions about Puma's relationships with Russian-connected wholesalers were raised back in May of 2022. The chart shows Suppliers of Puma product to Russia (updated )  Puma Exports to Russia by Supplier

Puma Exports to Russia by Supplier

One of the leading exporters after the invasion is EUT SOLUTIONS PTE. LTD, a Singapore-based company that was incorporated on 10 Aug 2022.

Finally, at the time of writing (June 21, 2023) Puma has still did not take down its Russian career page We note that the website was taken down by August 27, 2023, so the link is switched to the version archived on June 10, 2023.

Cocoa Products Exports into Russia

June 23, 2023 updated February 12, 2024

Previously, we looked at exports of prepared chocolate into Russia as well as at one of the main chocolate providers in Russia, Mondelēz International. The latter has been the recepient of an intense campaign to stop business in Russia, in particular in Scandinavia, where even commercial entities, such as IKEA have stopped carrying Mondelēz products (in particular an iconic Swedish chocolate Marabou). Under this pressure, in its defence, Mondelēz International issued a statement on June 15 of this year. We will parse the last two paragraphs of the statement, and there is quite a lot to unpack there.

First, the paragraph before last (quoted in its entirety): "We have scaled down our activities, discontinuing new capital investments, new product launches and our advertising media spending in Russia. As a result of these actions, we are selling significantly less products as our sales are now declining. This year, our overall volumes have declined double digits and both our import volumes and market share have significantly decreased."

The first sentence recaps actions undertaken by the company shortly after the invasion and described in the original statement from March 9, 2022. The second sentence draws a clear causal link between those actions (cause) and the declining sales (effect). The third sentence quantifies the effect: "This year, our overall volumes have declined double digits..." This quantification is ambiguous, and can be interpreted in two distinct ways: A. The volumes declined this year, as compared to the same period last year (or previous years). B. The volumes have declined since the beginning of this year. Below we will discuss which of those two outcomes is supported by data.

Turning to the last paragraph of the statement: "We’re continuing to reduce our activities and expect further volume and sales declines as we work to make our Russia operations self-sufficient. We plan to have the Russia business stand-alone with a self-sufficient supply chain before the end of the year." Effectively, there are two claims here: A. The Russian operations is becoming self-sufficient, and B. The volumes and sales of the Russian operations are declining and will continue to decline. We will look at each of these claims in turn.

First, let us step back and recall that there are two ways a foreign company can provide chocolates to Russian consumers: 1. Export ready-to-eat chocolate 2. Produce chocolate locally. The local production, in turn relies on some combination of three cocoa products: (1) Cocoa beans that can be processed into (2) Cocoa paste, which in turn can be further processed to extract (3) Cocoa butter. Cocoa paste and cocoa butter are used in chocolate production (milk and white chocolate also requires milk products, but we can assume that those can be obtained locally).

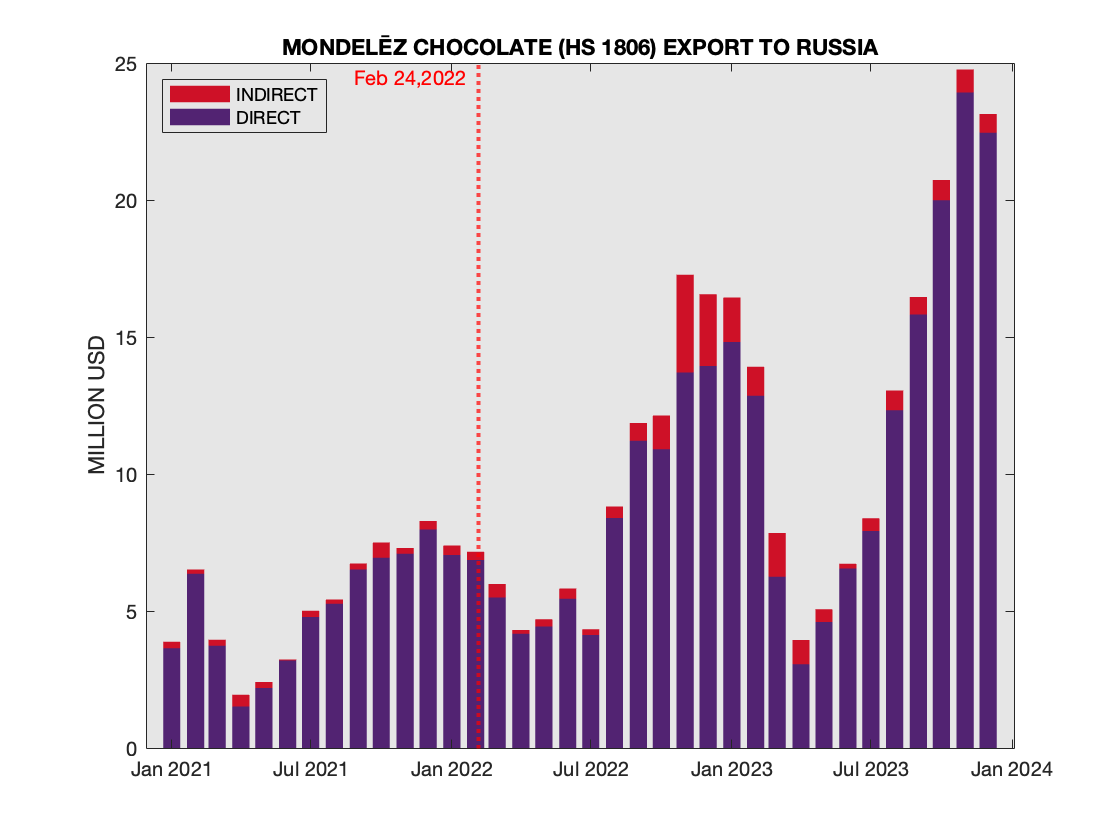

We have covered exports of prepared chocolate into Russia, so here we just reproduce an updated chart for Mondelēz that includes July '23 data.  Mondelēz chocolate exports to Russia by Value

Mondelēz chocolate exports to Russia by Value

Going back to the claim that the import volumes significantly declined we see that only interpretation B. supported by data: January to April monthly totals indeed show declined volumes, but this is only compared to very high volumes in January. When aggregate volumes for Jan-Apr (the last month for which the data was available) are compared to the corresponding volumes to the last year, or the year before, no declines are observed.

An update on September 20, 2023 - utilizing the customs data for May-July of 2023 we observe no further decline, in fact the decline has been reversed.

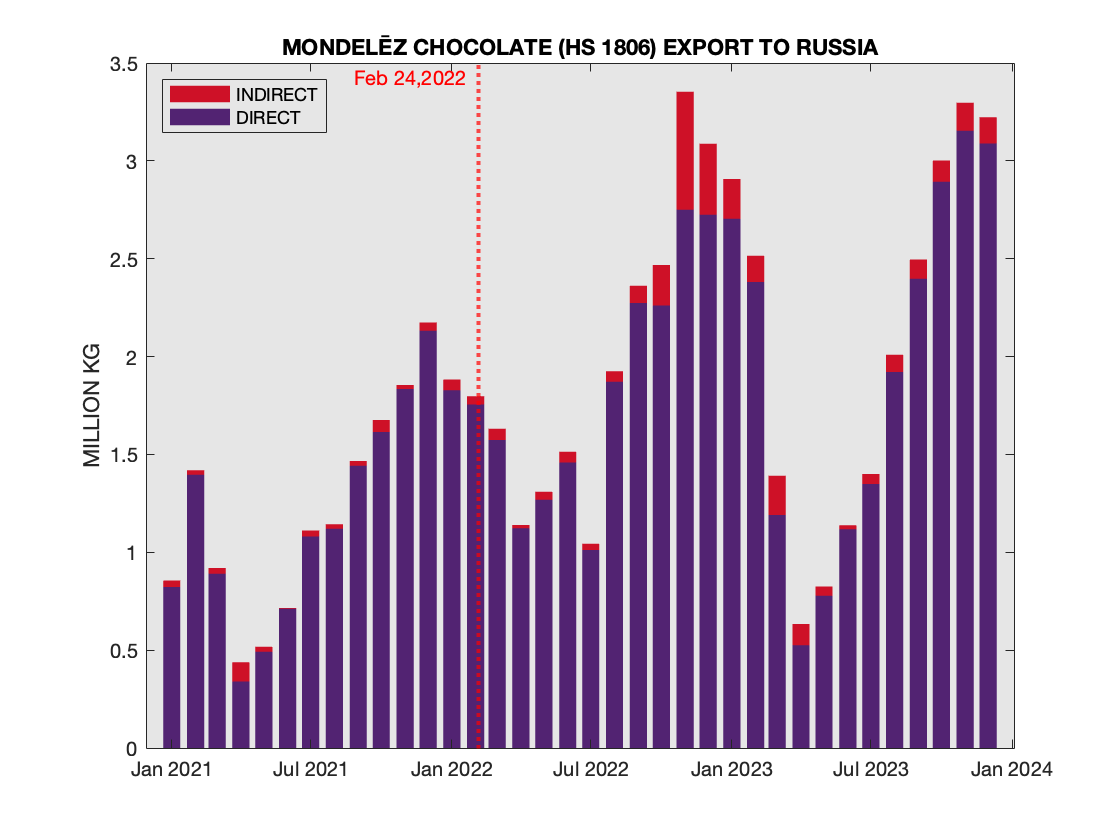

"Volume" can refer to the USD Value or weight, so we can look at the net weight of the shipments. While the inflation is definitely present, the overall trends stay the same. Looking at these two charts, it is really hard to see the claimed by the company causal link between the actions taken in March of 2022 and declined volumes (at least in terms of exports). The delay in the impact alone could be potentially explained by expiring contracts, but how does it square with the record high-levels in the winter?  Mondelēz chocolate exports to Russia by weight

Mondelēz chocolate exports to Russia by weight

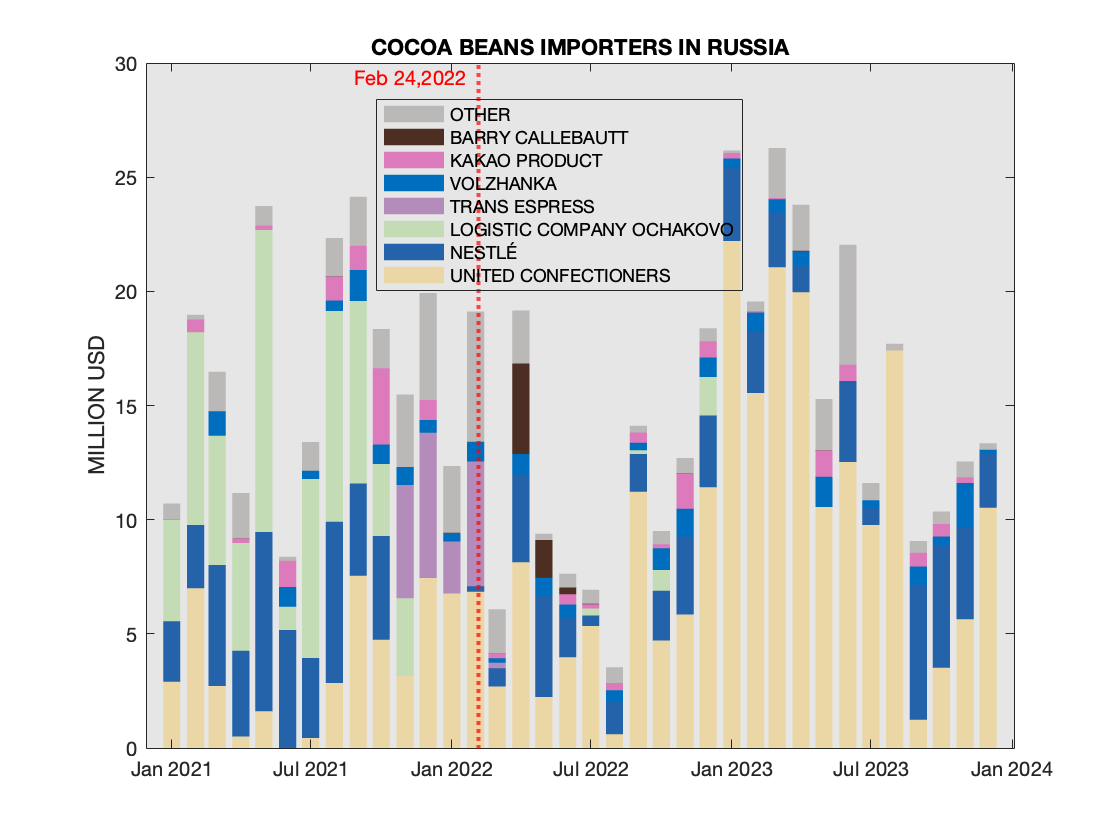

Perhaps the lack of declining is confined to exports of chocolate, while it is the local production that explains the decline declared by the company. To estimate the volumes of the production, we look at the imports of ingridients needed for making chocolate locally. First, we note that, apparently, Mondelēz production in Russia does not rely on processing of cocoa beans locally. Indeed, we can observe that the import of cocoa beans (HS 18.01) is dominated by United Confectioners (the Russian company that has united traditional Moscow's chocolate factories), and Mondelēz does not appear in the top importers of cocoa beans. It seems highly unlikely that Mondelēz would rely on cocoa beans that are not imported (and say, would buy them from its competitors).  Leading importers of cocoa beans into Russia

Leading importers of cocoa beans into Russia

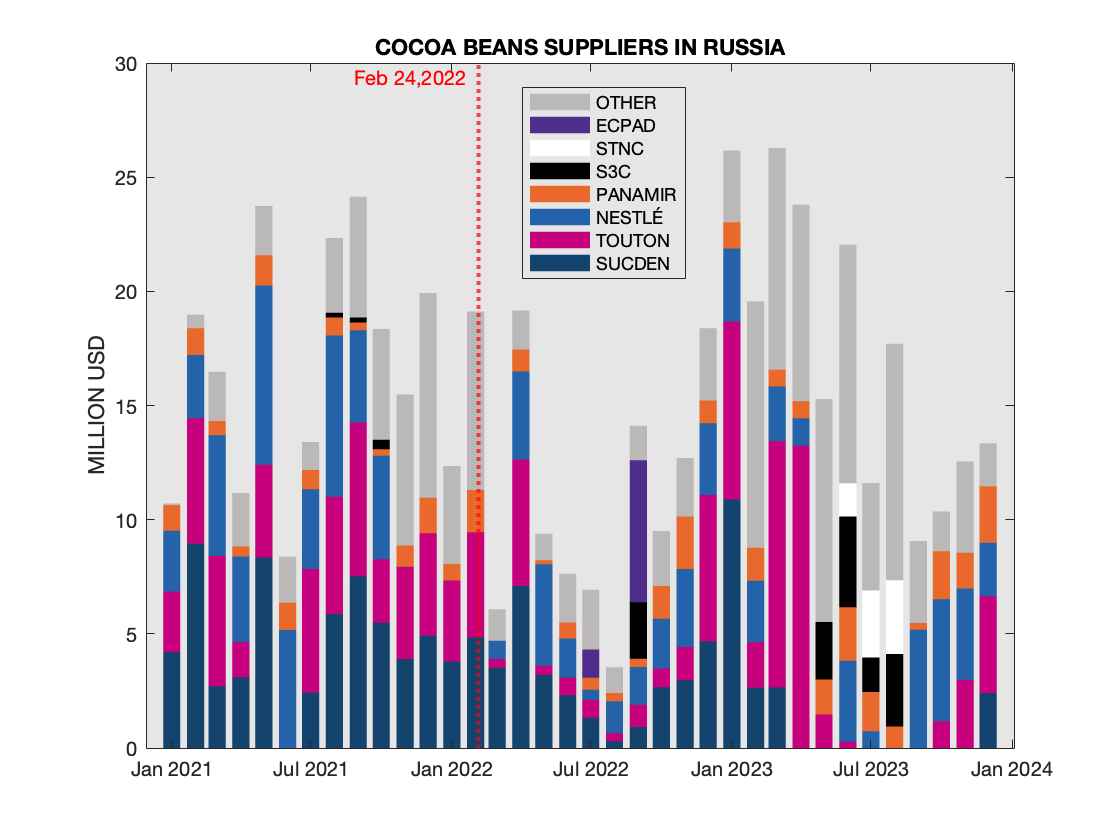

An update on September 20, 2023 As a side note it is interesting to see changing dynamics of the Suppliers of Cocoa beans. In particular, one can observe an increased reliance on what appears to be local companies from Côte d'Ivoire, such as S3C (Société de Commercialisation de Café et de Cacao) and SUTEC (Société d’Usinage, de Transformation et d’Exportation Café-cacao), although Nestlé also continues some export as well.  Leading suppliers of cocoa beans into Russia

Leading suppliers of cocoa beans into Russia

Another update on February 12, 2024 The previous note was made when the data for the first part of 2023 was available. The second part of 2023 showed the reversal to the business as usual and the return of the players that dominated prior to the full-fledged Russian invasion into Ukraine.

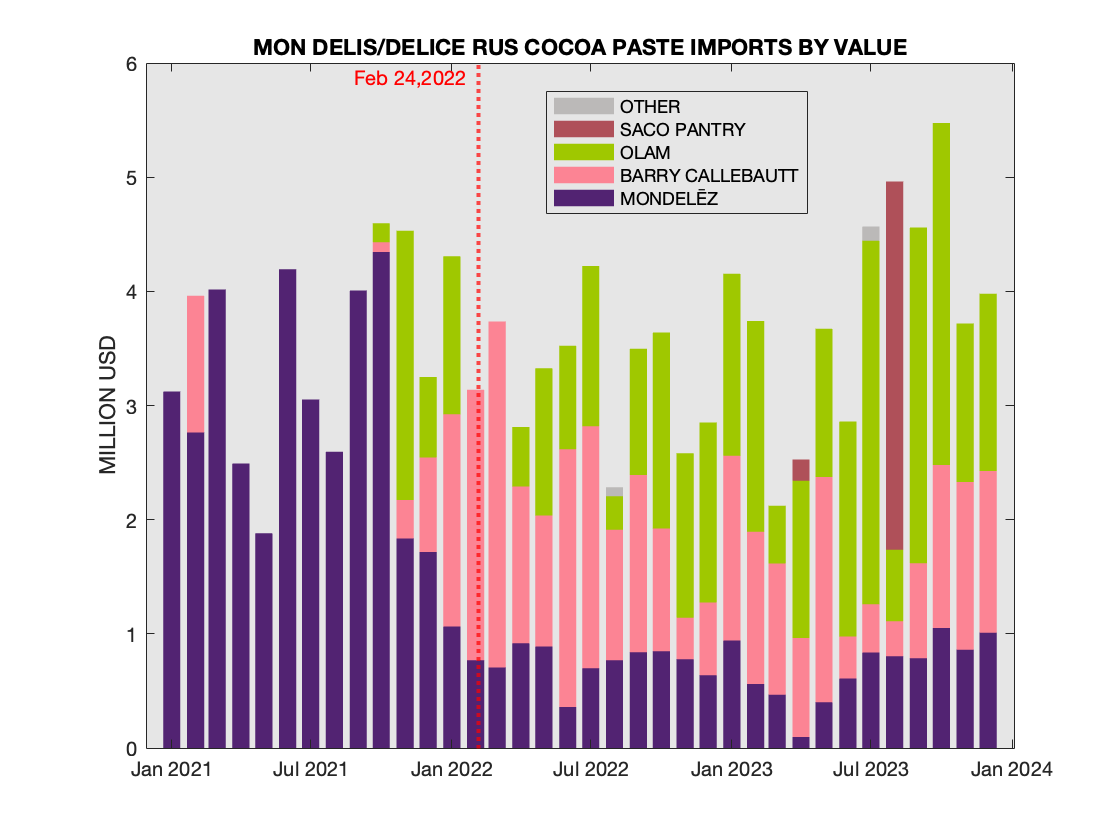

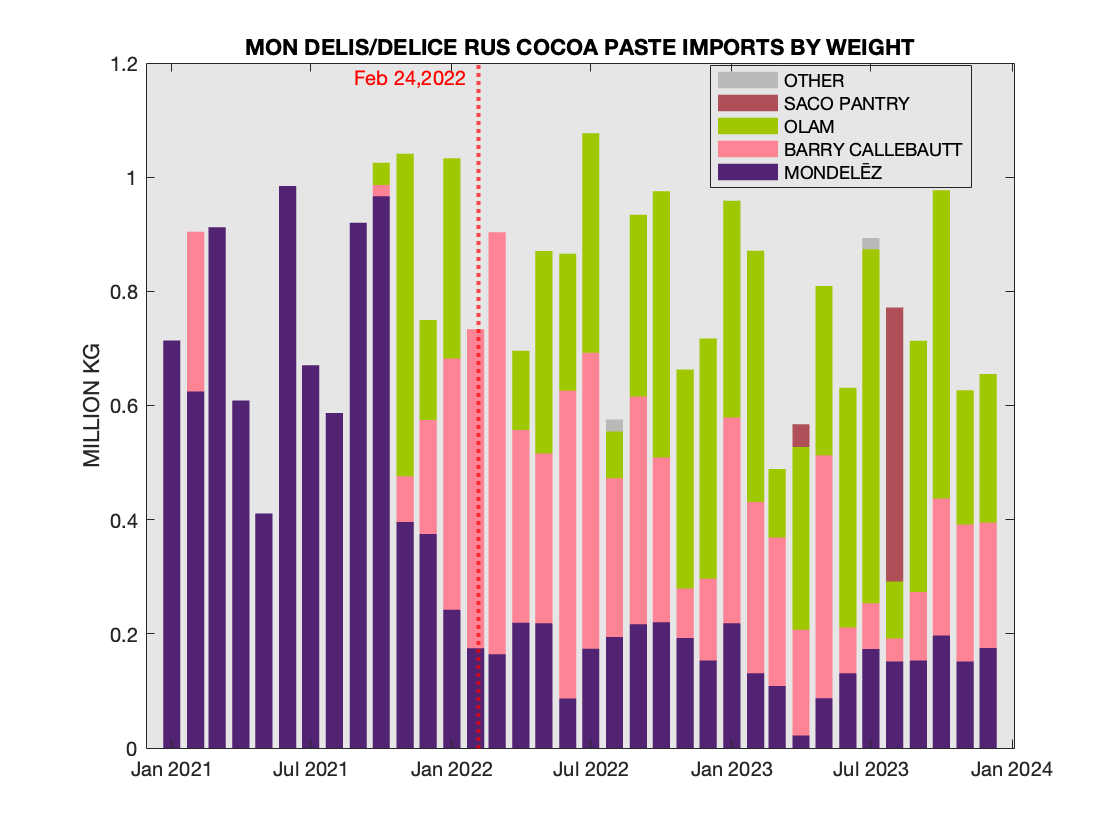

As a result, we conclude that local production of chocolate by Mondelēz in Russia relies on processed ingridients: cocoa paste (HS 18.03) and cocoa butter (HS 18.06), so we look at those in turn The chart shows cocoa paste imports by the Russian subsidiary of Mondelēz, Mon Delis Rus.

As of July 1, 2023 the spelling in Russian customs of the Russian subsidiary has changed from "Delis" to "Delice". Perhaps, the new name sounds more delicious.  Cocoa Paste imports by Mon Delis/Delice Rus by Value

Cocoa Paste imports by Mon Delis/Delice Rus by Value

An update on February 12, 2024 The careful conclusions in the previous paragraph were made based on the data available at the time of Mondelēz statement referenced above (which was up to April of 2023). With the benefit of hindsight, no credible claim of "self-sufficiency" by the Russian subsidiary can be made as of the end of 2023.  Cocoa Paste imports by Mon Delis/Delice Rus by Weight

Cocoa Paste imports by Mon Delis/Delice Rus by Weight

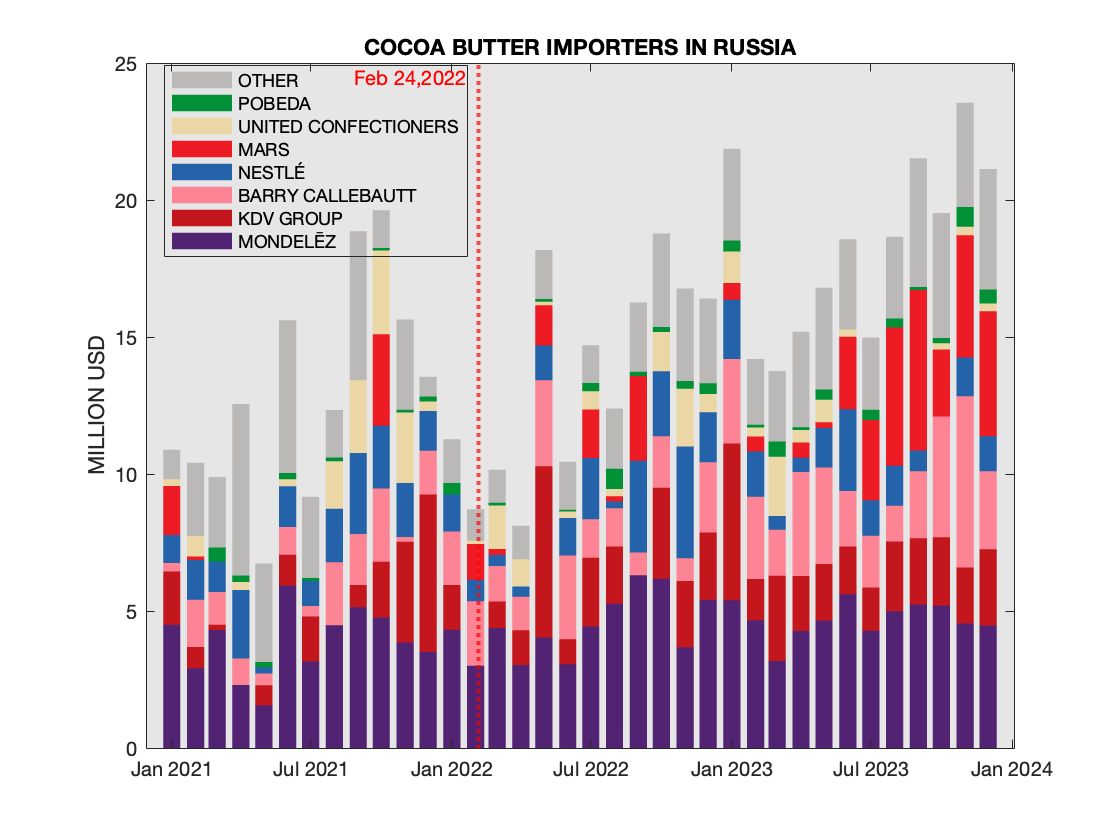

Top Cocoa Butter importers into Russia by Value

Top Cocoa Butter importers into Russia by ValueIn summary, it is not clear how the total volumes of sales in Russia for Mondelēz could decline, as the statement is claiming: the imports of chocolate has decreased since the start of the year, but from a very high base, so there is no overall year-on-year decrease, and there are no discernable reduction of supplies of key ingridients for production chocolate in Russia. In accordance with the Reuters article, it appears that Mondelēz feels that they were unfairly singled out. It is true that there are players on the Russian market that deserve a second look, say Barry Callebautt and Olam. To put things in perspective here is a useful reference.

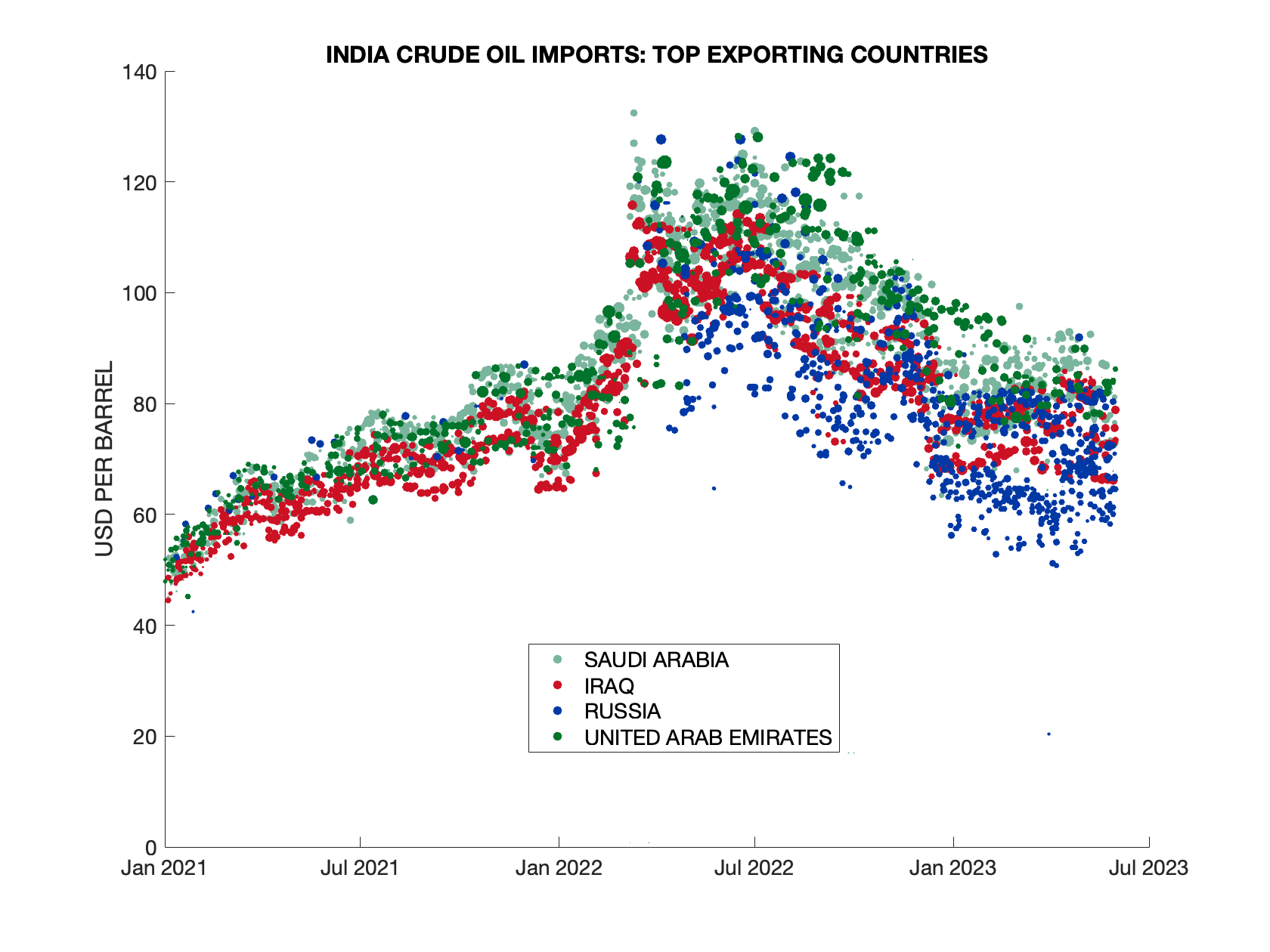

Russian Exports of Crude Oil Into India

June 25, 2023

Another look at the Indian Imports of Crude Oil (HS 270900). The volumes are reaching record levels. So, here is a look at the declared values of USD per barrel in accordance with Indian Customs. The value is evaluated by dividing the total declared value by the quantity of shipped oil (measured in MTS - metric tons) and converted to value per barrel. In order to avoid outliers, small (sample) shipments were omitted as well as several shipments that have obvious errors in stating the weight (declaring over a million MTS).

We will engage in a bit of pointillism, while not trying to compete with Georges Seurat and Paul Signac. First, a comparison of top four exporting countries. Each symbol represents a shipment with the size of the circle proportional to the size of the shipment. Crude Oil Imports to India by Exporting Countries

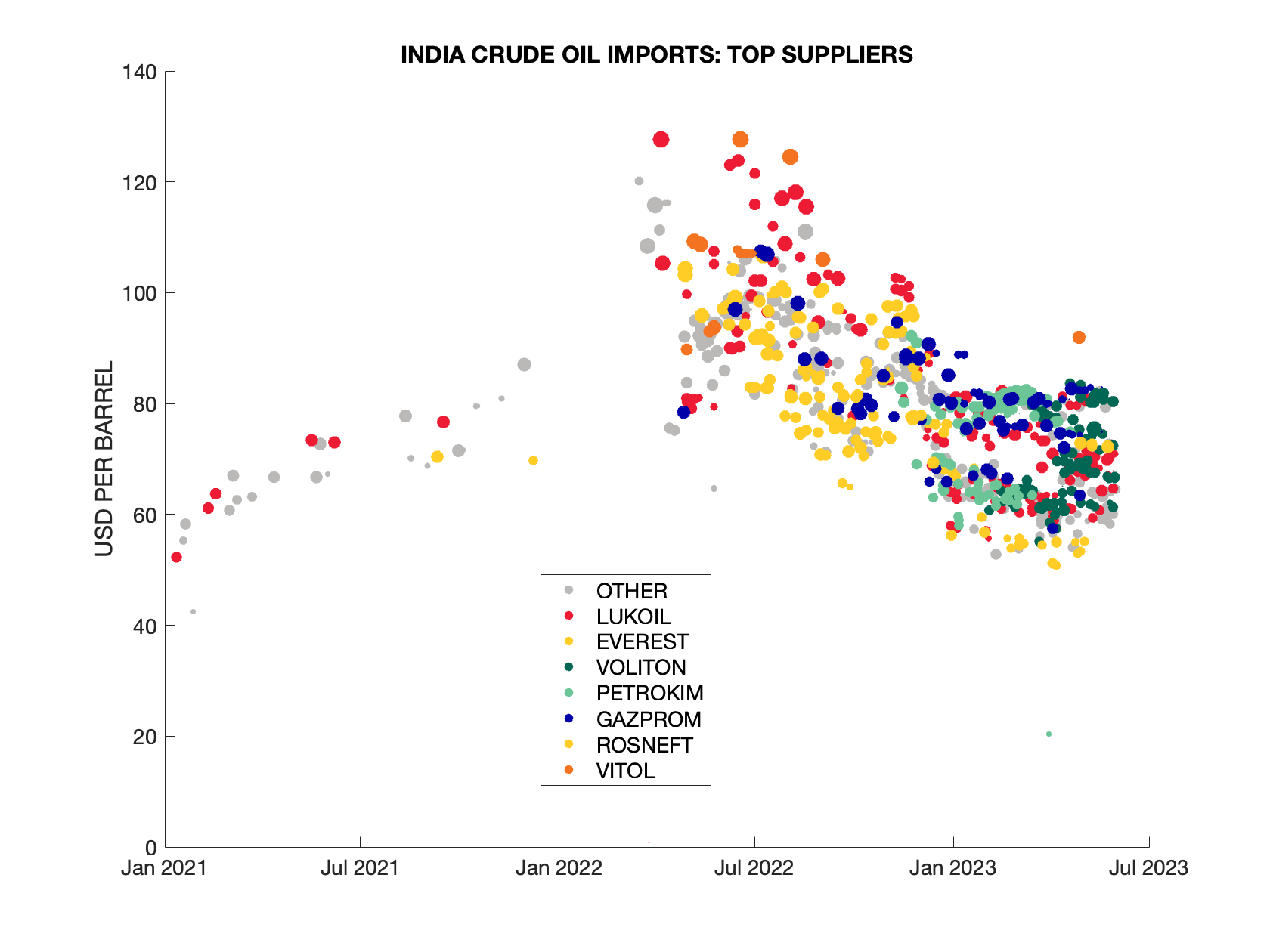

Crude Oil Imports to India by Exporting CountriesThe next chart shows the top Suppliers of Crude Oil from Russia to India. Here we have fewer shipments (since only oil from Russian is shown), so the scaling of circles increased by a factor of 2.5  Russian Oil Exports to India by Supplier

Russian Oil Exports to India by Supplier

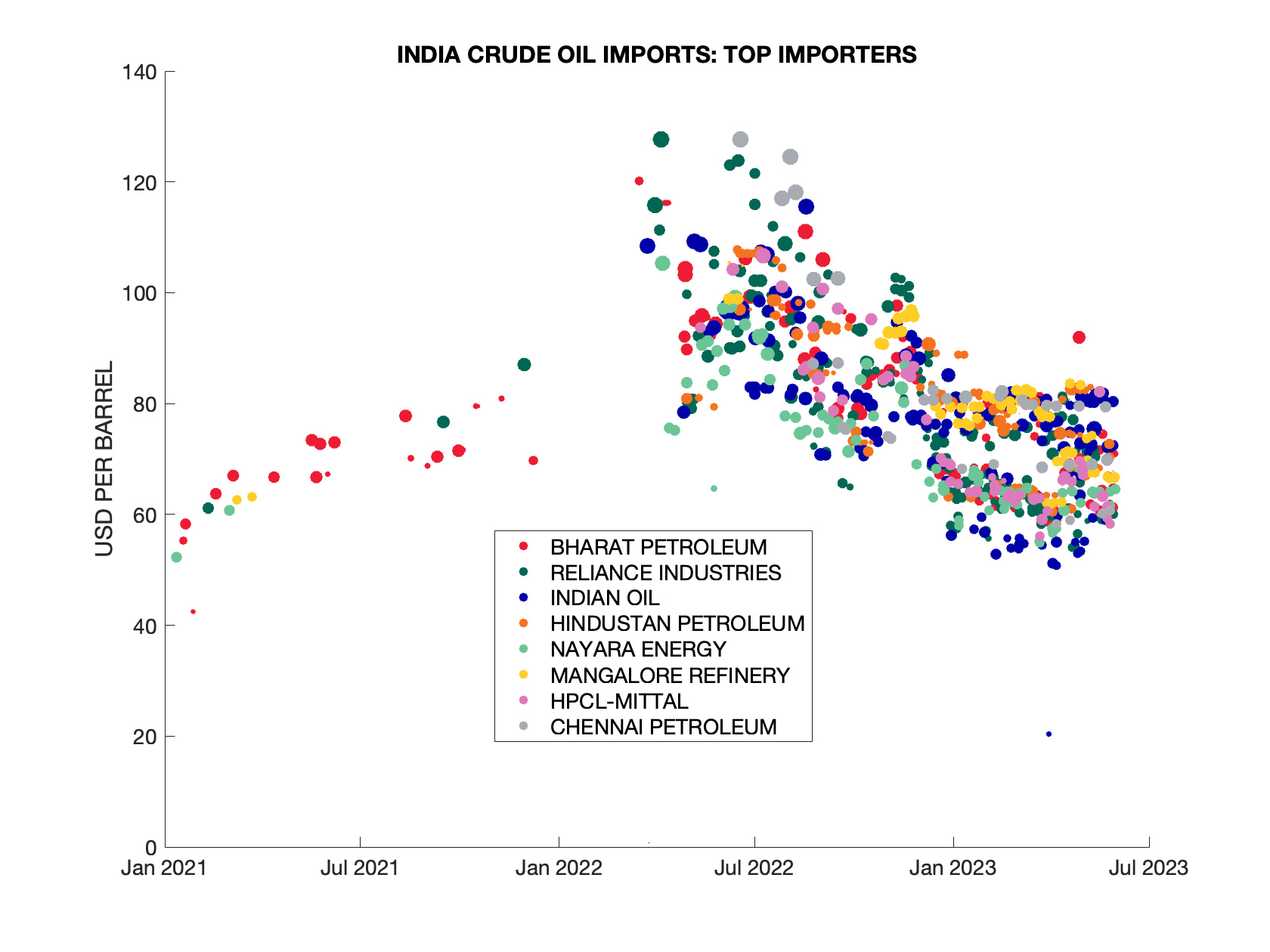

The third chart shows the Indian importers of Crude Oil from Russia (same scaling as before)  Russian Oil Exports to India by Importer

Russian Oil Exports to India by Importer

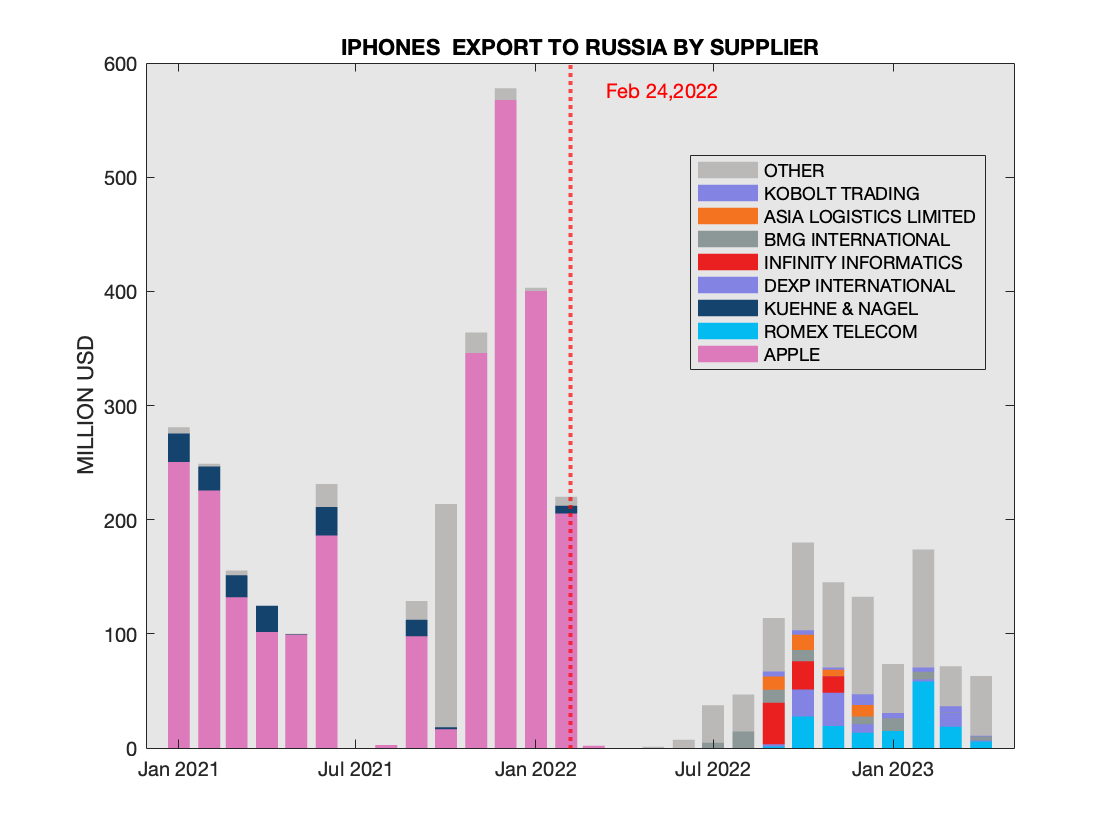

Iphones Exports into Russia and Kazakhstan

July 4, 2023

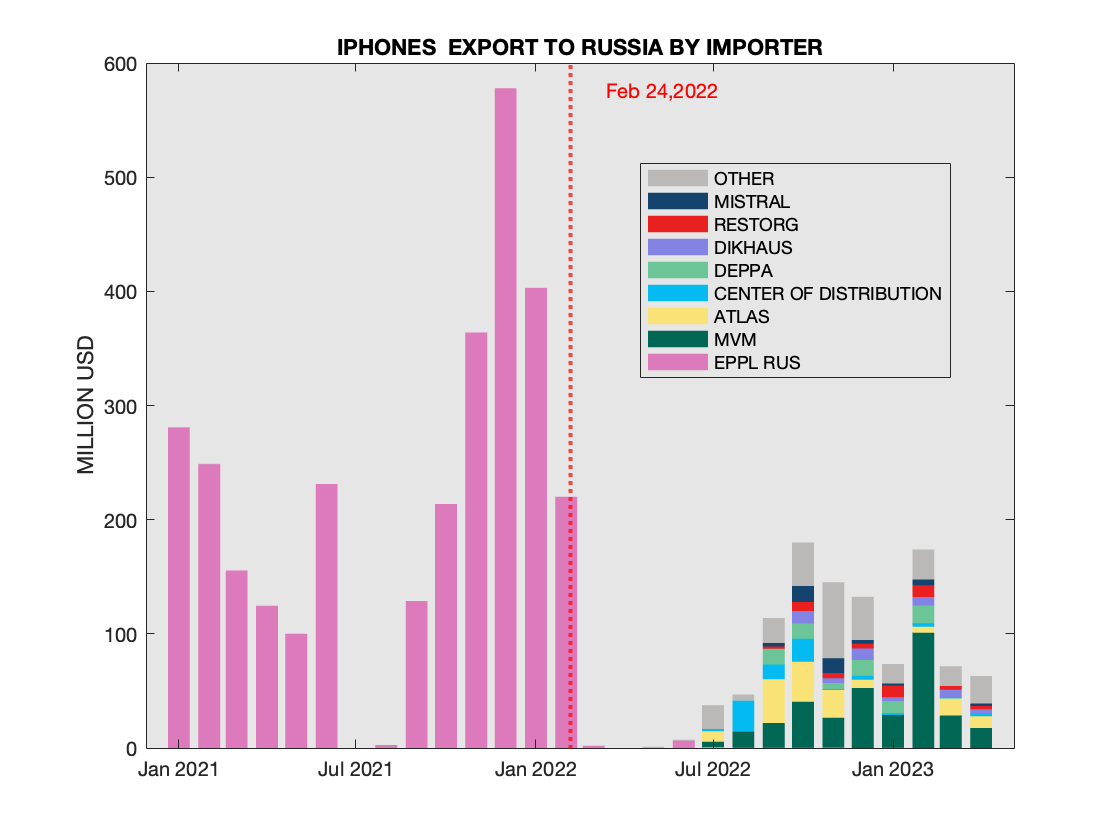

In March of 2022 Apple stopped shipping to Russia directly. But it does not mean that Russians were left without iphones. Indeed (indirect) exports have resumed in a couple of months, albeit at the lower than pre-invasion levels. To determine transactions of interest we focus Apple name present in the Manufacturer field as well as the word 'iphone" in the product description, consequenly narrowing the selection to the two relevant HS codes (851712 and 851713). Splitting the observed period (Jan '21 - Apr '23) into two equal periods of 14 months each (the largest equal periods before and after the invasion), we can observe that the total value of exports dropped from $3.05 billion to 1.05 billion (three-fold): after the invasion period is 66% decline as compared to the pre-invasion value.

Iphones shipments are seasonal, so we can look at year-to-year comparison: March '22 - Feb '23 vs. the prior year: $0.91 billion vs $2.54 billion (64% decline). Alternatively, we can avoid the initial period after the invasion and look at the six months Sep '22 - Feb '23 vs. the corresponding period in the previous year, thus comparing volumes after logistics chains were readjusted. The "after" value is $0.82 billion, vs. "before" $1.91 billion, or (57% decline). The dynamic can be seen from the next chart that shows Suppliers. Transition from direct Supplies to multiple indirect suppliers can be observed  iPhones exports to Russia by Supplier Jan '21 - Apr '23

iPhones exports to Russia by Supplier Jan '21 - Apr '23

A similar trend is observed for the importers  iPhones exports to Russia by Importer Jan '21 - Apr '23

iPhones exports to Russia by Importer Jan '21 - Apr '23

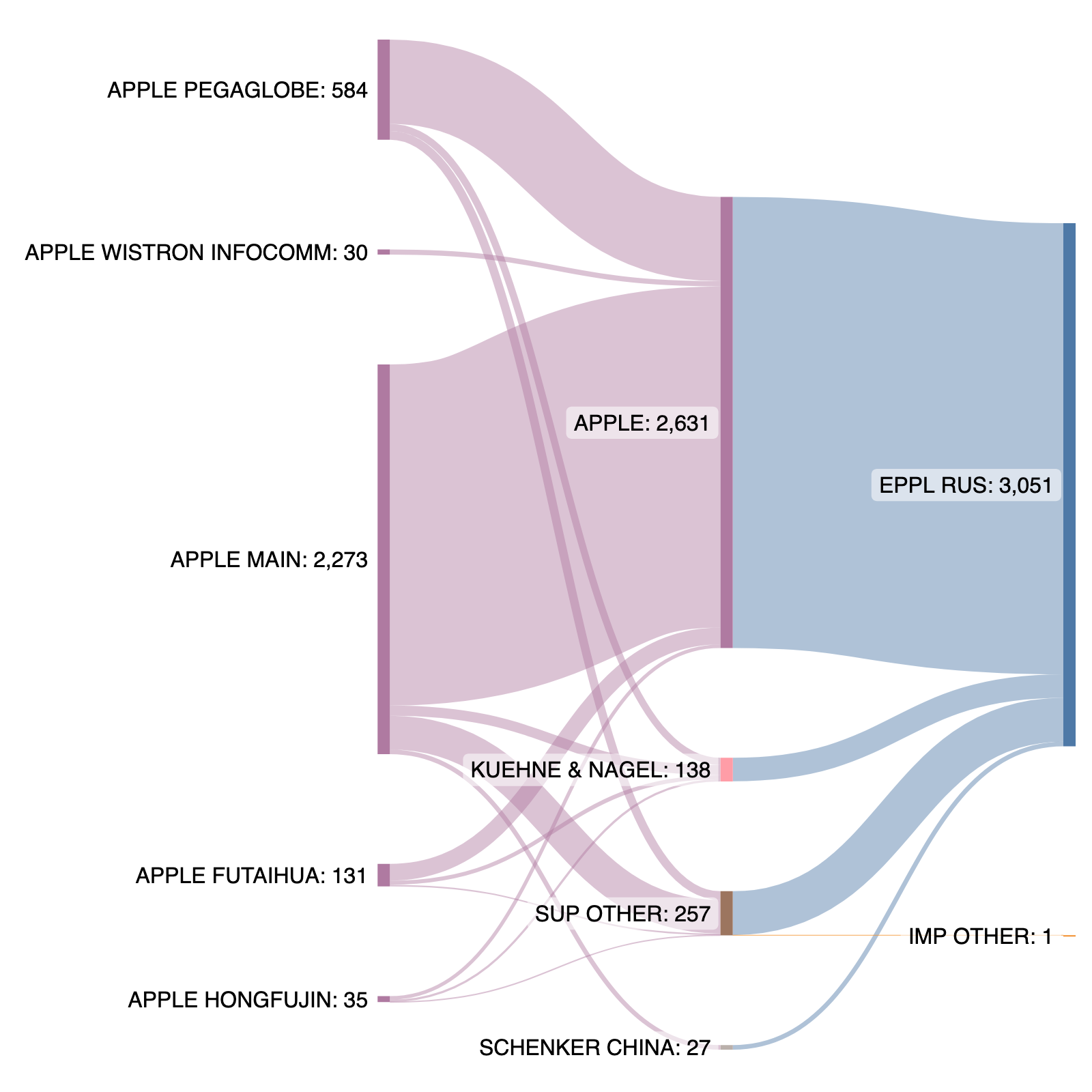

The next two charts show how the logistics flows changed, we will use Sankey charts for logisitcs flows before and after. The charts were created using SankeyMATIC.  Sankey Chart for iphone logistics flows into Russia before the invasion Jan '21 - Feb '22

Sankey Chart for iphone logistics flows into Russia before the invasion Jan '21 - Feb '22

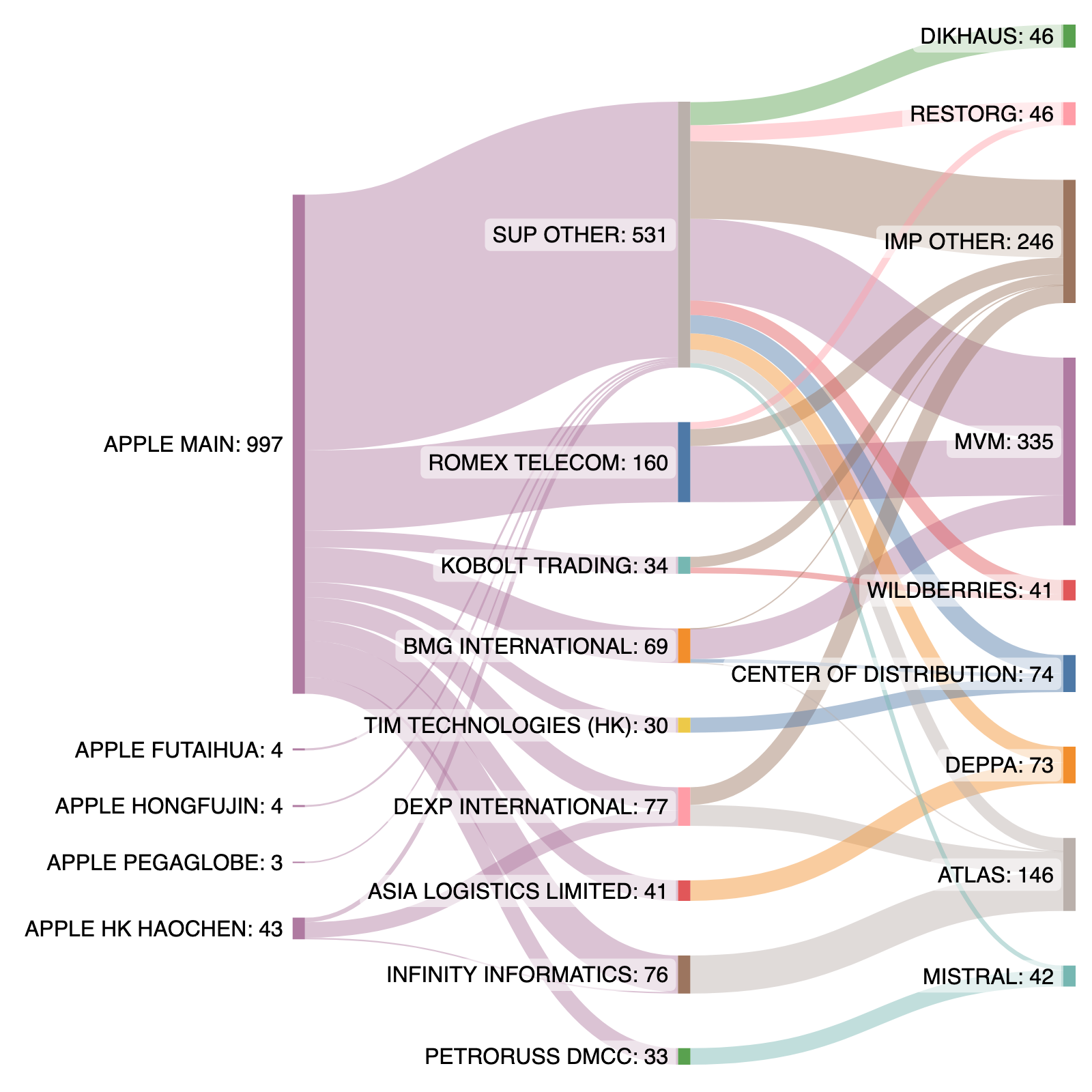

Here is the "after" chart showing much more fragmented market  Sankey Chart for iphone logistics flows into Russia after the invasion Mar '22 - Apr '23

Sankey Chart for iphone logistics flows into Russia after the invasion Mar '22 - Apr '23

While the volumes of iphone exports significantly decreased after the invasion, recently the lower demand for iphones has been reported, describing saturated market, and lowering of the retail sales by 4% (in January - May '23 timeframe). The explanation provided in the article was the increase of the supply due to prolifiration of grey schemes. With the caveat that custom data is only available until April, at least the data from customs does not support this explanation. What gives?

Logically, there are five possible factors that can contribute to the explanation of the apparent contradiction, and we look at this factors in turn

- Recent surge in Supply

- The available customs data is until April, so it is possible that the pattern changed in May and the first part of June (the article date is June 15, 2023). We will continue monitoring situation, but the pattern seems to be more long term and logistics chains have been rebuilt by Fall of 2022.

- Reduced functionality of Apple products in Russia

- In December of 2022 the same publication Kommersant has reported how the lack of collaboration of Apple with local providers might have degraded some aspects of phone performance. However, the same article noted that this degradation was unlikely to cause large customers defection to other brands.

- Overall price increase

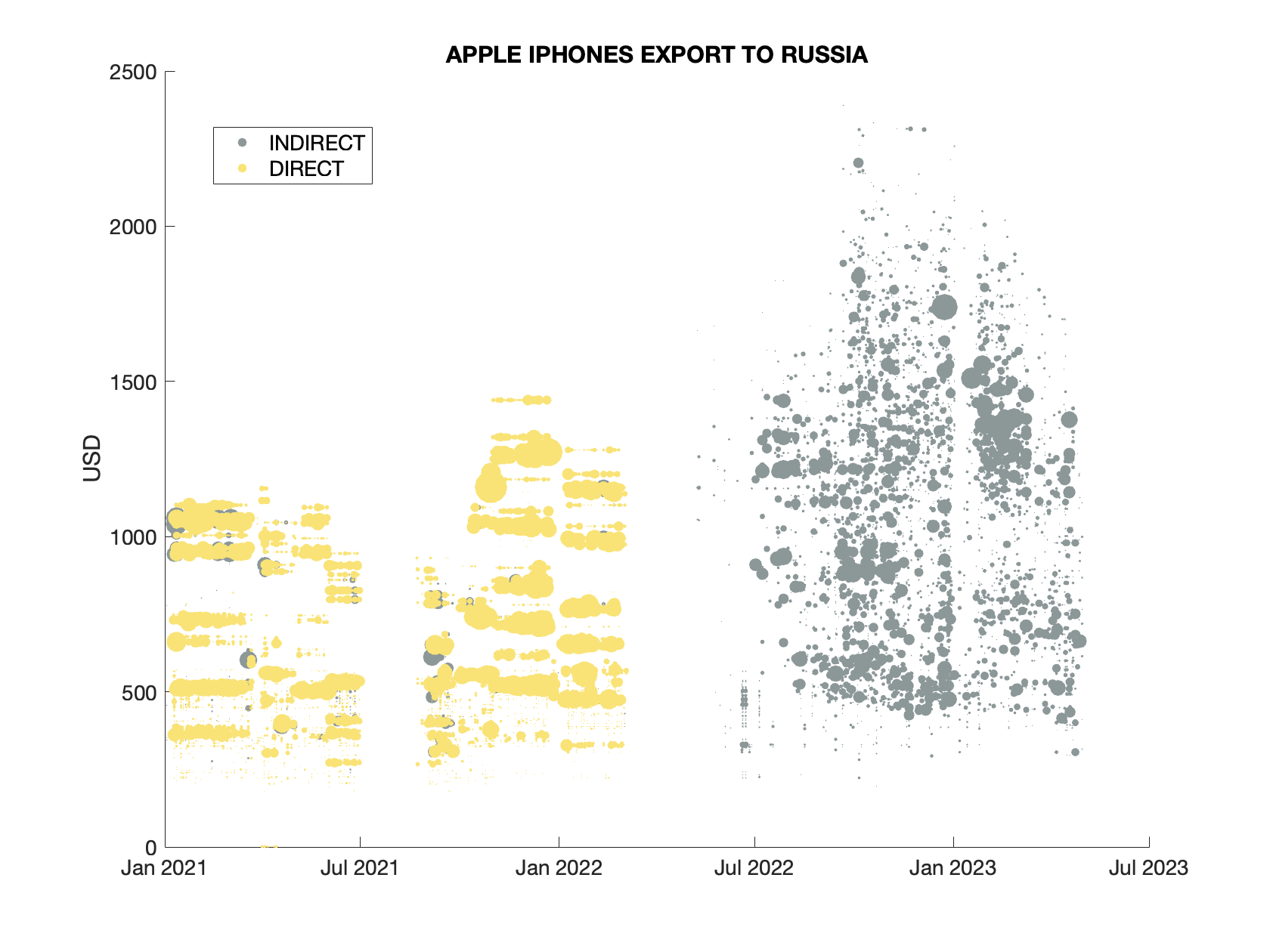

- Despite the reported 4% price decline (in January - May '23 timeframe), it is possible that by January the price was objectively too high. As an indirect evidence of this, let us consider distribution of declared value per one phone. One can observe much larger variation of the values for indirect scheme (the size of a circle is proportational to the total shipment value)

Declared value per phone, Russian Imports Jan '21 - Apr '23

Declared value per phone, Russian Imports Jan '21 - Apr '23 - Shifting demand patterns

- Worsening economic situation and the exodus of professional class abroad can contribute to the demand for a relatively premium mobile phone. The importance of this factor is a large topic outside of our expertize, but it can serve as the residual factor, if all other factors don't seem to be playing commensurate role.

- Grey schemes though neighboring countries

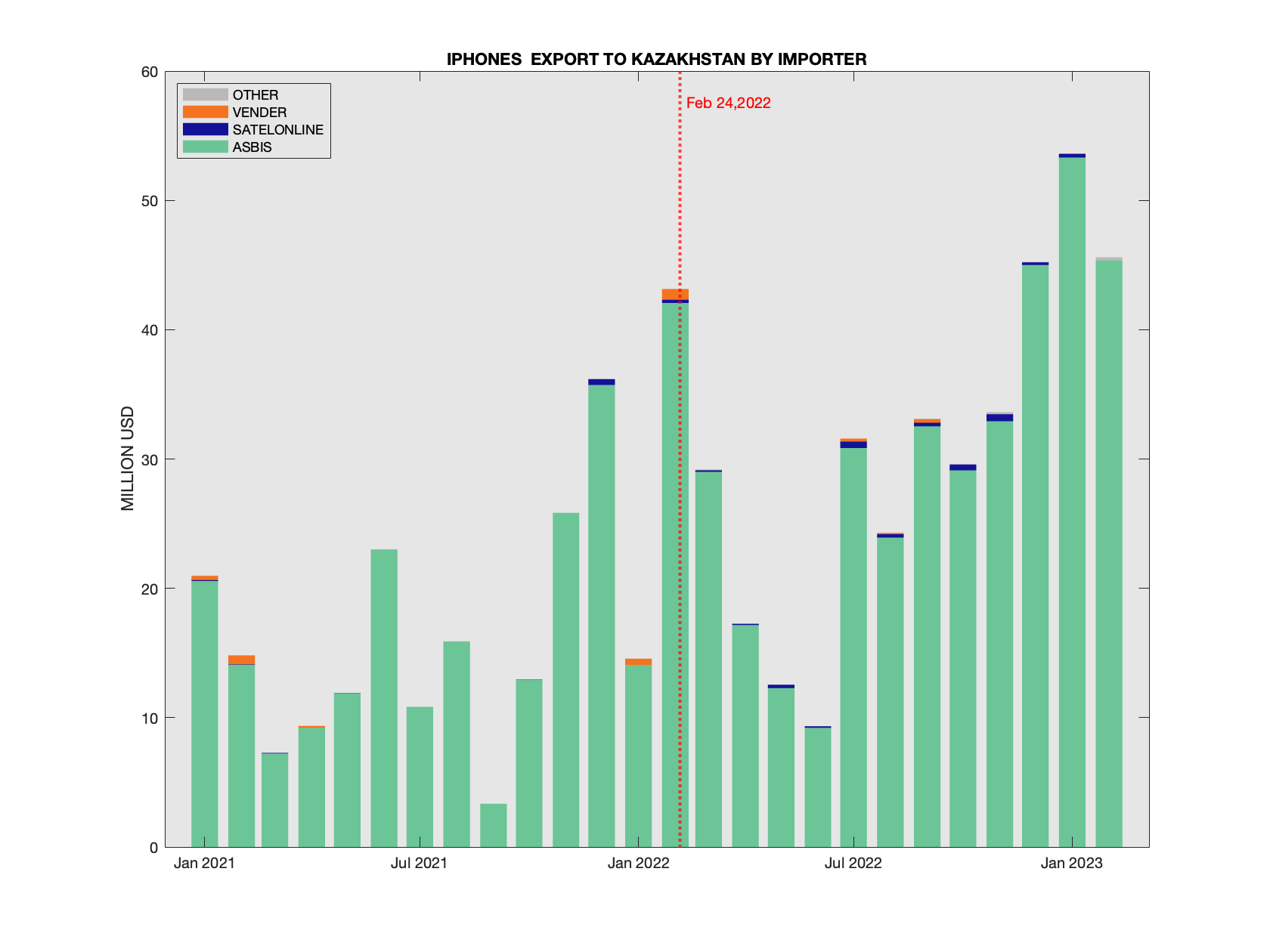

- These are known to play a role, and the existence of the Eurasian customs union provides a means to obsuscate the flow of goods within the union. The economy of Kazakhstan is easily larger than that of sum of the other three members of the Customs union (Armenia, Kyrgyzstan and Belarus), so we will take a look at Kazakhstan's import of iphones. The latest available data is for February 2023, so the natural way is to compare March '22 - Feb '23 vs. the prior year: $378 million vs $205 million (85% increase). This growth is quite remarkable indeed and while cannot compensate for the decline in Russia given the difference in the size of the respective economies, it merits a more detailed look next.

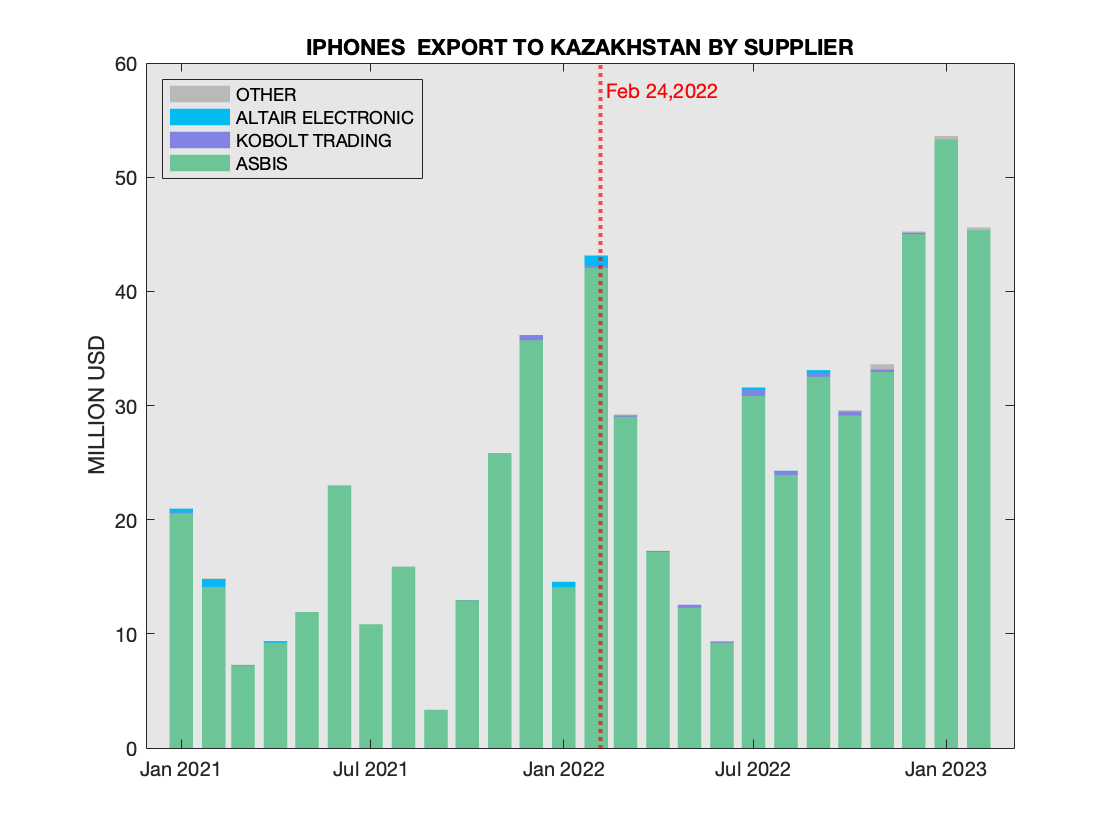

Kazakhstan market of iphones is dominated by a single entity, ASBIS as can be seen from both Importers and Supplier perspective, so the usual excuse of Western companies in regards to multiple intermediaries of dubious reputation is not applicable here.  Kazakhstan Imports of Iphones by Supplier Jan '21 - Feb '23

Kazakhstan Imports of Iphones by Supplier Jan '21 - Feb '23  Kazakhstan Imports of Iphones by Importer Jan '21 - Feb '23

Kazakhstan Imports of Iphones by Importer Jan '21 - Feb '23

Man Suits Exports into Russia

July 16, 2023

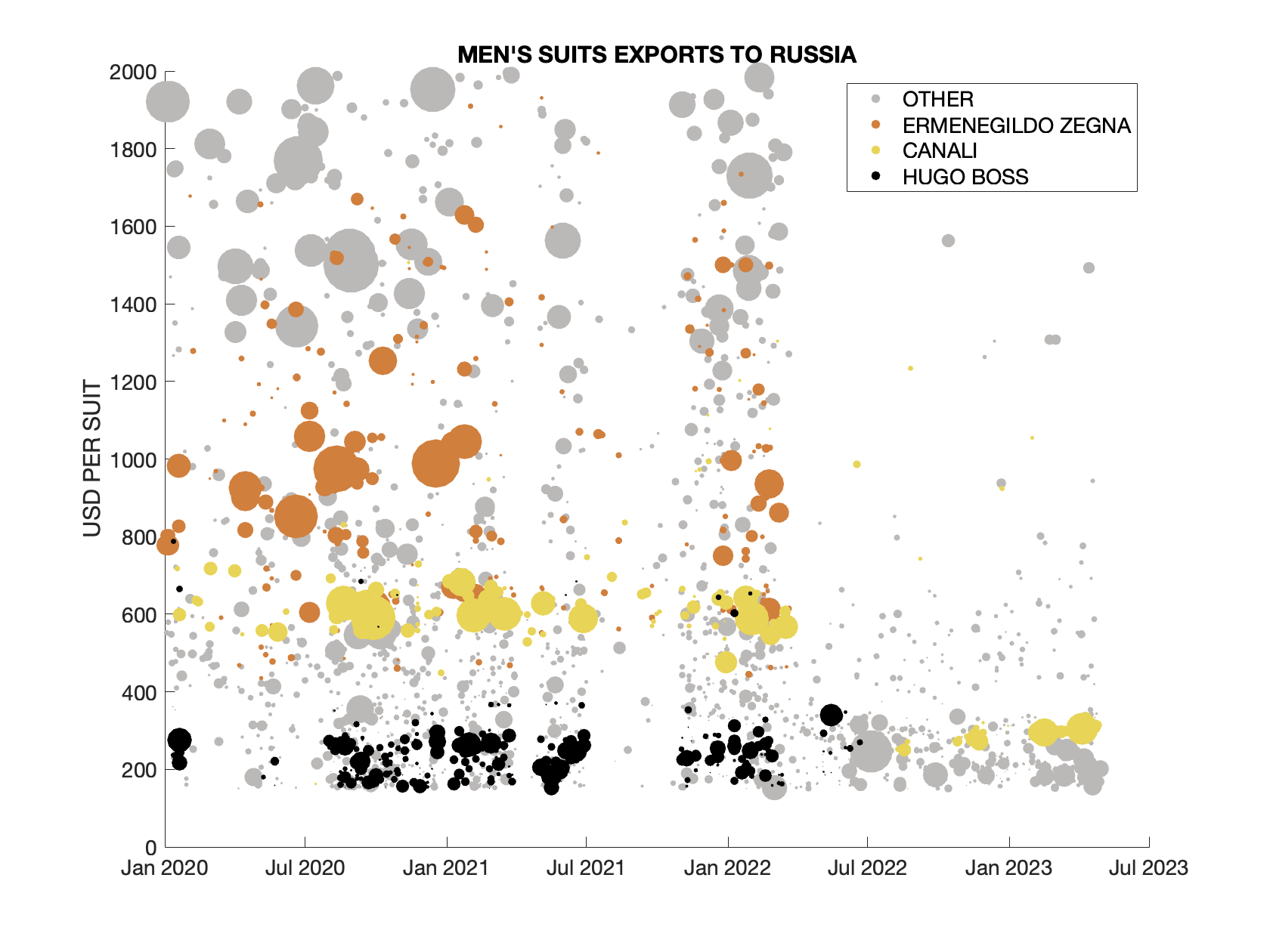

Despite its venerable Soviet past, Bolshevichka factory is not always the preferred purveyor of luxury men suits in Russia. The chart shows the shipments of top three brands from Jan '21 until Apr '23. The size of a circle is proportional to the value of each shipment.  Top three exporters of men's suits to Russia

Top three exporters of men's suits to Russia

In March of 2022 EU introduced a ceiling of 300 EUR for each article of luxury goods exported to Russia. This ceiling pertains to the price in the country of origin, so effectively a wholesale price before the shipping costs and retail markups are added. As a result, shipping a Hugo Boss suit to Russia that retails there for $600 might be morally objectionable, but not in violation of sanctions. The value of most of Hugo Boss suits was under $300 (and hence under the 300 EUR) before the introduction of sanctions, so continued shipments after the ceiling was imposed don't necessary raise any red flags.

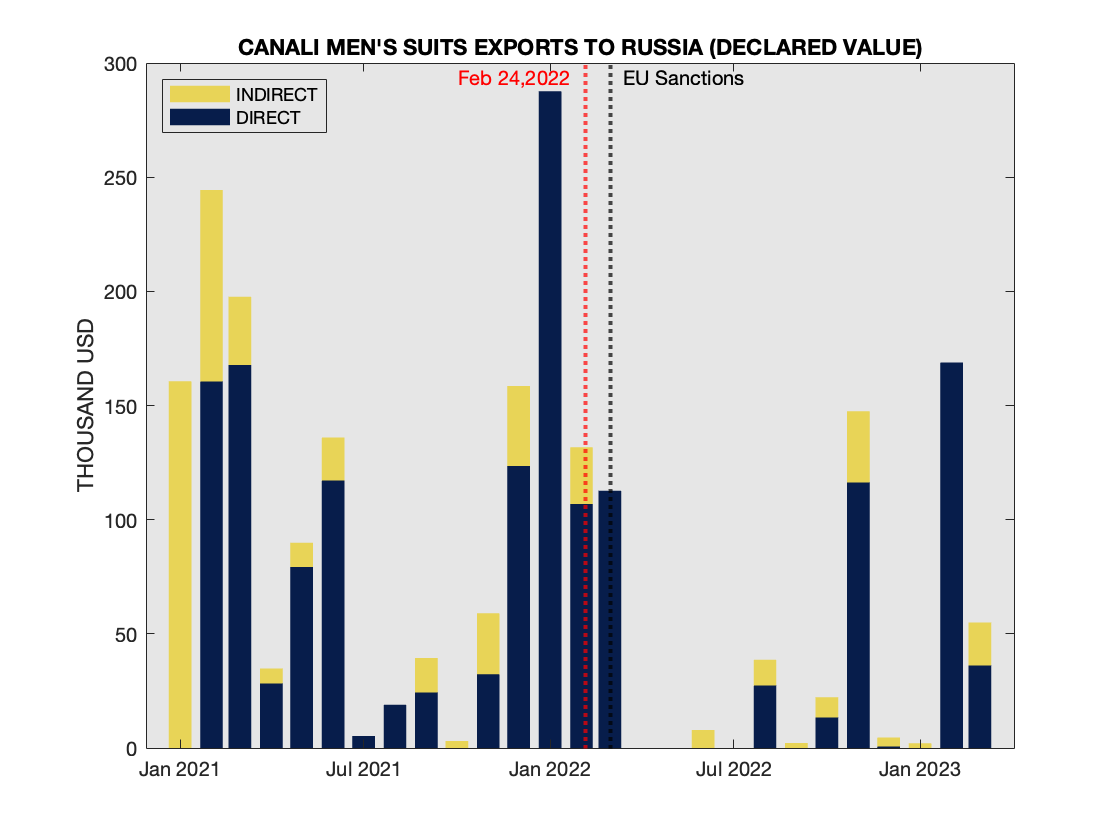

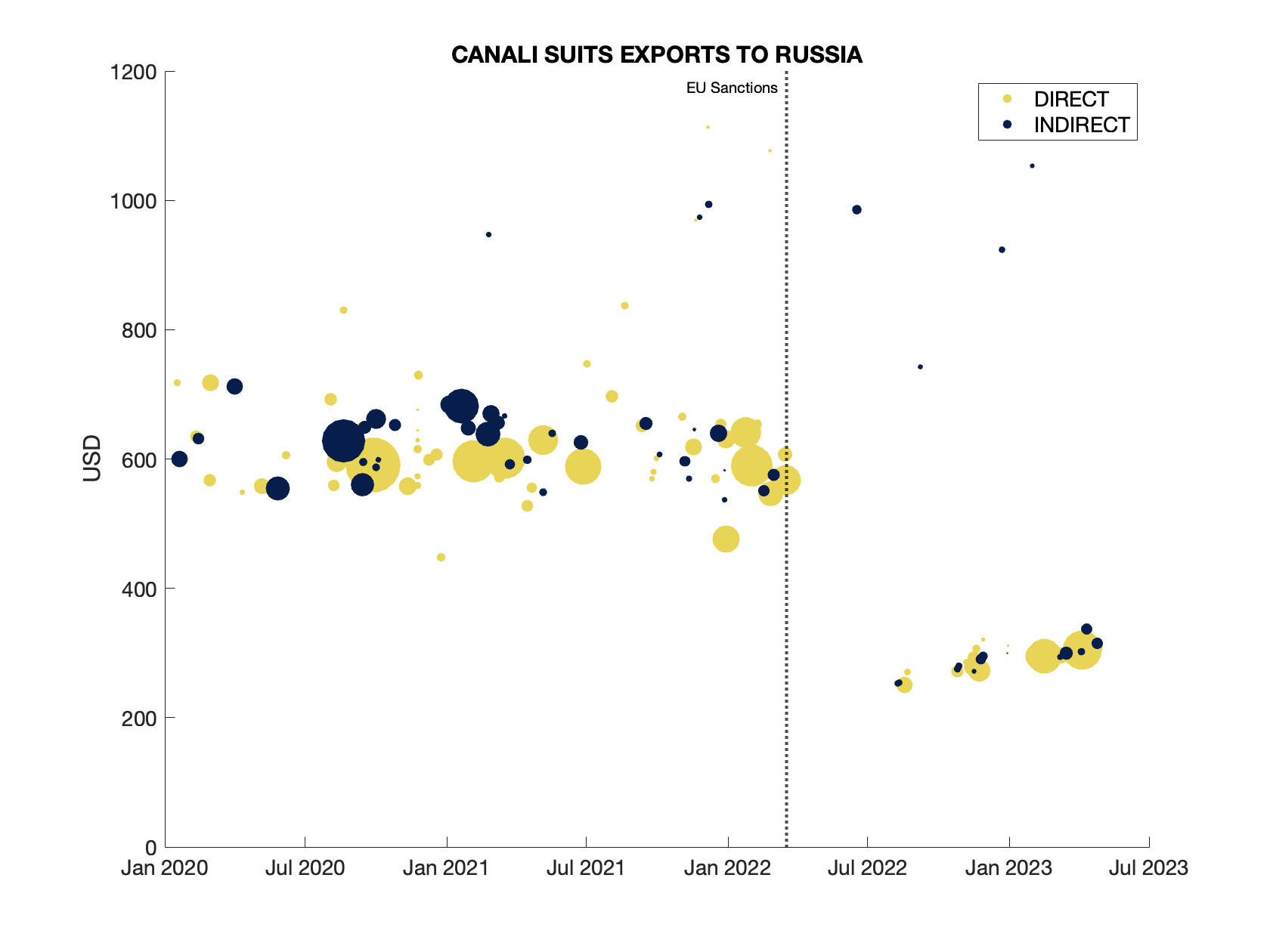

Zegna's suits appear to be much more expensive with the declared values way over the ceiling, and the shipments have stopped in accordance with customs records. This is leads us to the third player, Canali. In the US online store of the company the cheapest suit (on sale) is around $1600. Before the ceiling was imposed the declared values were clustered around $600, which is consistent with the US retail price (a bit more than a double of the declared value). None of the shipments were under $400 (i.e., over the ceiling). And yet after the ceiling was imposed, we see that the declared values dropped to around $300. What happened?

First let us separate direct shipments (where supplier is also Canali), from the shipments made by the intermediary. We can see that in the beginning of this year the shipments were mostly direct and by dollar value have not quite reached the pre-invasion levels.  Canali Men's Suits Exports to Russia by dollar value

Canali Men's Suits Exports to Russia by dollar value

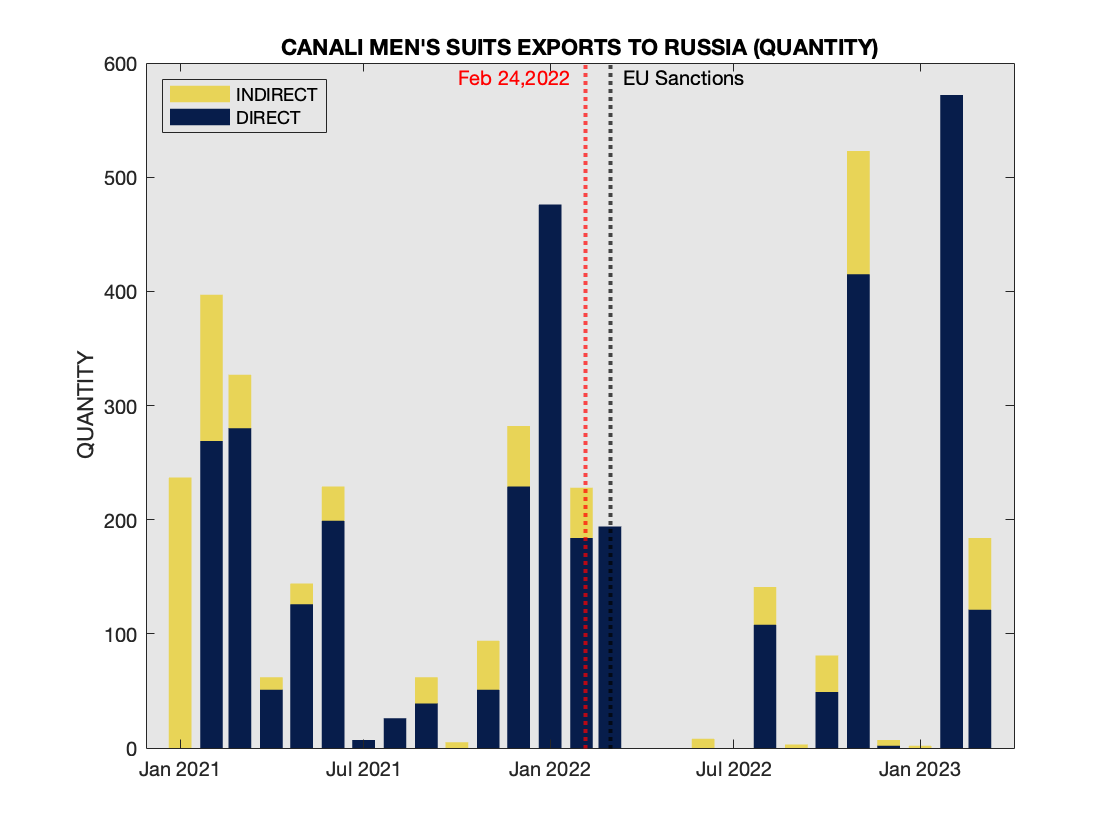

The next chart shows the same shipments, but from the quantity of the goods perspective. The quantity of shipments this February actually exceed the pre-invasion levels  Canali Men's Suits Exports to Russia by quantity

Canali Men's Suits Exports to Russia by quantity

Returning to the original scatter plot, we leave only Canali shipments and separate direct from indirect shipments. The drastic reduction of declared value is clear. The question is: what is explanation of that drop?  Canali Men's Suits Exports to Russia" Unit Declared Value

Canali Men's Suits Exports to Russia" Unit Declared Value

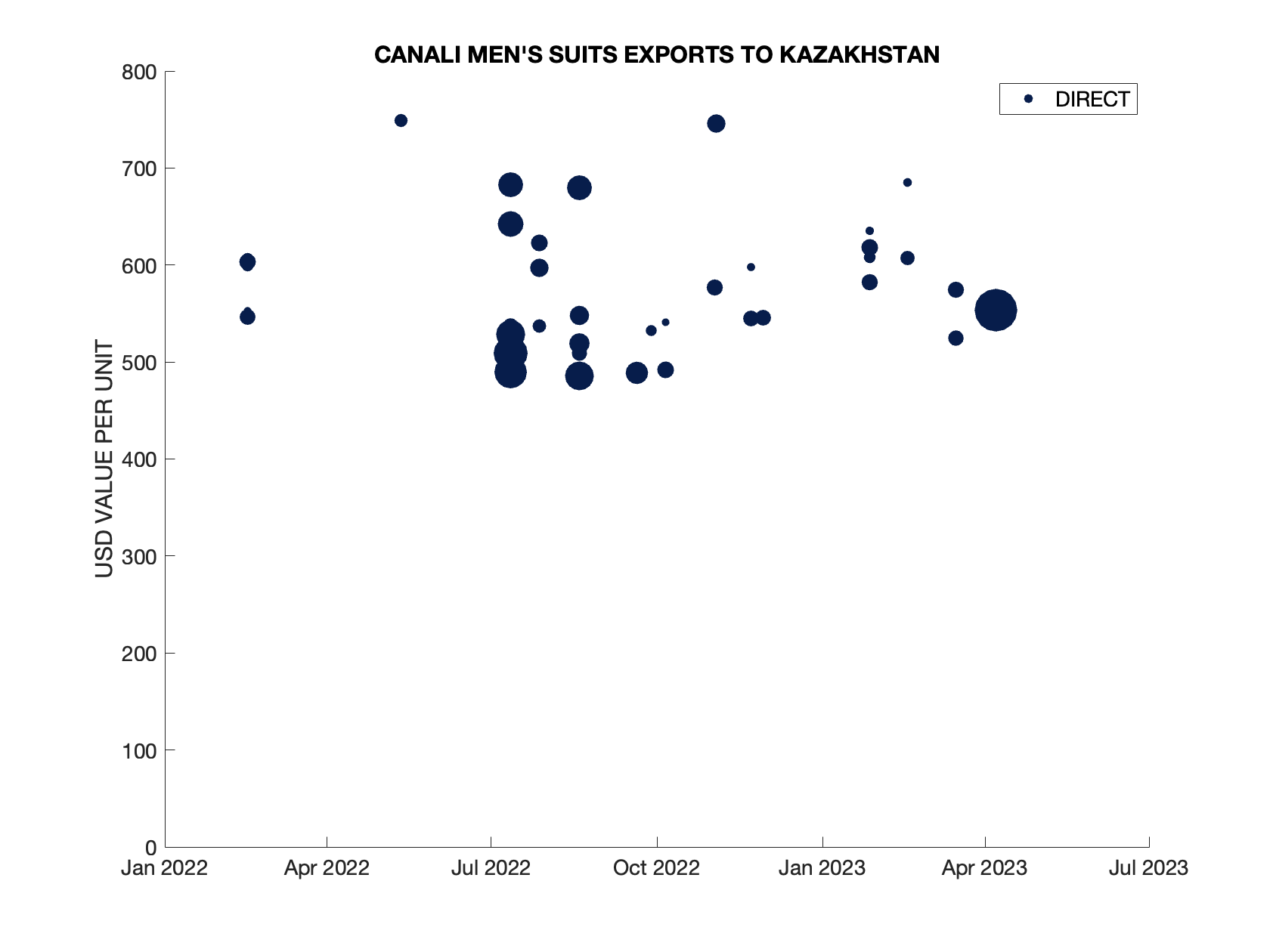

Finally, for comparison, let us look at Canali shipments to Kazakhstan. The scale is adjusted (increased 15 fold). Declared values staying in the expected range around $600 per suit. So, the drop in the declared value seem to be particular to Russia.  Canali Men's Suits Exports to Kazakhstan, Unit Declared Value

Canali Men's Suits Exports to Kazakhstan, Unit Declared Value

EXXON Exports into Russia

July 24, 2023

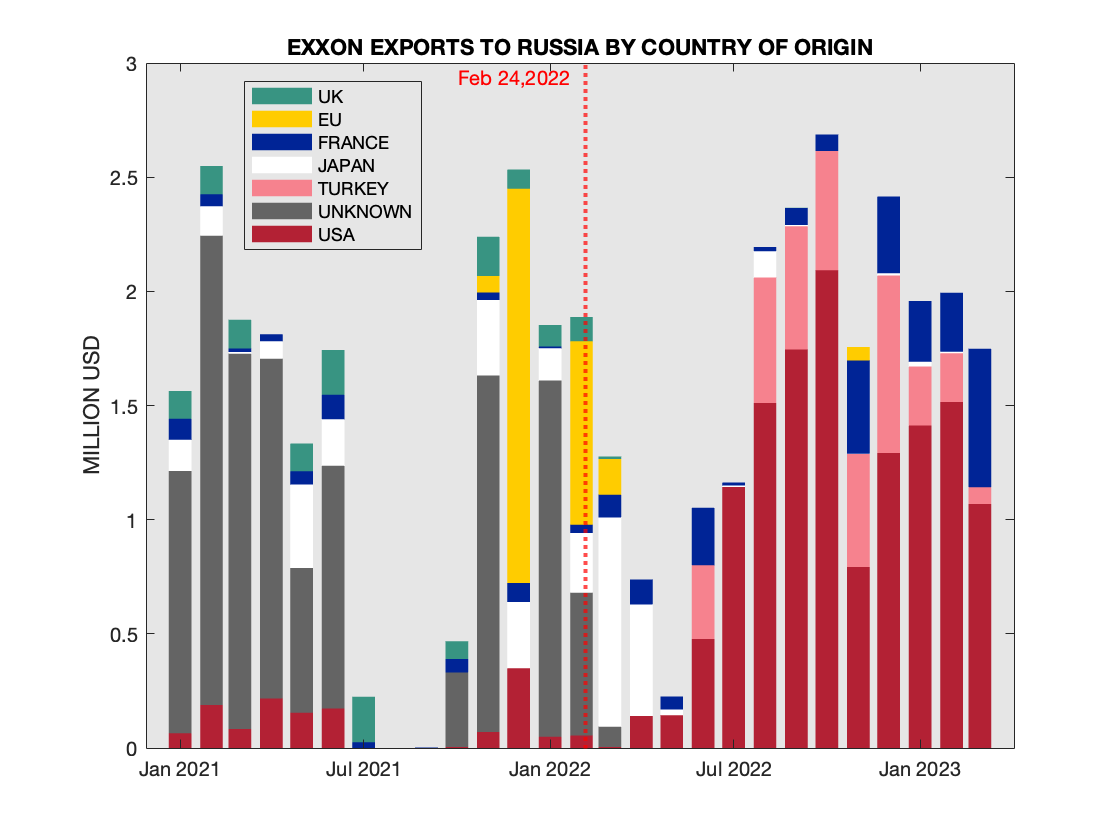

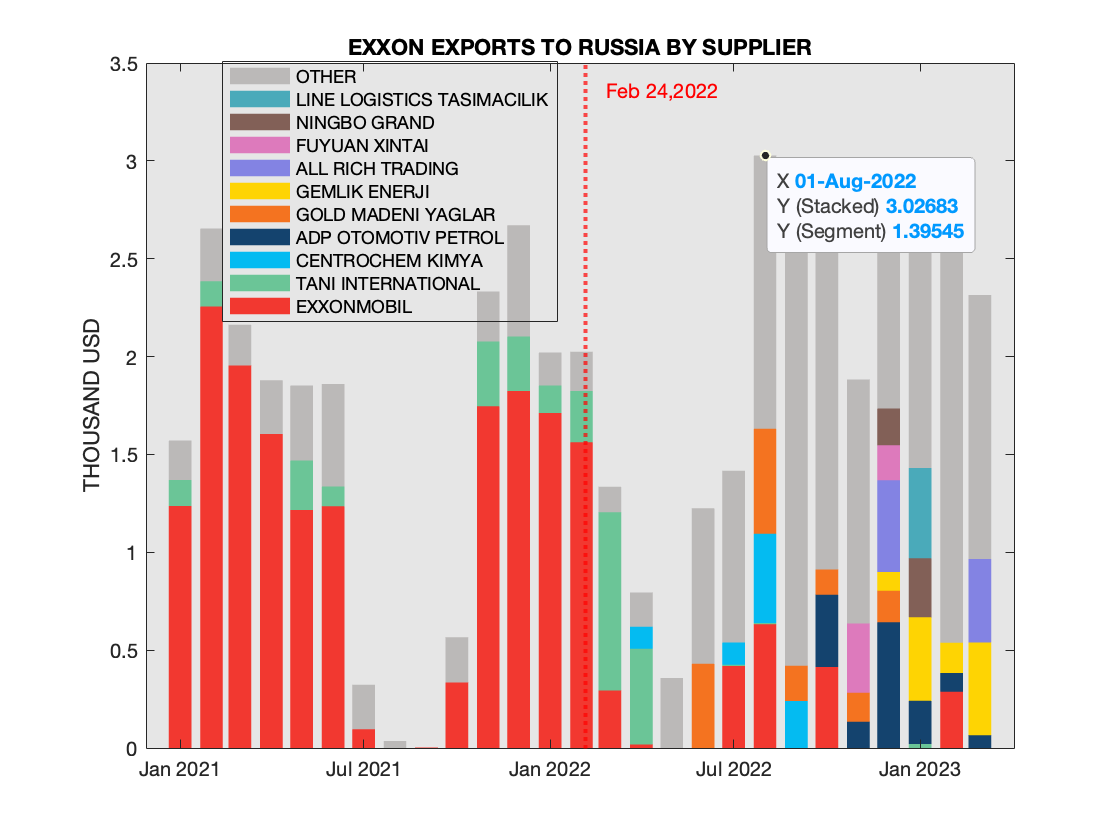

ExxonMobil got positive marks from Yale and KSE lists for cancelling Russian projects. We look at a different aspect of interactions of this company with Russia: namely its exports to Russia. ExxonMobil was (and still is) the largest provider of lubricants and other chemicals to Russia, as can be seen from the first chart. A couple of observations: first, the overall volume has not descreased after the full-fledged invasion, the second - most of the exports were originated in the United States  ExxonMobil Exports to Russia by Countries of Origin

ExxonMobil Exports to Russia by Countries of Origin

Of course, there is an important change: direct exports have "mostly" stopped and got very fragmented with lots of suppliers (mostly from Turkey but also from other countries) stepping in.  ExxonMobil Exports to Russia by Supplier

ExxonMobil Exports to Russia by Supplier

However, just like being "mostly dead" is not quite the same as dead, the direct exports have not stopped completely. In particular, there are four shipments from EXXONMOBIL PETROLEUM & CHEMICAL, BV to OLIMP LLC for the combined amount of $1.75 million of of lubricants for Aircraft Gas Turbines. There were two shipments in last August, one last December, and the last one (from Spain) was this February. Lubricants for Aircraft. Gas. Turbines. Made In USA.

CNC Exports into Russia

Aug 21, 2023

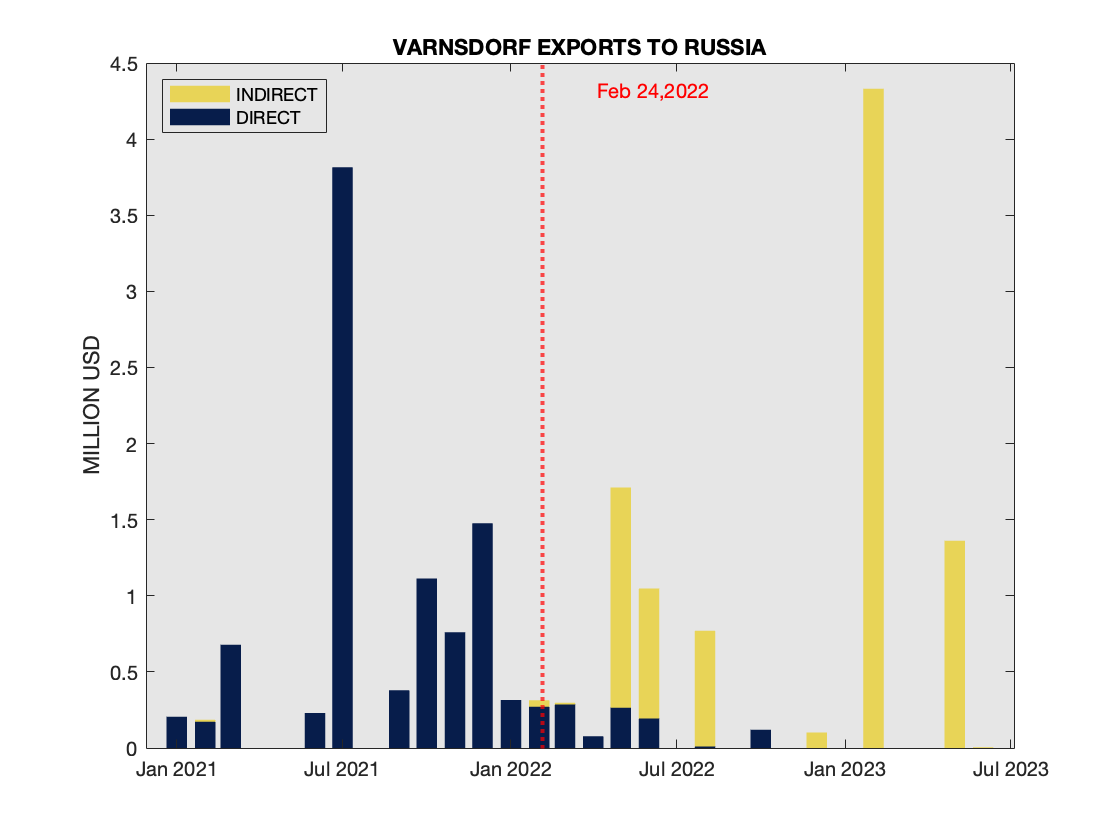

In this section we consider an important topic of modern machine tooling, commonly referred to as CNC (Computer Numerical Control) Machines. We start with a relatively uknown company from Czech Republic, TOS Varnsdorf. We note that while shipments swtiched from direct to indirect ones, the latter continue, and in particular, we note the shipment of a CNC machine from February 2023 from IX ELEKTRONIK IC VE DIS TICARET LIMITED SERKETI (Supplier) to ALLIANCE LLC (importer) valued at over $4 million.  TOS Varnsdorf Exports to Russia by Countries of Origin

TOS Varnsdorf Exports to Russia by Countries of Origin

The importance of western CNC tooling on Russian military has been well-known before the war, and it was confirmed shortly after afterthe war started.

Estonia Exports into Russia

September 5, 2023

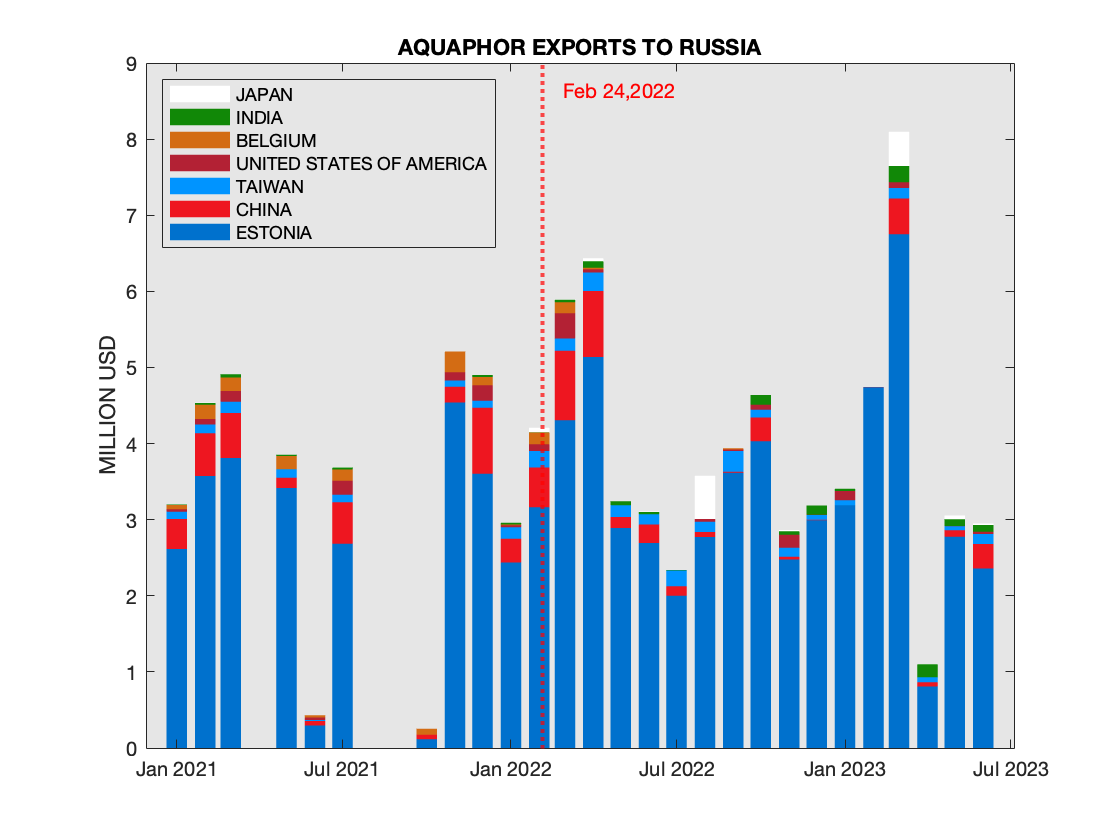

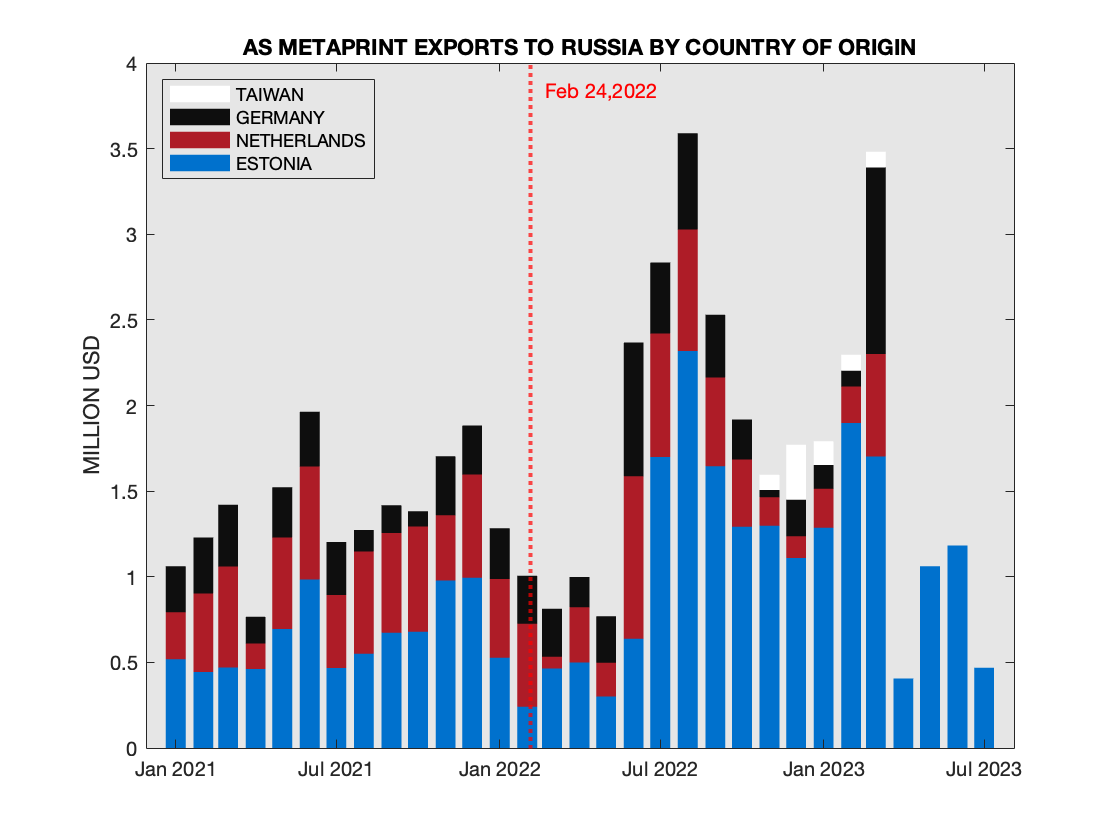

On August 23 ERR, the online English-language portal of Estonian Public Broadcasting, published an investigation into AS Metaprint business with Russia. In accordance with the article, the company exported $17 million worth of goods during the war, based on customs data between the end of February and November of 2022. Several days later, in an interview with the CEO of the company, an updated figure for exports to Russia from February 24, 2022 to August 24, 2023 of 30 million EUR has been disclosed.